#Bitcoin

Ex-LAPD Cop Convicted in $350K Bitcoin Kidnapping Case

Eric Halem, a former Los Angeles Police Department officer, has been found guilty of kidnapping a 17-year-old and stealing $350,000 worth of crypto after invading his home in 2024.

Halem, who served with the LAPD for 13 years but retired in 2022, was said to have illegally invaded the home of the teen, named Daniel, alongside three co-conspirators.

Upon gaining entrance into the teen's home under the guise of carrying out a search warrant, Halem subdued both the teen and his girlfriend, threatening to shoot him if he didn't hand over a hard drive containing Bitcoin. Apparently, the teen did have a significant amount of crypto.

Although Halem has been found guilty by the court, his sentencing is scheduled for March 31. And since he's been tried for kidnapping and robbery, which fall under California's aggravated statutes, Halem risks spending a long time in prison.

The Rise of Wrench Attacks

A wrench attack, also known as the $5 wrench attack, involves physical threats or violence to force a person to hand over their crypto private keys.

There has been an increase in the number of wrench attacks within the last few years. According to a 2025 security report from blockchain security firm CertiK, there were 72 recorded incidents of wrench attacks, a 75% increase from 2024.

Certik also reported a loss of more than $40.9 million from these attacks, with Europe accounting for 40% of these attacks worldwide, and kidnapping being the most common method used by assailants.

Jameson Lopp, Co-founder and Chief Security Officer of crypto security firm Casa Inc, has also been documenting these crypto wrench attacks from 2014 to date in a GitHub repository named "physical-bitcoin-attacks."

Based on tracked incidents in the GitHub repo, there have been 16 documented crypto-wrench attack cases this year alone, with France recording the most cases, with kidnapping being the most common method used by attackers.

Michael Saylor’s Strategy Makes its 101st Bitcoin Purchase

Image credit: Binance.com

Strategy, the world's largest public holder of Bitcoin, has deepened its Bitcoin bet, completing its 101st Bitcoin purchase.

According to a filing made to the US Securities and Exchange Commission on Monday of this week, Strategy acquired 3,015 bitcoins for $204.1 million last week.

Based on information available on the US SEC website, the average purchase price for this transaction was $67,700 per BTC, below the company's average acquisition price of $75,985. With this latest purchase, Strategy now has total Bitcoin holdings of 720,737 BTC.

Image credit: sec.gov

Saylor’s Long-Term Bitcoin Strategy

Michael Saylor, often regarded as the Bitcoin bull, has long been one of the strongest advocates of Bitcoin's long-term value. His belief system was first made public in August 2020 when his company, Strategy, purchased 21,454 Bitcoins for about $250 million.

Rather than continue holding traditional assets in its treasury, Strategy announced it would be making Bitcoin a core part of its treasury reserve.

Regarding this 2020 purchase, Saylor himself said:

"This investment reflects our belief that bitcoin, as the world's most widely adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash."

Since that day, Strategy has steadily accumulated Bitcoin, even during bearish market seasons.

To understand Strategy's stacking strategy, here is an overview of how it has accumulated Bitcoin over the last six years:

2020: Acquired 70,470 BTC (started Aug. 11 with the first purchase of 21,454 BTC; reached total holdings of 70,470 by Dec. 21)

2021: Acquired 53,921 BTC (total holdings reached 124,391 BTC by Dec. 30).

2022: Acquired 8,109 BTC (total holdings reached 132,500 BTC by year-end).

2023: Acquired 56,650 BTC (total holdings reached 189,150 BTC by Dec. 26).

2024: Acquired 257,250 BTC (total holdings reached 446,400 BTC by Dec. 30).

2025: Acquired 226,097 BTC (total holdings reached 672,497 BTC by Dec. 29).

2026: Has acquired 48,240 BTC, with total holdings reaching 720,737 BTC.

By steadily acquiring Bitcoin through open-market transactions, Strategy has cemented its position as the world's largest public holder of Bitcoin, making these purchases in a way that does not cause any short-term imbalance in the crypto market.

How the Market Reacted

Upon the announcement of this news, MicroStrategy's common stock (MSTR) experienced an uptick, jumping from $123 last Monday to $129 on Friday, a 4.7% increase.

The biggest gain for the MSTR stock, however, occurred on Wednesday, when it rose to $135. This increase suggests renewed investor confidence in Saylor's bitcoin purchase strategy. Even in bearish market conditions, Saylor's vision for Bitcoin remains unchanged.

Image credit: investing.com

Despite experiencing sharper selling pressure in February, with its price falling 14.8% to 15% from its January closing price of $78,621, Bitcoin experienced a slight uptick in its price, rising from $64,000 last Monday to $65,000 by Friday of last week.

Bitcoin Near $70K Again, Bottom or More Pain Ahead?

I came into Bitcoin in mid-2017. Not early, not late, but early enough to catch the euphoria and late enough to feel the consequences. I watched that cycle go vertical, then watched it unwind in slow motion through 2018. I stayed through the 2020–2022 cycle, including the November 2021 peak and the long grind down that followed.

So when Bitcoin slipped back toward $70,000 this week, the feeling wasn’t panic..well, maybe some panic. But there certainly was some recognition. The same quiet tension I’ve felt before, when the market shifts from confidence to defense and nobody is quite ready to admit it.

This move looks familiar on the surface. Risk assets are under pressure, equities are shaky, and Bitcoin is once again trading like the most volatile expression of risk in the room. But the environment around it feels very different than it did the last two times I lived through this.

Why $70,000 Matters More Than Most Want To Admit

For anyone who lived through 2021, $70K isn’t just a number. November of 2021 marked the prior cycle’s peak near $69,000. For years, that level symbolized excess. More recently, trading above it felt like proof that the market had finally moved on.

Once Bitcoin slipped back into that zone, the mood shifted fast. Selling stopped being about opinions and started being about mechanics. Stops were hit. Leverage came out. Liquidations took over. That transition is something I’ve learned to respect. When the market turns mechanical, it usually overshoots.That is obvious on both sides, euphoria and near depression.

I saw the same thing in early 2018 and again in 2022. Different triggers, same behavior.

BTC Still Trades Like A Risk Asset

As much as I want Bitcoin to be treated differently, moments like this remind me that it still trades like a high beta risk asset when macro pressure shows up.

