#Crypto Markets

Michael Saylor’s Strategy Makes its 101st Bitcoin Purchase

Image credit: Binance.com

Strategy, the world's largest public holder of Bitcoin, has deepened its Bitcoin bet, completing its 101st Bitcoin purchase.

According to a filing made to the US Securities and Exchange Commission on Monday of this week, Strategy acquired 3,015 bitcoins for $204.1 million last week.

Based on information available on the US SEC website, the average purchase price for this transaction was $67,700 per BTC, below the company's average acquisition price of $75,985. With this latest purchase, Strategy now has total Bitcoin holdings of 720,737 BTC.

Image credit: sec.gov

Saylor’s Long-Term Bitcoin Strategy

Michael Saylor, often regarded as the Bitcoin bull, has long been one of the strongest advocates of Bitcoin's long-term value. His belief system was first made public in August 2020 when his company, Strategy, purchased 21,454 Bitcoins for about $250 million.

Rather than continue holding traditional assets in its treasury, Strategy announced it would be making Bitcoin a core part of its treasury reserve.

Regarding this 2020 purchase, Saylor himself said:

"This investment reflects our belief that bitcoin, as the world's most widely adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash."

Since that day, Strategy has steadily accumulated Bitcoin, even during bearish market seasons.

To understand Strategy's stacking strategy, here is an overview of how it has accumulated Bitcoin over the last six years:

2020: Acquired 70,470 BTC (started Aug. 11 with the first purchase of 21,454 BTC; reached total holdings of 70,470 by Dec. 21)

2021: Acquired 53,921 BTC (total holdings reached 124,391 BTC by Dec. 30).

2022: Acquired 8,109 BTC (total holdings reached 132,500 BTC by year-end).

2023: Acquired 56,650 BTC (total holdings reached 189,150 BTC by Dec. 26).

2024: Acquired 257,250 BTC (total holdings reached 446,400 BTC by Dec. 30).

2025: Acquired 226,097 BTC (total holdings reached 672,497 BTC by Dec. 29).

2026: Has acquired 48,240 BTC, with total holdings reaching 720,737 BTC.

By steadily acquiring Bitcoin through open-market transactions, Strategy has cemented its position as the world's largest public holder of Bitcoin, making these purchases in a way that does not cause any short-term imbalance in the crypto market.

How the Market Reacted

Upon the announcement of this news, MicroStrategy's common stock (MSTR) experienced an uptick, jumping from $123 last Monday to $129 on Friday, a 4.7% increase.

The biggest gain for the MSTR stock, however, occurred on Wednesday, when it rose to $135. This increase suggests renewed investor confidence in Saylor's bitcoin purchase strategy. Even in bearish market conditions, Saylor's vision for Bitcoin remains unchanged.

Image credit: investing.com

Despite experiencing sharper selling pressure in February, with its price falling 14.8% to 15% from its January closing price of $78,621, Bitcoin experienced a slight uptick in its price, rising from $64,000 last Monday to $65,000 by Friday of last week.

BlackRock Enters DeFi, Putting Fund On Uniswap

The world’s largest asset manager is officially getting into DeFi. It has been revealed that BlackRock will be bringing its Treasury-backed digital token BUIDL onto Uniswap, the biggest decentralized exchange in crypto. At the same time, it has accumulated UNI, Uniswap’s governance token. That combination, infrastructure plus equity exposure, is what has the market paying attention.

For years, Wall Street talked about tokenization in theory. Now BlackRock is testing it inside a live DeFi venue.

What Happened

BlackRock’s USD Institutional Digital Liquidity Fund, known as BUIDL, will now be tradable through UniswapX. BUIDL is essentially a tokenized vehicle holding U.S. Treasurys and short term cash instruments. Think conservative yield product, but wrapped in blockchain rails.

This is not retail access. Not even close. Only approved institutional participants can interact with the fund in this format. Liquidity providers are also curated. The architecture blends DeFi execution with compliance guardrails.

In other words, this is decentralized plumbing with centralized controls layered on top.

At the same time, BlackRock bought an undisclosed amount of UNI. No dramatic governance takeover narrative here, at least not yet. But the signal matters. Buying the token is a way of buying into the protocol’s long term relevance.

Markets reacted quickly. UNI rallied sharply on the announcement. Traders interpreted it as validation, not just of Uniswap, but of DeFi’s staying power.

Why This Is Bigger Than a Listing

Uniswap is not just another exchange. It is core infrastructure in crypto. Billions of dollars in liquidity, years of smart contract iteration, deep composability across chains.

For a firm like BlackRock to integrate directly with that stack is a psychological shift.

Institutional capital has historically avoided permissionless systems. Concerns around compliance, custody, counterparty risk, and regulatory clarity kept most major players in controlled environments. Even crypto ETFs are wrapped in familiar structures.

This move edges closer to open rails.

It suggests that large asset managers are beginning to see DeFi less as a speculative playground and more as settlement infrastructure. Faster clearing. Fewer intermediaries. Continuous liquidity. Programmable ownership.

Still, it is not ideological decentralization. The participation model is selective. Access is gated. This is not BlackRock embracing cypherpunk philosophy. It is BlackRock experimenting with efficiency.

The Tokenization Angle

Tokenized real world assets have been one of the most persistent narratives in crypto over the past two years. Treasurys on chain, money market funds on chain, even private credit on chain.

The pitch is straightforward. Blockchain rails can make traditional assets easier to transfer, easier to collateralize, and potentially easier to integrate into global liquidity pools.

Until now, much of that activity lived in isolated ecosystems. What BlackRock is doing connects tokenized Treasurys to a decentralized exchange environment.

If this model scales, it could blur the line between crypto native liquidity and traditional yield products. Imagine on chain funds becoming composable building blocks in lending markets, derivatives platforms, structured products.

That is where things get interesting.

Risk and Reality

There are obvious constraints. Regulatory oversight remains intense. DeFi protocols still face scrutiny in multiple jurisdictions. Smart contract risk never disappears. And institutional risk committees do not move quickly.

This is likely a controlled experiment, not an overnight transformation of Wall Street.

But it does establish precedent.

Once one major asset manager connects to DeFi infrastructure, competitors pay attention. Asset management is not an industry that tolerates strategic disadvantage for long.

What It Means for UNI

UNI’s price spike reflects more than short term speculation. It reflects a repricing of perceived legitimacy. The price surged more than 30%, but has since retraced some.

Governance tokens often struggle to justify valuation beyond fee switches and voting rights. Institutional alignment changes that conversation. If large financial entities begin to treat protocols as infrastructure partners, governance tokens start to resemble strategic assets.

That does not guarantee sustained upside. Markets are fickle. But the narrative shift is tangible.

The Bottom Line

Crypto has long argued that decentralized protocols would eventually underpin parts of global finance. Critics said institutions would build private chains instead. Closed systems. Walled gardens.

BlackRock’s move suggests a hybrid path.

Traditional finance may not adopt pure decentralization. But it may selectively integrate public blockchain infrastructure where it improves efficiency.

That middle ground, regulated access layered onto open protocols, could define the next stage of market structure.

For DeFi, this is validation. For Wall Street, it is experimentation. For traders, it is another reminder that crypto infrastructure is no longer operating in isolation.

Robinhood Chain Launches Ethereum L2 Testnet

Robinhood is going deeper into crypto infrastructure.

