#Crypto

Tether Invests $100M in Anchorage Digital at $4.2B Valuation

Tether is writing another big check, and this one says a lot about where stablecoins are headed.

The company behind USDT has made a $100 million equity investment in Anchorage Digital, valuing the U.S. crypto bank at around $4.2 billion. It is not a flashy deal by crypto standards, but it is an important one, especially now that stablecoin regulation is no longer theoretical in the United States.

The investment deepens a relationship that has been building quietly for years. It also puts Tether right alongside one of the few crypto firms operating fully inside the U.S. banking system.

This Was Not a Sudden Move

Tether and Anchorage have been working together long before this deal.

Anchorage Digital runs one of the most unusual businesses in crypto. Through Anchorage Digital Bank N.A., it operates as a federally chartered crypto bank under U.S. regulators. That status lets it custody digital assets and support stablecoin activity within a traditional banking framework, something very few firms can offer.

For Tether, that matters more than it used to.

As regulators sharpen their focus on stablecoins, the days of issuing dollar tokens without close oversight are coming to an end, at least in the U.S. market. Anchorage gives Tether a partner that already lives in that regulatory world.

Regulation Has Changed the Math

The backdrop to this deal is the GENIUS Act, passed in 2024, which finally laid out clear rules for payment stablecoins in the U.S. The law introduced tighter requirements around reserves, disclosures, custody, and governance.

Soon after, Tether and Anchorage revealed plans to launch a U.S.-focused stablecoin, often referred to as USA₮. Unlike USDT, which operates globally, this token is designed specifically for the U.S. regulatory environment and would be issued through Anchorage’s federally regulated bank.

That announcement made it clear the two companies were getting closer. The $100 million investment makes that commitment financial as well as strategic.

Why Tether Is Investing Like This

Tether has been more active as an investor than many people realize.

Over the past couple of years, the company has put money into everything from infrastructure and mining to agriculture and commodities. The strategy seems straightforward: reduce reliance on stablecoin fees alone and build exposure to assets and systems that can last through market cycles.

Anchorage fits that strategy neatly.

This is not a bet on a new token or a speculative protocol. It is a bet on regulated plumbing, the kind institutions actually use. As more banks, funds, and corporates step into crypto, that plumbing becomes more valuable.

Tether’s leadership has consistently framed these investments as long-term positioning, not short-term trading. This deal feels very much in that category.

What Anchorage Gets Out of It

For Anchorage Digital, the money is helpful, but the signal may matter even more.

The firm has been expanding its stablecoin operations, adding staff focused on compliance, engineering, and product development. It has also been linked to plans for a major funding round and a potential IPO, possibly as early as 2026.

Having Tether as a strategic shareholder strengthens Anchorage’s credibility with both institutional clients and regulators. It also ties the company more closely to the largest stablecoin issuer in the world at a moment when stablecoins are becoming core financial infrastructure.

The Bottom Line

There is nothing flashy about this deal. No new token, no rebrand, no sudden pivot.

But it says a lot about where crypto is right now.

Stablecoins are drifting away from their roots as trading tools and toward something closer to regulated digital cash. That shift pulls crypto firms toward banks, charters, audits, and long-term capital, whether they like it or not.

Tether’s $100 million investment in Anchorage Digital is a clear sign it understands that reality. The future of stablecoins, at least in the U.S., is going to look a lot more institutional than the past.

Bitcoin on the Track at the 24 Hours of Daytona

Bitcoin was back on the biggest screens in global sports as the 24 Hours of Daytona marked the unofficial start of the year’s major sponsorship season. From that point forward, weekend after weekend, major sporting events once again became prime real estate for high profile brand exposure.

With the Super Bowl, Pro Bowl, Daytona 500, and the Formula 1 season opener approaching in the following weeks, Bitcoin, crypto, exchanges, and NFT companies were once again looking to maximize their advertising dollars by attaching their brands to the world’s most watched events.

This cycle had become familiar. It started years earlier with Matt Damon, Tom Brady, a crypto exchange, and a Super Bowl commercial. Since then, at least one crypto project had aimed to make a major splash during big game advertising season every year.

Crypto and Racing, A Proven Match

Racing and crypto sponsorships had proven to be a natural fit. It was fast, loud, bright, and made for the big screen, exactly where crypto wanted to be.

Three years earlier, PolkaDot took a shot at the IndyCar Championship with Conor Daly driving for Dreyer Rheinbold Racing. Kraken and Pudgy Penguins appeared on the wings of the Williams Formula 1 cars. Ed Carpenter Racing ran a Bitcoin-branded car in the Indy 500.

In Formula 1, Red Bull secured season-long sponsorships with SUI and Bybit. McLaren landed a season-long deal with OKX and later minted NFTs on Tezos. The overlap between motorsport audiences and crypto culture continued to deepen.

BitcoinMAX and Meyer Shank Racing at Daytona

That weekend, Meyer Shank Racing set out to potentially make history by bringing Bitcoin to victory lane at the birthplace of speed. The team ran the Bitcoin MAX sponsored Acura LMDh Prototype in one of the most demanding races in the world.