Equities, especially tech, have been weak. Volatility is up. Liquidity feels tighter. In that environment, Bitcoin rarely resists. It amplifies. Crypto trades 24/7, it’s easy to exit quickly, and it’s deeply intertwined with leverage. When investors want to reduce risk immediately, Bitcoin is often first in line.

Once liquidations start cascading, fundamentals stop mattering in the short term. Exchanges sell into weakness, bids step away, and price pushes through levels that felt solid just days earlier.

ETF flows add a new dynamic I didn’t have to think about in 2018 or even 2021. Institutional money can now enter and exit Bitcoin daily. That can support price over time, but during drawdowns it can also accelerate downside when outflows cluster.

What Past Cycles Taught Us

Living through the 2017 peak and the 2018 bear market changed how I think about Bitcoin permanently. Support can fail. Narratives can break. Time can do more damage than price. And something always happens that you least expect.

The 2020–2022 cycle reinforced that lesson. After peaking in November 2021, Bitcoin fell roughly 75 percent into the November 2022 lows. That wasn’t just a crash, it was a year of slow erosion that wore people down.

Those experiences make it hard for me to assume this cycle can’t get uglier. Bitcoin has always been good at humbling people who think they’ve seen it all.

At the same time, I can’t ignore what’s different now.

Will This Cycle Be Different?

In 2017 and 2021, regulation was mostly noise. Institutions were cautious or absent. Spot ETFs didn’t exist. Bitcoin lived largely outside traditional markets

That’s no longer true.

Efforts like the Clarity Act and broader moves to define digital commodities give Bitcoin something it’s never really had during a downturn, a clearer legal and regulatory framework. That matters more when prices are falling than when they’re rising.

Institutions also behave differently than retail traders. They don’t buy because of excitement or belief. They buy because mandates allow them to. That can create steadier demand when prices fall far enough.

But they also sell without emotion. When risk models say reduce exposure, they reduce it. No attachment, no narrative. That means drawdowns can still be sharp, but they may resolve differently than in prior cycles.

This is the tension I’m trying to navigate in this cycle. Regulation and institutional access could limit the worst outcomes we’ve seen before. They could also change the character of both rallies and declines in ways we haven’t fully experienced yet.

Is This The Bottom?

Honestly, It feels rough out there and I know I wish this was the bottom. Maybe we see some relief before more pain? Or, in true crypto fashion, we rip the band-aid off and go even further down today, but I don’t think it’s safe to assume it’s the bottom of this cycle.

Liquidations have already done some eal damage. Sentiment has flipped quickly. Price is sitting near a level that matters historically and psychologically. If ETF flows stabilize, forced selling fades, and equities stop sliding, a bottoming process could start soon.

But I’ve been around long enough to know that real bottoms don’t feel relieving. They feel boring. They form through time, failed breakdowns, and long stretches where nothing seems to happen. This is happening fast so...the chop is still going to come. We may some moves up soon, and even more quick crashes, but the long boring bottom of the market has yet to reveal its face.

If conditions continue to deteriorate, Bitcoin will grind lower. Slow declines have always been more dangerous than fast crashes. They exhaust conviction. People just get complacent and leave.

What I’m Watching

Rather than trying to call the exact low, I’m focused on a few things.

Whether ETF flows stabilize over weeks, not days

Whether liquidation events shrink instead of cascade

Whether equities, especially tech, stop dragging crypto lower

Whether Bitcoin can reclaim broken levels and hold them, not just tag them

And time, true reversals don't happen fast. Those things just take time. That is true when the market is up and when the market is down.

I came into Bitcoin in 2017 thinking it was all about price. Staying through multiple cycles taught me it’s really about structure, psychology, and time.

This drop toward $70K feels familiar for a reason. What’s different is the environment around it. Institutions are here. Regulation is evolving. The market is more connected to traditional finance than it’s ever been.

I don’t know if that makes the outcome better or just different. What I do know is, that this fourth chapter I’m living through doesn’t feel like a clean repeat of the last one, and that alone is worth paying attention to. I also don't know if I made you feel better about this whole thing or not. Or maybe, I was just trying to make myself feel better in the end.

Bitcoin on the Track at the 24 Hours of Daytona

Bitcoin was back on the biggest screens in global sports as the 24 Hours of Daytona marked the unofficial start of the year’s major sponsorship season. From that point forward, weekend after weekend, major sporting events once again became prime real estate for high profile brand exposure.

With the Super Bowl, Pro Bowl, Daytona 500, and the Formula 1 season opener approaching in the following weeks, Bitcoin, crypto, exchanges, and NFT companies were once again looking to maximize their advertising dollars by attaching their brands to the world’s most watched events.

This cycle had become familiar. It started years earlier with Matt Damon, Tom Brady, a crypto exchange, and a Super Bowl commercial. Since then, at least one crypto project had aimed to make a major splash during big game advertising season every year.

Crypto and Racing, A Proven Match

Racing and crypto sponsorships had proven to be a natural fit. It was fast, loud, bright, and made for the big screen, exactly where crypto wanted to be.

Three years earlier, PolkaDot took a shot at the IndyCar Championship with Conor Daly driving for Dreyer Rheinbold Racing. Kraken and Pudgy Penguins appeared on the wings of the Williams Formula 1 cars. Ed Carpenter Racing ran a Bitcoin-branded car in the Indy 500.

In Formula 1, Red Bull secured season-long sponsorships with SUI and Bybit. McLaren landed a season-long deal with OKX and later minted NFTs on Tezos. The overlap between motorsport audiences and crypto culture continued to deepen.

BitcoinMAX and Meyer Shank Racing at Daytona

That weekend, Meyer Shank Racing set out to potentially make history by bringing Bitcoin to victory lane at the birthplace of speed. The team ran the Bitcoin MAX sponsored Acura LMDh Prototype in one of the most demanding races in the world.

Bitcoin Max was a community-driven, decentralized digital currency project. The partnership centered on the global launch of OnlyBulls, a finance super app, and the establishment of BitcoinMAX, a Swiss-based Bitcoin trust launching in January 2026. BitcoinMAX was designed to democratize the digital economy and allow people to participate in the Bitcoin economy through a secure, regulated trust.

