#market structure

White House Calls Out Dimon on Stablecoin Yields

Washington's stablecoin standoff just got a whole lot more personal.

Patrick Witt, the executive director of the President's Council of Advisors for Digital Assets, publicly fired back at JPMorgan Chase CEO Jamie Dimon on Tuesday, calling his arguments about stablecoin yields misleading and, in Witt's own word, a "deceit."

The exchange marks one of the sharpest moments yet in a months-long tug-of-war between Wall Street and the White House over the future of digital asset regulation in America.

Dimon Draws a Line in the Sand

It started Monday, when Dimon went on CNBC and didn't mince words. His position was simple, if uncompromising: any platform holding customer balances and paying interest on them is functionally a bank, and should be regulated like one.

"If you do that, the public will pay. It will get bad," Dimon warned, arguing that a two-tiered system where crypto firms operate with fewer restrictions than banks is unsustainable.

Dimon suggested a narrow compromise: platforms could offer rewards tied to transactions. But he drew a clear line at interest-like payments on idle balances, saying, "If you're going to be holding balances and paying interest, that's a bank."

The list of obligations Dimon believes should apply is long, FDIC insurance, capital and liquidity requirements, anti-money laundering controls, transparency standards, community lending mandates, and board governance requirements. "If they want to be a bank, so be it," he said.

For Dimon, it's fundamentally about fairness. JPMorgan uses blockchain in its own operations, and the CEO was careful to frame his argument not as anti-crypto but as pro-competition on equal terms. "We're in favor of competition. But it's got to be fair and balanced," he said.

The White House Fires Back

Witt wasn't going to let that stand. In a post on X late Tuesday, he went directly at Dimon's framing, calling it deliberately misleading.

"The deceit here is that it is not the paying of yield on a balance per se that necessitates bank-like regulations, but rather the lending out or rehypothecation of the dollars that make up the underlying balance," Witt wrote. "The GENIUS Act explicitly forbids stablecoin issuers from doing the latter."

The argument gets at something technically important. What makes a bank risky, and therefore subject to heavy regulation, isn't that it pays interest. It's that banks take deposits and lend them back out, creating credit and the systemic risk that comes with it. If too many people want their money back at once, that's a bank run. Stablecoin issuers operating under the GENIUS Act must maintain reserves at a 1:1 ratio. There is no fractional reserve lending, no rehypothecation, no credit creation.

In Witt's view, stablecoin balances aren't deposits, and treating them as such misrepresents what's actually happening. He closed with a pointed equation: "Stablecoins ≠ Deposits."

President Donald Trump didn't stay quiet either. On Tuesday, he took to Truth Social with a message that made his position unmistakably clear.

"The U.S. needs to get Market Structure done, ASAP. Americans should earn more money on their money. The Banks are hitting record profits, and we are not going to allow them to undermine our powerful Crypto Agenda that will end up going to China, and other Countries if we don't get the Clarity Act taken care of," Trump wrote.

Senator Cynthia Lummis quickly reposted Trump's message, adding her own call to action: "America can't afford to wait. Congress must move quickly to pass the Clarity Act."

The same day Trump posted, a Coinbase delegation led by CEO Brian Armstrong visited the White House for talks. The timing was not subtle.

The Real Stakes: The CLARITY Act

To understand why this debate matters so much right now, you need to understand the legislation being held hostage by it.

The GENIUS Act, signed into law in July 2025, established the first federal framework for payment stablecoins. The CLARITY Act is its sequel: a broader market structure bill that would assign clear regulatory jurisdiction to the SEC and CFTC over the crypto industry, and is widely seen as the piece of legislation needed to unlock large-scale institutional participation in digital assets.

The bill cleared the House comfortably but has been mired in Senate gridlock since January, when the Senate Banking Committee indefinitely postponed a planned markup vote. The trigger was Coinbase withdrawing support over a proposed amendment that would have restricted stablecoin rewards for users.

That withdrawal, announced by CEO Brian Armstrong in a post on X the night before the scheduled committee vote, split the crypto industry. a16z crypto's Chris Dixon publicly disagreed, posting "Now is the time to move the Clarity Act forward." Kraken's co-CEO Arjun Sethi also pushed back, writing that "walking away now would not preserve the status quo in practice" and warning it "would lock in uncertainty and leave American companies operating under ambiguity while the rest of the world moves forward."

The stakes for Coinbase are concrete. Stablecoins contribute nearly 20% of Coinbase's revenue, roughly $355 million in the third quarter of 2025 alone, and most of USDC's growth is occurring on Coinbase's platform. Coinbase currently offers 3.5% yield on USDC, a figure most traditional bank accounts can't come close to matching.

Banks Are Scared, and They Have the Numbers to Show It

The banking lobby's concern isn't hypothetical. Banking trade groups, led by the Bank Policy Institute, have warned that unrestricted stablecoin yield could trigger deposit outflows of up to $6.6 trillion, citing U.S. Treasury Department analysis. Bank of America CEO Brian Moynihan put a similar figure forward, reportedly suggesting as much as $6 trillion in deposits, representing roughly 30-35% of all U.S. commercial bank deposits, could be at risk.

Stablecoins registered $33 trillion in transaction volume in 2025, up 72% year-over-year. Bernstein projects total stablecoin supply will reach approximately $420 billion by the end of 2026, with longer-run forecasts from Citi putting the market at up to $4 trillion by 2030. Those aren't niche numbers anymore. At that scale, deposit competition becomes a serious macroeconomic question.

The American Bankers Association and 52 state bankers' associations explicitly urged Congress to extend the GENIUS Act's yield prohibitions to partners and affiliates of stablecoin issuers, warning of deposit disintermediation.

