#Regulation

Ex-LAPD Cop Convicted in $350K Bitcoin Kidnapping Case

Eric Halem, a former Los Angeles Police Department officer, has been found guilty of kidnapping a 17-year-old and stealing $350,000 worth of crypto after invading his home in 2024.

Halem, who served with the LAPD for 13 years but retired in 2022, was said to have illegally invaded the home of the teen, named Daniel, alongside three co-conspirators.

Upon gaining entrance into the teen's home under the guise of carrying out a search warrant, Halem subdued both the teen and his girlfriend, threatening to shoot him if he didn't hand over a hard drive containing Bitcoin. Apparently, the teen did have a significant amount of crypto.

Although Halem has been found guilty by the court, his sentencing is scheduled for March 31. And since he's been tried for kidnapping and robbery, which fall under California's aggravated statutes, Halem risks spending a long time in prison.

The Rise of Wrench Attacks

A wrench attack, also known as the $5 wrench attack, involves physical threats or violence to force a person to hand over their crypto private keys.

There has been an increase in the number of wrench attacks within the last few years. According to a 2025 security report from blockchain security firm CertiK, there were 72 recorded incidents of wrench attacks, a 75% increase from 2024.

Certik also reported a loss of more than $40.9 million from these attacks, with Europe accounting for 40% of these attacks worldwide, and kidnapping being the most common method used by assailants.

Jameson Lopp, Co-founder and Chief Security Officer of crypto security firm Casa Inc, has also been documenting these crypto wrench attacks from 2014 to date in a GitHub repository named "physical-bitcoin-attacks."

Based on tracked incidents in the GitHub repo, there have been 16 documented crypto-wrench attack cases this year alone, with France recording the most cases, with kidnapping being the most common method used by attackers.

White House Calls Out Dimon on Stablecoin Yields

Washington's stablecoin standoff just got a whole lot more personal.

Patrick Witt, the executive director of the President's Council of Advisors for Digital Assets, publicly fired back at JPMorgan Chase CEO Jamie Dimon on Tuesday, calling his arguments about stablecoin yields misleading and, in Witt's own word, a "deceit."

The exchange marks one of the sharpest moments yet in a months-long tug-of-war between Wall Street and the White House over the future of digital asset regulation in America.

Dimon Draws a Line in the Sand

It started Monday, when Dimon went on CNBC and didn't mince words. His position was simple, if uncompromising: any platform holding customer balances and paying interest on them is functionally a bank, and should be regulated like one.

"If you do that, the public will pay. It will get bad," Dimon warned, arguing that a two-tiered system where crypto firms operate with fewer restrictions than banks is unsustainable.

Dimon suggested a narrow compromise: platforms could offer rewards tied to transactions. But he drew a clear line at interest-like payments on idle balances, saying, "If you're going to be holding balances and paying interest, that's a bank."

The list of obligations Dimon believes should apply is long, FDIC insurance, capital and liquidity requirements, anti-money laundering controls, transparency standards, community lending mandates, and board governance requirements. "If they want to be a bank, so be it," he said.

For Dimon, it's fundamentally about fairness. JPMorgan uses blockchain in its own operations, and the CEO was careful to frame his argument not as anti-crypto but as pro-competition on equal terms. "We're in favor of competition. But it's got to be fair and balanced," he said.

The White House Fires Back

Witt wasn't going to let that stand. In a post on X late Tuesday, he went directly at Dimon's framing, calling it deliberately misleading.

"The deceit here is that it is not the paying of yield on a balance per se that necessitates bank-like regulations, but rather the lending out or rehypothecation of the dollars that make up the underlying balance," Witt wrote. "The GENIUS Act explicitly forbids stablecoin issuers from doing the latter."

The argument gets at something technically important. What makes a bank risky, and therefore subject to heavy regulation, isn't that it pays interest. It's that banks take deposits and lend them back out, creating credit and the systemic risk that comes with it. If too many people want their money back at once, that's a bank run. Stablecoin issuers operating under the GENIUS Act must maintain reserves at a 1:1 ratio. There is no fractional reserve lending, no rehypothecation, no credit creation.

In Witt's view, stablecoin balances aren't deposits, and treating them as such misrepresents what's actually happening. He closed with a pointed equation: "Stablecoins ≠ Deposits."

President Donald Trump didn't stay quiet either. On Tuesday, he took to Truth Social with a message that made his position unmistakably clear.

"The U.S. needs to get Market Structure done, ASAP. Americans should earn more money on their money. The Banks are hitting record profits, and we are not going to allow them to undermine our powerful Crypto Agenda that will end up going to China, and other Countries if we don't get the Clarity Act taken care of," Trump wrote.

Senator Cynthia Lummis quickly reposted Trump's message, adding her own call to action: "America can't afford to wait. Congress must move quickly to pass the Clarity Act."

The same day Trump posted, a Coinbase delegation led by CEO Brian Armstrong visited the White House for talks. The timing was not subtle.

The Real Stakes: The CLARITY Act

To understand why this debate matters so much right now, you need to understand the legislation being held hostage by it.

The GENIUS Act, signed into law in July 2025, established the first federal framework for payment stablecoins. The CLARITY Act is its sequel: a broader market structure bill that would assign clear regulatory jurisdiction to the SEC and CFTC over the crypto industry, and is widely seen as the piece of legislation needed to unlock large-scale institutional participation in digital assets.

The bill cleared the House comfortably but has been mired in Senate gridlock since January, when the Senate Banking Committee indefinitely postponed a planned markup vote. The trigger was Coinbase withdrawing support over a proposed amendment that would have restricted stablecoin rewards for users.

That withdrawal, announced by CEO Brian Armstrong in a post on X the night before the scheduled committee vote, split the crypto industry. a16z crypto's Chris Dixon publicly disagreed, posting "Now is the time to move the Clarity Act forward." Kraken's co-CEO Arjun Sethi also pushed back, writing that "walking away now would not preserve the status quo in practice" and warning it "would lock in uncertainty and leave American companies operating under ambiguity while the rest of the world moves forward."

The stakes for Coinbase are concrete. Stablecoins contribute nearly 20% of Coinbase's revenue, roughly $355 million in the third quarter of 2025 alone, and most of USDC's growth is occurring on Coinbase's platform. Coinbase currently offers 3.5% yield on USDC, a figure most traditional bank accounts can't come close to matching.

Banks Are Scared, and They Have the Numbers to Show It

The banking lobby's concern isn't hypothetical. Banking trade groups, led by the Bank Policy Institute, have warned that unrestricted stablecoin yield could trigger deposit outflows of up to $6.6 trillion, citing U.S. Treasury Department analysis. Bank of America CEO Brian Moynihan put a similar figure forward, reportedly suggesting as much as $6 trillion in deposits, representing roughly 30-35% of all U.S. commercial bank deposits, could be at risk.

Stablecoins registered $33 trillion in transaction volume in 2025, up 72% year-over-year. Bernstein projects total stablecoin supply will reach approximately $420 billion by the end of 2026, with longer-run forecasts from Citi putting the market at up to $4 trillion by 2030. Those aren't niche numbers anymore. At that scale, deposit competition becomes a serious macroeconomic question.

