#Policy

Crypto CEOs Join CFTC Innovation Council as Market Shift Begins

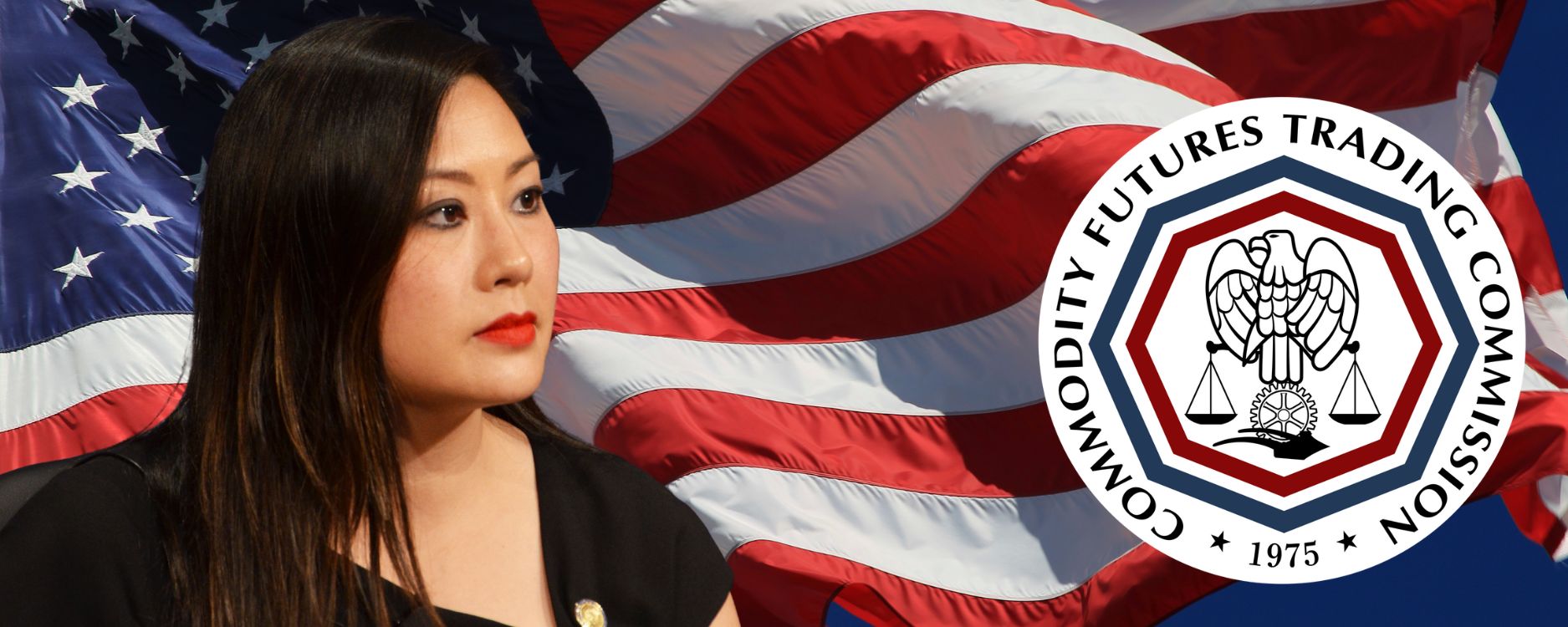

Caroline Pham is heading into her final stretch as acting chair of the CFTC, but she is not easing her way out. Instead, she has pulled together a new CEO Innovation Council, bringing in a mix of crypto founders and leaders from major financial institutions. The timing feels intentional. Markets are shifting fast, the technology is shifting even faster, and she clearly wanted this group in place before she hands off the job.

The council itself is an unusual gathering. On one side are Tyler Winklevoss from Gemini, Arjun Sethi from Kraken and Shayne Coplan from Polymarket. On the other, executives from CME Group, Nasdaq, ICE and Cboe. It is not often you see these people sitting on the same advisory panel, let alone one created this quickly. According to the commission, the entire list came together in about two weeks, which says a lot about how much urgency Pham applied.