The Bottom Line

What's playing out right now is a genuine philosophical disagreement about what money is and how it should be regulated, wrapped inside a very consequential legislative fight, a prize fight with Banks in one corner and Crypto in the other.

Dimon's argument is not frivolous. Banks are regulated as heavily as they are because of what they do with deposited money, and a world where consumers move trillions into yield-bearing crypto instruments held at lightly regulated platforms carries real risks. The history of financial crises is largely a history of regulatory arbitrage gone wrong.

But Witt's counter is also not frivolous. The GENIUS Act was designed specifically to prevent stablecoin issuers from doing the things that make banks dangerous. A fully reserved, non-lending stablecoin issuer is structurally different from a fractional reserve bank, and applying the same regulatory framework to both risks conflating two fundamentally different business models.

What's harder to square is that the banking lobby's intervention in the CLARITY Act seems, to many in the crypto world, less about prudential regulation and more about protecting market share. President Trump has not been subtle about that read, accusing banks of holding the CLARITY Act hostage to protect incumbent interests against crypto competition.

With the legislative window narrowing, Armstrong back at the White House, and Trump openly calling out the banking lobby by name, this standoff has reached the kind of inflection point where someone is going to have to blink. The question is whether either side is willing to do it before time runs out entirely.

CFTC Names 35 Crypto, Finance Leaders to Advisory Panel

-

Hayden Adams, CEO, Uniswap Labs

-

Brian Armstrong, CEO, Coinbase

-

Shayne Coplan, CEO, Polymarket

-

Brad Garlinghouse, CEO, Ripple

-

Luke Hoersten, CEO, Bitnomial

-

Tarek Mansour, CEO, Kalshi

-

Kris Marszalek, CEO, Crypto.com

-

Nathan McCauley, CEO, Anchorage Digital

-

Peter Mintzberg, CEO, Grayscale

-

Sergey Nazarov, CEO, Chainlink Labs

-

Arjun Sethi, Co CEO, Kraken

-

Peter Smith, CEO, Blockchain.com

-

Tyler Winklevoss, CEO, Gemini

-

Anatoly Yakovenko, CEO, Solana Labs

-

Andrej Bolkovic, CEO, Options Clearing Corporation

-

Thomas Chippas, CEO, Rothera Markets

-

Professor Harry Crane, Representative

-

Chris Dixon, General Partner, a16z Crypto

-

Craig Donohue, CEO, Cboe Global Markets

-

Terry Duffy, Chair and CEO, CME Group

-

Tom Farley, CEO, Bullish

-

Adena Friedman, Chair and CEO, Nasdaq

-

Christian Genetski, President, FanDuel

-

Frank LaSalla, President and CEO, Depository Trust and Clearing Corporation

-

Walt Lukken, CEO, FIA

-

Scott D. O’Malia, CEO, ISDA

-

Alana Palmedo, Managing Partner, Paradigm

-

Vivek Raman, CEO, Etherealize

-

Professor Carla Reyes, Representative

-

Jason Robins, CEO, DraftKings

-

David Schwimmer, CEO, LSEG

-

Vance Spencer, Co founder, Framework Ventures

-

Jeff Sprecher, CEO, Intercontinental Exchange

-

Vlad Tenev, CEO, Robinhood

-

Don Wilson, CEO, DRW

White House Meets Crypto and Banking Leaders as Market Structure Bill Stalls

The White House is preparing to bring crypto executives and banking leaders into the same room again, a sign that Washington’s long running fight over how to regulate digital assets has reached another pressure point.

According to reporting citing Reuters, senior figures from the crypto industry and the banking sector are expected to meet with White House officials in early February to discuss a market structure bill that has recently hit a wall in Congress. The meeting comes at a moment when lawmakers have already locked in a stablecoin framework, but cannot seem to agree on the bigger question of who regulates crypto markets and how.

Market structure may sound abstract, but it is the foundation of everything else. It determines which agency has authority, how tokens are classified, how exchanges register, and whether new products are built in the United States or somewhere else.

The fact that the White House is stepping in suggests the administration believes the debate has moved beyond talking points and into the phase where compromises need to be made, especially between banks and crypto firms that see the future very differently.

Why this meeting matters now

When the White House convenes both sides of a financial policy fight, it usually means the normal legislative process is struggling. That is exactly what is happening with crypto market structure.

Congress made real progress last year by passing a federal stablecoin law. That victory raised expectations across the industry that broader rules for exchanges, tokens, and decentralized finance would be next. Instead, lawmakers have found themselves bogged down in disagreements that are harder to paper over.

At a high level, everyone says they want clarity. In practice, clarity means deciding winners and losers.

Banks want to make sure crypto products do not look or behave like deposits without being regulated like deposits. Crypto firms want rules that let them list assets, offer yield, and build new protocols without constant fear of enforcement actions. Regulators want authority that actually matches how the market works.

Those goals collide most directly in market structure legislation, which is why it has become the most contentious piece of crypto policy in Washington.

Where the bill stands today

The House has moved, the Senate is stuck

The House of Representatives has already passed a sweeping market structure bill that lays out a framework for classifying digital assets and dividing oversight between the SEC and the CFTC. The basic idea is simple. Tokens that function like securities fall under the SEC. Tokens that operate more like commodities fall under the CFTC, including spot market oversight.

That approach has strong support in the crypto industry because it offers a path to compliance that does not rely on years of litigation.

The Senate, however, is a different story. Jurisdiction is split between the Banking Committee and the Agriculture Committee, which oversees the CFTC. Each committee has released its own drafts, and neither side has a clear path to unifying them.