The American Bankers Association and 52 state bankers' associations explicitly urged Congress to extend the GENIUS Act's yield prohibitions to partners and affiliates of stablecoin issuers, warning of deposit disintermediation.

The Bottom Line

What's playing out right now is a genuine philosophical disagreement about what money is and how it should be regulated, wrapped inside a very consequential legislative fight, a prize fight with Banks in one corner and Crypto in the other.

Dimon's argument is not frivolous. Banks are regulated as heavily as they are because of what they do with deposited money, and a world where consumers move trillions into yield-bearing crypto instruments held at lightly regulated platforms carries real risks. The history of financial crises is largely a history of regulatory arbitrage gone wrong.

But Witt's counter is also not frivolous. The GENIUS Act was designed specifically to prevent stablecoin issuers from doing the things that make banks dangerous. A fully reserved, non-lending stablecoin issuer is structurally different from a fractional reserve bank, and applying the same regulatory framework to both risks conflating two fundamentally different business models.

What's harder to square is that the banking lobby's intervention in the CLARITY Act seems, to many in the crypto world, less about prudential regulation and more about protecting market share. President Trump has not been subtle about that read, accusing banks of holding the CLARITY Act hostage to protect incumbent interests against crypto competition.

With the legislative window narrowing, Armstrong back at the White House, and Trump openly calling out the banking lobby by name, this standoff has reached the kind of inflection point where someone is going to have to blink. The question is whether either side is willing to do it before time runs out entirely.

SBF Seeks New Trial in FTX Fraud Case

More than two years after FTX collapsed and reshaped the crypto industry, Sam Bankman-Fried is still fighting.

The former FTX CEO, now serving a 25 year federal prison sentence, has formally moved for a new trial in Manhattan federal court. The filing argues that key evidence was excluded, important testimony never reached the jury, and that the original proceedings did not present the full picture of what was happening inside the exchange before its implosion.

It is a long shot. But it keeps one of crypto’s biggest scandals squarely in the headlines.

A Quick Reset: How We Got Here

FTX was once valued at $32 billion and marketed itself as the responsible face of crypto trading. Bankman-Fried cultivated relationships in Washington, testified before Congress, and presented himself as a regulator-friendly industry leader.

That narrative unraveled in November 2022.

After a liquidity crunch exposed a multibillion-dollar hole in FTX’s balance sheet, the exchange halted withdrawals and filed for bankruptcy. Prosecutors later alleged that customer deposits were secretly routed to Alameda Research, Bankman-Fried’s trading firm, where the funds were used for speculative bets, venture investments, loans to executives, and political donations.

The case moved quickly. By late 2023, a jury found Bankman-Fried guilty on seven counts including wire fraud, securities fraud, and conspiracy. Several former executives, including Caroline Ellison and Nishad Singh, testified for the government. In 2024, Judge Lewis Kaplan sentenced him to 25 years in prison.

It was one of the most significant criminal convictions in crypto’s short history.

The Argument for a New Trial

Bankman-Fried’s latest filing hinges on a legal mechanism that allows courts to grant a new trial if newly discovered evidence could materially affect the verdict, or if there were serious procedural errors.

His motion makes a few central claims.

First, that certain testimony from former FTX and Alameda insiders was either excluded or not fully presented to the jury. According to the filing, that testimony could challenge the government’s portrayal of FTX as hopelessly insolvent and operating as a straightforward fraud.

Second, the defense argues that FTX’s collapse was more akin to a bank run than an inevitable implosion. In this telling, the exchange had assets and would have recovered if not for the sudden withdrawal panic that followed public reporting about its balance sheet. That argument goes directly to intent, which was central to the prosecution’s case.

Third, the motion questions the credibility of cooperating witnesses. Bankman-Fried claims some testimony evolved under government pressure and suggests that early statements made by insiders painted a more ambiguous picture of events than what jurors ultimately heard.

The filing also calls for Judge Kaplan to step aside from reviewing the request, alleging bias in evidentiary rulings during trial.

None of this is easy to prove. Courts rarely grant new trials once a conviction has been secured and upheld through sentencing. The legal threshold is high, particularly in complex financial cases where juries have already weighed extensive testimony.

The Broader Legal Strategy

The new trial motion is separate from Bankman-Fried’s ongoing appeal. That appeal focuses on whether the trial court made reversible legal errors, including limiting certain lines of defense.

Appeals courts typically give trial judges considerable leeway in managing evidence and courtroom procedure. Overturning a conviction requires demonstrating more than disagreement. It requires showing that errors materially affected the outcome.

For now, the new filing appears to be part of a layered strategy. Preserve every argument. Challenge every ruling. Keep procedural options open.

The Bottom Line

FTX’s collapse triggered one of the most severe credibility crises crypto has faced. Billions in customer assets were trapped. Venture capital firms wrote down massive stakes. Regulators in the U.S. and abroad accelerated enforcement and oversight efforts.

Even as the industry shifts toward ETF approvals, institutional adoption, and regulatory frameworks, the FTX saga remains a reference point. It is cited in congressional hearings, enforcement actions, and investor debates about custodial risk.

Bankman-Fried’s continued legal maneuvers keep the story alive, even if the odds of a successful retrial remain slim.

For many in crypto, the question is less about whether he gets a second trial and more about what the case ultimately represents. Was FTX an isolated failure of governance and internal controls, or proof that parts of the industry scaled too quickly without guardrails?

The courts will decide the narrow legal questions. The market, as always, is deciding the broader narrative in real time.

For now, one of crypto’s most infamous founders is still arguing that the story jurors heard was incomplete. Whether a judge agrees is another matter entirely.

Tether Invests $100M in Anchorage Digital at $4.2B Valuation

Tether is writing another big check, and this one says a lot about where stablecoins are headed.

The company behind USDT has made a $100 million equity investment in Anchorage Digital, valuing the U.S. crypto bank at around $4.2 billion. It is not a flashy deal by crypto standards, but it is an important one, especially now that stablecoin regulation is no longer theoretical in the United States.

The investment deepens a relationship that has been building quietly for years. It also puts Tether right alongside one of the few crypto firms operating fully inside the U.S. banking system.

This Was Not a Sudden Move

Tether and Anchorage have been working together long before this deal.

Anchorage Digital runs one of the most unusual businesses in crypto. Through Anchorage Digital Bank N.A., it operates as a federally chartered crypto bank under U.S. regulators. That status lets it custody digital assets and support stablecoin activity within a traditional banking framework, something very few firms can offer.

For Tether, that matters more than it used to.

As regulators sharpen their focus on stablecoins, the days of issuing dollar tokens without close oversight are coming to an end, at least in the U.S. market. Anchorage gives Tether a partner that already lives in that regulatory world.

Regulation Has Changed the Math

The backdrop to this deal is the GENIUS Act, passed in 2024, which finally laid out clear rules for payment stablecoins in the U.S. The law introduced tighter requirements around reserves, disclosures, custody, and governance.

Soon after, Tether and Anchorage revealed plans to launch a U.S.-focused stablecoin, often referred to as USA₮. Unlike USDT, which operates globally, this token is designed specifically for the U.S. regulatory environment and would be issued through Anchorage’s federally regulated bank.

That announcement made it clear the two companies were getting closer. The $100 million investment makes that commitment financial as well as strategic.

Why Tether Is Investing Like This

Tether has been more active as an investor than many people realize.