She thanked the group for agreeing to join so quickly, noting that the commission needs their experience as it tries to prepare for what comes next. The council will focus on the areas where the rulebook is changing as fast as the products themselves. Tokenization. Prediction markets. Perpetual contracts. Crypto collateral. Around the clock trading. Blockchain market plumbing. Basically all the things that traditional derivatives systems were never built to handle.

Here is the full list of names:

Shayne Coplan, Polymarket

Craig Donohue, Cboe

Terry Duffy, CME Group

Tom Farley, Bullish

Adena Friedman, Nasdaq

Luke Hoersten, Bitnomial

Tarek Mansour, Kalshi

Kris Marszalek, Crypto.com

David Schwimmer, LSEG

Arjun Sethi, Kraken

Jeff Sprecher, Intercontinental Exchange

Tyler Winklevoss, Gemini

All of this is happening as the agency prepares for new leadership. President Trump’s nominee, Mike Selig, is expected to be confirmed soon. When he steps in, he will inherit an agency already deep into crypto policy work that accelerated under Pham. Just this week, the CFTC launched a pilot for using crypto collateral inside derivatives markets. A few days before that, Bitnomial began offering leverage spot crypto trading with her support.

Pham has only been in the acting role for a short time, but she treated crypto as a top priority, pushing several initiatives that line up with the administration’s goal of positioning the United States as a leading hub for digital assets. Over at the SEC, Chairman Paul Atkins has been doing something similar through Project Crypto, which has been absorbing much of the agency’s energy.

What comes next will land in Selig’s lap. But with this council now in place, he will walk into a job where the industry and the regulators are already in the middle of a much bigger conversation about what the future of market structure should look like.

Indiana Crypto Pension Bill Could Transform Retirement Investing

Indiana’s Bold Move: Crypto in Public Pensions

In early December 2025, Indiana surprised a lot of people by stepping directly into the world of digital assets. A new proposal, House Bill 1042, was introduced by state representative Kyle Pierce, and it does something pretty groundbreaking. It requires public retirement programs to offer crypto linked exchange traded funds, or ETFs, as part of their standard investment lineup.

This means that many public employees, including teachers, government workers, and possibly police and firefighters, would now see crypto related funds sitting right next to traditional retirement options. Instead of crypto being something you explore on your own, Indiana wants it to be a normal part of the overall retirement system.

The bill also outlines a set of protections for everyday crypto users. It limits how much local governments can restrict or interfere with digital asset activity. That includes mining, payments, self custody, and private wallet use. Unless restrictions also apply to traditional financial assets, cities and counties would not be allowed to single out crypto for special limitations.

If this becomes law, Indiana would be the first state in the country to require Bitcoin linked ETFs in public pension systems. That alone sets a bold precedent for how states might approach retirement investing in the future.

A Broader Trend: States Are Warming Up To Crypto

Indiana might feel like it is out ahead, but the move fits into a larger trend. Several other states have already been exploring crypto exposure in different ways.

For example, some states have passed laws allowing retirement systems to purchase Bitcoin ETFs. Others have focused more on legal protections, such as protecting self custody, clarifying how digital assets are classified, or encouraging blockchain adoption within government departments.

What makes Indiana stand out is not the idea of crypto exposure itself, but the fact that the bill attempts to make it a standard part of public retirement offerings. This goes beyond optional access and moves toward normalizing crypto as a core part of long term, institutional investing.

What Supporters Are Saying

Backers of House Bill 1042 believe this is simply a reflection of financial reality. Crypto is becoming a bigger part of the global economy, and Indiana residents should have access to it in the same way they do to other investments.

Supporters argue that this gives people more financial flexibility, especially younger workers who want exposure to assets they believe will appreciate over the next several decades. They also point out that Bitcoin ETFs remove much of the risk and complexity of direct crypto ownership, since they function inside the regulated ETF structure.

The bill also proposes pilot programs to test blockchain technology within state agencies. That includes using distributed ledgers for record keeping, identity management, and improving government transparency and efficiency. Supporters say this could modernize the way public systems operate.

What Critics Are Concerned About

Not everyone is excited about crypto appearing in pension plans. Critics bring up several concerns.

One of the biggest issues is volatility. Cryptocurrencies can swing up or down rapidly, and pension systems are normally built around stability and long term reliability. Some people worry that exposing retirement funds to such unpredictable markets may not serve the best interests of retirees.