Markups have been delayed. Amendments are piling up. And the clock is ticking as lawmakers turn their attention to other priorities.

Stablecoin rewards have become the flashpoint

One of the biggest reasons the bill is stalled is stablecoin yield.

Even though stablecoins already have their own law, they still sit at the center of the market structure debate because they touch the banking system directly. The most controversial issue is whether stablecoins should be allowed to offer rewards simply for being held.

From the banking perspective, yield bearing stablecoins look uncomfortably close to deposits. Banks argue that if a token offers a return and can be redeemed at par, it competes with insured deposits without being subject to the same rules.

From the crypto side, rewards are seen as a feature, not a loophole. Many firms argue that stablecoins backed by cash and short term Treasurys are fundamentally different from bank liabilities, and that banning rewards would freeze innovation and entrench incumbents.

Some Senate drafts have tried to split the difference by restricting passive yield while allowing activity based incentives. That compromise has not satisfied everyone, which is why the issue keeps resurfacing.

This is also where a White House meeting could make a difference. Any bill that passes will need language banks can accept and crypto firms can actually use.

DeFi is the second unresolved battle

Decentralized finance is the other major fault line.

Lawmakers and regulators agree that DeFi cannot exist entirely outside the law. They disagree on how to draw the boundary. Some Senate proposals push Treasury to define compliance obligations for DeFi platforms, including disclosures and recordkeeping requirements.

The challenge is obvious. If the rules treat software like a traditional intermediary, developers will leave or go dark. If the rules are too permissive, lawmakers worry about money laundering, sanctions evasion, and consumer harm.

So far, no draft has solved this cleanly. The result is cautious, sometimes vague language that satisfies no one and invites future fights.

The SEC versus CFTC question is still unresolved

At its core, market structure is about classification.

Is a token a security, a commodity, something else, or some hybrid category that does not fit neatly into existing law? That answer determines which regulator takes the lead and how companies design their products.

Some Senate drafts introduce concepts like network tokens or ancillary assets to bridge the gap between traditional securities and decentralized systems. These ideas are meant to reduce uncertainty, but they also raise new questions about enforcement and interpretation.

For exchanges, custodians, and issuers, this is not academic. Classification determines what can be listed, how staking works, and whether certain products are viable in the US at all.

The Bottom Line

I am generally positive on the White House holding this meeting. At a minimum, it acknowledges what everyone in the industry already knows, which is that market structure is stuck and normal committee process is not getting it unstuck.

Getting banks and crypto firms in the same room matters, even if no one walks out with a breakthrough headline. These conversations tend to shape the edges of legislation more than the core, but in a bill this complex, the edges are often where everything breaks.

That said, expectations should stay grounded. A single meeting is not going to magically resolve the stablecoin yield debate, redraw the DeFi compliance perimeter, or settle the SEC versus CFTC turf war. Those fights are structural and political, and they will take time.

If anything meaningful comes out of this, it will likely show up quietly in revised draft language weeks from now, not in a press release the next day.

Still, the fact that the White House is leaning in is a good sign. It suggests there is real pressure to get something done, and an understanding that half measures or endless delay are no longer acceptable. For an industry that has spent years asking Washington to engage seriously, that alone is progress, even if the final outcome remains very much in flux.

Ripple and LMAX Push Institutional Stablecoin Adoption

Ripple and LMAX Push Institutional Stablecoin Adoption

Ripple’s reported deal with LMAX Group is not really about another exchange listing or a short-term liquidity boost. It is about where stablecoins are finally starting to show up inside institutional finance, and what that shift says about the next phase of crypto market structure.

The headline is simple enough. Ripple and LMAX have struck a $150 million agreement that brings Ripple’s dollar-backed stablecoin, RLUSD, deeper into LMAX’s institutional trading venues. The more interesting part is what comes next: RLUSD is expected to be usable as collateral, margin, and settlement capital by professional trading firms.

That may not sound dramatic at first glance, but inside institutional markets, it is a big deal.

From parking asset to working capital

For years, stablecoins have mostly played a supporting role. They were the thing traders sat in between positions or used to move money between exchanges when banks were closed. Retail users cared about convenience and price stability. Institutions cared about something else entirely: whether a stablecoin could actually replace cash in live trading workflows.

Using a stablecoin as collateral changes the conversation. Suddenly, that token is not just sitting idle. It is supporting leveraged positions, absorbing margin requirements, and moving around trading venues without waiting for bank wires or settlement windows.

LMAX is a meaningful place for that shift to happen. The firm has built its reputation on institutional-grade execution in FX and digital assets, serving banks, brokers, hedge funds, and proprietary trading firms. If RLUSD is accepted inside that ecosystem as usable collateral, it moves closer to being treated as functional cash, not just crypto-native liquidity.

Why LMAX matters more than a typical exchange

This is not a retail exchange partnership. LMAX’s client base is made up of firms that already manage risk, margin, and balance sheets for a living. These are the players who care about haircut schedules, collateral eligibility, operational reliability, and compliance comfort.

If those firms are willing to post RLUSD as collateral, it suggests confidence not only in the token’s peg, but also in the issuer behind it. That trust is harder to earn than a listing, and far more valuable once it exists.

It also reflects a broader institutional reality. Firms want capital that moves around the clock, across venues, and across asset classes. Cash tied to banking hours and regional settlement systems increasingly feels like a constraint.

Ripple’s stablecoin strategy is becoming clearer

RLUSD is not a side project for Ripple. The company has been positioning it as an enterprise-grade stablecoin, backed by segregated reserves and supported by regular attestations. It runs on both XRP Ledger and Ethereum, and Ripple has been explicit about pushing it into real financial workflows rather than letting it exist as a passive asset.