Over the past couple of years, the company has put money into everything from infrastructure and mining to agriculture and commodities. The strategy seems straightforward: reduce reliance on stablecoin fees alone and build exposure to assets and systems that can last through market cycles.

Anchorage fits that strategy neatly.

This is not a bet on a new token or a speculative protocol. It is a bet on regulated plumbing, the kind institutions actually use. As more banks, funds, and corporates step into crypto, that plumbing becomes more valuable.

Tether’s leadership has consistently framed these investments as long-term positioning, not short-term trading. This deal feels very much in that category.

What Anchorage Gets Out of It

For Anchorage Digital, the money is helpful, but the signal may matter even more.

The firm has been expanding its stablecoin operations, adding staff focused on compliance, engineering, and product development. It has also been linked to plans for a major funding round and a potential IPO, possibly as early as 2026.

Having Tether as a strategic shareholder strengthens Anchorage’s credibility with both institutional clients and regulators. It also ties the company more closely to the largest stablecoin issuer in the world at a moment when stablecoins are becoming core financial infrastructure.

The Bottom Line

There is nothing flashy about this deal. No new token, no rebrand, no sudden pivot.

But it says a lot about where crypto is right now.

Stablecoins are drifting away from their roots as trading tools and toward something closer to regulated digital cash. That shift pulls crypto firms toward banks, charters, audits, and long-term capital, whether they like it or not.

Tether’s $100 million investment in Anchorage Digital is a clear sign it understands that reality. The future of stablecoins, at least in the U.S., is going to look a lot more institutional than the past.

Bitcoin Near $70K Again, Bottom or More Pain Ahead?

I came into Bitcoin in mid-2017. Not early, not late, but early enough to catch the euphoria and late enough to feel the consequences. I watched that cycle go vertical, then watched it unwind in slow motion through 2018. I stayed through the 2020–2022 cycle, including the November 2021 peak and the long grind down that followed.

So when Bitcoin slipped back toward $70,000 this week, the feeling wasn’t panic..well, maybe some panic. But there certainly was some recognition. The same quiet tension I’ve felt before, when the market shifts from confidence to defense and nobody is quite ready to admit it.

This move looks familiar on the surface. Risk assets are under pressure, equities are shaky, and Bitcoin is once again trading like the most volatile expression of risk in the room. But the environment around it feels very different than it did the last two times I lived through this.

Why $70,000 Matters More Than Most Want To Admit

For anyone who lived through 2021, $70K isn’t just a number. November of 2021 marked the prior cycle’s peak near $69,000. For years, that level symbolized excess. More recently, trading above it felt like proof that the market had finally moved on.

Once Bitcoin slipped back into that zone, the mood shifted fast. Selling stopped being about opinions and started being about mechanics. Stops were hit. Leverage came out. Liquidations took over. That transition is something I’ve learned to respect. When the market turns mechanical, it usually overshoots.That is obvious on both sides, euphoria and near depression.

I saw the same thing in early 2018 and again in 2022. Different triggers, same behavior.

BTC Still Trades Like A Risk Asset

As much as I want Bitcoin to be treated differently, moments like this remind me that it still trades like a high beta risk asset when macro pressure shows up.

Equities, especially tech, have been weak. Volatility is up. Liquidity feels tighter. In that environment, Bitcoin rarely resists. It amplifies. Crypto trades 24/7, it’s easy to exit quickly, and it’s deeply intertwined with leverage. When investors want to reduce risk immediately, Bitcoin is often first in line.

Once liquidations start cascading, fundamentals stop mattering in the short term. Exchanges sell into weakness, bids step away, and price pushes through levels that felt solid just days earlier.

ETF flows add a new dynamic I didn’t have to think about in 2018 or even 2021. Institutional money can now enter and exit Bitcoin daily. That can support price over time, but during drawdowns it can also accelerate downside when outflows cluster.

What Past Cycles Taught Us

Living through the 2017 peak and the 2018 bear market changed how I think about Bitcoin permanently. Support can fail. Narratives can break. Time can do more damage than price. And something always happens that you least expect.

The 2020–2022 cycle reinforced that lesson. After peaking in November 2021, Bitcoin fell roughly 75 percent into the November 2022 lows. That wasn’t just a crash, it was a year of slow erosion that wore people down.

Those experiences make it hard for me to assume this cycle can’t get uglier. Bitcoin has always been good at humbling people who think they’ve seen it all.

At the same time, I can’t ignore what’s different now.

Will This Cycle Be Different?

In 2017 and 2021, regulation was mostly noise. Institutions were cautious or absent. Spot ETFs didn’t exist. Bitcoin lived largely outside traditional markets

That’s no longer true.

Efforts like the Clarity Act and broader moves to define digital commodities give Bitcoin something it’s never really had during a downturn, a clearer legal and regulatory framework. That matters more when prices are falling than when they’re rising.

Institutions also behave differently than retail traders. They don’t buy because of excitement or belief. They buy because mandates allow them to. That can create steadier demand when prices fall far enough.

But they also sell without emotion. When risk models say reduce exposure, they reduce it. No attachment, no narrative. That means drawdowns can still be sharp, but they may resolve differently than in prior cycles.

This is the tension I’m trying to navigate in this cycle. Regulation and institutional access could limit the worst outcomes we’ve seen before. They could also change the character of both rallies and declines in ways we haven’t fully experienced yet.

Is This The Bottom?

Honestly, It feels rough out there and I know I wish this was the bottom. Maybe we see some relief before more pain? Or, in true crypto fashion, we rip the band-aid off and go even further down today, but I don’t think it’s safe to assume it’s the bottom of this cycle.

Liquidations have already done some eal damage. Sentiment has flipped quickly. Price is sitting near a level that matters historically and psychologically. If ETF flows stabilize, forced selling fades, and equities stop sliding, a bottoming process could start soon.

But I’ve been around long enough to know that real bottoms don’t feel relieving. They feel boring. They form through time, failed breakdowns, and long stretches where nothing seems to happen. This is happening fast so...the chop is still going to come. We may some moves up soon, and even more quick crashes, but the long boring bottom of the market has yet to reveal its face.

If conditions continue to deteriorate, Bitcoin will grind lower. Slow declines have always been more dangerous than fast crashes. They exhaust conviction. People just get complacent and leave.

What I’m Watching

Rather than trying to call the exact low, I’m focused on a few things.

Whether ETF flows stabilize over weeks, not days

Whether liquidation events shrink instead of cascade

Whether equities, especially tech, stop dragging crypto lower

Whether Bitcoin can reclaim broken levels and hold them, not just tag them

And time, true reversals don't happen fast. Those things just take time. That is true when the market is up and when the market is down.

I came into Bitcoin in 2017 thinking it was all about price. Staying through multiple cycles taught me it’s really about structure, psychology, and time.

This drop toward $70K feels familiar for a reason. What’s different is the environment around it. Institutions are here. Regulation is evolving. The market is more connected to traditional finance than it’s ever been.

I don’t know if that makes the outcome better or just different. What I do know is, that this fourth chapter I’m living through doesn’t feel like a clean repeat of the last one, and that alone is worth paying attention to. I also don't know if I made you feel better about this whole thing or not. Or maybe, I was just trying to make myself feel better in the end.