There are also questions about long term regulation. National rules around crypto continue to shift, and that uncertainty could create complications for publicly managed funds. Critics say lawmakers should move slowly and avoid building pension plans around assets that still feel risky to many households.

Another concern is whether the state should be responsible for promoting exposure to crypto at all. Some people feel that these decisions should be optional and entirely individual, rather than part of a default menu in a public benefits system.

Why Indiana’s Bill Could Be A Turning Point

If Indiana does pass House Bill 1042, the impact could go far beyond state borders.

It would accelerate the mainstream acceptance of crypto within public institutions. At the same time, it would create a legal framework that protects wallet access, mining, payments, and self custody rights. That combination of investment access and personal rights could easily serve as a template for other states.

It also encourages conversation about what public retirement investing should look like in the future. Some believe this is an opportunity for long term growth. Others feel the risks are too high. Either way, the bill forces the debate into the spotlight.

What To Watch Next

There are several things worth paying attention to in the months ahead.

First, lawmakers may modify the bill. They could adjust the requirement to offer crypto ETFs or turn it into an optional feature instead. They might also place limits on how much of a pension portfolio can be allocated to digital asset funds.

Second, pay attention to how pension administrators respond. Even if the bill passes, the practical process of integrating crypto ETFs will require careful planning.

Third, other states may begin crafting similar laws. Indiana’s move could spark a wave of legislative activity across the country as states look at whether they want to follow the same path.

Finally, federal regulatory changes will play a major role. As national crypto rules evolve, they could strengthen or weaken the long term viability of crypto pension investments.

Indiana’s proposal captures a pivotal moment in the evolution of digital assets. Crypto is no longer viewed as a fringe experiment. It is now part of serious, institutional conversation. Whether this turns out to be a smart long term shift or an overly ambitious leap is something only time will reveal, but it is clear that the landscape of public finance is changing quickly.

Texas Becomes First U.S. State to Establish a Bitcoin Treasury Reserve

Texas Breaks New Ground with Bitcoin Reserve, Committing Public Funds as the First U.S. State to Hold Bitcoin

Texas has become the first U.S. state to formally establish a Bitcoin-based strategic reserve, introducing public funds and a legal framework for direct cryptocurrency investment at the state level. Through Senate Bill 21 the state authorized a standalone fund to purchase and hold Bitcoin, signaling a bold shift in how governments view digital assets and offering a blueprint for other states to follow.

What Texas Has Done

In June 2025 Governor Greg Abbott signed Senate Bill 21 into law, creating the “Texas Strategic Bitcoin Reserve” under the management of the state’s Comptroller. The law explicitly authorizes the allocation of $10 million in public funds toward Bitcoin purchases. Crucially the reserve is structured outside the state’s general treasury and protected by a companion bill that prevents assets being transferred into general revenue.

Key structural features include:

-

A requirement that only cryptocurrencies with an average market capitalization above $500 billion qualify for inclusion, a threshold currently met only by Bitcoin.

-

Oversight by a multi-member advisory committee comprised of crypto-investment professionals, tasked with supervising asset acquisition, custody, and reporting.

-

A requirement for biennial public reporting on the reserve’s holdings and performance to ensure transparency and accountability.

In effect Texas is treating Bitcoin not simply as a speculative asset but as a strategic state asset, akin to gold reserves but adapted for the digital age. The allocation represents approximately 0.0004 percent of the state’s budgetary reserves, yet its symbolic weight is significant.

Why It Matters

Government Finance Innovation

By dedicating public funds to cryptocurrency, Texas is breaking new ground in state finance. Instead of merely authorizing a reserve in name only the state is committing capital and constructing a legal and operational framework for digital asset stewardship. This places the state at the forefront of public-sector crypto adoption and positions it as a hub for digital finance innovation.

Institutional Signal for Bitcoin

This move provides a powerful institutional signal that Bitcoin is now being taken seriously at the governmental level. While large companies and institutions have added Bitcoin to their treasuries, few public-sector entities have done so explicitly. Texas’s action could catalyze other states to follow suit, boosting demand and normalizing Bitcoin as part of a diversified asset strategy.