Bitcoin Max was a community-driven, decentralized digital currency project. The partnership centered on the global launch of OnlyBulls, a finance super app, and the establishment of BitcoinMAX, a Swiss-based Bitcoin trust launching in January 2026. BitcoinMAX was designed to democratize the digital economy and allow people to participate in the Bitcoin economy through a secure, regulated trust.

The task was never going to be easy. The Daytona 24 Hours was notoriously one of the toughest tests of man and machine. It was twice around the clock on one of the world’s fastest tracks, against the best drivers on the planet.

Long Odds and a Stacked Field

Bitcoin supporters entered the weekend as long odds contenders, despite Meyer Shank Racing having taken victory in the race in 2022 and 2023 with Acura. The team was also looking to rebound after finishing second the previous year behind Porsche.

Porsche, however, had pulled factory support from endurance racing that season, leaving Penske and JDC Miller Motorsports to compete as privateers using modified versions of the previous year’s car. Acura’s continued factory backing of Meyer Shank Racing offered a potential advantage, though not against a strong Cadillac effort that entered the season with momentum as they prepared to run a Formula 1 team.

The field was stacked. Cadillac arrived hungry to start fast. Aston Martin debuted the highly anticipated Valkyrie prototype. BMW remained a factory threat. Victory was never guaranteed.

An Elite Driver Lineup

Meyer Shank Racing assembled one of the strongest driver lineups in the field. Tom Blomqvist, a veteran endurance champion. Colin Braun, a young endurance ace who had consistently delivered results since arriving on the scene. Scott Dixon, a former IndyCar champion. A.J. Allmendinger, the “Dinger,” a road course specialist with major wins across NASCAR, IndyCar, and prototype racing.

If that group could cross the line first after 24 hours, they would become the first team to bring a Bitcoin-sponsored car to victory lane, a surprising milestone that had not happened since Bitcoin’s creation.

Chaos, Fog, and a Fight to the Finish

Qualifying went the way of Porsche and Cadillac, leaving the Bitcoin MAX Acura starting fifth for the 24-hour race.

Midway through the night, heavy fog rolled over Daytona, forcing a yellow flag period that lasted a record six and a half hours. When the sun rose and the fog finally lifted, the Bitcoin Acura was still firmly in contention for the overall win.

At the restart, the car ran fourth and even held the lead with more than three hours remaining. In the end, the pace of Felipe Nasr in the Penske Porsche proved just too strong. Meyer Shank Racing eventually slipped back to a sixth-place finish after pitting early in hopes that a late caution might shuffle the order. That caution never came.

Once again, a Bitcoin-sponsored car narrowly missed victory lane.

Beyond The Checkered Flag

The good news was that Bitcoin MAX secured a full-season sponsorship with Meyer Shank Racing. The goal remained clear, to finally bring Bitcoin to victory on the biggest stage in motorsports.

The opportunity would come again. And when it did, Bitcoin would once more be right where it wanted to be, fast, loud, and on the world’s biggest screens.

How Should Crypto Protocols Really Create Value for Token Holders?

Crypto has never been great at answering a simple question: what do token holders actually get?

For a long time, the answer was basically “number go up.” You bought a token because you believed the protocol would matter someday, and if that happened, the token would be worth more. Sometimes much more. And you could sell those tokens to someone else who believed that same as you, just a bit later in the timeline. That was enough in a market driven by growth, hype, and reflexivity.

But, now the industry is older, and presumably more mature. DeFi protocols generate real revenue. Some of them generate a lot of it. And once real money starts flowing through systems, people start asking uncomfortable but reasonable questions. Who benefits from this? Where does the value go? And why should I hold the token instead of just trading it to the next guy?

There are answers that show up again and again: burns, buybacks, and dividend-style payouts.

Each one says something different about how a protocol thinks about ownership.

The Good Old Token Burn: Familiar, Clean, and a Little Hollow

Burning tokens is crypto’s comfort food. It is simple, emotionally satisfying, and easy to explain on social media. Fewer tokens, more scarcity, higher price. Well, in theory.

And to be fair, burns can work, especially in strong markets. They create a sense of discipline. They tell holders that supply is being managed, that inflation is not running wild.

But burns do not actually give anyone anything. No cash, no yield, no participation in revenue. You are still relying on the market to do the rest of the work.

That can be fine if demand is strong. It is much less convincing when demand is uncertain. Scarcity alone does not create value, it only amplifies it if something else is already there.

Burns feel like an answer from an earlier era of crypto, when optics mattered more than fundamentals.

Token Buybacks: More Serious, Still Indirect

Buybacks feel like crypto growing up and borrowing language from public markets.

Instead of destroying tokens automatically, protocols use revenue or treasury funds to buy their own tokens on the open market. The signal is clear: the protocol believes the token is undervalued and is willing to spend real money to prove it.

That matters. Buybacks introduce actual demand. They are less abstract than burns. They also force protocols to think more carefully about treasury management and sustainability.