Crypto.com Launches OG as Prediction Markets Grow

Crypto.com is leaning harder into prediction markets, and it is doing so with a clear message: this is no longer a side experiment.

The exchange has launched OG, a standalone prediction markets app that pulls event trading out of the main Crypto.com platform and gives it its own dedicated product. The move comes at a moment when prediction markets are not just growing, but accelerating, driven by sports, politics, and a broader appetite for trading real-world outcomes.

For Crypto.com, spinning prediction markets into their own app is a signal that this category is starting to matter in a way it did not before.

Why Crypto.com Is Breaking Prediction Markets Out on Their Own

OG focuses on event contracts that allow users to trade on the outcome of future events, starting with high-profile sports like the Super Bowl. Over time, the company says it plans to expand into financial events, politics, entertainment, and culture.

What sets OG apart from many crypto-native prediction platforms is its regulatory structure. The contracts are offered through Crypto.com’s U.S. derivatives arm, which operates under federal oversight. That positioning allows Crypto.com to frame prediction markets as regulated financial products rather than gambling, a distinction that has become increasingly important in the U.S.

There is also a product reason for the separation. Prediction markets behave differently than spot crypto trading. They move faster, they are driven by opinion and information flow, and they tend to be more social by nature. OG leans into that with features like leaderboards and community-style engagement, along with aggressive incentives aimed at onboarding early users.

Crypto.com has used that playbook before, and it is betting it works again here.

Prediction Markets Are Booming

Prediction markets are seeing record activity across the industry. Recent data shows combined monthly trading volume on leading platforms Kalshi and Polymarket has climbed for six straight months, rising from roughly $2 billion last August to nearly $17.5 billion in January.

That growth has been fueled by a mix of major sports events, political cycles, and growing interest in markets that reflect real-world probabilities rather than token price action. For many users, trading on whether something will happen feels more intuitive than trading whether a coin will go up or down.

Sports, in particular, have become an entry point. They are familiar, emotionally charged, and easy to understand. From there, users often branch into macroeconomic events, policy decisions, and cultural moments that attract attention well beyond crypto.

How Event Trading Actually Works

At its core, prediction markets allow users to buy and sell positions tied to whether an event happens or not. Prices move based on collective belief. A contract trading at 65 cents implies the market sees about a 65 percent chance of that outcome occurring.

As new information enters the market, whether it is an injury report, polling data, or an economic release, prices adjust in real time.

In regulated environments, these contracts are treated as derivatives. That classification is what allows companies like Crypto.com to operate nationally, rather than navigating a patchwork of state-level gambling rules. It is also what opens the door, at least in theory, to more advanced features like leverage and margin trading on event outcomes.

Crypto.com has signaled interest in going down that path, pending regulatory approval.

Regulation Is Becoming the Real Battleground

As prediction markets grow, regulation has become the defining line between platforms.

Some operate entirely outside the U.S. framework, relying on crypto-native liquidity and offshore structures. Others are betting that long-term scale depends on regulatory clarity, even if that means slower iteration and tighter constraints.

Crypto.com has clearly chosen the second route. By anchoring OG to a federally regulated derivatives entity, the company gains credibility with regulators and institutions, and potentially access to a much larger user base.

That does not eliminate risk. Legal interpretations continue to evolve, and prediction markets still sit in an uncomfortable gray area between finance and betting. But for now, regulation looks less like a constraint and more like a competitive advantage.

Kalshi and Polymarket have established themselves as leaders, particularly around political and macro events. Other major exchanges are watching closely, and in some cases preparing their own entries. Prediction markets offer something many crypto products struggle with: relevance to people who do not care about crypto prices.

Crypto.com’s advantage is distribution. The company already knows how to onboard millions of users through mobile-first products, and OG is clearly designed to plug into that existing funnel.

Whether that is enough to stand out in this crowded field remains an open question.

The Bottom Line

Prediction markets have moved out of the margins and into the center of the crypto conversation.

Crypto.com’s launch of OG reflects a broader shift in how exchanges are thinking about growth. Not everything needs to revolve around tokens. Not every product needs to look like a traditional exchange. The fact that Crypto.com has a huge user base as an traditional exchange definitely makes this latest move smart, and it is certainly following the trend of exchanges becoming more than just a place to buy and sell. They are beginning to offer a full suite of products for an ever-growing customer base.

By turning real-world events into tradable markets, prediction platforms tap directly into attention, opinion, and information flow. If OG succeeds, it could help push prediction markets...and Crypto.com even more in to the mainstream.

UAE Sheikh’s Stake in Trump-Linked Crypto Firm Raises Questions

A few days before Donald Trump was sworn in for his second term, a little-known crypto company tied to his family quietly changed hands in a very big way.

According to reporting from The Wall Street Journal, an investment network linked to Sheikh Tahnoon bin Zayed al Nahyan, one of the most powerful figures in the United Arab Emirates, agreed to acquire a 49 percent stake in World Liberty Financial, a Trump-associated crypto venture. The price tag was roughly $500 million. The deal was not disclosed at the time.

On its own, that might sound like another splashy foreign investment in crypto. But when you line up the timing, the players involved, and what happened next in Washington, the story is far less routine.

The deal that surfaced after the fact

World Liberty Financial has been marketed as a crypto and stablecoin project aligned with the Trump brand. It has drawn attention before for its political overtones, but the WSJ reporting introduced a new layer entirely.

The Journal reported that the agreement gave Emirati-linked investors just under half the company, enough to wield serious influence without triggering automatic control disclosures. Under the agreement, half of the $500 million was paid upfront, with $187 million flowing to Trump family-controlled entities and at least $31 million going to entities affiliated with the family of Steve Witkoff, the real estate magnate who co-founded World Liberty and was later named U.S. Special Envoy to the Middle East. Witkoff's son Zach is the current CEO of the project.

The timing did not help the optics. The deal was reached days before inauguration, when policy direction for the next four years was coming into focus and foreign governments were jockeying for position.

David Wachsman, a spokesperson for World Liberty Financial, said the company moved forward with Aryam’s investment because it believes the deal supports World Liberty’s long-term growth. He pushed back on the idea that the company should be held to a higher bar than other privately held U.S. firms when raising capital, calling that notion unreasonable and out of step with core American business principles.

Wachsman said neither President Trump nor Steve Witkoff played any role in the transaction, and that neither has been involved in World Liberty Financial’s operations since taking office. He added that Witkoff has never held an operational role at the company. According to Wachsman, the investment does not give any party access to government decision-making or policy influence, and the company follows the same rules and regulatory requirements as others in the industry.

Who is Sheikh Tahnoon?

Sheikh Tahnoon is not a Silicon Valley VC taking a flier on tokens. He is the UAE’s national security adviser, a senior royal, and a central figure in Abu Dhabi’s intelligence, defense, and investment apparatus.

He also oversees or influences a web of firms operating at the intersection of AI, data infrastructure, and geopolitics. That includes G42, an Emirati AI company that has faced scrutiny in the past over its international ties and access to advanced computing technology.

A person familiar with the investment of World Liberty said Sheikh Tahnoon and his team spent months reviewing World Liberty Financial’s business plans before committing capital, ultimately completing the deal alongside several co-investors. The person said the investment did not involve funds from G42.

