#Financial Regulation

Coinbase Is Suing Three States, and the Future of Prediction Markets Is on Trial

Coinbase has sued Connecticut, Michigan, and Illinois today, but it does not look like a typical regulatory skirmish. On the surface, it was about a few cease-and-desist orders targeting prediction market contracts. In practice, it put a much bigger question on the table. What exactly are prediction markets supposed to be?

Are they casinos in disguise, digital poker rooms with better UX, or a new kind of financial market that belongs under federal oversight?

The answer matters, because the wrong classification could freeze a fast-growing corner of finance in legal limbo.

Why Coinbase Is Taking States to Court

The states argue that Coinbase’s prediction markets amount to illegal gambling. Users put money down on outcomes. Some win, some lose. No state gambling license, no approval.

Coinbase sees it very differently. These contracts, the company argues, are event-based derivatives. They look like futures, trade like futures, and are already subject to federal commodities law. The Chief Legal Officer for Coinbase, Paul Grewal, stated in an X post on Friday that the company filed the lawsuits to "confirm what is clear" and that prediction market should fall under the jurisdiction of the U.S. Commodity Futures Trading Commission.

If states are allowed to regulate these markets anyway, the logic goes, national liquidity disappears. A market that works in one state but not another stops being a market at all. But, there are comparisons to existing gambling laws and we broke those down for you.

The Casino Comparison Only Goes So Far

State regulators tend to reach for the casino analogy first, and it is easy to see why. There is money at risk. Outcomes are uncertain. The optics are not subtle.

But structurally, prediction markets do not behave like casinos. Casinos set the odds. The house always wins over time. The product is entertainment.

Prediction markets do not work that way. Prices are set by participants. New information moves markets. There is no built-in house edge. The value comes from aggregating beliefs into a number that says something useful about the future.

Calling that gambling because it involves money is a shortcut, and not a very precise one.

Poker Explains the Skill Argument, and Its Limits

Poker is the comparison that usually comes next. Courts have spent years debating whether poker is mostly luck or mostly skill. Many have concluded that skill dominates over time, even if chance plays a role in the short run.

Yet poker is still regulated as gambling in most places. Not because it lacks skill, but because the law never quite figured out where else to put it.

That history matters. It shows how activities that clearly reward information and decision-making can still end up trapped in gaming frameworks that were built for something else entirely.

Prediction markets risk repeating that mistake. Like poker, they reward skill. Unlike poker, they are not games. They are continuous markets with prices, liquidity, and arbitrage. Treating them like a card room because money changes hands misses the point.

Why Prediction Markets Look Like Futures Markets

If you strip away the cultural baggage, prediction markets start to look familiar. They are standardized contracts tied to future outcomes. Prices reflect probability. Traders respond to data.

That is the same basic logic behind futures contracts tied to interest rates, inflation, or commodities. Those markets involve speculation, risk, and uncertainty too. They are regulated, but they are not treated as gambling.

This is where Coinbase’s argument lands. Congress already created a regulator for markets like this. The CFTC exists to oversee contracts that trade future outcomes, including event-based ones. The fact that an outcome is an election or a policy decision does not change the structure of the market.

What Changes If Coinbase Wins

If Coinbase wins, the impact goes well beyond these three states.

First, jurisdiction becomes clearer. States would no longer be able to regulate federally governed prediction markets simply by labeling them gambling. That alone would remove one of the biggest sources of uncertainty hanging over the industry.

Second, the casino argument loses legal weight. Courts would be acknowledging that uncertainty plus money does not automatically equal gambling, especially when prices are discovered through open trading rather than set by an operator.

Third, prediction markets would finally escape the poker problem. They would not sit in a gray zone where skill is recognized but regulation never quite fits. Instead, they would fall under a framework designed for markets, not games.

With that clarity, these markets could scale. Liquidity would deepen. Institutional participants could step in. Contracts tied to economic data, climate outcomes, and corporate milestones could expand without the constant risk of state-level shutdowns.

Over time, prediction markets could start to look less like a regulatory headache and more like infrastructure. Another tool, alongside surveys and models, for figuring out what the world might do next.

A Bigger Signal About Regulation

This case is not really about Coinbase. It is about whether U.S. regulation can adapt when finance starts to blur into something new, a question that has stifled digital asset growth for years.

Casinos deal in chance. Poker deals in skill inside a gaming framework. Futures markets deal in information. Prediction markets belong in the third category, even if they make people uncomfortable.

If courts agree, it would send a signal that regulation can still be about function rather than analogy. That is not a radical idea. It is how most financial markets came to exist in the first place. Prediction markets are here to stay. We've seen huge partnerships with major media news outlets and exchanges. The regulatory details need to be clearly defined for this emerging industry.