Cultural and Economic Positioning

Texas already hosts a large number of Bitcoin mining operations, blockchain startups and fintech companies. By creating a Bitcoin reserve the state further signals its ambition to be a national leader in crypto infrastructure. The initiative may attract tech investment, talent, and ancillary services around digital finance.

Inflation Hedge and Portfolio Diversification

Proponents of the reserve point to Bitcoin’s fixed supply, decentralized nature and historical appreciation as a hedge against inflation and a weak dollar. For state financial planners the reserve offers a novel tool for diversification beyond traditional assets like bonds and gold.

Next Steps and Execution Considerations

This initiative is still in its early stages, and several critical steps will determine whether it succeeds:

-

Purchase execution: Texas must determine timing, custodial arrangements, and whether it will self-custody or partner with third-party custodians.

-

Scaling of reserve: While $10 million is modest relative to the state’s overall budget, the legislative structure allows for further allocations, donations, forks or airdrops to grow the reserve over time.

-

Risk management: The law includes bespoke guardrails, but volatility exposure, cybersecurity risk and abrupt regulatory shifts remain key concerns. Texas’s ability to manage these risks will be a test of the model.

-

Benchmarking and transparency: The requirement for public reporting every two years is meaningful, but stakeholders will watch how performance is measured, assets valued and governance instantiated.

The coming months will reveal whether Texas builds a model that is replicable by other states or whether this remains a symbolic gesture.

Implications for Broader Crypto Markets

Texas’s Bitcoin reserve could influence several broader market and regulatory dynamics:

-

Copy-cat moves: Other states may feel pressure to approve or establish their own crypto reserves, accelerating institutional adoption of digital assets.

-

Asset legitimation: Government investments in crypto can improve perception among institutional investors, potentially lowering hurdles for adoption.

-

Regulatory pathfinding: Texas’s approach may shape how regulators evaluate state-level crypto holdings, custody practices and public-sector asset management strategies.

-

Market demand: While $10 million is not large in market terms, the precedent may stimulate demand as other actors follow suit and cryptocurrency becomes increasingly embedded in traditional finance.

Final Thoughts

Texas’s decision to allocate public funds to Bitcoin for the first time marks a turning point in how government can engage with digital assets. The state has moved beyond regulatory gestures and built a legal, structural and asset-allocation framework around crypto reserves.

While the initiative is still early and carries significant risks the message is clear: Bitcoin is no longer purely a retail speculation or technology novelty. It is entering the domain of public finance and institutional asset strategy. If Texas’s model proves scalable and resilient many more jurisdictions may follow, and Bitcoin’s role in the broader financial system may grow substantially.

For now Texas is the only state placing actual funds behind crypto reserves. It is a bold experiment in public-sector innovation. The coming months and years will test whether it remains a trailblazer or becomes the first of many.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bitcoin for America Act Could Transform U.S. Tax Payments and Create Major Economic Impact

The Bitcoin for America Act: A Potential Game Changer for Crypto and the U.S. Economy

A new bill introduced in the U.S. House of Representatives known as the “Bitcoin for America Act” could usher in a historic shift in how Americans interact with cryptocurrency. Under the legislation, individuals and businesses would be allowed to pay federal taxes in Bitcoin, and the payments would be directed into a proposed U.S. Strategic Bitcoin Reserve. If enacted, the policy has the potential to create unprecedented demand for Bitcoin while bolstering America’s position in the digital asset economy.

What the Bill Proposes and Why It Matters

The bill, introduced by Congressman Warren Davidson of Ohio, sets out to allow taxpayers to settle their federal tax liabilities in Bitcoin (BTC) without triggering capital gains tax on the transaction. In practice this means that someone could pay their IRS tax bill using Bitcoin directly, rather than converting to fiat first and then paying the IRS. Importantly the proceeds from these payments would go toward building a U.S. government held stockpile of Bitcoin, dubbed the Strategic Bitcoin Reserve.

This approach marks a major policy shift for several reasons:

-

For the first time the government would accept crypto assets directly for tax payments.

-

The removal of capital gains liability would make such payments more appealing.

-

The creation of a national Bitcoin reserve elevates Bitcoin from an investment asset into a component of state financial policy.