The source also said the investment was never discussed with President Trump, either during the due diligence process or afterward, and described Tahnoon as a significant investor in the crypto sector.

The AI chip question hovering over everything

One reason this story has legs beyond crypto is what happened after the investment.

Following Trump’s return to office, the administration moved on policies involving advanced AI chips, an area where the UAE has been actively lobbying for expanded access. These chips are tightly controlled, highly strategic, and essential for modern AI development.

No reporting has established a direct quid pro quo. There is no document that says money went in and policy came out.

From a governance perspective, this is exactly the kind of situation ethics experts warn about. Even if no one crosses a legal line, foreign investors with deep political ties may gain goodwill, access, or priority simply by being financially intertwined with the president’s broader business ecosystem.

The legal fight may be narrow, the political fallout less so

Some legal scholars cited in reporting have raised the emoluments clause, the constitutional provision meant to prevent U.S. officials from receiving benefits from foreign states. Trump’s defenders counter that he is not directly receiving payments and that the structure insulates him from day-to-day involvement.

That argument may hold up in court. It often has before.

But the political risk is broader. Even without a legal violation, the appearance of foreign influence is enough to trigger congressional scrutiny, especially with Trump's polarizing nature and Senate Democrats, many anti-crypto, looking for any angle to stifle crypto innovation and hang Trump out to dry...all at the same time. Some Lawmakers have already begun calling for reviews, especially given the national security dimensions of AI and crypto infrastructure.

The Bottom Line

This is not just a Trump story or a UAE story. It is a preview of how crypto-era influence works.

Instead of overt lobbying, capital moves through private deals. Instead of formal control, investors stop at 49 percent. Instead of campaign donations, value flows through equity, tokens, and stablecoin rails.

It is cleaner, quieter, and harder to regulate.

Whether or not this specific deal leads to formal investigations or enforcement, it highlights a structural vulnerability. Crypto allows political proximity, financial upside, and strategic infrastructure to blend in ways legacy systems never quite allowed.

And that is why this episode is likely to be studied long after the headlines fade.

Why Banks Are Fighting So Hard Against Stablecoin Yield

There’s been a lot of language coming out of Washington lately about stablecoins.

Words like "prudence", "guardrails", and "financial stability" get thrown around whenever the CLARITY Act comes up. Coinbase recently pulled their support amid stablecoin issues in the same bill. But if you take a step back, it’s hard not to feel like something else is driving the intensity of the debate. Big banks don’t usually fight this hard over niche policy details unless there’s something material at stake.

Browsing the web, trying to find my next article for all of you, I came across a recent report from Standard Chartered’s digital assets research team, led by Geoff Kendrick, and it may just help to explain the fight a bit better.

A Forecast Banks Can’t Ignore

Kendrick’s research doesn’t treat stablecoins as a crypto sideshow. It treats them as a potential alternative home for real money, the kind of money that currently sits in checking and savings accounts. He actually estimated that $500 billion will move from bank deposits to stablecoins by 2028. The idea isn’t that everyone suddenly abandons banks. It’s subtler than that. Even a gradual shift of deposits into stablecoins changes the math for banks in ways they really don’t like. Funding becomes more expensive, liquidity assumptions get weaker, margins get squeezed. Those aren’t ideological concerns. Those are spreadsheet concerns. And spreadsheet concerns really make banks want to fight the issue.

But to understand the real threat to banks, you first have to better understand the business itself. Banks don’t just hold your money. They use it. Under fractional reserve banking, they keep only a slice and lend the rest out to earn interest for themselves. Sure, they'll keep that small portion of your deposit, but the majority gets reinvested through loans and other activities. That’s how they earn money and why they can afford to even pay any interest to you at all, even if it’s usually minimal.

This system works because deposits are assumed to be sticky. People don’t move their money often, and when they do, it usually stays within the banking system. Moving from one bank to another.

Stablecoins challenge that assumption. They make dollars mobile in a way they haven’t been before.

The Shift Is Coming

Right now, most stablecoins feel like tools, not destinations. They’re useful for transfers, trading, and crypto-native activity, but they’re not where most people park idle cash. Yield changes that. The moment a stablecoin starts paying something meaningfully better than a traditional savings account, the comparison becomes unavoidable. A digital dollar that moves instantly, works around the clock, and earns yield starts to look less like a crypto product and more like a better bank balance. That’s when stablecoins stop being adjacent to banking and start competing with it.

But, we're still talking mostly about crypto-native people. The real shift happens when stablecoins stop feeling like crypto at all, when they live inside apps people already trust and use every day. When you easily pay for your groceries on your phone without writing down that seed phrase for crypto that sits on a separate wallet that may or may not be linked to payments.

PayPal is already experimenting here. Their Paypal USD (PYUSD) exists inside a platform with hundreds of millions of users, and it already lets people move dollars instantly between PayPal and Venmo for free. That’s everyday payment stuff. It’s not a niche oracles or decentralized exchange use case. It’s peer to peer transfers in apps people use for rent, splitting bills, or sending money to family.

Cash App has also signaled support for stablecoin payments and more flexible money movement options, even if Bitcoin hasn’t become everyday cash yet. The point is simple: If stablecoins actually become integrated into the way regular people pay for things, save for short-term goals, and move money around, they stop being a "crypto thing” and become an alternative store of value and payment rail to banks.

That’s exactly the scenario a bank CFO would find unsettling.

Why the CLARITY Act Matters So Much

This is why the fight over stablecoin yield inside the CLARITY Act feels so charged. It’s not really about whether stablecoins should exist. That battle is already over. It’s about whether they’re allowed to become a true alternative to bank deposits. If yield stays restricted, stablecoins grow slowly and remain mostly transactional. If yield is allowed under a clear regulatory framework, they start to compete directly with how banks fund themselves. That’s a much bigger shift.

The Bottom Line

If you take Kendrick’s projections seriously, and I know that I do. I have been in this blockchain industry for a decade now. I have seen the shift from Silk Road and from not even being a second thought in Washington to being a presidential election policy issue and talked about at the highest levels of government, from sea to shining sea.

But pushback from banks does make sense. It’s not panic. It’s defense. Stablecoins that are easy to use, deeply integrated into everyday payment apps, how people spend their money, and capable of earning yield... threaten something fundamental. They threaten the quiet bargain where banks get cheap access to capital and customers accept low returns in exchange for convenience. Seen through that lens, the resistance to stablecoin yield isn’t surprising at all. It’s exactly what you’d expect when a new form of money starts to look a little too good at doing the job banks have always relied on to make money.

I know where I stand on the issue and I'm interested to know what you think. Do banks evolve, embrace stablecoins as inevitability or do they hold on to the old ways for dear life?

Davos 2026 Shows How Crypto and Digital Assets Entered Mainstream Finance

The World Economic Forum’s annual gathering in Davos didn’t treat crypto like a fringe experiment or a buzzword for the sidelines. In 2026, digital assets were woven into the fabric of mainstream finance discussions, with dedicated sessions, public clashes, and real institutional debate. What stood out wasn’t hype about price charts but serious questions about how blockchain, stablecoins, and tokenization might actually function inside global financial markets.

The forum still had the usual Davos theatrics: world leaders, geopolitical angst, and even some absurd headlines. But under that backdrop, crypto’s presence felt more substantive than symbolic.