And if that happens, prediction markets may finally stop being debated as gambling, and start being treated as what they have been trying to become all along. Markets that trade in probabilities, under rules built for markets, not casinos.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

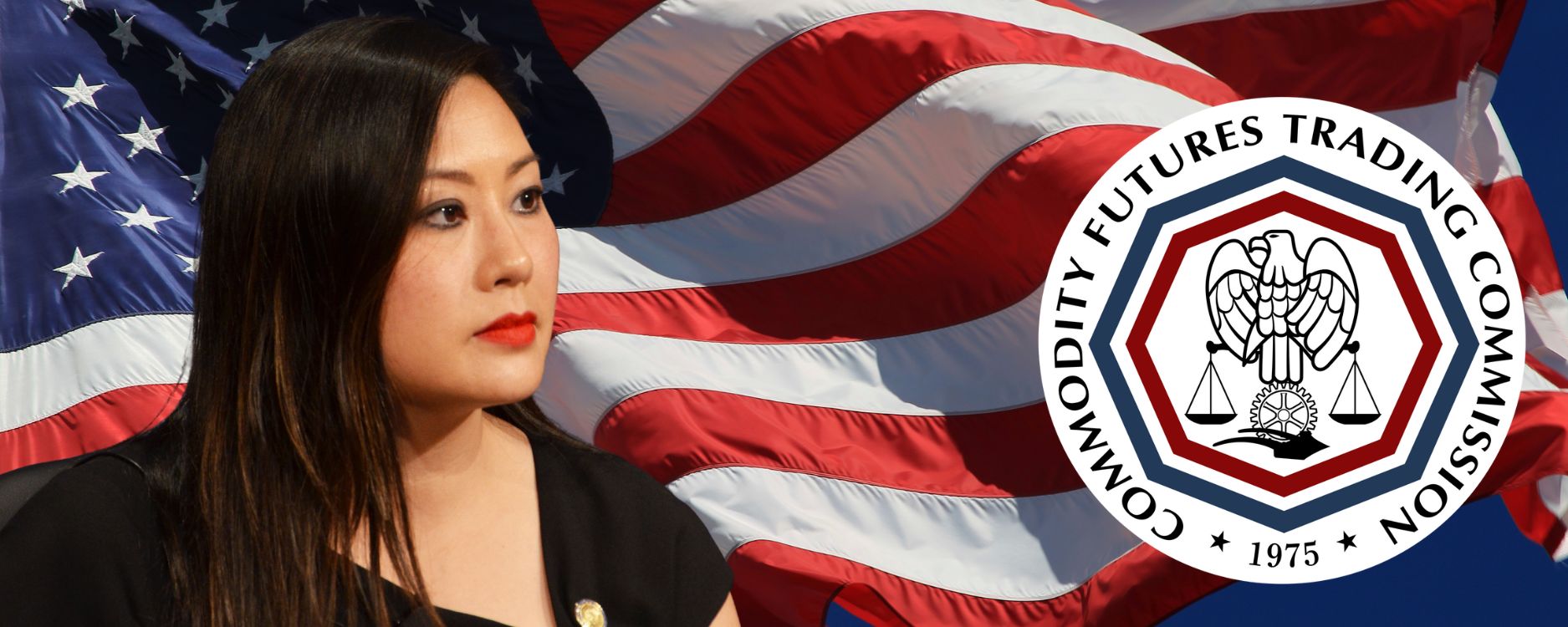

Crypto CEOs Join CFTC Innovation Council as Market Shift Begins

Caroline Pham is heading into her final stretch as acting chair of the CFTC, but she is not easing her way out. Instead, she has pulled together a new CEO Innovation Council, bringing in a mix of crypto founders and leaders from major financial institutions. The timing feels intentional. Markets are shifting fast, the technology is shifting even faster, and she clearly wanted this group in place before she hands off the job.

The council itself is an unusual gathering. On one side are Tyler Winklevoss from Gemini, Arjun Sethi from Kraken and Shayne Coplan from Polymarket. On the other, executives from CME Group, Nasdaq, ICE and Cboe. It is not often you see these people sitting on the same advisory panel, let alone one created this quickly. According to the commission, the entire list came together in about two weeks, which says a lot about how much urgency Pham applied.

She thanked the group for agreeing to join so quickly, noting that the commission needs their experience as it tries to prepare for what comes next. The council will focus on the areas where the rulebook is changing as fast as the products themselves. Tokenization. Prediction markets. Perpetual contracts. Crypto collateral. Around the clock trading. Blockchain market plumbing. Basically all the things that traditional derivatives systems were never built to handle.

Here is the full list of names:

Shayne Coplan, Polymarket

Craig Donohue, Cboe

Terry Duffy, CME Group

Tom Farley, Bullish

Adena Friedman, Nasdaq

Luke Hoersten, Bitnomial

Tarek Mansour, Kalshi

Kris Marszalek, Crypto.com

David Schwimmer, LSEG

Arjun Sethi, Kraken

Jeff Sprecher, Intercontinental Exchange

Tyler Winklevoss, Gemini

All of this is happening as the agency prepares for new leadership. President Trump’s nominee, Mike Selig, is expected to be confirmed soon. When he steps in, he will inherit an agency already deep into crypto policy work that accelerated under Pham. Just this week, the CFTC launched a pilot for using crypto collateral inside derivatives markets. A few days before that, Bitnomial began offering leverage spot crypto trading with her support.

Pham has only been in the acting role for a short time, but she treated crypto as a top priority, pushing several initiatives that line up with the administration’s goal of positioning the United States as a leading hub for digital assets. Over at the SEC, Chairman Paul Atkins has been doing something similar through Project Crypto, which has been absorbing much of the agency’s energy.

What comes next will land in Selig’s lap. But with this council now in place, he will walk into a job where the industry and the regulators are already in the middle of a much bigger conversation about what the future of market structure should look like.