-

The bill frames crypto adoption as not only financial innovation but also national economic strategy.

Supporters argue that the policy would reduce pressure on the dollar, expand alternative stores of value for U.S. capital, and accelerate the growth of digital infrastructure.

Economic Impact: Could This Really Be a $14-Trillion Boost?

One of the more ambitious claims of the legislation is that it could contribute up to a $14-trillion boost to the U.S. economy over time. The rationale behind this figure includes:

-

The compounding effect of a government-held Bitcoin reserve appreciating alongside institutional demand.

-

Lower costs of capital and inflation hedge benefits that arise from allocating national value into crypto assets.

-

Spillover investment into digital entitlements, blockchain infrastructure, decentralized finance and tokenized real-world assets.

-

A “flywheel effect” where acceptance of Bitcoin for taxes catalyzes corporate and institutional adoption, thereby increasing velocity, liquidity and real economic activity.

While such a number is speculative and depends on many variables, the underlying mechanism is clear: by institutionalizing Bitcoin and giving it official status in economic and fiscal policy, the effect could ripple across investment, technology, and global economic positioning.

Regulatory and Institutional Landscape

Crucially this bill is aligned with broader shifts in U.S. policy and regulatory thinking:

-

The IRS continues to treat digital assets as property and is doubling down on reporting requirements for crypto transactions. While paying taxes in Bitcoin would require major administrative changes, the notion of digital assets interacting with official tax systems is gaining traction.

-

Other legislation such as the BITCOIN Act and proposals to establish a national Bitcoin reserve signal rising bipartisan interest in crypto as a strategic asset rather than just a market speculation.

-

The fact that this tax payment in Bitcoin proposal is being advanced by a sitting Congressman signals that crypto adoption is no longer a fringe topic but is moving toward policy mainstream.

From an institutional standpoint the step from private market crypto investment to tax payments and national reserves is profound. It creates a pathway for cryptocurrencies to be embedded in sovereign financial strategy rather than simply private portfolios.

The Mechanics: How Would Tax Payments in Bitcoin Work?

While the bill’s overview is bold the implementation would require substantive changes:

-

Taxpayers would submit tax liabilities in Bitcoin rather than U.S. dollars.

-

The IRS or Treasury would need to accept BTC, probably by converting it to USD or holding it as an asset.

-

The bill proposes to treat the crypto payment without capital gains tax exposure for the taxpayer, which is a major incentive.

-

Collected Bitcoin would be placed into the Strategic Bitcoin Reserve, converting tax payments into a national digital asset stockpile.

-

Systems and regulatory frameworks would be needed to track and value received crypto, handle refunds, and integrate with existing tax infrastructure.

While the logistics are significant, proponents argue that digital asset infrastructure is already technologically capable of handling such a flow if policy and regulation align.

Risks and Considerations

There are meaningful hurdles and risks that must be considered:

-

Volatility risk: Bitcoin is a volatile asset. Accepting tax payments in BTC exposes the treasury or reserve to price swings.

-

Administrative complexity: Standardizing crypto tax payments across millions of filings requires new systems and raises questions about custody, valuation, tax basis and audit ability.

-

Regulatory clarity: While the bill is ambitious it must pass committee, survive amendments, and contend with the fact that many regulators still treat crypto as property and not currency.

-

Public perception and fairness: Some may question whether allowing Bitcoin payments favors crypto-savvy taxpayers or shifts risks to general taxpayers.

-

Economic numbers may be aspirational: While the $14-trillion potential is headline grabbing the actual outcome depends on broad adoption, global demand, and macroeconomic environment.

Why This Could Be a Turning Point for Crypto Adoption

If this bill passes it would shift several long-standing barriers:

-

Crypto becomes not only an investment asset but a valid means of tax payment, enhancing its legitimacy.

-

Governments participating in crypto expand the ecosystem beyond pockets of enthusiast use into full sovereign inclusion.

-

Institutional and corporate adoption could accelerate dramatically when foundational use cases like tax payments are enabled.

-

The narrative of crypto as volatile and speculative would be countered by its new function in everyday fiscal operations.

In short this is not just a policy tweak; it is a redefinition of how digital assets can interface with government, finance, and economies at large.