The company has launched the public testnet for Robinhood Chain, its own Ethereum layer 2 network built on Arbitrum’s rollup technology. Until now, Robinhood has mostly acted as a gateway, letting users trade crypto and, in some regions, tokenized equities. This move changes that. It is now building the underlying blockchain where those assets could live.

It is a meaningful shift. Running a brokerage app is one thing. Operating blockchain infrastructure is another.

What Robinhood Chain Actually Is

Robinhood Chain is a permissionless Ethereum layer 2. It uses Arbitrum’s technology, which means it inherits Ethereum’s security while offering lower transaction costs and higher throughput through rollups.

“With Arbitrum’s developer-friendly technology, Robinhood Chain is well-positioned to help the industry deliver the next chapter of tokenization and permissionless financial services,” said Steven Goldfeder, Co-Founder and CEO of Offchain Labs. “Working alongside the Robinhood team, we are excited to help build the next stage of finance.”

For developers, it is EVM compatible. Smart contracts built for Ethereum can be deployed here with standard tooling. Wallets, developer libraries, and infrastructure services should feel familiar.

On paper, nothing radical. The differentiation is not in the virtual machine. It is in the intended use case.

The Core Bet: Tokenized Stocks

Robinhood is clearly focused on tokenized real world assets, especially public equities and ETFs.

The company has already offered tokenized stock exposure in Europe. Now it is building infrastructure that could support broader issuance and trading of these assets directly onchain.

A big part of the pitch is continuous trading. Crypto markets operate 24 7. Traditional stock exchanges do not. If equities are represented as tokens on a blockchain, they can, in theory, trade at any time and settle much faster than traditional systems.

That sounds straightforward. In practice, it depends heavily on regulatory clarity. Tokenized securities raise questions around custody, investor protections, and jurisdictional restrictions. Robinhood has acknowledged this and appears to be designing the chain with compliance in mind.

Compliance Is Not an Afterthought

Unlike many general purpose layer 2 networks, Robinhood Chain is being built with regulated financial products as the primary target.

That means infrastructure that can handle minting and burning of tokenized securities in a controlled way. It likely also means features that support jurisdiction based restrictions and other compliance requirements at the protocol or system level.

Robinhood has not framed this as a purely decentralized experiment. It is positioning the network as financial infrastructure, with guardrails.

That will appeal to some institutions. It may frustrate parts of the crypto community. Both reactions are predictable.

Infrastructure Partners in Place

Robinhood is not building this alone.

Chainlink is involved to provide oracle services, which are essential if you are dealing with tokenized stocks that need accurate real world price feeds. Alchemy is supporting developer infrastructure. Other analytics and compliance firms are integrated from the outset.

This is not a bare bones testnet thrown into the wild. It is being launched with a fairly complete infrastructure stack.

The company is also rolling out developer documentation and encouraging builders to start experimenting immediately.

The Exchange Layer 2 Trend

Robinhood joins a growing list of exchanges and fintech firms launching their own Ethereum layer 2 networks.

Coinbase operates Base. Kraken is developing its own network. Other trading platforms are exploring similar strategies.

The rationale is not complicated. If tokenized assets and onchain trading grow, exchanges would prefer that activity to happen on networks they influence, rather than on third party chains. Controlling infrastructure can mean more flexibility in product design, fee structures, and integration with existing platforms.

For Robinhood, which already serves millions of retail users, owning a layer 2 could tighten the loop between its app, its wallet, and onchain markets.

Testnet Today, Mainnet Later

Right now, Robinhood Chain is in public testnet. Developers can deploy contracts, test integrations, and experiment with wallet flows, including direct testing with Robinhood Wallet. No production assets are live yet.

To drive activity, Robinhood is backing developer engagement with hackathons and incentives, including a seven figure prize pool aimed at financial applications built on the network.

A mainnet launch is expected later this year, though exact timing has not been pinned down publicly. Technical stability and regulatory comfort will likely dictate the pace.

The Bottom Line

Robinhood Chain is a signal that tokenized finance is not just a side project for major platforms anymore.

If tokenized equities become widely accepted, infrastructure will matter as much as distribution. Robinhood already has distribution through its app. Now it is trying to build the rails underneath.

There are open questions. Will regulators in the US allow meaningful onchain trading of tokenized securities? Will liquidity concentrate on exchange backed layer 2s or on more neutral networks? Will users care which chain their tokenized stock sits on?

For now, Robinhood has made its position clear. It wants to be more than a broker. It wants to operate the blockchain layer where digital versions of traditional assets trade and settle.

The testnet is the first real step in that direction.

Bitcoin Near $70K Again, Bottom or More Pain Ahead?

I came into Bitcoin in mid-2017. Not early, not late, but early enough to catch the euphoria and late enough to feel the consequences. I watched that cycle go vertical, then watched it unwind in slow motion through 2018. I stayed through the 2020–2022 cycle, including the November 2021 peak and the long grind down that followed.

So when Bitcoin slipped back toward $70,000 this week, the feeling wasn’t panic..well, maybe some panic. But there certainly was some recognition. The same quiet tension I’ve felt before, when the market shifts from confidence to defense and nobody is quite ready to admit it.

This move looks familiar on the surface. Risk assets are under pressure, equities are shaky, and Bitcoin is once again trading like the most volatile expression of risk in the room. But the environment around it feels very different than it did the last two times I lived through this.

Why $70,000 Matters More Than Most Want To Admit

For anyone who lived through 2021, $70K isn’t just a number. November of 2021 marked the prior cycle’s peak near $69,000. For years, that level symbolized excess. More recently, trading above it felt like proof that the market had finally moved on.

Once Bitcoin slipped back into that zone, the mood shifted fast. Selling stopped being about opinions and started being about mechanics. Stops were hit. Leverage came out. Liquidations took over. That transition is something I’ve learned to respect. When the market turns mechanical, it usually overshoots.That is obvious on both sides, euphoria and near depression.

I saw the same thing in early 2018 and again in 2022. Different triggers, same behavior.

BTC Still Trades Like A Risk Asset

As much as I want Bitcoin to be treated differently, moments like this remind me that it still trades like a high beta risk asset when macro pressure shows up.

Equities, especially tech, have been weak. Volatility is up. Liquidity feels tighter. In that environment, Bitcoin rarely resists. It amplifies. Crypto trades 24/7, it’s easy to exit quickly, and it’s deeply intertwined with leverage. When investors want to reduce risk immediately, Bitcoin is often first in line.

Once liquidations start cascading, fundamentals stop mattering in the short term. Exchanges sell into weakness, bids step away, and price pushes through levels that felt solid just days earlier.

ETF flows add a new dynamic I didn’t have to think about in 2018 or even 2021. Institutional money can now enter and exit Bitcoin daily. That can support price over time, but during drawdowns it can also accelerate downside when outflows cluster.

What Past Cycles Taught Us

Living through the 2017 peak and the 2018 bear market changed how I think about Bitcoin permanently. Support can fail. Narratives can break. Time can do more damage than price. And something always happens that you least expect.

The 2020–2022 cycle reinforced that lesson. After peaking in November 2021, Bitcoin fell roughly 75 percent into the November 2022 lows. That wasn’t just a crash, it was a year of slow erosion that wore people down.

Those experiences make it hard for me to assume this cycle can’t get uglier. Bitcoin has always been good at humbling people who think they’ve seen it all.