That push has shown up in a few places already. RLUSD has been integrated into Ripple’s payments stack. It has been listed on institutional venues. And now, with LMAX, it is moving into collateral use cases.

Seen together, these steps suggest Ripple is trying to build something closer to an institutional cash layer than a retail stablecoin brand.

The collateral flywheel institutions care about

For professional trading firms, collateral is where the real leverage sits. If a stablecoin can be posted as margin, it becomes part of the firm’s core capital stack. That unlocks capital efficiency, especially for firms operating across time zones and asset classes.

Once a stablecoin clears that bar, it can expand into settlement, netting, and treasury operations. It can move between venues over the weekend. It can reduce idle balances. It can simplify how firms manage liquidity across crypto and traditional markets.

This is also why Ripple’s broader institutional moves matter. The company has been building out infrastructure that connects stablecoins, custody, prime brokerage, and payments. The LMAX deal fits neatly into that picture.

A crowded market with a narrow institutional lane

RLUSD is entering a stablecoin market dominated by incumbents with massive scale. But market cap is not the only metric that matters in institutional finance. Acceptance as collateral, integration into regulated venues, and operational trust often matter more than raw supply.

Institutions do not ask which stablecoin is biggest. They ask which one their venue will accept, which one clears risk checks, and which one will still work under stress.

Ripple is clearly aiming at that narrow lane, where trust, compliance, and plumbing matter more than retail mindshare.

What still needs to be proven

There are still open questions. The exact scope of RLUSD’s collateral eligibility at LMAX matters. Haircuts, product coverage, and custody integration will determine how widely it is actually used.

There is also the question of scale. True institutional adoption shows up in volume, not announcements. It shows up during volatile markets, when liquidity and redemptions are tested.

And as always, jurisdiction matters. Stablecoin availability and usage depend on regulatory boundaries that vary by region and client type.

Why this matters now

The broader takeaway is that stablecoins are quietly moving from the edges of crypto markets toward the center of institutional finance. Not through hype cycles, but through plumbing.

If RLUSD becomes a routine piece of collateral inside venues like LMAX, it will be less about Ripple winning a headline and more about stablecoins winning a role they have been chasing for years.

In that sense, this deal is less about a token and more about a shift. Stablecoins are no longer just crypto’s cash. They are starting to look like finance’s.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Coinbase Breaks With Senate on Crypto Bill as Stablecoin Rules Spark Pushback

Coinbase Draws a Line in the Sand on Market Structure Bill

Coinbase is stepping back from Washington’s biggest crypto push yet.

Just days before a crucial vote in the Senate Banking Committee, the largest US crypto exchange says it will not support the Senate’s sweeping crypto market structure bill in its current form. The message from Coinbase CEO, Brian Armstrong, is blunt. Regulatory clarity matters, but not at any cost.

The move highlights a growing divide between lawmakers eager to lock in federal rules and an industry increasingly wary of legislation that could reshape its business in unintended ways.

A Bill Meant to End the Gray Area

The Senate bill, months in the making, is designed to finally spell out how digital assets are regulated in the United States. At its core, the proposal tries to answer long-standing questions about which crypto assets fall under securities law, which should be treated as commodities, and how oversight should be split between regulators.

For years, crypto companies have complained that the lack of clear rules has pushed innovation offshore and left firms vulnerable to enforcement actions after the fact. On paper, this bill is supposed to fix that.

But as the text has taken shape, it has also picked up provisions that some in the industry see as deal-breakers.

Stablecoin Rewards Become the Flashpoint

For Coinbase, the biggest problem sits with stablecoins.

The draft legislation includes language that could sharply limit or effectively eliminate rewards paid to users who hold stablecoins on platforms like Coinbase. These rewards are not technically interest paid by issuers, but incentives offered by exchanges and intermediaries. Still, critics argue they look and feel a lot like bank deposits, without bank-style regulation.

Traditional banking groups have pushed hard for tighter rules here. Their concern is straightforward. If consumers can earn yield on dollar-pegged crypto tokens outside the banking system, deposits could drain from insured banks, particularly smaller ones.

Coinbase sees it differently. Stablecoin rewards have become a meaningful part of how crypto platforms compete and how users engage with dollar-based crypto products. Cutting them off, the company argues, would harm consumers and hand an advantage back to traditional finance.

In private and public conversations, Coinbase executives have made it clear that they are unwilling to back a bill that undercuts what they view as a legitimate and already regulated product.

"After reviewing the Senate Banking draft text over the last 48 hours, Coinbase unfortunately can’t support the bill as written,” Armstrong said. "This version would be materially worse than the current status quo, we'd rather have no bill than a bad bill."

Why This Matters Beyond Coinbase

Coinbase’s stance carries weight. It is one of the most politically active crypto companies in Washington and often serves as a bellwether for broader industry sentiment.

If Coinbase is out, others may quietly follow.

That raises the risk that lawmakers end up with a bill that lacks meaningful industry buy-in, or worse, one that passes but leaves key players unhappy enough to challenge or work around it.

Some firms are already exploring alternatives, including banking charters or trust licenses, as a hedge against restrictive federal rules. Others may simply slow US expansion and look overseas.

A Narrow Path Forward in the Senate

The timing is not ideal.

The Senate Banking Committee is expected to vote on the bill imminently, but support remains fragile. Lawmakers are divided not just on stablecoins, but also on how to handle decentralized finance, custody rules, and even ethics provisions tied to political exposure to crypto.