But at the end of the day, buybacks still work through price. If the market reacts, holders benefit. If it does not, they do not. There is no guarantee, no direct transfer of value, no moment where a holder can say, “I received this because the protocol performed well.”

In traditional finance, buybacks are often paired with dividends. In crypto, they are usually positioned as the whole story. That gap is something worth paying attention to.

Dividends and Revenue Sharing: The Awkward but Honest Option

Dividend-style payouts in crypto tend to make people uncomfortable. They feel a bit too close to traditional finance. And the instinctive reaction is usually something like, aren’t we supposed to be reinventing all of this?

In some ways, yes. There are definitely parts of the financial system that deserve to be challenged or rebuilt entirely. But that does not automatically mean everything old is useless. Some mechanisms stuck around because they solved real problems. Dividends are one of those.

At its core, the idea is pretty simple. If a protocol makes money, some of that money goes back to the people holding the token. Maybe you have to stake. Maybe you have to lock tokens for a while. Maybe the payout changes over time. The specifics can vary, but the relationship is clear enough. When the protocol does well, holders benefit.

That alone changes the dynamic. You are no longer just holding a token and hoping it becomes more desirable later. You are actually participating in the economics of the thing you own.

It also forces a kind of honesty. If revenue drops, payouts drop. If the protocol grows, holders feel it directly. There is not much room to hide behind supply tweaks or clever treasury narratives.

The objections are predictable. Regulation. Complexity. Governance risk. And to be fair, those are not imaginary concerns. Once you start sharing revenue, it starts to look a lot like ownership, and ownership comes with responsibilities that crypto has historically tried to sidestep.

But pretending that reality does not exist does not really help. And once protocols manage capital and distribute value, they are already doing financial work, whether they want to admit it or not.

Dividends do not invent that reality. They just stop dancing around it.

This Is Really About Maturity

Burns, buybacks, and dividends are not just technical choices. They are statements about what a protocol wants to be.

Burns prioritize simplicity and narrative. Buybacks prioritize signaling and market mechanics. Dividends prioritize alignment and accountability.

None of them are universally right or wrong. Early-stage protocols probably should not be paying out revenue. Infrastructure layers may prefer reinvestment. Some tokens are governance tools first and economic assets second.

But as DeFi matures, it is becoming harder to justify tokens that never touch the value they help create.

At some point, holders stop asking how clever the tokenomics are and start asking a simpler question: what do I get if this works?

Crypto does not need to become traditional finance. But it probably does need to answer that question more directly. Whether that leads to dividends, something like them, or an entirely new model is still open.

But what is beginning to feel increasingly outdated is pretending that question does not matter.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Crypto in 2026: Less Hype, More Infrastructure, and a Market Growing Up

Crypto enters 2026 without the drama that once defined the start of a new year. Prices are steady but not euphoric. The timelines are calmer. The noise has faded. And yet, beneath that surface calm, the industry feels more focused and more self-assured than it has in a long time.

This does not feel like a market losing relevance. It feels like one that has stopped trying to prove itself every day.

After a tough reset in 2025, crypto is no longer driven by momentum alone. It is being shaped by infrastructure, regulation, and a growing sense that digital assets are slowly becoming part of the financial background rather than a constant headline.

The Reset Did What Cycles Are Supposed to Do

The pullback that closed out 2025 forced a hard reset across the industry. Excess leverage was flushed out. Projects built purely on narrative struggled to survive. Capital became more cautious, and in many cases, more serious.

Entering 2026, the market feels leaner and more selective. Bitcoin and Ethereum remain central, not because they promise overnight gains, but because they sit at the core of a system that is gradually being integrated into global finance.

Volatility has not disappeared, but it feels more tied to real catalysts. Flows, macro conditions, regulatory developments. This is no longer a market reacting to every rumor or viral post.

For investors who think in cycles rather than weeks, this is often the phase where foundations quietly form.

Institutions Are Acting Like They Are Here to Stay

Institutional involvement is no longer a future narrative. It is an active force shaping how crypto evolves.

ETFs, custody platforms, tokenized funds, and on chain settlement tools are becoming familiar concepts inside traditional finance. What stands out is how little of this activity is happening in public. Much of it is operational, slow, and deliberate.

That shift is noticeable at industry conferences and in private meetings. The energy is different. Fewer grand predictions. More conversations about compliance, liquidity, risk frameworks, and long term deployment. More handshakes, fewer hype decks.

Institutions do not move quickly, but when they start building infrastructure, they tend to stay.

Regulation Brings Structure, Not an End

Regulation is still controversial, but the tone has softened. Clearer rules are beginning to replace uncertainty, especially around stablecoins, custody, and reporting.

For many market participants, this clarity is not restrictive. It is enabling. It allows companies to plan, investors to allocate, and builders to focus on execution instead of interpretation.

Crypto does not need to be unregulated to grow. It needs to be understood. 2026 feels like a step in that direction.

Stablecoins and Tokenization Quietly Gain Momentum

One of the strongest signals for crypto’s future is how little attention some of its most important developments receive.