At the same time, I can’t ignore what’s different now.

Will This Cycle Be Different?

In 2017 and 2021, regulation was mostly noise. Institutions were cautious or absent. Spot ETFs didn’t exist. Bitcoin lived largely outside traditional markets

That’s no longer true.

Efforts like the Clarity Act and broader moves to define digital commodities give Bitcoin something it’s never really had during a downturn, a clearer legal and regulatory framework. That matters more when prices are falling than when they’re rising.

Institutions also behave differently than retail traders. They don’t buy because of excitement or belief. They buy because mandates allow them to. That can create steadier demand when prices fall far enough.

But they also sell without emotion. When risk models say reduce exposure, they reduce it. No attachment, no narrative. That means drawdowns can still be sharp, but they may resolve differently than in prior cycles.

This is the tension I’m trying to navigate in this cycle. Regulation and institutional access could limit the worst outcomes we’ve seen before. They could also change the character of both rallies and declines in ways we haven’t fully experienced yet.

Is This The Bottom?

Honestly, It feels rough out there and I know I wish this was the bottom. Maybe we see some relief before more pain? Or, in true crypto fashion, we rip the band-aid off and go even further down today, but I don’t think it’s safe to assume it’s the bottom of this cycle.

Liquidations have already done some eal damage. Sentiment has flipped quickly. Price is sitting near a level that matters historically and psychologically. If ETF flows stabilize, forced selling fades, and equities stop sliding, a bottoming process could start soon.

But I’ve been around long enough to know that real bottoms don’t feel relieving. They feel boring. They form through time, failed breakdowns, and long stretches where nothing seems to happen. This is happening fast so...the chop is still going to come. We may some moves up soon, and even more quick crashes, but the long boring bottom of the market has yet to reveal its face.

If conditions continue to deteriorate, Bitcoin will grind lower. Slow declines have always been more dangerous than fast crashes. They exhaust conviction. People just get complacent and leave.

What I’m Watching

Rather than trying to call the exact low, I’m focused on a few things.

Whether ETF flows stabilize over weeks, not days

Whether liquidation events shrink instead of cascade

Whether equities, especially tech, stop dragging crypto lower

Whether Bitcoin can reclaim broken levels and hold them, not just tag them

And time, true reversals don't happen fast. Those things just take time. That is true when the market is up and when the market is down.

I came into Bitcoin in 2017 thinking it was all about price. Staying through multiple cycles taught me it’s really about structure, psychology, and time.

This drop toward $70K feels familiar for a reason. What’s different is the environment around it. Institutions are here. Regulation is evolving. The market is more connected to traditional finance than it’s ever been.

I don’t know if that makes the outcome better or just different. What I do know is, that this fourth chapter I’m living through doesn’t feel like a clean repeat of the last one, and that alone is worth paying attention to. I also don't know if I made you feel better about this whole thing or not. Or maybe, I was just trying to make myself feel better in the end.

Bitcoin Mining Stocks Rally as Riot Signs AMD Deal and Galaxy Expands in Texas

Bitcoin mining stocks are back in focus, and this time the rally is not just about the price of Bitcoin. A wave of corporate announcements from major industry players is giving investors a new narrative to work with, one centered on data centers, artificial intelligence, and long term infrastructure plays.

Two companies in particular, Riot Platforms and Galaxy Digital, helped spark renewed interest across the sector after unveiling ambitious plans tied to Texas based operations. The moves highlight how crypto miners are quietly reshaping themselves as broader digital infrastructure companies.

Mining Stocks Ride a New Momentum Wave

Mining equities tend to act like leveraged bets on Bitcoin, and recent price action has followed that familiar script. As Bitcoin pushed higher and held key levels, stocks tied to the mining ecosystem responded quickly. Names like Riot Platforms, Marathon Digital, CleanSpark, Hive Digital, and Bitfarms all saw renewed buying interest.

But this rally looks different from past cycles. Instead of focusing purely on hash rate growth or fleet upgrades, investors are paying closer attention to balance sheets, power access, and how miners are positioning themselves beyond block rewards. The sector is increasingly being viewed through the same lens as energy infrastructure and data center operators.

Riot’s AMD Deal Signals a Strategic Shift

Riot Platforms (Nasdaq: RIOT) delivered one of the more consequential announcements. The company revealed a long term lease agreement with AMD that will bring a significant data center tenant to Riot’s Rockdale, Texas site.

Under the deal, Riot will provide 25 megawatts of capacity to AMD under an initial 10 year contract worth at least $311 million with further extension options that could boost spending to $1 billion. Potentially scaling into the hundreds of megawatts if demand grows.

For Riot, the deal is about more than headline revenue. It is a signal to the market that its infrastructure has value beyond Bitcoin mining. The company owns large tracts of land, controls substantial power capacity, and now has proof that major technology firms are willing to commit capital to those assets.

Investors reacted accordingly. Riot shares moved higher, up more than 14% on Friday trading, following the announcement as markets began to reassess the company not just as a miner, but as a data center landlord with optionality tied to AI and high performance computing.

Galaxy Digital’s Texas Vision Goes Bigger

Galaxy Digital Holdings (Nasdaq: GLXY) is taking a similar path, but on a much larger scale. The company is pushing ahead with plans to transform its Helios site in Texas into one of the largest AI and high performance computing campuses in North America.

Originally built with Bitcoin mining in mind, the Helios campus is being reimagined as a multi gigawatt data center hub. Galaxy has lined up major financing, private investment, and long term leasing commitments from AI focused cloud providers to make the vision real.

If fully built out, the site could support several gigawatts of capacity and generate recurring revenue that dwarfs traditional mining income. For Galaxy, this represents a pivot away from the boom and bust nature of crypto markets toward something closer to a regulated infrastructure business.

The market response has been mixed but attentive. While Galaxy shares remain volatile, investors appear increasingly willing to assign value to the long term cash flow potential of the Helios project, Galaxy shares were up over 6% on the day to $34, following a 13% rally on Thursday. The stock is now up about 57% year-to-date.

A Broader Shift Across the Mining Sector

Taken together, the Riot and Galaxy announcements point to a broader transformation underway in crypto mining. Rising competition, higher network difficulty, and the effects of Bitcoin’s halving cycle are pushing miners to look for steadier revenue streams.

Access to cheap power and large scale land holdings are turning out to be valuable assets beyond mining. AI workloads, cloud computing, and enterprise data services are all competing for the same infrastructure that miners already operate.

For public market investors, this creates a new way to think about mining stocks. They are no longer just proxies for Bitcoin price action. In some cases, they are becoming hybrid plays on energy, data centers, and next generation computing.

Mining stocks in general are up significantly compared to other crypto-related public companies on Friday. IREN is up 12.8%, Cypher 8%, and MARA 6%, for example, while RIOT, leading the pack, is approaching a multi-year high.

The recent rally in mining stocks suggests markets are starting to price in these shifts. Bitcoin’s price still matters, but it is no longer the only story. Corporate strategy, infrastructure quality, and long term contracts are beginning to carry more weight.

If the trend continues, the next phase of the crypto mining industry may look less like a speculative arms race and more like a battle to become essential digital infrastructure providers. For now, investors appear willing to give the sector another look, especially when miners start acting a little more like data center companies and a little less like pure crypto bets.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Ripple and LMAX Push Institutional Stablecoin Adoption

Ripple and LMAX Push Institutional Stablecoin Adoption

Ripple’s reported deal with LMAX Group is not really about another exchange listing or a short-term liquidity boost. It is about where stablecoins are finally starting to show up inside institutional finance, and what that shift says about the next phase of crypto market structure.