Add in election-year politics, and the window for compromise looks tight.

If the bill stalls or fails in committee, there is a real chance it gets pushed into the next Congress. That would mean at least another year, and likely more, of regulatory uncertainty.

No Law vs a Bad Law

Behind the scenes, a familiar argument is playing out.

Some in Washington believe that imperfect legislation is better than none at all. The industry, scarred by years of enforcement-first regulation, is no longer convinced.

Coinbase’s decision reflects a growing view among crypto companies that a flawed law could do more long-term damage than continued ambiguity. Once rules are written into statute, they are far harder to undo.

For now, the standoff continues.

Whether lawmakers soften the bill to keep major players on board or push ahead regardless may determine not just the fate of this legislation, but the shape of US crypto regulation for years to come.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Polymarket To Bring Prediction Market Data to The Wall Street Journal In Dow Jones Deal

Dow Jones is bringing prediction market data into the center of mainstream financial news, and the move says a lot about how institutions now think about expectations.

Through a new partnership, Polymarket’s real-time probabilities will begin appearing across Dow Jones properties, including The Wall Street Journal, Barron’s, and MarketWatch. These are not experimental sidebars or crypto-only sections. They are some of the most influential platforms in global finance. Placing prediction market data alongside prices, earnings estimates, and economic indicators reflects a belief that expectations themselves are now core financial information.

This is not about betting for entertainment. It is about who defines what the market thinks, and how fast that belief can be measured.

From curiosity to core signal

Prediction markets spent years on the margins, popular with political traders and information obsessives who wanted a cleaner read on future outcomes. What changed was not the concept, but the credibility and distribution.

Dow Jones is not treating Polymarket as a novelty widget. The company plans to integrate its data directly into consumer-facing products, including prominent digital placements and market-focused pages. One early example is an earnings calendar built around market-implied expectations rather than analyst consensus or corporate guidance alone.

Markets move on belief before they move on fact. Earnings surprises, regulatory decisions, court rulings, and central bank signals all trade on anticipation. Prediction markets make that anticipation visible in a single number that updates continuously.

For readers, the value is immediate. Instead of asking what already happened, the data answers a more urgent question: what does the market think is about to happen right now?

Why institutions are choosing markets over polls

For decades, polling was the default way media organizations measured expectations. Ask a group what they think will happen, average the answers, and publish the result. That model worked when belief changed slowly and news cycles moved in days rather than minutes.

That is no longer the case.

Prediction markets like Polymarket offer a live, self-correcting signal that polling cannot match. Participants are not just stating opinions, they are committing capital. When new information appears, prices adjust immediately. There is no waiting for another survey, no methodological lag, and no static snapshot that begins aging the moment it is published.

For Dow Jones, this matters because speed and credibility are now inseparable. Polls depend on sampling assumptions, response honesty, and weighting choices that are easy to question after the fact. Prediction markets push that weighting into the market itself. Influence emerges through price, not editorial judgment.

Markets also surface uncertainty more honestly. A poll can show a stable percentage while masking deep disagreement. A prediction market exposes that tension directly through volatility and rapid probability swings. For financial coverage built around anticipation rather than confirmation, that visibility is valuable.

In that sense, Polymarket data is not replacing journalism. It is replacing an aging expectations tool.

Built for modern financial media

Financial news has steadily moved toward modular data. Futures boxes, rate probability tables, volatility gauges, and dashboards now sit alongside traditional reporting. Prediction market probabilities fit naturally into that structure.

They are compact, intuitive, and fast. A 64 percent probability communicates instantly, without requiring paragraphs of caveats. For audiences already trained to think in odds and ranges, the format feels native.

Dow Jones executives have described prediction market data as a way to show collective belief in real time. The wording is careful for a reason. These numbers are not forecasts handed down as truth. They are signals of sentiment, continuously updated, sometimes wrong, often revealing.

Part of a broader shift, not a one-off

The Dow Jones partnership is not happening in isolation. CNBC recently announced a multi-year deal with Kalshi to integrate prediction data across its television and digital platforms. Intercontinental Exchange, the parent company of the New York Stock Exchange, has made a strategic investment in Polymarket and positioned its data as a product for institutional clients.

The pattern is clear. Prediction markets are trying to move from destination platforms to infrastructure. Less about attracting users to trade, more about embedding probabilities wherever decisions are made.

For publishers, that creates a new class of data product. For prediction platforms, distribution is the growth strategy.

How prediction data reshapes coverage

The most important change will be editorial, not technical.

Sudden shifts in probability can become story drivers. Why did expectations flip overnight? What information entered the market? Who acted first? The probability move becomes the signal, and the reporting explains it.

Earnings coverage is an obvious fit, but so are regulatory deadlines, major lawsuits, macro announcements, and elections. Anywhere the market is waiting, prediction data creates a visible tension line that journalism can follow.

Used well, these markets do not replace analysis. They sharpen it.

The risks are still there

Prediction markets are not neutral truth engines.

Thin liquidity can create false confidence. Small groups of traders can push prices, especially in niche markets. Numbers that look authoritative can mislead if they are presented without context.

There are also real issues around contract definitions and resolution. Ambiguity can turn into public disputes, and those disputes matter more when probabilities are embedded in major media brands.

Regulatory uncertainty remains part of the backdrop as well. As prediction data reaches broader retail audiences through mainstream publishers, scrutiny is likely to increase.

For Dow Jones, the challenge is framing. These probabilities must be treated like market data, not predictions carved in stone.

Why this matters long term

This partnership points to a larger shift in how financial information is consumed.