Stablecoins are increasingly used for payments and settlement, especially in cross border contexts where traditional systems are slow and expensive. This is not a speculative use case. It is a practical one.

Tokenization is following a similar path. Real world assets like funds, bonds, and private credit are being tested on chain. The goal is efficiency, transparency, and liquidity, not buzz.

These are the kinds of changes that rarely reverse once they gain traction.

DeFi and AI Settle Into Useful Roles

DeFi is no longer trying to reinvent finance overnight. It is focusing on doing specific things better. Automation, interoperability, and capital efficiency are the priorities now.

AI, meanwhile, is becoming part of the background. It shows up in analytics, trading strategies, monitoring tools, and security systems. Less hype, more utility.

This maturation may feel less exciting, but it is exactly what long term systems tend to look like before they scale.

A Market That Feels Like It Is Setting Up

Crypto in 2026 does not feel like a peak. It feels like a setup.

Builders are still building, even without constant attention. Institutions are committing resources, not just headlines. Regulators are engaging instead of reacting. Investors are meeting in person again, comparing notes, and thinking beyond the next quarter.

The industry feels more grounded, but also more aligned.

A Sharper Outlook Beyond 2026

What makes 2026 particularly interesting is not what happens this year, but what it enables next.

If infrastructure continues to solidify, regulation continues to clarify, and real usage keeps expanding, crypto may enter its next growth phase from a position of strength rather than speculation. The next cycle, whenever it arrives, is likely to be driven less by hype and more by inevitability.

Markets tend to move fastest when most people are no longer watching closely. Crypto may be entering that phase now.

It does not need to shout. It just needs to keep working.

And if it does, the years beyond 2026 may end up being the ones that finally justify everything that came before.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Crypto Surges Ahead of FOMC Decision as Traders Position for Policy Shift