The headline is simple enough. Ripple and LMAX have struck a $150 million agreement that brings Ripple’s dollar-backed stablecoin, RLUSD, deeper into LMAX’s institutional trading venues. The more interesting part is what comes next: RLUSD is expected to be usable as collateral, margin, and settlement capital by professional trading firms.

That may not sound dramatic at first glance, but inside institutional markets, it is a big deal.

From parking asset to working capital

For years, stablecoins have mostly played a supporting role. They were the thing traders sat in between positions or used to move money between exchanges when banks were closed. Retail users cared about convenience and price stability. Institutions cared about something else entirely: whether a stablecoin could actually replace cash in live trading workflows.

Using a stablecoin as collateral changes the conversation. Suddenly, that token is not just sitting idle. It is supporting leveraged positions, absorbing margin requirements, and moving around trading venues without waiting for bank wires or settlement windows.

LMAX is a meaningful place for that shift to happen. The firm has built its reputation on institutional-grade execution in FX and digital assets, serving banks, brokers, hedge funds, and proprietary trading firms. If RLUSD is accepted inside that ecosystem as usable collateral, it moves closer to being treated as functional cash, not just crypto-native liquidity.

Why LMAX matters more than a typical exchange

This is not a retail exchange partnership. LMAX’s client base is made up of firms that already manage risk, margin, and balance sheets for a living. These are the players who care about haircut schedules, collateral eligibility, operational reliability, and compliance comfort.

If those firms are willing to post RLUSD as collateral, it suggests confidence not only in the token’s peg, but also in the issuer behind it. That trust is harder to earn than a listing, and far more valuable once it exists.

It also reflects a broader institutional reality. Firms want capital that moves around the clock, across venues, and across asset classes. Cash tied to banking hours and regional settlement systems increasingly feels like a constraint.

Ripple’s stablecoin strategy is becoming clearer

RLUSD is not a side project for Ripple. The company has been positioning it as an enterprise-grade stablecoin, backed by segregated reserves and supported by regular attestations. It runs on both XRP Ledger and Ethereum, and Ripple has been explicit about pushing it into real financial workflows rather than letting it exist as a passive asset.

That push has shown up in a few places already. RLUSD has been integrated into Ripple’s payments stack. It has been listed on institutional venues. And now, with LMAX, it is moving into collateral use cases.

Seen together, these steps suggest Ripple is trying to build something closer to an institutional cash layer than a retail stablecoin brand.

The collateral flywheel institutions care about

For professional trading firms, collateral is where the real leverage sits. If a stablecoin can be posted as margin, it becomes part of the firm’s core capital stack. That unlocks capital efficiency, especially for firms operating across time zones and asset classes.

Once a stablecoin clears that bar, it can expand into settlement, netting, and treasury operations. It can move between venues over the weekend. It can reduce idle balances. It can simplify how firms manage liquidity across crypto and traditional markets.

This is also why Ripple’s broader institutional moves matter. The company has been building out infrastructure that connects stablecoins, custody, prime brokerage, and payments. The LMAX deal fits neatly into that picture.

A crowded market with a narrow institutional lane

RLUSD is entering a stablecoin market dominated by incumbents with massive scale. But market cap is not the only metric that matters in institutional finance. Acceptance as collateral, integration into regulated venues, and operational trust often matter more than raw supply.

Institutions do not ask which stablecoin is biggest. They ask which one their venue will accept, which one clears risk checks, and which one will still work under stress.

Ripple is clearly aiming at that narrow lane, where trust, compliance, and plumbing matter more than retail mindshare.

What still needs to be proven

There are still open questions. The exact scope of RLUSD’s collateral eligibility at LMAX matters. Haircuts, product coverage, and custody integration will determine how widely it is actually used.

There is also the question of scale. True institutional adoption shows up in volume, not announcements. It shows up during volatile markets, when liquidity and redemptions are tested.

And as always, jurisdiction matters. Stablecoin availability and usage depend on regulatory boundaries that vary by region and client type.

Why this matters now

The broader takeaway is that stablecoins are quietly moving from the edges of crypto markets toward the center of institutional finance. Not through hype cycles, but through plumbing.

If RLUSD becomes a routine piece of collateral inside venues like LMAX, it will be less about Ripple winning a headline and more about stablecoins winning a role they have been chasing for years.

In that sense, this deal is less about a token and more about a shift. Stablecoins are no longer just crypto’s cash. They are starting to look like finance’s.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bakkt Stock Jumps After Stablecoin Infrastructure Acquisition Plans

Bakkt (NYSE: BKKT) shares jumped sharply this week after the company announced plans to acquire stablecoin payments infrastructure firm Distributed Technologies Research Ltd., or DTR. The rally says as much about what investors want Bakkt to become as it does about the deal itself.

The all-stock acquisition is the clearest signal yet that Bakkt is no longer trying to be a broad crypto platform. Instead, it is leaning into a narrower, and arguably more defensible, role as a regulated financial infrastructure company built around stablecoin settlement and payments.

Markets liked the pivot. Bakkt stock closed the day up 18% to $19.21, briefly hitting its highest level in months.

What Bakkt is actually buying

DTR is not a consumer brand. It does not run an exchange or wallet that retail users recognize. Instead, it sells payments plumbing. Its technology is designed to move money across borders using stablecoins, while still interfacing with traditional fiat rails.

That positioning matters. Stablecoins have increasingly become the connective tissue between crypto and traditional finance, especially for payments, treasury operations, and international settlement. Owning infrastructure in that layer gives Bakkt something closer to a picks-and-shovels business rather than another trading venue fighting for volume.

For Bakkt, the appeal is straightforward. By bringing stablecoin settlement in-house, the company can reduce reliance on third-party providers, speed up product development, and package a single, integrated stack for institutional clients.

This is not about launching another app. It is about selling rails.

The structure of the deal

The transaction is structured as an all-stock acquisition and still needs regulatory and shareholder approval. Based on Bakkt’s disclosures, the deal would result in the issuance of just over nine million new shares, though the final number could change depending on adjustments laid out in prior agreements.

One important detail is governance. DTR is controlled by Akshay Naheta, who has also served as Bakkt’s co-CEO. That relationship introduces obvious questions around conflicts and valuation.

Bakkt appears to have anticipated that scrutiny. The company said the deal was reviewed and approved by an independent special committee of the board. Intercontinental Exchange, which owns a significant stake in Bakkt, has also agreed to vote in favor of the transaction.

Those steps do not eliminate concerns, but they do suggest Bakkt understood the optics and tried to address them early.

Why the market reacted so strongly

The stock move was not just about the acquisition. It was about narrative.

Bakkt has spent the past year trying to simplify itself. The company has pulled back from consumer-facing experiments and loyalty products, and has talked more openly about becoming a pure crypto infrastructure provider.

This deal fits that story cleanly.

Stablecoin infrastructure is one of the few areas in crypto where traditional finance firms are quietly increasing engagement. Banks, payment processors, and large enterprises are exploring settlement use cases even as trading volumes fluctuate. Investors see optionality in that shift, especially if regulation continues to clarify rather than clamp down.