Markets increasingly trade on narratives, second-order beliefs, and collective anticipation. Prediction markets make those forces legible. Media companies want tools that help readers understand not just what happened, but what everyone thinks is about to happen.

For Polymarket, the strategy is clear. Becoming embedded in the workflows of investors, analysts, and journalists is more powerful than being another destination site.

For financial media, this is a bet that probabilities will become as standard as price charts.

And for readers, it suggests the future of market news will focus less on confident forecasts and more on watching belief itself move, in real time.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

What the CLARITY Act Means for Crypto and Why It Matters So Much

If you have spent any real time building, trading, or working in crypto in the U.S., you already know the pattern. The rules are never fully clear. Guidance usually comes after the fact. And “compliance” often feels less like a checklist and more like a guessing game.

That is the environment the Digital Asset Market Clarity Act, better known as the CLARITY Act, is trying to change.

On January 15, 2026, the Senate Banking Committee is scheduled to hold a critical markup session on the bill. That might sound like inside-baseball legislative procedure, but it is not. A markup is where lawmakers decide what a bill really is. Language gets tightened. Loopholes get closed or widened. Entire sections can disappear.

For crypto, this is one of those moments where the future shape of U.S. regulation is actually being decided.

The problem CLARITY is trying to solve

Right now, crypto regulation in the U.S. is reactive.

The laws that exist were written long before blockchains, tokens, or decentralized networks. Regulators have mostly tried to force crypto into frameworks that were never designed for it, often relying on enforcement actions to define the rules retroactively.

CLARITY is an attempt to stop doing that.

The bill starts from a simple premise: not everything in crypto is the same, so it should not all be regulated the same way.

Launching a token to fund a network is not the same as trading that token years later. Writing open-source code is not the same as holding customer funds. Running a wallet is not the same as running an exchange.

Those distinctions sound obvious inside the industry. CLARITY tries to make them explicit in law.

Tokens are not frozen in time

One of the most important ideas in the bill is that a token’s legal treatment should not be locked forever to how it was first sold.

Under the current system, if a token was ever distributed in a way that looks like fundraising, it can carry securities risk indefinitely. Even if the network decentralizes. Even if the original team steps away. Even if the token functions more like a commodity than an investment.

CLARITY tries to separate:

-

The initial transaction, which may look like an investment contract

-

The token itself, once it is broadly distributed and actively used

That distinction matters because it opens the door to secondary markets operating without constant legal uncertainty, while still keeping guardrails around early fundraising.

What “mature blockchain” actually means

To make that transition possible, CLARITY introduces the concept of a mature blockchain system.

Stripped of legal language, the question is pretty straightforward: does anyone actually control this thing?

If a small group can still unilaterally change the rules, supply, or governance, regulators get more leverage. If control is meaningfully distributed and no one actor is calling the shots, the regulatory burden can ease.

The bill creates a certification process around this idea, with a defined window for regulators to challenge a claim of maturity.

This is one of the most debated sections of the bill. It is also one of the most important. The standard has to be real, but it also has to be achievable. Senate changes here could dramatically affect how useful the bill ends up being.

How token launches could work going forward

CLARITY does not remove oversight from token launches. Instead, it tries to make that oversight fit reality.

The bill allows certain token offerings to proceed under an exemption, but only with meaningful disclosures. Projects would need to explain things like:

-

How token supply and issuance work

-

What rights, if any, token holders have

-

How governance actually functions in practice

-

What the project plans to build and what risks exist

The shift here is away from clever legal gymnastics and toward plain-English transparency. For founders, that could mean fewer surprises and a clearer sense of what is expected.

Why exchanges are watching this so closely

For U.S. crypto exchanges, CLARITY is largely about secondary markets.

Today, listing a token can feel risky even if that same asset trades freely outside the U.S. The legal line between primary fundraising and secondary trading has never been cleanly drawn.

CLARITY tries to draw that line. If it holds, exchanges would finally have a framework designed specifically for spot crypto markets, instead of trying to fit into rules written for something else.

A bigger role for the CFTC

Another major shift is regulatory jurisdiction.

CLARITY gives the CFTC clear authority over spot markets for digital commodities, not just derivatives. It also creates new registration paths for exchanges, brokers, and dealers that are tailored to how crypto markets actually function.

Importantly, the bill pushes for speed. It directs the CFTC to create an expedited registration process, acknowledging that waiting years for clarity is not realistic in fast-moving markets.

DeFi, software, and where things get tricky

DeFi is where the bill walks a tightrope.

CLARITY says that people should not be treated as regulated intermediaries just for building or maintaining software, running nodes, providing wallets, or supporting non custodial infrastructure. It also makes clear that participating in certain liquidity pools, by itself, should not automatically trigger exchange-level regulation.

At the same time, fraud and manipulation laws still apply.

Supporters see this as long overdue recognition that infrastructure is not the same as custody or brokerage. Critics worry about edge cases, especially where front ends, admin controls, or governance tokens blur the lines.

This is an area where Senate edits could have outsized impact.

Federal rules versus state rules

The bill also leans toward stronger federal oversight and narrower state-by-state requirements in certain areas.

For companies, that means fewer conflicting regimes and lower compliance friction. For critics, it raises concerns about losing fast-moving state enforcement in an industry that still sees its share of bad actors.

That tension is not going away, and it will likely surface again during markup.

Self custody, explicitly protected

One of the clearest statements in CLARITY is its protection of self custody.

The bill explicitly affirms the right to hold your own crypto and transact peer to peer for lawful purposes. In an environment where indirect restrictions have been a constant fear, putting this into statute is not symbolic. It is structural.

Developers get some breathing room

CLARITY also addresses a long-running concern among builders.