Dedicated Sessions for Crypto’s Practical Questions

This year’s agenda included two clearly labeled sessions that would have been unthinkable just a few years ago. One was titled “Is Tokenization the Future?” and another “Where Are We on Stablecoins?” These weren’t happy-talk panels. They featured heavy hitters from both the crypto world and traditional finance, and the exchanges got frank and occasionally tense.

In the tokenization session, the debate wasn’t about whether tokenization mattered, but how to make it work in real markets. Executives from leading exchanges and tokenization platforms shared the stage with regulators and central bank representatives. Banks and custodians talked about technical issues like governance, custody, and interoperability. The message from financial incumbents was cautious but clear: tokenization is interesting, but it has to fit into existing market infrastructure with clear rules and risk controls.

Stablecoins got their own moment too. The session on stablecoins drew some of the biggest names in crypto alongside central bankers and global settlement experts. One of the most explosive moments came when industry CEOs pushed back against regulators on whether stablecoins should be allowed to pay yield to holders. That argument went far beyond textbook economics. On stage, executives argued that interest-bearing stablecoins were essential for consumer utility and global competitiveness, while some central bankers warned that yields could undermine banking systems and monetary sovereignty. Those side conversations revealed just how uneasy regulators still are, even when they acknowledge stablecoins’ potential as settlement rails.

These discussions reflected a broader shift. The question at Davos was no longer whether digital assets belong in the financial system, but how they should be regulated, engineered, and governed if they are going to be part of the future of payments, markets, and enterprise infrastructure.

Tokenization Takes the Spotlight

Out in the corridors and at side events, almost every conversation came back to one theme: tokenization of real-world assets. Whether you were talking to a sovereign wealth fund advisor or a fintech CEO, the framing was similar. Crypto tech is moving past speculation and into something that could materially change liquidity and access in global finance.

The story from a range of institutional participants was that tokenization is no longer an academic idea. There are live projects tokenizing government bonds and traditional funds, and institutional settlement firms are piloting systems that blend blockchain principles with existing financial rails. The buzz was not about replacing banks but about layering new capabilities on top of old systems in ways that reduce friction and increase transparency.

One telling difference this year was that tokenization was discussed in terms of liquidity and fractional ownership, not volatility. That shows where the conversation has matured: from digital assets as a wild bet to digital assets as potential plumbing for capital markets.

Stablecoins, Regulation, and Real Debate

The stablecoin panel was one of the most watched crypto moments in Davos. People crowded into the room not for price predictions but for substance. Here you had exchange CEOs, stablecoin issuers, and veteran regulators hashing out definitions, safeguards, and the practical role stablecoins could play in cross-border settlement.

One point that came up repeatedly was that stablecoins could act as a connective layer between traditional finance and digital markets. Advocates painted a picture where businesses run treasury operations using stablecoins, and global money movement gets more efficient as a result. Critics, especially from central banking circles, countered that allowing stablecoins to pay competitive yields could disrupt bank deposits and challenge monetary policy levers.

That tension came out in specific debates on policy design. Industry representatives argued for clearer frameworks that enable innovation while protecting holders and financial stability. Regulators struck back with questions about reserve requirements, audit regimes, and who ultimately backs these digital dollars.

This was not Davos speak for broader audiences. The conversation was technical, at times dry, and realistic about where the risks and opportunities lie.

Crossroads Between Crypto and Geopolitics

Crypto at Davos didn’t exist in a vacuum. It was wrapped into broader threads of geopolitical competition and economic strategy. Several high-profile talks touched on how digital finance intersects with national priorities. Leaders from the United States framed crypto engagement as part of broader global competitiveness. European regulators emphasized monetary sovereignty and financial stability in ways that indirectly questioned unfettered digital asset growth. These differing philosophies underscored how regulatory fragmentation is almost guaranteed for now.

You could see it play out in individual exchanges between CEOs and policymakers. Some firms pushed the narrative that restrictive rules in one region would push innovation offshore. Others pushed back, saying that control and trust are prerequisites for large institutional adoption.

Institutional Players, Not Just Crypto Natives

What was remarkable at Davos this year was how many traditional institutions turned up with real substance on digital assets, not just lip service. Big banks, settlement providers, and regulators were on panels alongside crypto founders. Conversations about custody solutions, compliance tools, interoperability standards, and governance models were not niche; they were mainstream finance topics with crypto elements built into them.

Some of the most detailed sessions focused on technical integration questions, including how blockchain standards could interoperate with legal and compliance frameworks around the world. That kind of discussion would have felt out of place at Davos only a few years ago.

What This All Means for Crypto’s Place in Finance Today

Out of Davos 2026 comes a clear message: crypto is no longer an outsider in global finance. There’s still enormous disagreement about details. Regulators worry, technologists dream, and institutions hedge. But the conversation has shifted toward execution and integration, not justification.

Crypto is being talked about not for short-term price moves but for what it could mean for settlement, liquidity, cross-border flows, and asset ownership structures going forward. The debates were real, messy, and imperfect, but they were also grounded and practical in a way they hadn’t been before.

For the crypto world, that is a much bigger step forward than any headline about price or bull markets. Davos has made clear that digital assets are now a topic global leaders feel they have to wrestle with, seriously and directly. The question now is not whether crypto belongs in the future of finance. It is how that future gets built, who shapes it, and where the regulatory guardrails ultimately land.

Revolut Ditches Bank Buyout Plan, Goes All-In on Federal License Bet

Revolut has scrapped its plan to buy a U.S. bank, deciding instead to apply for a brand new federal banking license directly from the Office of the Comptroller of the Currency. It's a notable gamble that the regulatory winds have shifted enough under the Trump administration to make the slower, riskier path actually the faster one.

The pivot comes after Revolut apparently concluded that acquiring an existing American bank would take longer and create more headaches than originally expected. Sources familiar with the matter say the acquisition route would have forced the digital-only company into owning physical branches, which is basically the opposite of everything Revolut stands for. Not exactly ideal when your whole pitch is "banking on your phone, no branches needed."

Reading the regulatory tea leaves

Here's where it gets interesting. Revolut is clearly betting that the new administration's much friendlier stance toward fintech and crypto companies means they can actually get a de novo charter approved in a reasonable timeframe. That would have been borderline laughable just two years ago.

The OCC under Biden basically shut the door on crypto firms and fintechs looking for national bank charters. But things changed fast after Trump took office. By late 2025, the agency started conditionally approving charters for companies like Circle and Ripple, which would have been unthinkable under the previous regime. The regulatory floodgates didn't just open, they got ripped off the hinges.

So Revolut's calculation seems to be: why spend months or years trying to negotiate an acquisition, deal with integration nightmares, and inherit a bunch of branches we don't want, when we might be able to get a fresh charter approved faster than ever before?

The de novo difference

For those not deep in banking arcana, a de novo license means starting from scratch. You're building a new bank rather than buying an existing one. It's traditionally been the longer, harder path because regulators scrutinize new applications intensely.

But for a company like Revolut, it has some real advantages. They get to build exactly what they want without dealing with legacy systems, outdated tech stacks, or that branch in Des Moines that somehow still uses fax machines. Everything can be designed for mobile-first customers who expect instant everything.