Crypto Market Surges Ahead of the FOMC Decision and What It Means for the Market

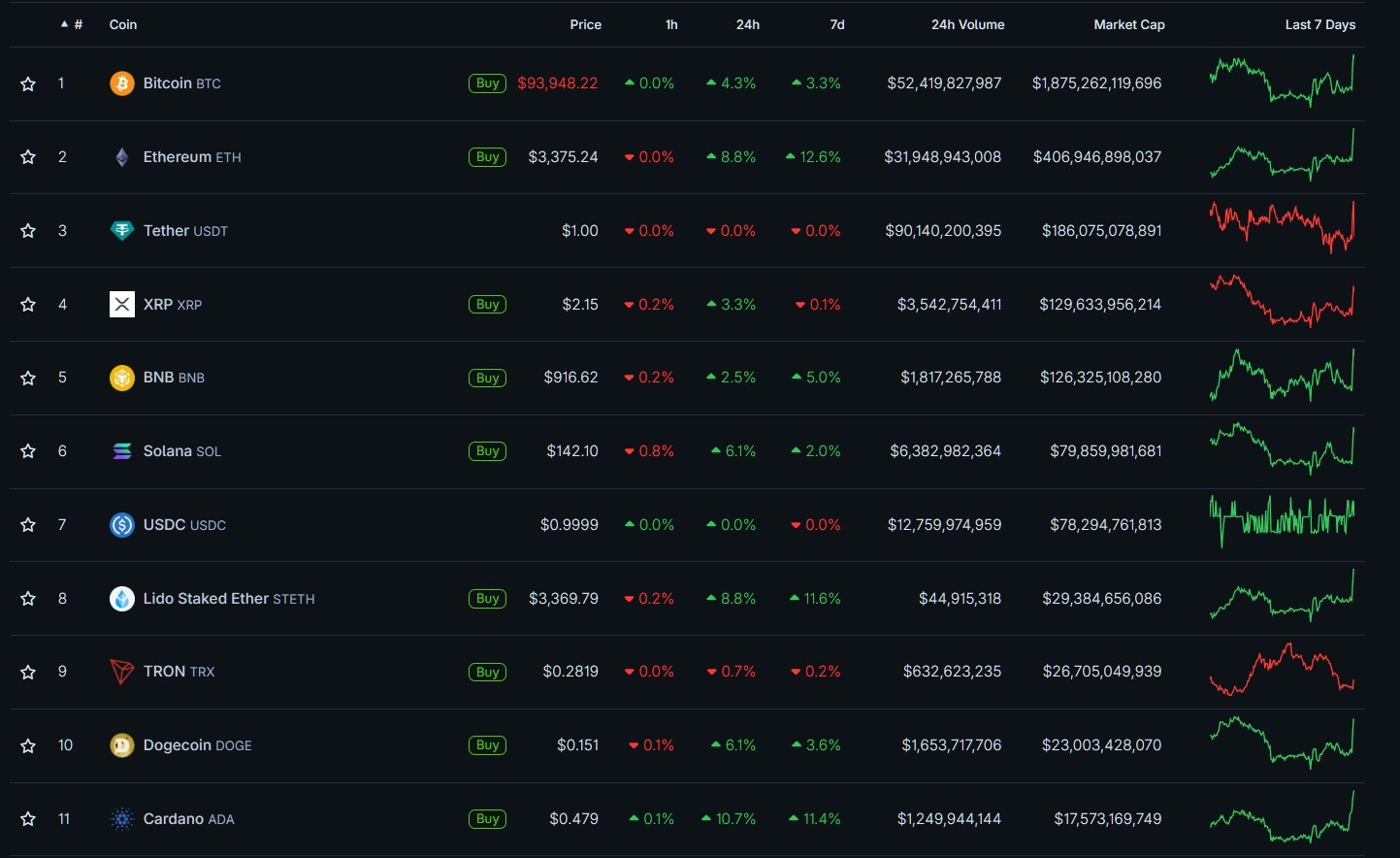

The crypto market has seen a sharp rise in volatility and price movement, with Bitcoin and Ethereum leading the rally. This surge has not come out of nowhere. It is tied closely to speculation surrounding the latest Federal Open Market Committee decision. As traders positioned themselves for potential changes in U.S. monetary policy, the crypto market responded with a wave of buying, short liquidations, and renewed bullish sentiment.

The move is another clear example of how deeply connected crypto has become to broader macroeconomic conditions.

How FOMC Speculation Became the Spark for the Latest Crypto Rally

In the days leading up to the meeting, expectations grew that the Federal Reserve might soften its stance on interest rates. Even the possibility of a rate cut or a more dovish tone tends to shift investors toward higher risk assets. Crypto is usually among the first to react.

Lower interest rates reduce the appeal of cash and bonds, while making speculative and growth oriented assets more attractive. That dynamic has long played out in equities. Now it is becoming increasingly visible in crypto as well.

Bitcoin and Ethereum both climbed into short term highs before the decision. As prices moved up, heavily leveraged short positions began to unwind. This added fuel to the rally as forced liquidations pushed prices even higher. It was a feedback loop that often appears during major macro events and is especially common in the crypto market due to its high leverage environment.

Market Behavior Shows the Fed Still Drives Risk Appetite

Even though crypto operates independently of government control, the industry still reacts strongly to the tone and trajectory of central bank policy.

A few things are becoming clear:

-

Traders treat FOMC guidance as a direct indicator of risk sentiment.

-

Expectations alone can drive price action before the decision is released.

-

Liquidity conditions continue to shape the strength of crypto market rebounds.

-

Bitcoin and Ethereum are increasingly acting like macro assets rather than purely speculative ones.

As the market leaned toward a more accommodative outlook, traders began rotating capital back into large cap cryptocurrencies. Bitcoin and Ethereum benefited the most, but the effect spilled into altcoins as well.

Short term, this created a volatile environment. Longer term, it signals a deeper connection between crypto and global financial cycles.

Why Some Analysts See This as More Than a Temporary Move

While investors always react to big economic events, this moment feels different. The alignment of easing inflation, slower economic pressure, and the possibility of rate cuts creates a setup where risk assets could see more sustained inflows.

Crypto is no longer operating separately from traditional finance. If liquidity improves across the economy, that liquidity tends to find its way into high growth and high volatility markets. Bitcoin and Ethereum fit that profile perfectly.

This raises a question that many in the industry are now considering. Is this the beginning of a broader shift where crypto consistently responds to macro cycles the same way equities and bonds do?

If so, price behavior may become more predictable around central bank events than it was in the early years of the industry.

What Could Go Right and What Could Still Disrupt the Momentum

What Could Go Right

-

If the Fed follows a path of easing or signals greater flexibility, crypto markets could experience a sustained wave of inflows.

-

Investors may shift back toward risk, viewing Bitcoin and Ethereum as core components of a diversified macro portfolio.

-

Lower interest rates increase liquidity across financial markets, which historically supports larger moves in non traditional assets.

-

A clearer link between crypto and macro conditions could attract more institutional traders who specialize in macro driven strategies.

What Could Go Wrong

-

If the Fed holds rates higher for longer or delivers a hawkish message, the market could see an immediate reversal.

-

Liquidations can cut both ways. The same leverage that amplifies rallies can intensify declines.

-

Uncertainty in global markets, geopolitical pressure, or a sudden risk off event could stall any recovery.

-

Crypto may remain highly sensitive to macro shifts, reducing the independence that once drove speculative surges.

What This Phase Means for Investors and the Broader Market

This moment serves as a reminder that crypto does not move in isolation. Bitcoin and Ethereum now sit within the larger financial ecosystem. When central bank policy shifts, these assets feel the impact quickly. That connection is growing stronger, not weaker.

For traders, FOMC weeks will continue to be periods of heightened volatility. Positioning before and after the decision may offer opportunities, but it also increases risk.

For long term investors, understanding macro cycles is becoming just as important as understanding blockchain fundamentals.

For the market as a whole, this could signal a shift toward a more mature ecosystem. If crypto continues to move with global financial cycles, it may attract more institutional interest, more capital, and more stability over time.