Final Thoughts

The Bitcoin for America Act is a bold proposal that could reshape how cryptocurrency interacts with tax systems, government reserves, and the global economy. If implemented it could be a defining moment for the sector.

For investors and observers this is a pivotal moment: the path from niche technology to sovereign asset becomes clearer. While the ambitions are large and the risks real the upside, both for Bitcoin and the broader digital asset industry, is massive.

This is a moment to watch closely. Public policy is aligning with crypto innovation and the tip of the spear could very well be tax payments in Bitcoin and a national digital reserve. If that happens the narrative around crypto will change forever.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

U.S. Senate and State AGs Unveil Landmark Crypto Market Structure Legislation

U.S. Senate and State AGs Unveil Landmark Crypto Market Structure Legislation

After months of build-up the U.S. Senate along with state attorneys general have released a landmark draft of crypto market-structure legislation intended to create a comprehensive regulatory framework for the digital asset industry. The bill seeks to establish clearer rules for exchanges, custodians, stablecoins, and token issuers, signalling a major step in integrating crypto markets into the broader financial-regulatory system.

Key provisions of the legislation

Exchange registration and custody oversight

One of the bill’s cornerstone features is the requirement that platforms offering token trading register as exchanges or alternative trading systems under federal law. Custodial service providers will face enhanced capital, segregation, and reporting standards similar to traditional securities and futures firms. This aims to reduce counterparty risk and improve investor protections.

Stablecoin regulation and redemption guarantees

Stablecoins are addressed explicitly in the legislation. Issuers must maintain redemption rights at par value, hold reserves in approved categories, and submit to regular audits. This creates a regulated pathway for stablecoins to operate under federal oversight rather than piecemeal state rules.

Token classification and issuance protocols

The bill also introduces a clearer set of rules distinguishing when a token is treated as a security versus when it remains a commodity or other asset. Token issuers will face registration or exemption requirements depending on utility, liquidity and decentralization factors. This aims to reduce legal ambiguity for projects and improve market integrity.

Inter-agency coordination and enforcement

The legislation mandates cooperation among the U.S. Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) and state regulators. A new federal-state crypto oversight council is proposed to harmonize enforcement, share data and coordinate cross-border investigations.

Investor protection and disclosures

Exchanges and token issuers will be required to disclose meaningful risk information, liquidity metrics and relationship with affiliated entities. Retail investors would gain clearer visibility into where their assets are held, how trades are processed and what rights they possess in the case of insolvency or cyber-attack.

Why this matters for crypto markets

Path to legitimacy

For years the crypto industry has operated across fragmented regulatory regimes with varying standards. This legislation offers the possibility of a unified federal framework that could increase trust, lower friction and bring institutional capital to the space.

Institutional onboarding

Clearer rules for custody, trading and stablecoin issuance reduce operational risk for large players. Institutional funds, fiduciaries and corporates may be more willing to enter crypto markets if they can rely on regulated entities rather than offshore or lightly supervised platforms.

Token projects and innovation

While increased regulation introduces burden the bill simultaneously provides clarity. Projects now have clearer paths to token issuance, less fear of regulatory surprise and improved access to U.S. markets. The transparency could foster broader crypto ecosystem growth, especially for high-quality protocols.

Risks and criticisms

-

Regulatory burden & cost Many smaller projects argue that compliance costs may favour large incumbents and stifle innovation in early-stage ecosystems.

-

Securities law crossover If tokens are treated as securities many projects may face retroactive registration or litigation risk. The timing and grandfathering provisions will matter.

-

Implementation complexity Coordinating federal and state regulators, aligning rules across 50 states and dealing with cross-border issues will be operationally intense.

-

Risk of over-regulation Some stakeholders worry the legislation may push innovation offshore or drive it underground if U.S. rules become too restrictive compared to global peers.

What to watch next

-

Senate floor votes and committee mark-ups The timeline for passing the legislation will influence market sentiment and business planning.

-

Rule-making phases Exchanges, custodians and token issuers will monitor how the SEC, CFTC and new oversight council implement the rules.

-

Stablecoin ecosystem response Will major stablecoin issuers adjust to the new reserve and audit standards and maintain parity?

-

Token classification outcomes How many tokens will be reclassified as securities and how quickly issuers will respond?