There is also a timing element. Bakkt plans to formally change its corporate name later this month and has scheduled an investor day at the New York Stock Exchange in March. Those milestones give the market something to anchor expectations to, and something to trade around.

While the announcement felt abrupt to the market, the relationship between Bakkt and DTR is not new.

The two companies have been commercially aligned for months, with earlier agreements focused on integrating stablecoin payments technology into Bakkt’s platform. From that perspective, the acquisition looks less like a bold leap and more like a second step.

First comes the partnership. Then comes ownership of the core layer once both sides decide the integration matters enough.

The risks still on the table

The excitement does not erase real questions.

Dilution is the most immediate one. This is an all-stock deal, and existing shareholders will want clarity on how much value DTR is actually contributing relative to the equity being issued.

Execution risk is another. Payments infrastructure sounds clean on a slide deck, but it is operationally demanding. It requires compliance discipline, bank partnerships, uptime guarantees, and a credible enterprise sales motion. None of that happens automatically.

There is also the issue of revenue concentration. Bakkt has previously lost large clients, and investors will want to know whether this new strategy truly diversifies revenue or simply shifts dependence to a different set of partners.

Those answers are unlikely to come all at once. The March investor day will probably be the first real test of whether Bakkt can explain this strategy in concrete terms.

But, Bakkt’s acquisition of DTR is a bet on where crypto quietly intersects with traditional finance, not where the loudest narratives live. Stablecoins, settlement, and payments are not as flashy as meme coins or ETFs, but they are where real volumes tend to stick.

The stock’s reaction shows investors are willing to believe in that story, at least for now.

Whether Bakkt can turn that belief into a durable business will depend on execution in the months ahead.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

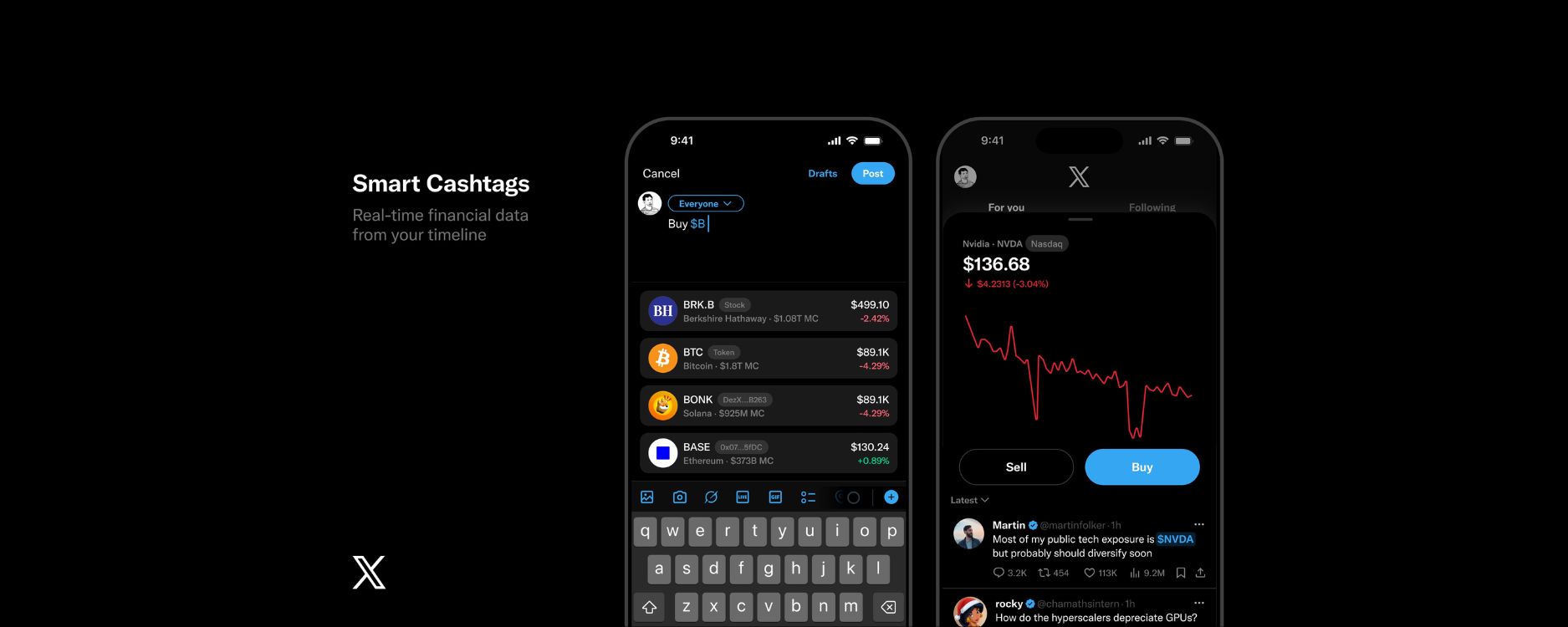

X Plans Smart Cashtags to Show Live Crypto Prices Inside the Timeline

X is getting ready to roll out something called Smart Cashtags, and while the feature sounds minor on the surface, it could change how people follow crypto markets day to day.

Cashtags are already familiar to anyone who spends time on crypto Twitter. Add a dollar sign in front of a ticker like $BTC or $ETH and the platform turns it into a clickable reference tied to ongoing conversations. It has always been useful for tracking sentiment, but not particularly helpful if you actually want to know what the market is doing in that moment.

Smart Cashtags are meant to fix that.

Instead of just linking to a stream of posts, the upgraded version will surface live prices, basic performance data, and charts directly in the feed. The idea is simple: if people are talking about a token, you should be able to see what it is doing without leaving the timeline.

For a platform where crypto narratives often move faster than prices themselves, that shift matters.

Turning the Feed Into a Market Snapshot

Crypto trading already lives on X. News breaks there. Narratives form there. Panic and euphoria show up there first. What has been missing is the data itself.

Smart Cashtags bring that data closer to the conversation.

The feature was announced by Nikita Bier, who is Head of Product at X, saying it will convert posts into live market data entry points.

When someone mentions a token using a cashtag, the platform will recognize the asset and display up to date pricing alongside the post. Tapping the tag is expected to open more context, recent price moves, charts, and related discussion, all in one place.

It reduces the constant app hopping that most traders know too well. Instead of checking a charting app, then jumping back to X to see what people are saying, everything shows up together.

Over time, that could subtly change how people consume market information. The feed becomes less of a rumor mill and more of a lightweight market view.

Why Crypto Traders Will Care

Crypto is unusually sensitive to social momentum. A token can start trending hours before volume shows up. A single viral post can spark a rally or accelerate a selloff.

Putting price data directly next to those conversations tightens that feedback loop.

A trader scrolling their timeline might see a surge in posts about a token at the same moment the price is breaking out. The same dynamic works in reverse during downturns. That kind of visibility favors speed and awareness, especially for retail traders who do not live inside professional trading dashboards.

It also lowers the barrier to entry. You do not need to know where to look or which tools to use. The information comes to you as part of the conversation.

That accessibility cuts both ways. More visibility can mean better context, but it can also amplify emotional reactions during volatile moments.

Not Just a Visual Upgrade

Smart Cashtags are not just about showing a price number.

One of the quieter improvements is accuracy. Crypto tickers can be messy. Different tokens share similar symbols, and some symbols overlap with stocks or other assets. Smart Cashtags are expected to better identify and map posts to the correct asset, reducing confusion and mislabeling.