The surge before the FOMC decision is not just another short term rally. It is a signal of where the market is heading and how interconnected crypto has become with traditional finance.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bitwise CIO Predicts 10x to 20x Crypto Growth as Regulation Shifts

Why Bitwise Is Thinking Bigger About Crypto, and Why the Timing Matters

The crypto industry is moving into a new phase, and Bitwise Chief Investment Officer Matt Hougan believes the shift is much larger than the market realizes. His view is that the combination of regulatory changes, institutional interest, and the rise of on chain financial infrastructure is creating an environment that could redefine how global markets function.

What is striking is not just his optimism, but the level of detail behind it. Hougan is not talking about the next bull run or a temporary upswing. He is talking about a structural change that could reshape how assets move and how financial services are delivered.

A Regulatory Turn That Few Saw Coming

For years, regulation has been the main obstacle standing between crypto and traditional finance. That has started to change in a very real way. In a recent address, Securities and Exchange Commission Chair Paul Atkins presented a plan known informally as Project Crypto. Instead of focusing primarily on enforcement, the initiative outlines a path for integrating traditional markets with public blockchains.

Hougan called this the most optimistic regulatory stance he has ever seen and said it forced him to revise not just the scale of crypto’s potential, but the timeline as well. His point is straightforward. The market has not fully absorbed what a cooperative regulatory regime could unlock. Investors have priced in caution for so long that they have not adjusted to the possibility of acceleration.

Three Areas Where the Biggest Winners May Emerge

Hougan identifies three categories where he sees the strongest potential.

1. Layer 1 blockchains and core crypto networks.

If financial activity continues to move on chain, the blockchains that support settlement, tokenization, stablecoins, and decentralized financial rails could see massive growth. Hougan mentions networks like Ethereum, Solana, Cardano, Avalanche, Aptos, Sui, NEAR and others. His view is that the right approach is not to pick a single winner, but to build a diversified basket of networks that are gaining real world usage.

2. Decentralized finance protocols.

With clearer regulatory treatment, DeFi could move from a niche set of applications to the backbone of a new financial system. Protocols that automate trading, lending, borrowing, derivatives, and stablecoin issuance could scale far beyond their current user base. Hougan believes that once regulatory friction drops, institutional participation could flow in rapidly.

3. Financial super apps.

This is one of the most ambitious parts of the projection. Hougan believes new platforms will combine traditional finance and crypto into a single interface. Instead of having brokerage accounts in one place, bank accounts in another, and crypto apps somewhere else, users could interact with all financial assets through one unified system. He thinks a company in this category could become the largest financial services firm in the world, potentially passing a one trillion dollar valuation.

Why a Ten to Twenty Times Expansion Does Not Sound Unrealistic

Hougan has consistently argued that crypto could deliver ten to twenty times growth over the next decade. His reasoning is not based on hype. It is based on the idea that crypto is entering a period where cycles driven by halving events or speculative trading matter less than structural factors. He believes the “four year cycle” narrative has lost relevance. What now matters is the maturation of the asset class and the integration of crypto with global finance.

In his view, the size of the market today reflects years of hesitation driven by legal uncertainty. Once that uncertainty lifts, capital could move faster than analysts expect. Institutions that have been watching from the sidelines may feel more comfortable allocating real budget to crypto infrastructure, tokens, or tokenized assets.

What Could Go Right, and What Could Still Undermine This Vision

There is no guarantee that the optimistic scenario plays out. Hougan acknowledges both sides.

What could go right:

-

Regulatory clarity could remove the largest barrier to institutional adoption.

-

Layer 1 networks with real usage could become the settlement layers of a digital financial system.

-

Super apps could reduce friction for everyday users, pulling millions more into on chain ecosystems.

-

The industry could attract capital at a scale closer to major traditional asset classes.

What could go wrong:

-

Regulatory implementation may move slower than expected, or shift again under new political leadership.

-

Some networks or protocols may fail to scale, or may lose out to competitors.

-

Macroeconomic conditions could suppress risk assets even if fundamentals improve.

-

Volatility could remain a psychological barrier for mainstream investors.

What This Means for Investors, Builders, and Policymakers

If Hougan is right, the industry is not just entering a new market cycle. It is entering the early stages of a long transformation in how financial markets operate. Investors who once tried to time cycles may need to rethink their approach and focus more on diversified exposure to infrastructure. Builders may find themselves working in an environment that is more supportive than anything they have experienced so far. Policymakers may influence the shape of global finance for decades based on decisions they make in the next few years.

It is possible that crypto still has years of volatility ahead. It is also possible that the industry is standing on the edge of the most meaningful phase of its development. Hougan’s message is that the market may be thinking too small. He believes the shift underway is not incremental. It is transformative.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Indiana Crypto Pension Bill Could Transform Retirement Investing

Indiana’s Bold Move: Crypto in Public Pensions

In early December 2025, Indiana surprised a lot of people by stepping directly into the world of digital assets. A new proposal, House Bill 1042, was introduced by state representative Kyle Pierce, and it does something pretty groundbreaking. It requires public retirement programs to offer crypto linked exchange traded funds, or ETFs, as part of their standard investment lineup.