The task was never going to be easy. The Daytona 24 Hours was notoriously one of the toughest tests of man and machine. It was twice around the clock on one of the world’s fastest tracks, against the best drivers on the planet.

Long Odds and a Stacked Field

Bitcoin supporters entered the weekend as long odds contenders, despite Meyer Shank Racing having taken victory in the race in 2022 and 2023 with Acura. The team was also looking to rebound after finishing second the previous year behind Porsche.

Porsche, however, had pulled factory support from endurance racing that season, leaving Penske and JDC Miller Motorsports to compete as privateers using modified versions of the previous year’s car. Acura’s continued factory backing of Meyer Shank Racing offered a potential advantage, though not against a strong Cadillac effort that entered the season with momentum as they prepared to run a Formula 1 team.

The field was stacked. Cadillac arrived hungry to start fast. Aston Martin debuted the highly anticipated Valkyrie prototype. BMW remained a factory threat. Victory was never guaranteed.

An Elite Driver Lineup

Meyer Shank Racing assembled one of the strongest driver lineups in the field. Tom Blomqvist, a veteran endurance champion. Colin Braun, a young endurance ace who had consistently delivered results since arriving on the scene. Scott Dixon, a former IndyCar champion. A.J. Allmendinger, the “Dinger,” a road course specialist with major wins across NASCAR, IndyCar, and prototype racing.

If that group could cross the line first after 24 hours, they would become the first team to bring a Bitcoin-sponsored car to victory lane, a surprising milestone that had not happened since Bitcoin’s creation.

Chaos, Fog, and a Fight to the Finish

Qualifying went the way of Porsche and Cadillac, leaving the Bitcoin MAX Acura starting fifth for the 24-hour race.

Midway through the night, heavy fog rolled over Daytona, forcing a yellow flag period that lasted a record six and a half hours. When the sun rose and the fog finally lifted, the Bitcoin Acura was still firmly in contention for the overall win.

At the restart, the car ran fourth and even held the lead with more than three hours remaining. In the end, the pace of Felipe Nasr in the Penske Porsche proved just too strong. Meyer Shank Racing eventually slipped back to a sixth-place finish after pitting early in hopes that a late caution might shuffle the order. That caution never came.

Once again, a Bitcoin-sponsored car narrowly missed victory lane.

Beyond The Checkered Flag

The good news was that Bitcoin MAX secured a full-season sponsorship with Meyer Shank Racing. The goal remained clear, to finally bring Bitcoin to victory on the biggest stage in motorsports.

The opportunity would come again. And when it did, Bitcoin would once more be right where it wanted to be, fast, loud, and on the world’s biggest screens.

Bitcoin vs. Gold: Why the Yellow Metal is Soaring While ‘Digital Gold’ Stumbles And Why I’m Betting on Bitcoin’s Long Game

As a relatively new reporter in the financial space here in Cincinnati, I’m still learning the ropes of these massive markets every day. I’ve pored over charts, read analyst reports, and talked to people who live and breathe this work. The facts right now are clear: gold is on fire, while Bitcoin, often called “digital gold,” is lagging or even pulling back. Gold has surged past $5,000 per ounce amid global tensions and renewed safe-haven buying, while Bitcoin is hovering around $87,000 to $88,000 after dipping from recent highs near $98,000. It is tempting to think gold has won this round outright. But when I look deeper at the data and think about where we are headed, I cannot shake the feeling that Bitcoin is still the head of the future.

Let me break down the current picture using real data and major players, then explain why, as someone still green in this industry, I am leaning toward the digital side over the long term.

The Numbers Don’t Lie: Gold’s Dominance in Early 2026

Gold’s dominance in early 2026 has been unmistakable. As of January 26, 2026, spot gold is trading roughly between $5,067 and $5,100 per ounce, up about 1.6 percent on the day and nearly 85 percent from a year ago. It recently pushed past $5,100 as investors rushed into safe assets driven by geopolitical flashpoints, a weaker U.S. dollar, and continued central bank accumulation. Analysts at firms such as J.P. Morgan are projecting average prices near $5,055 by the fourth quarter of 2026, with more aggressive scenarios reaching $5,400 or even $6,000 if uncertainty remains elevated.

This surge is being driven by familiar forces. Demand for safe havens has intensified amid global risks, including tensions involving Venezuela, Iran, and broader macroeconomic stress. Central banks continue to purchase gold at a strong pace, and expectations for lower interest rates are making non-yielding assets like gold more attractive relative to bonds and cash.

Major mining companies are capitalizing on these conditions. Newmont Corp., the world’s largest gold producer, is benefiting from its diversified operations and has seen its shares rise alongside record prices. Barrick Gold continues to deliver strong output from its core assets, while Agnico Eagle is expanding in politically stable jurisdictions. The emphasis these companies place on operational efficiency and ESG-conscious production has helped attract institutional capital, reinforcing gold’s reputation as a reliable hedge in uncertain times.

Bitcoin’s Rough Patch: Stagnation Amid the Rally

Bitcoin, meanwhile, is struggling to keep pace. It is trading in the $87,000 to $88,000 range, down from highs near $98,000 earlier this month and well below its 2025 peak. Year-to-date performance has been flat to negative at times, and the Bitcoin-to-gold ratio has fallen to roughly 17 to 18, meaning one Bitcoin now buys significantly fewer ounces of gold than it did previously. Recent outflows from crypto-focused ETFs have added pressure, and Bitcoin has failed to capture the same fear-driven momentum that is powering gold’s rally.

Several factors are weighing on sentiment. Regulatory uncertainty and ongoing energy concerns remain unresolved, while broader macro resets are pushing investors toward traditional safe havens first. At the same time, profit-taking by early Bitcoin holders has contributed to selling pressure during rallies.

On the mining side, companies such as Marathon Digital and Riot Platforms are facing margin pressure from higher energy costs and the effects of the most recent halving. Some firms, including CleanSpark, are attempting to adapt by shifting portions of their operations toward AI-related infrastructure. Institutional backing through products like BlackRock’s Bitcoin ETFs has helped establish a price floor, but so far it has not been enough to spark a sustained breakout.