-

Global regulatory spill-over Other jurisdictions may adopt similar frameworks or respond to U.S. leadership in crypto regulation.

Final thoughts

The release of this crypto market-structure legislation marks a milestone in the maturation of the digital asset industry. By creating clearer rules for exchanges, custodians and issuers the U.S. is signalling that crypto is not outside the financial system—it is increasingly part of it.

For markets this means the potential for deeper liquidity, institutional participation and broader adoption—but also higher expectations around compliance, governance and transparency. The next phase of crypto may well depend less on token hype and more on regulated infrastructure, institutional trust and sustainable business models.

As this framework moves through Congress regulators and the industry alike will be watching closely. The outcome will shape not just the next bull market, but how crypto fits into global finance for years to come.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Romania Blacklists Polymarket for Unlicensed Crypto Betting

Romania Blacklists Polymarket in Crackdown on Unlicensed Crypto Betting

Romania’s National Office for Gambling (ONJN) has placed Polymarket, a popular blockchain-based prediction market, on its national blacklist for operating without a local gambling license. The move marks one of the first times a European regulator has explicitly targeted a decentralized crypto-betting platform.

What Happened

According to reports confirmed by Yahoo Finance and Gambling Insider, the ONJN issued an updated list of banned gambling and betting sites, adding Polymarket to the roster. The regulator said it would “not allow the transformation of blockchain into a screen for illegal betting.”

The blacklist directs internet service providers in Romania to block access to the listed sites. Operators without a license are considered unregulated gambling entities, regardless of whether they use crypto or fiat currencies.

Polymarket users in Romania have since reported difficulty accessing the platform, which runs on the Ethereum and Polygon networks and allows people to bet on outcomes of political events, sports, and social trends using stablecoins.

Why Polymarket Was Targeted

Under Romanian law, all gambling or betting platforms that serve local users must register with and obtain authorization from the ONJN. This includes online platforms that use cryptocurrencies.

Polymarket, which positions itself as a “decentralized prediction market,” does not hold a gambling license in Romania. The ONJN therefore treated it as an unlicensed operator, grouping it with dozens of other offshore betting sites that have been banned from local access in recent months.

Romania’s approach reflects a wider regulatory push across Europe to enforce licensing requirements even for decentralized or crypto-based services. Authorities argue that while blockchain can improve transparency, it cannot be used to bypass national gambling regulations.

A Growing Global Trend

Polymarket is no stranger to regulatory scrutiny. In 2022, the company paid a civil penalty to the U.S. Commodity Futures Trading Commission (CFTC) for operating unregistered event-based markets. Since then, it has implemented geo-blocking to limit access from certain jurisdictions.

Romania’s action follows similar moves by other countries tightening oversight of crypto-gambling platforms. Regulators in the United Kingdom, Italy, and the Netherlands have all increased enforcement against unlicensed or offshore betting operators, many of which use cryptocurrencies for wagers and payouts.

These measures form part of a global effort to bring crypto-related gambling into existing regulatory frameworks, focusing on consumer protection, anti-money-laundering compliance, and tax reporting.

What It Means for Users

For Romanian residents, access to Polymarket is now restricted. Users attempting to visit the site are redirected or blocked by local ISPs. Engaging with unlicensed gambling services can also expose users to penalties under national law.

Globally, the move underscores a clear message from regulators: using blockchain does not exempt a platform from traditional licensing requirements. While crypto-based betting platforms promote transparency and open participation, they remain subject to the same laws as conventional gambling operators.

Polymarket’s Position

Polymarket has not publicly commented on the Romanian blacklist, but the platform’s documentation already lists Romania among its “restricted jurisdictions.” The company has previously stated that it aims to operate responsibly within local regulations and continues to expand in markets where prediction markets are permitted.

Industry observers note that Polymarket’s technology itself is not illegal; the challenge lies in regulatory definitions. Many jurisdictions classify markets that allow users to profit from event outcomes as a form of gambling, regardless of how the bets are structured or settled on-chain.

A Broader Message

Romania’s decision is part of a larger balancing act between innovation and oversight. Regulators are increasingly recognizing the potential of blockchain technology, but they are also drawing firm lines around activities that resemble gambling or financial speculation.