That matters more as crypto bleeds into traditional finance, with tokenized assets, ETFs, and crossover tickers becoming more common.

This is also not X’s first step into market data. Earlier versions of cashtags already offered limited chart previews through external integrations. Those features felt bolted on. Smart Cashtags move the data front and center, making it part of the native experience instead of a side panel.

Embedding live prices into social feeds is not risk free.

If data is delayed or inaccurate, misinformation spreads faster. When price movements and social reactions are displayed together, markets can become more reflexive. Trends may accelerate, and herd behavior could become more pronounced, especially in smaller or thinner markets.

There is also the question of incentives. Once price data lives inside the feed, it opens the door to monetization, premium analytics, or trading integrations. None of that has been formally announced, but the direction is hard to ignore.

A Bigger Picture Play

Smart Cashtags fit neatly into X’s broader ambitions. The platform has been inching toward financial services, payments, and creator driven monetization for some time. Turning the feed into a place where financial data lives alongside conversation feels like a natural extension, and ultimately leads toward X becoming the everything app.

For crypto specifically, it reinforces X’s position as the main arena where narratives meet price action. It is not a trading terminal, but it does not need to be. Influence often matters more than precision.

The Bottom Line

Smart Cashtags may look like a small product update, but they point to something bigger.

By putting live crypto prices directly into the timeline, X is collapsing the distance between sentiment and market reality. For traders, builders, and casual observers alike, that could change how quickly ideas turn into action.

Whether it leads to better informed decisions or faster hype cycles will depend on how it is used. Either way, crypto conversations on X are about to feel a lot closer to the market itself.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bitcoin May Face a Volatile Day as Macro Events Stack Up

Bitcoin is waking up to a market that feels unusually fragile.

Price itself looks calm enough. The range has been tight, daily swings have been muted, and nothing on the surface screams urgency. But anyone paying attention to today’s calendar knows this kind of calm can disappear quickly.

Several macro events are stacked into the U.S. session, all tied to interest rates, inflation, and risk appetite. When those forces collide, Bitcoin rarely sits still.

This is shaping up to be one of those days where volatility does not need a single dramatic headline. It just needs friction.

A Morning That Rarely Stays Quiet

The first real test arrives early, when U.S. jobs data hits the tape around the start of the New York session.

Employment numbers still carry outsized influence over markets. They shape expectations around how tight financial conditions will remain and how much flexibility the Federal Reserve really has. Bitcoin has become increasingly sensitive to these shifts, especially when liquidity is thin.

The initial reaction is often fast and emotional. Sometimes it sticks. Sometimes it fades within minutes. Either way, it tends to wake the market up.

From there, the morning does not get any simpler.

As the session develops, attention turns to Washington. A Supreme Court ruling related to tariffs is expected during the late morning hours. While not crypto-specific, tariff decisions feed directly into inflation assumptions, and inflation is still one of the most important variables in global markets.

Around the same window, a Federal Reserve official is scheduled to speak. That overlap matters. When legal decisions, inflation narratives, and Fed messaging collide, markets can struggle to find a clean interpretation. Bitcoin often reflects that confusion in real time.

Why This Timing Matters for Bitcoin

What makes today feel different is not just the events themselves, but how close together they land.

Bitcoin thrives on liquidity and clear narratives. Days like this offer neither. Instead, traders are forced to process multiple signals that may not point in the same direction.

That is when volatility tends to rise.

A strong jobs report followed by cautious Fed language. A soft report paired with inflation concerns. Even outcomes that are mostly expected can trigger sharp moves if positioning is wrong.

Bitcoin does not need certainty to move. It needs imbalance.

The Quiet Role of Liquidity

Another reason this day feels risky is what has been happening quietly in the background.

Spot Bitcoin ETFs have seen periods of outflows recently, reducing a layer of steady demand that helped stabilize price during previous pullbacks. With that cushion thinner, price reacts more aggressively to macro headlines.

That cuts both ways. Breakouts can extend faster. Pullbacks can feel heavier. The same headline that barely moved Bitcoin a month ago can suddenly matter a lot more.

Midday Calm Can Be Misleading

If Bitcoin survives the morning without a major break, it would not be surprising to see price settle into a narrow range through the middle of the day.

That lull can be deceptive.

Often, midday calm simply reflects traders waiting for confirmation, not confidence that the danger has passed. Volatility can resurface later as markets digest positioning data and prepare for the next global session.

Bitcoin has a habit of making its real move when attention starts to drift.

A Market That Feels Coiled

Recent price action tells a familiar story. Bitcoin has struggled to push decisively higher, but sellers have not taken control either. The result is a compressed range that feels increasingly unstable.

Historically, these conditions do not resolve gently.

When volatility returns after a long period of compression, it tends to overshoot. Direction is still uncertain, but movement feels inevitable.

The Bigger Picture

This is not about predicting whether Bitcoin goes up or down today. It is about recognizing the environment.

Macro pressure is building. Liquidity is thinner. Volatility has been suppressed for too long. And the calendar is packed with catalysts that can disrupt the balance.

For traders, today is about staying alert, not getting comfortable.

For long-term holders, it is another reminder that Bitcoin often chooses moments like this to reassert its personality.

The market may look calm right now, but we'll see how the day plays out. Jobs reports, Supreme Court decisions, and Fed Talks should make it very interesting either way.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Spot Crypto ETFs Cross $2 Trillion in Trading Volume as Market Matures

U.S. spot crypto ETFs have now crossed $2 trillion in cumulative trading volume, and the pace is what stands out. The second trillion arrived in a fraction of the time it took to reach the first, a sign that these products are no longer just a post launch curiosity. They’ve become part of the daily machinery of crypto markets.

This milestone is about usage, not hype. Cumulative volume counts every trade that’s taken place since launch. It’s not a measure of how much money investors have parked in these funds, and it’s not a scorecard for inflows. It simply answers one question: how often are people actually using these ETFs to trade crypto exposure?

The answer now is: a lot.

Bitcoin Did the Heavy Lifting, Ethereum Added Fuel

Most of that $2 trillion comes from spot Bitcoin ETFs, which have been trading heavily all year. Bitcoin products built liquidity early and never really gave it back. By the end of 2025, they were doing massive daily volume even on relatively quiet market days.

Ethereum ETFs came later, but once they found their footing, they added a meaningful second leg. As ETH products matured, traders began using them not just for long term exposure, but also for positioning, rotation, and relative value trades against Bitcoin.

Together, they pushed cumulative volume past the $2 trillion mark, and the curve got steeper along the way.

Why Trading Picked Up So Quickly

A few things changed over the past year.

First, the plumbing improved. Market makers figured out how to price these products efficiently, spreads tightened, and trading got easier. Once friction drops, volume usually follows.

Second, volatility helped. Crypto spent much of the year moving between risk on and risk off. In those environments, ETFs are an easy switch. They let traders adjust exposure fast without dealing with custody, exchanges, or operational headaches.

Third, liquidity concentrated. A handful of ETFs became clear winners, and traders gravitate to the deepest pools. That concentration pulls even more activity into the same tickers, reinforcing the trend.

And finally, these ETFs stopped feeling “new.” Once something becomes familiar, it starts getting used more casually, for hedges, reallocations, and short term trades that don’t make headlines.