Ty’s Take: Gold Feels Safe Now, But Bitcoin Is the Future I’m Betting On

I will be upfront: I am new to covering this beat, and the data clearly shows that gold has been the winner so far in 2026. Its thousands of years of history as a store of value, its lower volatility, and its tangible demand during periods of turmoil make it feel especially solid when headlines are filled with uncertainty. From my desk in Cincinnati, where many investors favor steady and familiar assets, gold’s rally makes complete sense. Mining stocks such as Newmont and Barrick look like attractive options for those seeking exposure without extreme swings.

But here is where my gut...and what I have learned through deeper research, come into play. Bitcoin is not failing; it is moving through a cyclical pullback while gold does what it has always done best during risk-off environments. Bitcoin’s fixed supply of 21 million coins, expanding adoption, and potential as borderless, programmable money position it as an evolution in how value is stored and transferred. Gold has history on its side, but Bitcoin brings innovation, including growing institutional participation, the possibility of clearer regulation under current leadership, and continued improvements in efficiency and infrastructure. Forecasts for Bitcoin range from relatively conservative targets of $120,000 to $170,000 by year end, with much higher outcomes possible if momentum returns.

As someone still learning this industry, I see gold winning the short-term fear trade, while Bitcoin leads the longer-term shift toward digital assets. For investors building wealth over the next decade, allocating to both can make sense: gold for near-term stability through miners or ETFs, and a heavier tilt toward Bitcoin or its broader ecosystem for long-term growth. The facts show gold shining today, but the future, in my view, remains digital.

Schwab Jumps into the Crypto Ring: A New Era for TradFi?

The walls between Wall Street and the "Wild West" of digital assets just got a little thinner.

Charles Schwab, the stalwart of retail investing, has officially signaled its intent to join the spot crypto trading fray.

CEO Rick Wurster confirmed on Yahoo Finance’s Opening Bid podcast that Schwab plans to roll out spot Bitcoin and Ethereum trading within the next 12 months. The rollout will debut on their high-octane Thinkorswim platform before migrating to the standard Schwab.com and mobile interfaces.

The Strategy: Blue Chips Only

While platforms like Robinhood or Coinbase often lean into the viral chaos of "meme coins," Schwab is taking a predictably measured approach. Wurster made it clear that the firm isn't interested in the speculative frenzy of the latest Shiba Inu derivative.

"Those are areas we will leave to the side," Wurster stated, emphasizing that Schwab’s focus remains on "everyday investors" looking to integrate crypto into a diversified, long-term portfolio.

A Shifting Regulatory Tide

Schwab isn't acting in a vacuum. The move comes as the regulatory environment in Washington undergoes a massive vibe shift. Since the Trump administration took office, the SEC has pivoted from its previously aggressive "regulation by enforcement" stance.

With the swearing-in of the pro-crypto Paul Atkins as SEC Chair—replacing the crypto-skeptic Gary Gensler—lawsuits against major exchanges have been dropped, and restrictive accounting rules for banks holding crypto have been scrapped. Morgan Stanley is reportedly following a similar blueprint, with eyes on adding spot trading to E*Trade by 2026.

Ty’s Take: The View from the New Guy

As someone who is relatively new to the financial industry, watching this unfold feels like seeing a massive cruise ship finally decide to change course. For years, the "old guard" of finance treated crypto like a radioactive hobby. Now, they're laying out the red carpet.

My honest opinion? This is the "Adults in the Room" moment for crypto.

I think Schwab’s decision to avoid meme coins is a brilliant move for their brand. It tells their clients: "We aren't here to help you gamble; we're here to help you invest." For a guy like me, seeing these legacy institutions provide a regulated, familiar bridge to Bitcoin makes the space feel less like a casino and more like a legitimate asset class.

However, there’s a catch. Part of me wonders if Schwab is a little late to the party. By the time they launch, many retail investors may have already set up shop elsewhere. But if there’s one thing I’ve learned in my short time here, it’s that you never bet against the convenience of having all your money—stocks, bonds, and now crypto—under one roof.

The "crypto winter" is officially over, and the thaw is being led by the very people who once told us to stay away. It’s an exciting time to be entering the industry, even if it means I have a lot more homework to do on blockchain tech.

Bitcoin Mining Stocks Rally as Riot Signs AMD Deal and Galaxy Expands in Texas

Bitcoin mining stocks are back in focus, and this time the rally is not just about the price of Bitcoin. A wave of corporate announcements from major industry players is giving investors a new narrative to work with, one centered on data centers, artificial intelligence, and long term infrastructure plays.

Two companies in particular, Riot Platforms and Galaxy Digital, helped spark renewed interest across the sector after unveiling ambitious plans tied to Texas based operations. The moves highlight how crypto miners are quietly reshaping themselves as broader digital infrastructure companies.

Mining Stocks Ride a New Momentum Wave

Mining equities tend to act like leveraged bets on Bitcoin, and recent price action has followed that familiar script. As Bitcoin pushed higher and held key levels, stocks tied to the mining ecosystem responded quickly. Names like Riot Platforms, Marathon Digital, CleanSpark, Hive Digital, and Bitfarms all saw renewed buying interest.

But this rally looks different from past cycles. Instead of focusing purely on hash rate growth or fleet upgrades, investors are paying closer attention to balance sheets, power access, and how miners are positioning themselves beyond block rewards. The sector is increasingly being viewed through the same lens as energy infrastructure and data center operators.

Riot’s AMD Deal Signals a Strategic Shift

Riot Platforms (Nasdaq: RIOT) delivered one of the more consequential announcements. The company revealed a long term lease agreement with AMD that will bring a significant data center tenant to Riot’s Rockdale, Texas site.

Under the deal, Riot will provide 25 megawatts of capacity to AMD under an initial 10 year contract worth at least $311 million with further extension options that could boost spending to $1 billion. Potentially scaling into the hundreds of megawatts if demand grows.

For Riot, the deal is about more than headline revenue. It is a signal to the market that its infrastructure has value beyond Bitcoin mining. The company owns large tracts of land, controls substantial power capacity, and now has proof that major technology firms are willing to commit capital to those assets.

Investors reacted accordingly. Riot shares moved higher, up more than 14% on Friday trading, following the announcement as markets began to reassess the company not just as a miner, but as a data center landlord with optionality tied to AI and high performance computing.