For crypto-prediction markets, the key challenge ahead will be finding ways to remain open and decentralized while still complying with regional laws.

The ONJN’s statement summed up the sentiment clearly: blockchain cannot be used as a shield for unlicensed betting.

The Bottom Line

The blacklisting of Polymarket in Romania highlights a new phase in the global conversation about crypto regulation. As blockchain applications expand into areas like prediction markets and decentralized finance, governments are working to ensure these innovations operate under existing legal structures.

For Polymarket, the ban may limit its reach in one European market, but it also reinforces the growing need for dialogue between blockchain innovators and traditional regulators. Transparency and accountability, it seems, will remain central to the next chapter of crypto’s evolution.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Court Rules in Favor of Federal Reserve in Custodia Bank Case

Appeals Court Upholds Ruling Against Custodia Bank in Fed Master Account Case

A U.S. appeals court, the United States Court of Appeals for the Tenth Circuit, has affirmed that Custodia Bank is not automatically entitled to a Federal Reserve master account. The ruling supports an earlier decision from a Wyoming district court, which found that the Federal Reserve has discretion in granting or denying master account privileges.

The case centers on a special-purpose depository institution (SPDI) chartered in Wyoming that focuses on digital assets and crypto services. Custodia applied for a master account in October 2020 with the Federal Reserve Bank of Kansas City and later sued both the Federal Reserve and the Kansas City Fed for what it described as unfair delay and denial of access.

In its judgment, the appeals court agreed that the Fed acted within its legal authority, rejecting Custodia’s claim that it was unlawfully denied access under federal banking laws.

Why It Matters

Access to a master account matters because it allows direct participation in core central bank services such as Fedwire and the Automated Clearing House (ACH). Without it, a bank must rely on a partner institution that already holds an account.

For Custodia and other crypto-friendly institutions, this ruling is significant because it reaffirms that eligibility does not guarantee access. Even if an institution meets charter requirements, the Federal Reserve retains discretion to deny or delay master account access.

For the broader banking and crypto industries, this decision sends a clear message: non-traditional or digital asset banks cannot assume central bank access simply because they hold a state charter. The Federal Reserve’s oversight and standards remain firm.

What’s Behind the Legal Battle

-

Custodia argued that under the Monetary Control Act of 1980, Federal Reserve services are mandatory for eligible depository institutions. The bank claimed that the word “shall” in the law means entitlement to master account services.

-

Regulators and legal experts disagreed, stating that the Federal Reserve Act gives the Fed discretion to assess risks and decide whether to grant access.

-

The court found that Custodia failed to show a legally enforceable right to a master account. It also ruled that Custodia did not properly challenge a “final agency action” under the Administrative Procedure Act (APA).

-

The district court judge warned that removing the Fed’s discretion could lead to a “race to the bottom,” with states offering light regulations to attract new banks looking for automatic access to Federal Reserve services.

What’s Next for Custodia and the Industry

Custodia may still seek further review, but this ruling narrows the path forward. The company can request a rehearing or appeal to the Supreme Court, though both options face long odds.

For the crypto banking industry, the message is clear: meeting state charter requirements is necessary but not enough. Institutions must also demonstrate strong risk management, compliance, and operational standards that meet Federal Reserve expectations.

Regulators and the financial sector will likely use this case as a precedent to define clearer guidelines for digital asset banks. Risk management, anti-money-laundering measures, and transparent governance will remain top priorities before granting master account access.

This case also signals that the Federal Reserve is cautious about integrating crypto-related banks into traditional financial systems until their risk frameworks align with established banking norms.

Final Thoughts

While the ruling is a setback for Custodia, it reinforces an important principle: access to central bank systems comes with oversight and responsibility. The decision does not shut out crypto banks entirely, but it does raise the bar for entry.

For the broader digital asset sector, this moment highlights the ongoing challenge of bridging innovation with regulation. The focus for crypto banks will now shift from arguing for entitlement to demonstrating readiness — proving that they can meet the same safety, stability, and trust standards that define the U.S. banking system.

In the end, this case is less about denial and more about definition. It sets the boundaries for what a compliant, well-managed crypto bank must look like if it wants a seat at the table in traditional finance.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.