This Isn’t Just About New Money

It’s important to separate volume from inflows.

Yes, spot crypto ETFs have pulled in tens of billions in new capital since launch, especially on the Bitcoin side. That shows real demand for regulated crypto exposure. But volume tells a different story. It shows repetition. The same capital moving in and out, sometimes many times over.

That’s actually what makes this milestone interesting. It suggests ETFs are becoming the default execution venue for a growing slice of crypto trading, not just a one way funnel for long term investors.

ETFs Are Becoming a Price Discovery Layer

As trading volume piles up, ETFs start to matter more for price formation. On active days, price moves often show up in ETFs first, then ripple into futures and spot markets as arbitrage kicks in.

That doesn’t mean ETFs control crypto prices, but it does mean they’re part of the feedback loop now. For traditional investors especially, the ETF ticker is the market.

This also nudges crypto a bit closer to traditional market behavior. Flows, positioning, and narrative cycles start to matter more, sometimes even more than onchain activity in the short term.

What to Watch From Here

Crossing $2 trillion doesn’t mean volume will grow in a straight line forever. Trading activity can cool when volatility drops or when investors get more comfortable holding through cycles.

But a few things will signal whether this trend sticks:

-

steady daily volume, not just spikes

-

broader participation beyond one or two dominant funds

-

continued activity in Ethereum ETFs, not just Bitcoin

-

how ETFs behave during the next real market stress test

For now, the takeaway is simple. Spot crypto ETFs aren’t an experiment anymore. They’re being used, heavily, and the market is treating them like infrastructure. That $2 trillion figure isn’t just a big number. It’s a sign that crypto trading has quietly picked up a new center of gravity.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Hyperliquid Begins Team Token Unlock With First HYPE Distribution

Hyperliquid has taken its first visible step in releasing tokens to its team, unstaking around 1.2 million HYPE ahead of a planned distribution in early January. While the move was always part of the project’s vesting plan, it is the first time those mechanics have shown up clearly on chain, which is why it caught the market’s attention.

The tokens were unstaked in late December and are expected to land with contributors on January 6. According to the team, this is not a one-off event. Future releases are set to follow a monthly rhythm, with additional tokens unlocking on the sixth day of each month as vesting milestones are reached.

On its own, the amount is relatively small. Still, in crypto, any unexpected token movement tends to raise questions, especially when it involves team allocations.

Why the Unstake Raised Eyebrows

The initial on-chain activity sparked speculation that Hyperliquid was preparing a much larger release. Some traders circulated figures suggesting that close to 10 million tokens could hit the market at once, a scenario that would have meaningfully increased circulating supply.

That interpretation turned out to be off the mark. The team later clarified that the unstake was simply a procedural step tied to an existing vesting schedule, not an acceleration or change in plans. Once that context became clearer, concerns eased, though the episode highlighted how quickly uncertainty can spread when token movements appear without explanation.

For now, the unstaked tokens remain part of the team allocation. They are scheduled to be distributed to individual contributors in early January rather than sold or transferred immediately.

What Hyperliquid Is Building

Hyperliquid is a trading-focused crypto project that has taken a different route than most decentralized platforms. Instead of launching a general-purpose blockchain and layering applications on top, the team built a high-speed perpetual futures exchange first, then designed a custom Layer-1 network around it. Hyperliquid remains the largest decentralized perps DEX by volume.

The exchange has been the main draw so far. It offers deep liquidity, advanced order types, and execution speeds that feel closer to centralized trading venues than what most on-chain platforms can deliver. That performance focus has helped Hyperliquid attract active traders, including professional market makers who typically avoid decentralized exchanges due to latency and reliability issues.

To make that possible, Hyperliquid runs its own blockchain rather than relying on shared infrastructure. The network is optimized specifically for financial activity, prioritizing throughput and consistency over broad flexibility. It is not trying to support every type of application, but it does aim to do trading extremely well. The model has worked. Hyperliquid has generated almost $1B in fees, with another $843B in total revenue in 2025.

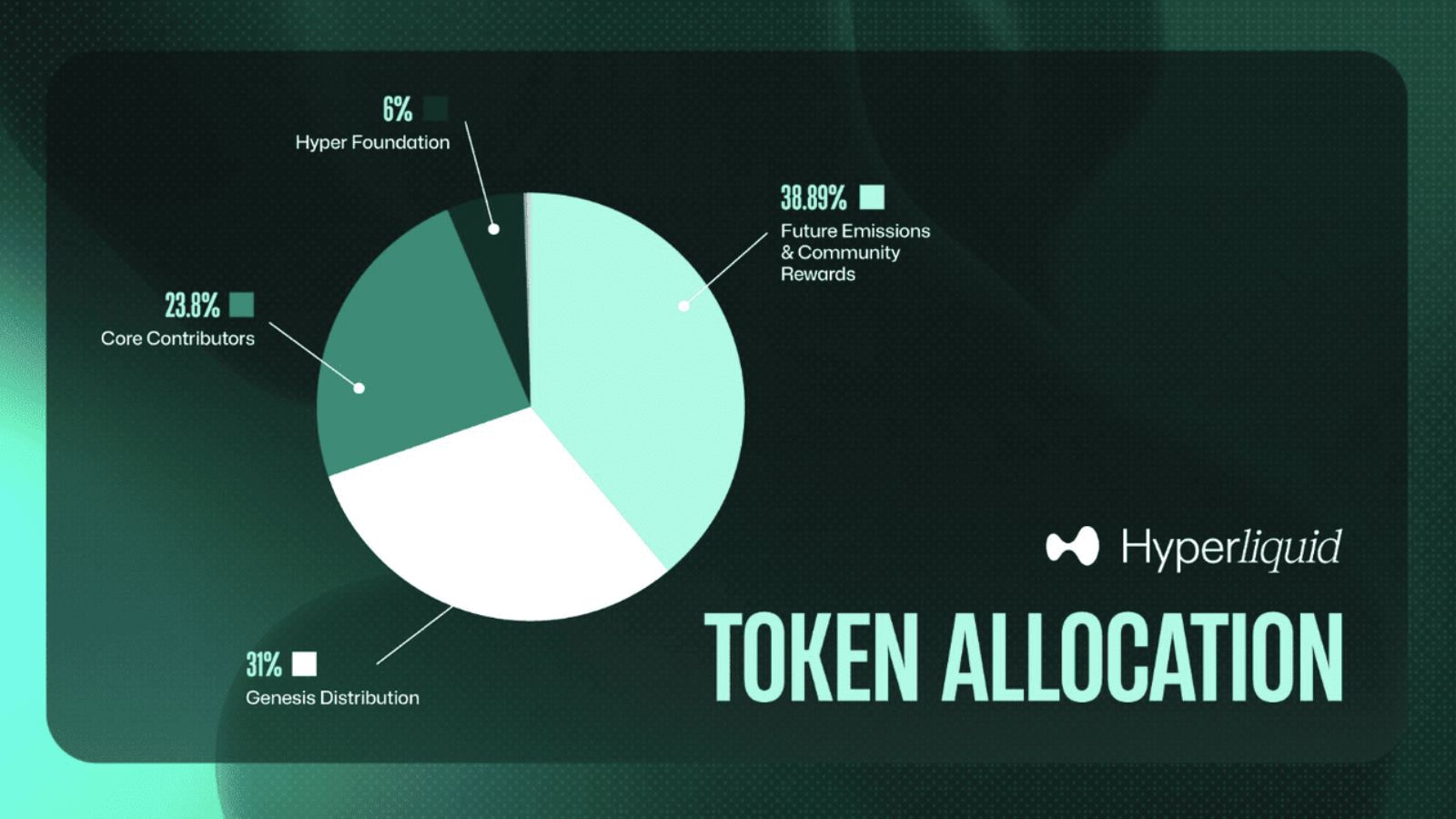

How the Token Supply Is Structured

HYPE has a fixed supply of one billion tokens. The protocol did not raise money from traditional venture capital firms and instead distributed a large share of its token supply directly to users through a genesis airdrop. That decision helped build early loyalty, while leaving the team with a significant role in guiding the protocol as it grows

About 24 percent is allocated to core contributors, with the rest split between community rewards, the initial user airdrop, and funds set aside for ecosystem development and operations.