Galaxy Digital’s Texas Vision Goes Bigger

Galaxy Digital Holdings (Nasdaq: GLXY) is taking a similar path, but on a much larger scale. The company is pushing ahead with plans to transform its Helios site in Texas into one of the largest AI and high performance computing campuses in North America.

Originally built with Bitcoin mining in mind, the Helios campus is being reimagined as a multi gigawatt data center hub. Galaxy has lined up major financing, private investment, and long term leasing commitments from AI focused cloud providers to make the vision real.

If fully built out, the site could support several gigawatts of capacity and generate recurring revenue that dwarfs traditional mining income. For Galaxy, this represents a pivot away from the boom and bust nature of crypto markets toward something closer to a regulated infrastructure business.

The market response has been mixed but attentive. While Galaxy shares remain volatile, investors appear increasingly willing to assign value to the long term cash flow potential of the Helios project, Galaxy shares were up over 6% on the day to $34, following a 13% rally on Thursday. The stock is now up about 57% year-to-date.

A Broader Shift Across the Mining Sector

Taken together, the Riot and Galaxy announcements point to a broader transformation underway in crypto mining. Rising competition, higher network difficulty, and the effects of Bitcoin’s halving cycle are pushing miners to look for steadier revenue streams.

Access to cheap power and large scale land holdings are turning out to be valuable assets beyond mining. AI workloads, cloud computing, and enterprise data services are all competing for the same infrastructure that miners already operate.

For public market investors, this creates a new way to think about mining stocks. They are no longer just proxies for Bitcoin price action. In some cases, they are becoming hybrid plays on energy, data centers, and next generation computing.

Mining stocks in general are up significantly compared to other crypto-related public companies on Friday. IREN is up 12.8%, Cypher 8%, and MARA 6%, for example, while RIOT, leading the pack, is approaching a multi-year high.

The recent rally in mining stocks suggests markets are starting to price in these shifts. Bitcoin’s price still matters, but it is no longer the only story. Corporate strategy, infrastructure quality, and long term contracts are beginning to carry more weight.

If the trend continues, the next phase of the crypto mining industry may look less like a speculative arms race and more like a battle to become essential digital infrastructure providers. For now, investors appear willing to give the sector another look, especially when miners start acting a little more like data center companies and a little less like pure crypto bets.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

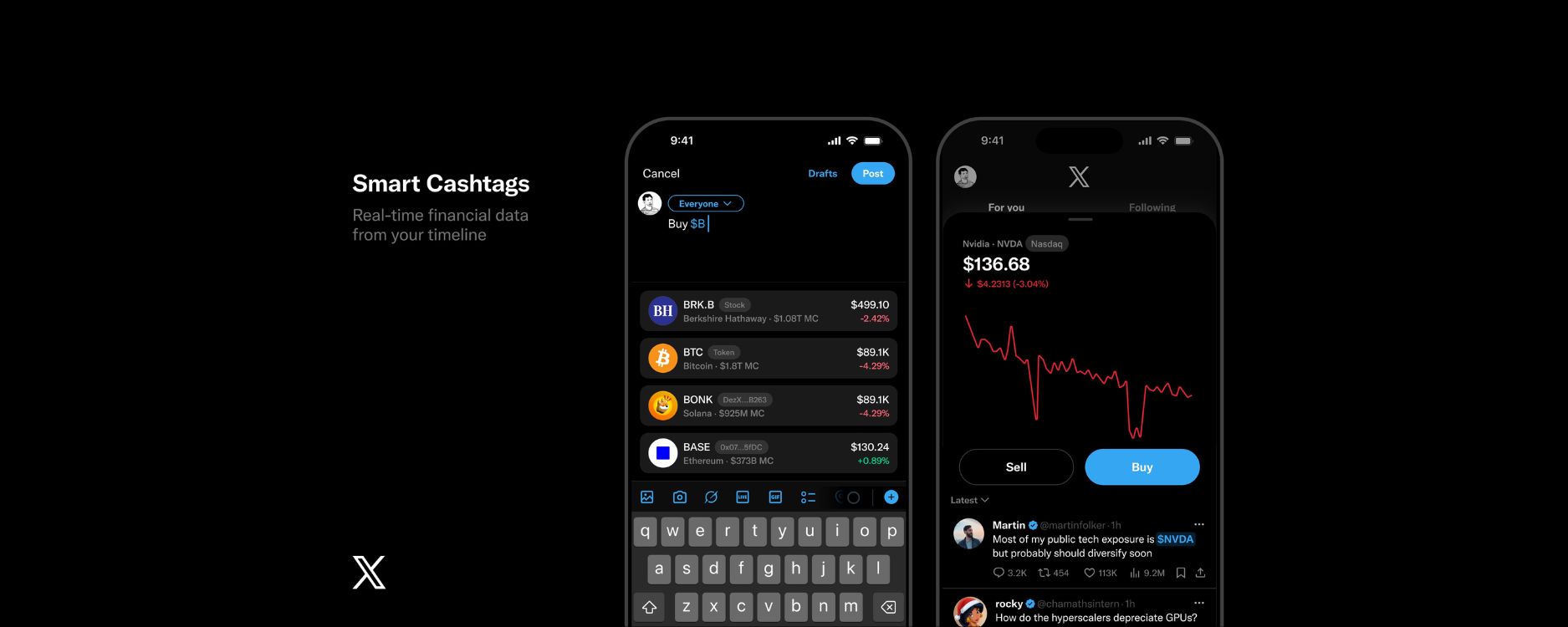

X Plans Smart Cashtags to Show Live Crypto Prices Inside the Timeline

X is getting ready to roll out something called Smart Cashtags, and while the feature sounds minor on the surface, it could change how people follow crypto markets day to day.

Cashtags are already familiar to anyone who spends time on crypto Twitter. Add a dollar sign in front of a ticker like $BTC or $ETH and the platform turns it into a clickable reference tied to ongoing conversations. It has always been useful for tracking sentiment, but not particularly helpful if you actually want to know what the market is doing in that moment.

Smart Cashtags are meant to fix that.

Instead of just linking to a stream of posts, the upgraded version will surface live prices, basic performance data, and charts directly in the feed. The idea is simple: if people are talking about a token, you should be able to see what it is doing without leaving the timeline.

For a platform where crypto narratives often move faster than prices themselves, that shift matters.