This means that many public employees, including teachers, government workers, and possibly police and firefighters, would now see crypto related funds sitting right next to traditional retirement options. Instead of crypto being something you explore on your own, Indiana wants it to be a normal part of the overall retirement system.

The bill also outlines a set of protections for everyday crypto users. It limits how much local governments can restrict or interfere with digital asset activity. That includes mining, payments, self custody, and private wallet use. Unless restrictions also apply to traditional financial assets, cities and counties would not be allowed to single out crypto for special limitations.

If this becomes law, Indiana would be the first state in the country to require Bitcoin linked ETFs in public pension systems. That alone sets a bold precedent for how states might approach retirement investing in the future.

A Broader Trend: States Are Warming Up To Crypto

Indiana might feel like it is out ahead, but the move fits into a larger trend. Several other states have already been exploring crypto exposure in different ways.

For example, some states have passed laws allowing retirement systems to purchase Bitcoin ETFs. Others have focused more on legal protections, such as protecting self custody, clarifying how digital assets are classified, or encouraging blockchain adoption within government departments.

What makes Indiana stand out is not the idea of crypto exposure itself, but the fact that the bill attempts to make it a standard part of public retirement offerings. This goes beyond optional access and moves toward normalizing crypto as a core part of long term, institutional investing.

What Supporters Are Saying

Backers of House Bill 1042 believe this is simply a reflection of financial reality. Crypto is becoming a bigger part of the global economy, and Indiana residents should have access to it in the same way they do to other investments.

Supporters argue that this gives people more financial flexibility, especially younger workers who want exposure to assets they believe will appreciate over the next several decades. They also point out that Bitcoin ETFs remove much of the risk and complexity of direct crypto ownership, since they function inside the regulated ETF structure.

The bill also proposes pilot programs to test blockchain technology within state agencies. That includes using distributed ledgers for record keeping, identity management, and improving government transparency and efficiency. Supporters say this could modernize the way public systems operate.

What Critics Are Concerned About

Not everyone is excited about crypto appearing in pension plans. Critics bring up several concerns.

One of the biggest issues is volatility. Cryptocurrencies can swing up or down rapidly, and pension systems are normally built around stability and long term reliability. Some people worry that exposing retirement funds to such unpredictable markets may not serve the best interests of retirees.

There are also questions about long term regulation. National rules around crypto continue to shift, and that uncertainty could create complications for publicly managed funds. Critics say lawmakers should move slowly and avoid building pension plans around assets that still feel risky to many households.

Another concern is whether the state should be responsible for promoting exposure to crypto at all. Some people feel that these decisions should be optional and entirely individual, rather than part of a default menu in a public benefits system.

Why Indiana’s Bill Could Be A Turning Point

If Indiana does pass House Bill 1042, the impact could go far beyond state borders.

It would accelerate the mainstream acceptance of crypto within public institutions. At the same time, it would create a legal framework that protects wallet access, mining, payments, and self custody rights. That combination of investment access and personal rights could easily serve as a template for other states.

It also encourages conversation about what public retirement investing should look like in the future. Some believe this is an opportunity for long term growth. Others feel the risks are too high. Either way, the bill forces the debate into the spotlight.

What To Watch Next

There are several things worth paying attention to in the months ahead.

First, lawmakers may modify the bill. They could adjust the requirement to offer crypto ETFs or turn it into an optional feature instead. They might also place limits on how much of a pension portfolio can be allocated to digital asset funds.

Second, pay attention to how pension administrators respond. Even if the bill passes, the practical process of integrating crypto ETFs will require careful planning.

Third, other states may begin crafting similar laws. Indiana’s move could spark a wave of legislative activity across the country as states look at whether they want to follow the same path.

Finally, federal regulatory changes will play a major role. As national crypto rules evolve, they could strengthen or weaken the long term viability of crypto pension investments.

Indiana’s proposal captures a pivotal moment in the evolution of digital assets. Crypto is no longer viewed as a fringe experiment. It is now part of serious, institutional conversation. Whether this turns out to be a smart long term shift or an overly ambitious leap is something only time will reveal, but it is clear that the landscape of public finance is changing quickly.

Is the End of Quantitative Tightening Setting Up Crypto’s Next Big Rebound?

The End of Quantitative Tightening Might Be Exactly What Crypto Needed

If you’ve been watching the crypto market lately, it has not felt great. Bitcoin dipping into the low 90s usually sparks panic, threads full of doom and plenty of “it’s over” takes. But this time, the headlines do not tell the full story. Something different is happening underneath the surface. Something that actually looks pretty promising.

A few major shifts are lining up at once, and together they point in one direction.

We might be closing out the long, grinding downtrend that has weighed on crypto for nearly two years.

The Federal Reserve formally ended quantitative tightening on Dec. 1, coinciding with the New York Fed conducting approximately $25 billion in morning repo operations and another $13.5 billion overnight, the largest injections that we've seen since 2020.