Team tokens were locked at launch and are subject to a multi-year vesting schedule. Earlier unlocks affecting developers and contributors began in late 2025, but the bulk of the allocation remains locked and will continue to enter circulation gradually over time.

The January distribution represents a small slice of the total team allocation. Even so, these releases are closely watched because they incrementally increase circulating supply, which can influence liquidity and price dynamics.

How the Market Has Responded

So far, the reaction has been relatively calm. HYPE has continued trading within a fairly tight range, suggesting that traders are treating the unlock as expected rather than disruptive.

Market observers often point out that predictable vesting schedules tend to be easier for investors to digest than irregular or poorly communicated releases. By committing to a consistent monthly timeline, Hyperliquid appears to be trying to set clearer expectations around future supply changes.

That does not mean future unlocks will be ignored. Larger tranches and shifts in broader market conditions could still shape sentiment as time goes on.

What to Watch Going Forward

As more team tokens vest in the months and years ahead, attention will likely shift toward how those tokens are handled. Whether contributors hold, stake, or sell their allocations will matter, particularly as Hyperliquid continues to expand its trading and blockchain infrastructure.

For now, the first team distribution serves as a reference point. It gives the market a clearer sense of how Hyperliquid plans to manage token releases while continuing to scale its platform. The longer-term test will be whether that transparency holds as the numbers grow and expectations rise.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Robinhood Crypto Revenue Soars 339% as Bitstamp Acquisition Expands Global Reach

Robinhood’s Crypto Revenue Soars, Signaling Surge in Retail Crypto Engagement

Robinhood Markets reported that its cryptocurrency-trading revenue surged by 339% in Q3 2025 to $268 million. This performance underscores the increasing role of crypto in Robinhood’s business model and reflects broader retail investor enthusiasm for digital assets. The rise comes against a backdrop of product innovation, global expansion and favorable sector sentiment.

Strong Performance Across the Platform

While crypto trading was a standout, Robinhood’s overall performance paints a positive picture of a company gaining traction. Earlier in the year the company reported Q2 revenue of $989 million, up 45% year-on-year and with crypto revenue alone up 98% to $160 million. The momentum built into stronger Q3 performance where crypto contributed a larger share of transaction-based revenues. The company’s expanded crypto product offerings, including new tokens, staking and acquisition of Bitstamp, helped fuel activity.

Why Crypto Revenue Grew So Fast

Several factors helped drive Robinhood’s crypto-business acceleration:

- Retail engagement in crypto trading is high. With more tokens listed, easier access and zero-commission trading, Robinhood has captured more users’ attention.

- Global expansion. The acquisition of Bitstamp gave Robinhood more licensing in Europe and access to more markets, increasing liquidity and cross-border trading.

- New product launches. Added services such as crypto staking in the U.S. and EU, tokenized stocks, and enhanced platform features boosted user activity.

- Macro environment. Periods of heightened crypto volatility and interest often correspond with higher trading volumes and revenue for platforms like Robinhood.

Implications for Robinhood and Crypto Platforms

For Robinhood, the spike in crypto revenue suggests the firm is successfully evolving beyond a retail stock-trading app into a broader digital-asset-centric platform. Crypto trading is no longer a niche segment, it is now a meaningful driver of revenue and growth.

For the broader crypto industry, Robinhood’s results highlight several important trends:

- Retail platforms with strong user bases and simple onboarding for crypto are gaining a larger share of trading volume and attention.

- Crypto is becoming more integrated into mainstream fintech business models, not just peripheral to them.

- Expanding regulatory clarity and global licensing (as seen via Bitstamp acquisition) are helping platforms scale crypto services globally.

- The overlap between equities, options and crypto trading is becoming more pronounced, as platforms leverage overlapping customer bases.

What to Watch Moving Forward

- Sustainability of the growth. Strong quarter-to-quarter gains are impressive but maintaining this requires continuous product innovation, user acquisition and regulatory compliance.

- Crypto revenue mix and token exposure. As crypto revenue grows, the breakdown by asset class, trading type and geography will matter for understanding risk and opportunity.

- Platform expansion and licensing. Global regulatory regimes continue to evolve, so Robinhood’s ability to scale globally while maintaining compliance will be key.

- Competitive landscape. Other platforms are competing aggressively in crypto trading, tokenization and wallet services. Robinhood’s product velocity and customer experience will determine how it holds competitive edge.

Robinhood’s Market Strength and Expanding Footprint

Robinhood’s impressive crypto performance came alongside strong overall financial results. Although shares dipped about 2% in after-hours trading, the stock remains up roughly 260% year-to-date, reflecting the market’s confidence in the company’s long-term trajectory.

Chief Financial Officer Jason Warnick said the quarter highlighted “another period of profitable growth” and emphasized the company’s diversification. He noted that Robinhood added two new business lines, Prediction Markets and Bitstamp, each already generating around $100 million in annualized revenue.

“Q4 is off to a strong start,” Warnick added, pointing to record trading volumes across equities, options, prediction markets, and futures, along with new highs for margin balances.

The company’s market capitalization has now reached $126 billion, placing it ahead of major competitors like Coinbase, which also reported strong earnings recently.

These results follow a string of moves aimed at deepening Robinhood’s role in the global crypto ecosystem. The acquisition of Bitstamp, one of the world’s oldest crypto exchanges, gave Robinhood an established regulatory presence and a user base spanning more than 50 countries. This acquisition not only expanded access to international markets but also strengthened its compliance infrastructure — a crucial advantage as global regulators define the next phase of crypto policy.

Final Thoughts

Robinhood’s record-setting quarter represents more than just strong numbers, it highlights a pivotal transformation in how traditional fintech and digital assets are converging.

The company’s 339% surge in crypto trading revenue reflects growing confidence among retail investors, while its acquisitions and new business lines show a clear pivot toward becoming a comprehensive global trading platform. With Bitstamp under its umbrella and new markets like prediction trading contributing nine-figure revenues, Robinhood is building an ecosystem that spans equities, options, futures, and crypto — all within a single, regulated framework.

Despite the minor dip in after-hours trading, investor sentiment remains overwhelmingly positive. Robinhood’s valuation of $126 billion underscores that the market views the company not as a speculative fintech, but as a major financial institution reshaping digital trading.

As the boundaries between finance and crypto continue to blur, Robinhood’s expansion signals a broader truth: the next generation of global markets will not separate traditional and digital assets. Instead, they will coexist on platforms that offer both speed and security — and Robinhood appears determined to lead that charge.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.