Turning the Feed Into a Market Snapshot

Crypto trading already lives on X. News breaks there. Narratives form there. Panic and euphoria show up there first. What has been missing is the data itself.

Smart Cashtags bring that data closer to the conversation.

The feature was announced by Nikita Bier, who is Head of Product at X, saying it will convert posts into live market data entry points.

When someone mentions a token using a cashtag, the platform will recognize the asset and display up to date pricing alongside the post. Tapping the tag is expected to open more context, recent price moves, charts, and related discussion, all in one place.

It reduces the constant app hopping that most traders know too well. Instead of checking a charting app, then jumping back to X to see what people are saying, everything shows up together.

Over time, that could subtly change how people consume market information. The feed becomes less of a rumor mill and more of a lightweight market view.

Why Crypto Traders Will Care

Crypto is unusually sensitive to social momentum. A token can start trending hours before volume shows up. A single viral post can spark a rally or accelerate a selloff.

Putting price data directly next to those conversations tightens that feedback loop.

A trader scrolling their timeline might see a surge in posts about a token at the same moment the price is breaking out. The same dynamic works in reverse during downturns. That kind of visibility favors speed and awareness, especially for retail traders who do not live inside professional trading dashboards.

It also lowers the barrier to entry. You do not need to know where to look or which tools to use. The information comes to you as part of the conversation.

That accessibility cuts both ways. More visibility can mean better context, but it can also amplify emotional reactions during volatile moments.

Not Just a Visual Upgrade

Smart Cashtags are not just about showing a price number.

One of the quieter improvements is accuracy. Crypto tickers can be messy. Different tokens share similar symbols, and some symbols overlap with stocks or other assets. Smart Cashtags are expected to better identify and map posts to the correct asset, reducing confusion and mislabeling.

That matters more as crypto bleeds into traditional finance, with tokenized assets, ETFs, and crossover tickers becoming more common.

This is also not X’s first step into market data. Earlier versions of cashtags already offered limited chart previews through external integrations. Those features felt bolted on. Smart Cashtags move the data front and center, making it part of the native experience instead of a side panel.

Embedding live prices into social feeds is not risk free.

If data is delayed or inaccurate, misinformation spreads faster. When price movements and social reactions are displayed together, markets can become more reflexive. Trends may accelerate, and herd behavior could become more pronounced, especially in smaller or thinner markets.

There is also the question of incentives. Once price data lives inside the feed, it opens the door to monetization, premium analytics, or trading integrations. None of that has been formally announced, but the direction is hard to ignore.

A Bigger Picture Play

Smart Cashtags fit neatly into X’s broader ambitions. The platform has been inching toward financial services, payments, and creator driven monetization for some time. Turning the feed into a place where financial data lives alongside conversation feels like a natural extension, and ultimately leads toward X becoming the everything app.

For crypto specifically, it reinforces X’s position as the main arena where narratives meet price action. It is not a trading terminal, but it does not need to be. Influence often matters more than precision.

The Bottom Line

Smart Cashtags may look like a small product update, but they point to something bigger.

By putting live crypto prices directly into the timeline, X is collapsing the distance between sentiment and market reality. For traders, builders, and casual observers alike, that could change how quickly ideas turn into action.

Whether it leads to better informed decisions or faster hype cycles will depend on how it is used. Either way, crypto conversations on X are about to feel a lot closer to the market itself.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bitcoin May Face a Volatile Day as Macro Events Stack Up

Bitcoin is waking up to a market that feels unusually fragile.

Price itself looks calm enough. The range has been tight, daily swings have been muted, and nothing on the surface screams urgency. But anyone paying attention to today’s calendar knows this kind of calm can disappear quickly.

Several macro events are stacked into the U.S. session, all tied to interest rates, inflation, and risk appetite. When those forces collide, Bitcoin rarely sits still.

This is shaping up to be one of those days where volatility does not need a single dramatic headline. It just needs friction.

A Morning That Rarely Stays Quiet

The first real test arrives early, when U.S. jobs data hits the tape around the start of the New York session.

Employment numbers still carry outsized influence over markets. They shape expectations around how tight financial conditions will remain and how much flexibility the Federal Reserve really has. Bitcoin has become increasingly sensitive to these shifts, especially when liquidity is thin.

The initial reaction is often fast and emotional. Sometimes it sticks. Sometimes it fades within minutes. Either way, it tends to wake the market up.

From there, the morning does not get any simpler.

As the session develops, attention turns to Washington. A Supreme Court ruling related to tariffs is expected during the late morning hours. While not crypto-specific, tariff decisions feed directly into inflation assumptions, and inflation is still one of the most important variables in global markets.

Around the same window, a Federal Reserve official is scheduled to speak. That overlap matters. When legal decisions, inflation narratives, and Fed messaging collide, markets can struggle to find a clean interpretation. Bitcoin often reflects that confusion in real time.

Why This Timing Matters for Bitcoin

What makes today feel different is not just the events themselves, but how close together they land.

Bitcoin thrives on liquidity and clear narratives. Days like this offer neither. Instead, traders are forced to process multiple signals that may not point in the same direction.

That is when volatility tends to rise.

A strong jobs report followed by cautious Fed language. A soft report paired with inflation concerns. Even outcomes that are mostly expected can trigger sharp moves if positioning is wrong.

Bitcoin does not need certainty to move. It needs imbalance.

The Quiet Role of Liquidity

Another reason this day feels risky is what has been happening quietly in the background.

Spot Bitcoin ETFs have seen periods of outflows recently, reducing a layer of steady demand that helped stabilize price during previous pullbacks. With that cushion thinner, price reacts more aggressively to macro headlines.

That cuts both ways. Breakouts can extend faster. Pullbacks can feel heavier. The same headline that barely moved Bitcoin a month ago can suddenly matter a lot more.

Midday Calm Can Be Misleading

If Bitcoin survives the morning without a major break, it would not be surprising to see price settle into a narrow range through the middle of the day.

That lull can be deceptive.

Often, midday calm simply reflects traders waiting for confirmation, not confidence that the danger has passed. Volatility can resurface later as markets digest positioning data and prepare for the next global session.

Bitcoin has a habit of making its real move when attention starts to drift.

A Market That Feels Coiled

Recent price action tells a familiar story. Bitcoin has struggled to push decisively higher, but sellers have not taken control either. The result is a compressed range that feels increasingly unstable.