The bill says that non-controlling developers and infrastructure providers should not be treated as money transmitters simply for writing code or publishing software, as long as they do not control user funds or transactions.

For many developers, this removes a quiet but persistent legal cloud that has hung over the industry.

Why January 15 is such a big deal

The January 15 markup is where all of this either becomes real or starts to unravel.

This is where lawmakers decide how strict the maturity standards are, how wide the DeFi exclusions go, how much authority regulators actually get, and whether the bill delivers usable clarity or just new gray areas.

If CLARITY moves forward in a recognizable form, it becomes the most serious attempt yet to give crypto a durable U.S. market structure. If it does not, the industry likely stays where it is now, building first and hoping the rules catch up later.

How you can get involved?

This is also the moment where voices outside Washington still matter.

Lawmakers are actively weighing feedback. Staffers are reading messages. Offices are tracking where their constituents stand. Silence gets interpreted as indifference, and indifference makes it easier for complex bills to stall or be watered down.

If you believe crypto should have clear rules instead of enforcement-by-surprise, this is the time to say so.

That means contacting your representatives. Find out who your representative is and where they stand on crypto policy. Tell them that market structure clarity matters. Explain why builders, users, and businesses need predictable rules to stay in the U.S. Explain why self custody, open infrastructure, and lawful innovation should be protected, not pushed offshore.

It also means supporting organizations that are trying to organize that voice.

One such organization is Rare PAC, a political action committee advocating for regulatory clarity, innovation, and economic opportunity powered by decentralized technologies. Rare PAC works to ensure that the United States remains a global leader in those decentralized technologies and supports candidates who are committed to building A Crypto Forward America.

Bills like CLARITY do not pass or fail in a vacuum. They pass because people show up, speak up, and make it clear that getting this right matters.

January 15 is not the end of the process, but it is one of the moments that will shape everything that comes after.

Spot Crypto ETFs Cross $2 Trillion in Trading Volume as Market Matures

U.S. spot crypto ETFs have now crossed $2 trillion in cumulative trading volume, and the pace is what stands out. The second trillion arrived in a fraction of the time it took to reach the first, a sign that these products are no longer just a post launch curiosity. They’ve become part of the daily machinery of crypto markets.

This milestone is about usage, not hype. Cumulative volume counts every trade that’s taken place since launch. It’s not a measure of how much money investors have parked in these funds, and it’s not a scorecard for inflows. It simply answers one question: how often are people actually using these ETFs to trade crypto exposure?

The answer now is: a lot.

Bitcoin Did the Heavy Lifting, Ethereum Added Fuel

Most of that $2 trillion comes from spot Bitcoin ETFs, which have been trading heavily all year. Bitcoin products built liquidity early and never really gave it back. By the end of 2025, they were doing massive daily volume even on relatively quiet market days.

Ethereum ETFs came later, but once they found their footing, they added a meaningful second leg. As ETH products matured, traders began using them not just for long term exposure, but also for positioning, rotation, and relative value trades against Bitcoin.

Together, they pushed cumulative volume past the $2 trillion mark, and the curve got steeper along the way.

Why Trading Picked Up So Quickly

A few things changed over the past year.

First, the plumbing improved. Market makers figured out how to price these products efficiently, spreads tightened, and trading got easier. Once friction drops, volume usually follows.

Second, volatility helped. Crypto spent much of the year moving between risk on and risk off. In those environments, ETFs are an easy switch. They let traders adjust exposure fast without dealing with custody, exchanges, or operational headaches.

Third, liquidity concentrated. A handful of ETFs became clear winners, and traders gravitate to the deepest pools. That concentration pulls even more activity into the same tickers, reinforcing the trend.

And finally, these ETFs stopped feeling “new.” Once something becomes familiar, it starts getting used more casually, for hedges, reallocations, and short term trades that don’t make headlines.

This Isn’t Just About New Money

It’s important to separate volume from inflows.

Yes, spot crypto ETFs have pulled in tens of billions in new capital since launch, especially on the Bitcoin side. That shows real demand for regulated crypto exposure. But volume tells a different story. It shows repetition. The same capital moving in and out, sometimes many times over.

That’s actually what makes this milestone interesting. It suggests ETFs are becoming the default execution venue for a growing slice of crypto trading, not just a one way funnel for long term investors.

ETFs Are Becoming a Price Discovery Layer

As trading volume piles up, ETFs start to matter more for price formation. On active days, price moves often show up in ETFs first, then ripple into futures and spot markets as arbitrage kicks in.

That doesn’t mean ETFs control crypto prices, but it does mean they’re part of the feedback loop now. For traditional investors especially, the ETF ticker is the market.

This also nudges crypto a bit closer to traditional market behavior. Flows, positioning, and narrative cycles start to matter more, sometimes even more than onchain activity in the short term.

What to Watch From Here

Crossing $2 trillion doesn’t mean volume will grow in a straight line forever. Trading activity can cool when volatility drops or when investors get more comfortable holding through cycles.