The company already has experience running banks in other markets. They've held a European banking license since 2018 and got a restricted UK banking license in 2024. So it's not like they're starting completely fresh, they know how this game works.

Coming from a position of strength

Revolut isn't exactly limping into this application process. The company hit a $75 billion valuation in a secondary share sale back in November 2025, making it one of the most valuable private tech companies in Europe. That funding round pulled in heavy hitters like Coatue, Greenoaks, and even Nvidia's venture arm.

The financials back up the hype too. Revolut reported $4 billion in revenue for 2024, up 72% year over year. Pre-tax profit jumped 149% to $1.4 billion. They've got over 65 million users across 39 countries. These aren't struggling startup numbers, this is a company that's figured out how to grow profitably at scale.

Right now, Revolut operates in the U.S. through a partnership with Metropolitan Commercial Bank, which limits what they can offer. A full federal banking license would unlock deposit accounts, loans, overdraft protection, basically the full menu of services that would let them actually compete as a primary bank rather than a secondary account people use for travel.

Why the U.S. matters so much

The American market is the big prize that Revolut hasn't quite cracked yet. It's the world's largest financial market and arguably the toughest nut to crack for foreign fintechs. But the potential upside is massive.

U.S. consumers have shown they're willing to ditch traditional banks for digital alternatives. Chime has millions of customers. SoFi went public. There's clearly appetite for what Revolut does, they just need the regulatory approvals to do it properly.

The company calls itself "the world's first global financial superapp," which is the kind of ambitious branding you'd expect from a $75 billion fintech. But you can't really claim to be global if you're hamstrung in the U.S. market.

Part of a bigger push

The U.S. license application fits into Revolut's broader expansion blitz. They applied for a banking license in Peru in January 2026, their fifth market in Latin America after Mexico, Colombia, Argentina, and Brazil. They've also moved into India, got regulatory approval in the UAE, and announced a $1.1 billion investment in France over three years.

Latin America in particular seems ripe for disruption. In Peru, the top four banks control over 82% of total loans. That kind of concentration creates opportunities for newcomers, especially ones focused on remittances and cross-border payments where traditional banks tend to charge hefty fees.

The crypto angle

Revolut's crypto capabilities might actually help its case, which would have sounded absurd a few years ago. The company runs a crypto exchange called Revolut X and has a MiCA license from Cyprus to offer regulated crypto services across the European Economic Area.

Under Trump, the OCC has made clear that crypto activities are fair game for national banks, assuming they have proper risk controls. The agency issued multiple interpretive letters throughout 2025 clarifying that banks can do crypto custody, stablecoin activities, and participate in blockchain networks.

The GENIUS Act passed in July 2025 created a federal framework for payment stablecoins, requiring full reserve backing and putting federal banking regulators in charge of oversight. That kind of regulatory clarity is exactly what banks need to feel comfortable offering crypto services without worrying they'll get slapped down later.

So Revolut's crypto experience could actually be a selling point rather than a liability, depending on who's reviewing the application.

But it's not all smooth sailing

Revolut has some baggage to deal with. The company's customer service has been criticized pretty heavily, with some customers reporting major difficulties resolving fraud claims or getting help with account issues.

In 2023, Action Fraud in the UK received 10,000 reports of fraud naming Revolut, which was more than Barclays, one of Britain's biggest banks. Consumer organization Which? has warned people not to keep large amounts of money with Revolut, citing concerns about fraud reimbursement.

Those aren't the kind of headlines that make regulators eager to approve your banking license application. The OCC is going to want to see evidence that Revolut has seriously upgraded its consumer protection and customer support operations. A few bad reviews are one thing, but systematic problems with fraud response could sink the whole application.

What's next

Revolut confirmed it's exploring multiple paths for U.S. expansion but the de novo license is currently the priority. They haven't said when they'll formally submit the application or how long they expect the process to take.

The OCC typically aims to make decisions within 120 days of accepting an application, though that timeline can stretch depending on complexity. Given Revolut's size, international operations, and the breadth of services they want to offer, this probably won't be a quick rubber stamp approval.

Still, the recent approvals for crypto-focused companies suggest the regulatory environment is about as friendly as it's been in years. If there was ever a time to roll the dice on a de novo application, this is probably it.

Bigger picture for fintech

Revolut's strategic flip illustrates how quickly regulatory changes can reshape business strategy. Two years ago, every fintech was looking at acquisitions as the realistic path into U.S. banking. Now the calculus has completely reversed for some companies.

The Trump administration's lighter touch on fintech and crypto regulation has opened a window that might not stay open forever. Companies are rushing to get applications in while the getting's good. Whether this regulatory approach proves sustainable long-term is anyone's guess, but for now it's created opportunities that simply didn't exist under the previous administration.

For Revolut specifically, cracking the U.S. market is kind of the final boss level in their quest to become a truly global financial platform. They've got strong financials, solid user growth, and a regulatory environment that's actually receptive to innovation for once.

The next few months will show whether their bet on going the de novo route pays off, or if U.S. banking regulation proves too complex even for a $75 billion company to navigate smoothly. Either way, it's going to be an interesting case study in how fintechs approach regulatory strategy in an era of rapid political change.

One thing's for sure though: if Revolut pulls this off, expect every other major fintech to start reconsidering their U.S. market strategies too.

CFTC Launches Future-Proof Initiative, Signaling Shift in U.S. Crypto Regulation

When Michael Selig stepped into the role of CFTC chair late last year, the crypto industry was already expecting a change in tone. This week, it got confirmation.

On January 20, Selig announced the launch of the CFTC’s new “Future-Proof” initiative, a program designed to rethink how U.S. markets regulate crypto, digital assets, and other fast-moving financial technologies. The message was clear. The old approach is no longer enough.

Rather than relying on enforcement actions and retroactive interpretations of decades-old rules, the CFTC wants to build regulatory frameworks that actually reflect how these markets function today.

For an industry that has spent years navigating uncertainty, that alone is a notable shift.

A Chair With Deep Crypto Roots

Selig is not new to crypto regulation. Before taking the top job at the CFTC, he worked closely with digital asset policy at the SEC and spent time in private practice advising both traditional financial firms and crypto companies. He also previously clerked at the CFTC, giving him an unusually well-rounded view of how regulators and markets interact.

That background shows up in his public comments. Since taking office, Selig has repeatedly emphasized predictability, clarity, and rules that market participants can actually follow without guessing how an agency might interpret them years later.

The Future-Proof initiative is the clearest expression of that philosophy so far.

What “Future-Proof” Really Means

At its core, Future-Proof is about moving away from improvisation. The CFTC wants to stop forcing novel digital products into regulatory boxes built for traditional derivatives and commodities.

Instead, the agency plans to pursue purpose-built rules through formal notice-and-comment processes. That means more upfront guidance and fewer surprises delivered through enforcement actions.

Selig has described the goal as applying the minimum effective level of regulation. Enough oversight to protect markets and participants, but not so much that innovation is choked off before it has a chance to mature.

For crypto firms, that approach could offer something they have long asked for but rarely received, which is regulatory certainty.

Why the Industry Is Paying Attention

The timing matters. Crypto markets are more institutional than they were even a few years ago. Large asset managers, trading firms, and infrastructure providers want clearer rules before committing serious capital. Uncertainty around jurisdiction and compliance has been one of the biggest obstacles.