Historically, these conditions do not resolve gently.

When volatility returns after a long period of compression, it tends to overshoot. Direction is still uncertain, but movement feels inevitable.

The Bigger Picture

This is not about predicting whether Bitcoin goes up or down today. It is about recognizing the environment.

Macro pressure is building. Liquidity is thinner. Volatility has been suppressed for too long. And the calendar is packed with catalysts that can disrupt the balance.

For traders, today is about staying alert, not getting comfortable.

For long-term holders, it is another reminder that Bitcoin often chooses moments like this to reassert its personality.

The market may look calm right now, but we'll see how the day plays out. Jobs reports, Supreme Court decisions, and Fed Talks should make it very interesting either way.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Florida Lawmakers Renew Push for State Bitcoin Reserve

Florida lawmakers are once again taking up the question of whether the state should hold Bitcoin as part of its long-term financial strategy, reviving a proposal that failed to advance last year but now returns with a revised structure and new momentum.

The effort comes as crypto markets have stabilized after a volatile stretch, with Bitcoin regaining ground and institutional interest continuing to grow. Against that backdrop, Florida’s move places it back into a widening national debate over whether digital assets belong on government balance sheets.

At the center of the push is House Bill 1039, filed during the 2026 legislative session, which would establish a Florida Strategic Cryptocurrency Reserve.

What the Bill Would Do

House Bill 1039 proposes creating a standalone reserve fund held outside the State Treasury and overseen by Florida’s Chief Financial Officer. The CFO would be granted authority to acquire, hold, sell, or manage digital assets under prudent investment standards, including the ability to contract with third-party custodians and service providers.

While the bill is written broadly, it sets strict eligibility rules for any asset included in the reserve. To qualify, a cryptocurrency must have maintained an average market capitalization of at least $500 billion over the prior two years. Based on current market conditions, that threshold effectively limits the reserve to Bitcoin.

The legislation also establishes a Strategic Cryptocurrency Reserve Advisory Committee, designed to provide guidance and oversight. At least three members would be required to have direct experience investing in digital assets, acknowledging the technical and operational complexity involved in managing crypto at the state level.

If passed, the bill would take effect on July 1, 2026.

A Return to an Unfinished Debate

Florida’s renewed push follows the collapse of similar efforts during the 2025 legislative session. Those earlier proposals would have allowed the state to allocate up to 10 percent of certain public funds directly into Bitcoin but were ultimately withdrawn before a final vote.

Another bill introduced around the same time would have gone even further, authorizing the CFO and the State Board of Administration to invest portions of public and pension funds into Bitcoin, crypto exchange-traded products, tokenized securities, and non-fungible tokens. That proposal included detailed custody and compliance provisions but also failed to gain enough traction to advance.

This year’s bill reflects a more cautious approach. By placing the reserve outside the main treasury and narrowing eligible assets, lawmakers appear to be trying to strike a balance between experimentation and risk control.

Market Context and State Competition

The timing of Florida’s move is notable. Bitcoin prices have rebounded from earlier lows, and digital assets are increasingly being discussed in the context of long-term portfolio diversification rather than short-term speculation. Exchange-traded products, corporate treasury allocations, and broader institutional adoption have shifted how policymakers frame the asset.

Florida is not alone. Texas moved ahead last year with legislation establishing a state-managed Bitcoin reserve funded with public dollars, making it the most aggressive example so far of a U.S. state embracing Bitcoin at an institutional level. Other states, including Arizona and New Hampshire, have passed narrower frameworks that stop short of direct funding.

Many similar proposals across the country have stalled, underscoring how politically sensitive the issue remains.

Supporters and Skeptics Remain Split

Supporters of Florida’s proposal argue that a Bitcoin reserve could help diversify state assets, hedge against inflation, and position Florida as a forward-looking financial hub. They also point to the advisory committee and high eligibility threshold as safeguards against reckless exposure.

Critics continue to raise concerns about volatility, custody risks, and the appropriateness of using public funds for an asset that can swing sharply in value. Questions about accounting standards, security practices, and public accountability are expected to feature prominently as the bill moves through committee hearings.

What Happens Next

House Bill 1039 must clear multiple legislative hurdles, including committee review, passage in both chambers, and approval by the governor. While its future remains uncertain, the proposal signals that Florida lawmakers are not ready to abandon the idea of state-level crypto reserves.

As more governments revisit Bitcoin through a policy lens rather than a speculative one, Florida’s debate could offer a clearer picture of how digital assets fit into the next phase of public finance.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Rumble Launches Crypto Wallet for Bitcoin and USDT Creator Tips

Rumble has been talking for years about building an alternative to YouTube. With the launch of its new crypto wallet, it is now making a serious attempt to rethink how creators actually get paid.

The company has rolled out Rumble Wallet, a built-in, non-custodial wallet that lets viewers tip creators directly in Bitcoin, USDT, and Tether Gold. The wallet is integrated into the Rumble platform itself, meaning users do not have to leave the site or rely on third-party payment tools to support creators.

On paper, it looks like a tipping feature. In reality, it is closer to a payments strategy.

What Rumble actually launched

Rumble Wallet allows users to hold crypto and send it directly to creators inside the platform. The wallet is non-custodial, which means users control their own funds rather than handing custody to Rumble.

At launch, the wallet supports three assets. Bitcoin provides the recognizable flagship. USDT offers price stability for users and creators who do not want volatility. Tether Gold adds a more niche option, but one that fits Rumble’s broader narrative around alternatives to traditional finance.

MoonPay is handling the fiat on and off ramps, which matters more than it might sound. Without that bridge, crypto tipping stays limited to users who already hold tokens. With it, Rumble can realistically target a much wider audience.

Many platforms have tried tipping. Few have tried wallets.

A tipping button is a feature layered on top of an existing system. A wallet becomes part of the system itself. Once users hold value inside the platform, the possibilities expand quickly.

A native wallet opens the door to subscriptions, paywalled content, creator payouts, merch payments, and cross-border transfers that do not depend on banks or card networks. It also shifts leverage. Instead of creators relying on ad revenue or platform-controlled payouts, they can receive funds directly from their audience.

Rumble appears to be aiming for exactly that. Control the wallet, and you control the flow of value across the platform.