But a few things will signal whether this trend sticks:

-

steady daily volume, not just spikes

-

broader participation beyond one or two dominant funds

-

continued activity in Ethereum ETFs, not just Bitcoin

-

how ETFs behave during the next real market stress test

For now, the takeaway is simple. Spot crypto ETFs aren’t an experiment anymore. They’re being used, heavily, and the market is treating them like infrastructure. That $2 trillion figure isn’t just a big number. It’s a sign that crypto trading has quietly picked up a new center of gravity.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

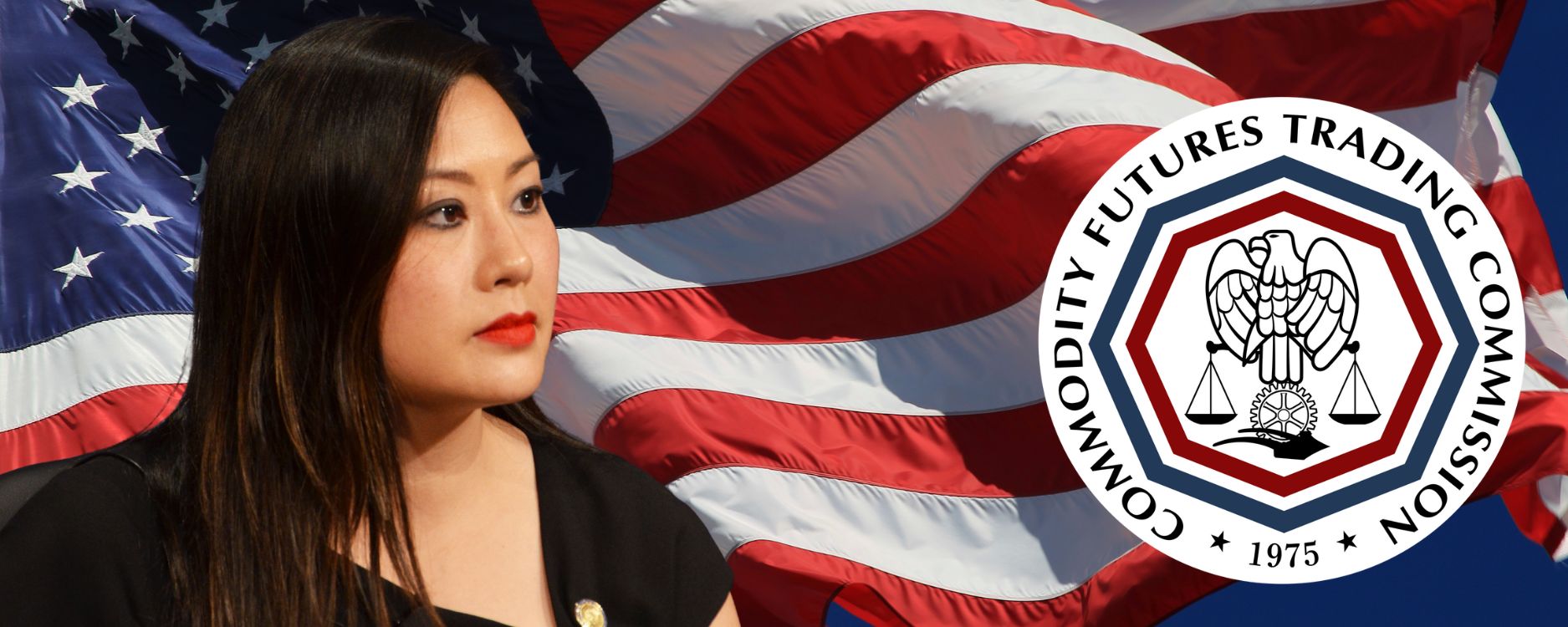

Crypto CEOs Join CFTC Innovation Council as Market Shift Begins

Caroline Pham is heading into her final stretch as acting chair of the CFTC, but she is not easing her way out. Instead, she has pulled together a new CEO Innovation Council, bringing in a mix of crypto founders and leaders from major financial institutions. The timing feels intentional. Markets are shifting fast, the technology is shifting even faster, and she clearly wanted this group in place before she hands off the job.

The council itself is an unusual gathering. On one side are Tyler Winklevoss from Gemini, Arjun Sethi from Kraken and Shayne Coplan from Polymarket. On the other, executives from CME Group, Nasdaq, ICE and Cboe. It is not often you see these people sitting on the same advisory panel, let alone one created this quickly. According to the commission, the entire list came together in about two weeks, which says a lot about how much urgency Pham applied.

She thanked the group for agreeing to join so quickly, noting that the commission needs their experience as it tries to prepare for what comes next. The council will focus on the areas where the rulebook is changing as fast as the products themselves. Tokenization. Prediction markets. Perpetual contracts. Crypto collateral. Around the clock trading. Blockchain market plumbing. Basically all the things that traditional derivatives systems were never built to handle.

Here is the full list of names:

Shayne Coplan, Polymarket

Craig Donohue, Cboe

Terry Duffy, CME Group

Tom Farley, Bullish

Adena Friedman, Nasdaq

Luke Hoersten, Bitnomial

Tarek Mansour, Kalshi

Kris Marszalek, Crypto.com

David Schwimmer, LSEG

Arjun Sethi, Kraken

Jeff Sprecher, Intercontinental Exchange

Tyler Winklevoss, Gemini

All of this is happening as the agency prepares for new leadership. President Trump’s nominee, Mike Selig, is expected to be confirmed soon. When he steps in, he will inherit an agency already deep into crypto policy work that accelerated under Pham. Just this week, the CFTC launched a pilot for using crypto collateral inside derivatives markets. A few days before that, Bitnomial began offering leverage spot crypto trading with her support.

Pham has only been in the acting role for a short time, but she treated crypto as a top priority, pushing several initiatives that line up with the administration’s goal of positioning the United States as a leading hub for digital assets. Over at the SEC, Chairman Paul Atkins has been doing something similar through Project Crypto, which has been absorbing much of the agency’s energy.

What comes next will land in Selig’s lap. But with this council now in place, he will walk into a job where the industry and the regulators are already in the middle of a much bigger conversation about what the future of market structure should look like.