If the CFTC follows through, Future-Proof could help define how derivatives, spot markets, and emerging products like prediction markets are treated under U.S. law. That would make it easier for firms to build, invest, and operate without constantly second-guessing regulators.

At the same time, clarity cuts both ways. More defined rules could also raise the bar for compliance, especially for smaller startups and decentralized platforms that have operated in legal gray zones.

Tennessee Attempts to Block Prediction Markets

A Broader Political Shift

Selig’s initiative does not exist in isolation. It comes as lawmakers in Washington continue debating how to split crypto oversight between the CFTC and the SEC. Several proposed bills aim to draw clearer lines around digital commodities and spot market regulation, potentially expanding the CFTC’s role.

Future-Proof appears designed to fit neatly into that broader push. If Congress hands the agency more authority, the CFTC wants to be ready with frameworks that can scale.

Still, challenges remain. The commission currently lacks a full slate of confirmed commissioners, raising questions about how durable these policy shifts will be. Coordination with the SEC is another open issue, especially where token classifications blur the line between securities and commodities.

What Does The Future Hold?

For now, Future-Proof is more direction than destination. The real test will be how quickly the CFTC turns principles into actual rules, and whether those rules survive political change and legal scrutiny.

But the tone alone represents a meaningful break from the past. After years of regulation by enforcement and ambiguity, the agency is signaling that crypto markets are not a temporary problem to be contained, but a permanent part of the financial system that deserves thoughtful governance.

Whether that vision becomes reality will shape the next phase of U.S. crypto regulation, and potentially determine whether innovation stays onshore or continues looking elsewhere.

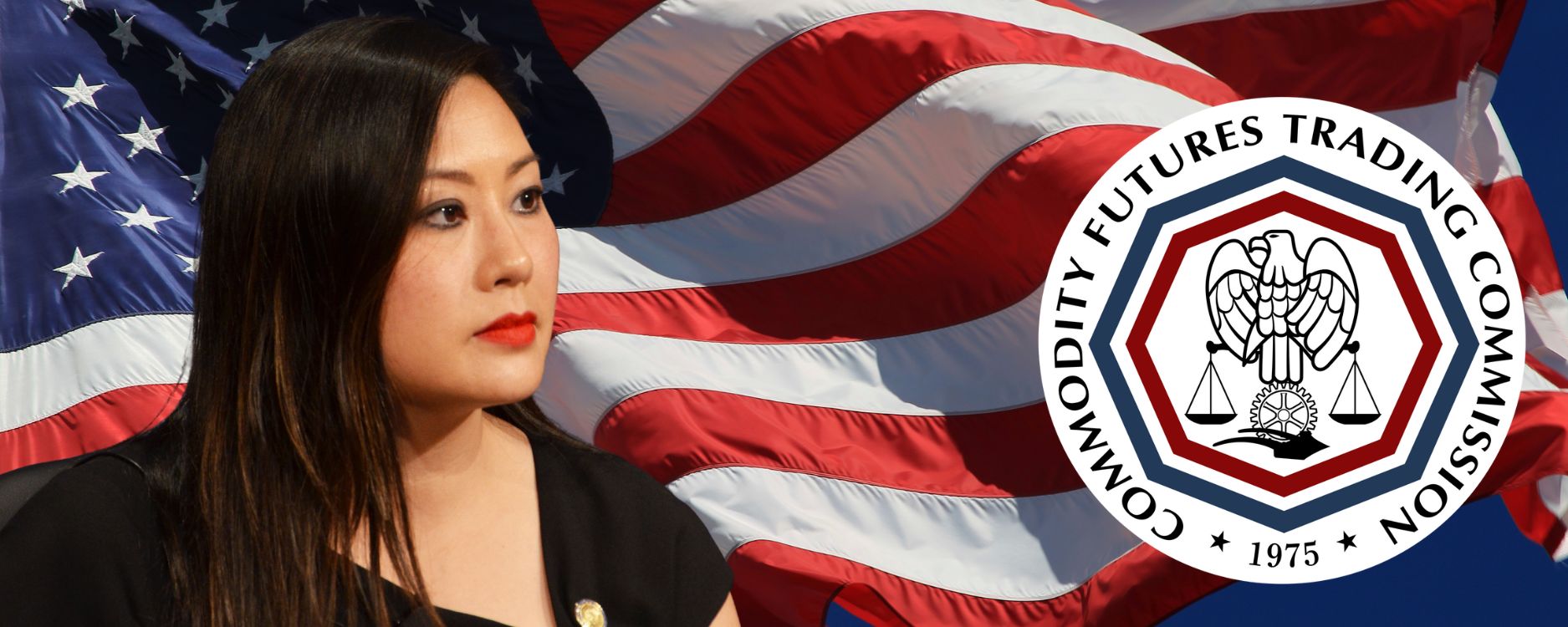

Crypto CEOs Join CFTC Innovation Council as Market Shift Begins

Caroline Pham is heading into her final stretch as acting chair of the CFTC, but she is not easing her way out. Instead, she has pulled together a new CEO Innovation Council, bringing in a mix of crypto founders and leaders from major financial institutions. The timing feels intentional. Markets are shifting fast, the technology is shifting even faster, and she clearly wanted this group in place before she hands off the job.

The council itself is an unusual gathering. On one side are Tyler Winklevoss from Gemini, Arjun Sethi from Kraken and Shayne Coplan from Polymarket. On the other, executives from CME Group, Nasdaq, ICE and Cboe. It is not often you see these people sitting on the same advisory panel, let alone one created this quickly. According to the commission, the entire list came together in about two weeks, which says a lot about how much urgency Pham applied.

She thanked the group for agreeing to join so quickly, noting that the commission needs their experience as it tries to prepare for what comes next. The council will focus on the areas where the rulebook is changing as fast as the products themselves. Tokenization. Prediction markets. Perpetual contracts. Crypto collateral. Around the clock trading. Blockchain market plumbing. Basically all the things that traditional derivatives systems were never built to handle.

Here is the full list of names:

Shayne Coplan, Polymarket

Craig Donohue, Cboe

Terry Duffy, CME Group

Tom Farley, Bullish

Adena Friedman, Nasdaq

Luke Hoersten, Bitnomial

Tarek Mansour, Kalshi

Kris Marszalek, Crypto.com

David Schwimmer, LSEG

Arjun Sethi, Kraken

Jeff Sprecher, Intercontinental Exchange

Tyler Winklevoss, Gemini

All of this is happening as the agency prepares for new leadership. President Trump’s nominee, Mike Selig, is expected to be confirmed soon. When he steps in, he will inherit an agency already deep into crypto policy work that accelerated under Pham. Just this week, the CFTC launched a pilot for using crypto collateral inside derivatives markets. A few days before that, Bitnomial began offering leverage spot crypto trading with her support.

Pham has only been in the acting role for a short time, but she treated crypto as a top priority, pushing several initiatives that line up with the administration’s goal of positioning the United States as a leading hub for digital assets. Over at the SEC, Chairman Paul Atkins has been doing something similar through Project Crypto, which has been absorbing much of the agency’s energy.

What comes next will land in Selig’s lap. But with this council now in place, he will walk into a job where the industry and the regulators are already in the middle of a much bigger conversation about what the future of market structure should look like.