Tether is central to the move

Tether’s role here goes well beyond providing a stablecoin.

The wallet is built using Tether’s wallet infrastructure tooling, positioning Rumble as an early, high-profile example of how Tether wants its technology used. This fits neatly with Tether’s broader strategy of moving downstream, not just issuing tokens but embedding them directly into consumer products.

There is also a financial alignment. Tether has already invested heavily in Rumble, and this wallet turns that relationship into something tangible. Rumble gets infrastructure and liquidity. Tether gets distribution inside a large, consumer-facing platform.

From Tether’s perspective, a wallet embedded into a video platform is far more powerful than another exchange listing.

Why creators might actually care

Creators have spent years complaining about monetization. Ad revenue is unpredictable. Platform rules change. Payouts can be delayed, reversed, or cut off entirely.

Crypto does not magically solve those problems, but it offers a different model. Direct payments. Faster settlement. Global reach. Fewer intermediaries.

Stablecoins like USDT are especially practical here. They reduce volatility while keeping payments digital and borderless. For international creators or audiences outside major banking systems, that matters.

If Rumble can make tipping and payments feel normal, not like a crypto experiment, it gives creators a reason to treat the platform as more than a backup distribution channel.

What's next?

Adoption will matter more than announcements. If tipping remains niche, the wallet is a branding move. If it becomes common behavior, it changes how Rumble makes money.

The first signal will be usage. Are creators actually receiving tips at scale, or is this limited to a small crypto-native subset?

The second is expansion. A wallet built only for tips leaves value on the table. Subscriptions, gated content, and commerce feel like natural next steps.

The third is competition. If Rumble proves crypto payments can work at scale inside a video platform, larger players will take notice.

The bigger picture

Rumble Wallet is not just a crypto feature. It is an attempt to rebuild creator monetization around direct payments rather than ads and intermediaries.

If it works, it offers a glimpse of how social platforms could operate when payments are native, programmable, and global by default. If it fails, it will still serve as one of the clearest real-world tests of crypto’s promise in the creator economy so far.

Either way, it shows that the next phase of crypto adoption may not come from trading apps, but from where people already spend their time online.

Crypto in 2026: Less Hype, More Infrastructure, and a Market Growing Up

Crypto enters 2026 without the drama that once defined the start of a new year. Prices are steady but not euphoric. The timelines are calmer. The noise has faded. And yet, beneath that surface calm, the industry feels more focused and more self-assured than it has in a long time.

This does not feel like a market losing relevance. It feels like one that has stopped trying to prove itself every day.

After a tough reset in 2025, crypto is no longer driven by momentum alone. It is being shaped by infrastructure, regulation, and a growing sense that digital assets are slowly becoming part of the financial background rather than a constant headline.

The Reset Did What Cycles Are Supposed to Do

The pullback that closed out 2025 forced a hard reset across the industry. Excess leverage was flushed out. Projects built purely on narrative struggled to survive. Capital became more cautious, and in many cases, more serious.

Entering 2026, the market feels leaner and more selective. Bitcoin and Ethereum remain central, not because they promise overnight gains, but because they sit at the core of a system that is gradually being integrated into global finance.

Volatility has not disappeared, but it feels more tied to real catalysts. Flows, macro conditions, regulatory developments. This is no longer a market reacting to every rumor or viral post.

For investors who think in cycles rather than weeks, this is often the phase where foundations quietly form.

Institutions Are Acting Like They Are Here to Stay

Institutional involvement is no longer a future narrative. It is an active force shaping how crypto evolves.

ETFs, custody platforms, tokenized funds, and on chain settlement tools are becoming familiar concepts inside traditional finance. What stands out is how little of this activity is happening in public. Much of it is operational, slow, and deliberate.

That shift is noticeable at industry conferences and in private meetings. The energy is different. Fewer grand predictions. More conversations about compliance, liquidity, risk frameworks, and long term deployment. More handshakes, fewer hype decks.

Institutions do not move quickly, but when they start building infrastructure, they tend to stay.

Regulation Brings Structure, Not an End

Regulation is still controversial, but the tone has softened. Clearer rules are beginning to replace uncertainty, especially around stablecoins, custody, and reporting.

For many market participants, this clarity is not restrictive. It is enabling. It allows companies to plan, investors to allocate, and builders to focus on execution instead of interpretation.

Crypto does not need to be unregulated to grow. It needs to be understood. 2026 feels like a step in that direction.

Stablecoins and Tokenization Quietly Gain Momentum

One of the strongest signals for crypto’s future is how little attention some of its most important developments receive.

Stablecoins are increasingly used for payments and settlement, especially in cross border contexts where traditional systems are slow and expensive. This is not a speculative use case. It is a practical one.

Tokenization is following a similar path. Real world assets like funds, bonds, and private credit are being tested on chain. The goal is efficiency, transparency, and liquidity, not buzz.

These are the kinds of changes that rarely reverse once they gain traction.

DeFi and AI Settle Into Useful Roles

DeFi is no longer trying to reinvent finance overnight. It is focusing on doing specific things better. Automation, interoperability, and capital efficiency are the priorities now.

AI, meanwhile, is becoming part of the background. It shows up in analytics, trading strategies, monitoring tools, and security systems. Less hype, more utility.

This maturation may feel less exciting, but it is exactly what long term systems tend to look like before they scale.

A Market That Feels Like It Is Setting Up

Crypto in 2026 does not feel like a peak. It feels like a setup.

Builders are still building, even without constant attention. Institutions are committing resources, not just headlines. Regulators are engaging instead of reacting. Investors are meeting in person again, comparing notes, and thinking beyond the next quarter.

The industry feels more grounded, but also more aligned.

A Sharper Outlook Beyond 2026

What makes 2026 particularly interesting is not what happens this year, but what it enables next.

If infrastructure continues to solidify, regulation continues to clarify, and real usage keeps expanding, crypto may enter its next growth phase from a position of strength rather than speculation. The next cycle, whenever it arrives, is likely to be driven less by hype and more by inevitability.

Markets tend to move fastest when most people are no longer watching closely. Crypto may be entering that phase now.

It does not need to shout. It just needs to keep working.

And if it does, the years beyond 2026 may end up being the ones that finally justify everything that came before.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.