A Quiet Turning Point: Institutions Are Opening the Doors

For years, crypto’s biggest obstacle has not been technology or innovation. It has been access. Most big financial institutions treated crypto like a guest they did not want at the party.

That wall is finally cracking.

The clearest sign is Vanguard, managing roughly $9 trillion to $10 trillion in assets, opened its brokerage platform to third-party crypto ETFs and mutual funds tied to BTC, ETH, XRP, and SOL for the first time, creating immediate demand pressure.

This is a firm that has historically avoided anything remotely risky. They did not just ignore crypto; they actively rejected it. And now they are letting clients buy regulated crypto ETFs through the same accounts they use for retirement and index funds.

That is not a small change. When a company managing trillions finally decides that crypto belongs on the menu, it means something fundamental has shifted.

Even if only a small percentage of Vanguard’s clients add exposure, it creates a slow, steady flow of long term capital. That type of investor does not FOMO in or panic out. They allocate, rebalance and hold. That is the kind of capital that helps stabilize a market.

Crypto Moves on Liquidity, Not Hype

You can talk narratives all day, and crypto certainly loves its narratives. But the thing that consistently moves this market more than anything else is global liquidity.

And for the first time in a long while, liquidity is starting to return. The era of aggressive tightening looks like it is ending. If central banks start easing, capital gets cheaper, markets loosen up and investors take on more risk. Crypto usually reacts quickly.

The money supply had been shrinking for months. Now those indicators are stabilizing and, in some cases, ticking upward.

Look back at previous bull runs. They did not start because of tweets or new coins. They all aligned with periods of easier monetary policy.

We are entering one of those periods again.

ETFs Are Changing How Money Enters the Market

One of the underrated shifts happening right now is how investors access crypto.

Before ETFs, getting into Bitcoin or Ethereum meant dealing with exchanges, wallets, seed phrases and a bunch of complexity that ordinary investors simply did not want.

Now it is as simple as buying an index fund. ETFs are often part of automated portfolios. When crypto drops, the system buys more to rebalance. When it rises too fast, it trims. That smooths out volatility.

Investors trust the platforms they already use. If crypto is right there next to S&P 500 funds, the hesitation disappears. Those regulated products bring in the kind of capital that sticks around. Not tourists. Not gamblers. Long term investors.

This shift alone could reshape how crypto behaves during both rallies and corrections.

Why the End of Quantitative Tightening Is the Real Catalyst

The last couple of years have been rough for risk assets across the board. Higher rates, reduced liquidity and tighter financial conditions made it hard for anything speculative to breathe. Crypto got hit hardest.

Now that cycle is ending.

When quantitative tightening slows, liquidity flows back into the system. Banks lend more. Investors take more risk. Capital moves faster. Crypto is one of the first beneficiaries because it lives so far out on the risk curve.

Put simply, crypto does not need a hype cycle to turn around. It needs liquidity.

And liquidity is finally returning.

This Market Might Be Underestimating What Comes Next

People are tired. They are skeptical. And that is usually when markets quietly shift direction.

Think about the setup right now:

-

Institutions are entering.

-

ETFs are creating new pipelines.

-

Liquidity is stabilizing.

-

Rate cuts look increasingly likely.

-

Crypto is oversold and structurally stronger than it was in past cycles.

This is the kind of macro environment where bottoms form, often long before sentiment catches up.

The Foundation for the Next Run Is Taking Shape

Downtrends do not end on good news. They end when conditions change behind the scenes while everyone is too focused on the price chart.

That is what seems to be happening now.

The end of quantitative tightening is not just another headline. It is the kind of shift that has historically marked the beginning of major reversals in risk assets. And with crypto gaining easier access, stronger infrastructure and broader institutional acceptance, this could be the setup for something bigger than most people expect.

Crypto might not just recover.

It may be preparing for a stronger, more mature cycle than anything we have seen before.

Kalshi and Polymarket Hit Record 10 Billion Dollar Volume

Kalshi and Polymarket Post Record Volume as Prediction Markets Hit Nearly $10 Billion in November

Prediction markets are entering their strongest era to date. In November 2025, Kalshi and Polymarket collectively recorded nearly 10 billion dollars in trading volume, marking the most active month in the history of the sector. This surge shows that prediction markets are no longer niche experiments. They are becoming influential financial instruments used by millions of traders, analysts and institutions.

The industry’s rapid expansion reflects growing interest in real world event trading, increased liquidity and a shift in how investors view information markets.

How Kalshi and Polymarket Reached New Heights

Institutional Investment and Regulatory Clarity

Kalshi has positioned itself as the regulated prediction exchange in the United States. With a green light from federal derivatives regulators, the platform attracted significant institutional investment. Its most recent funding round valued the company at approximately 11 billion dollars.

Polymarket, on the other hand, grew from the crypto native community. Its decentralized architecture and global accessibility attracted users drawn to event based markets that operate without borders. As Polymarket expanded, its volume accelerated sharply, particularly in 2024 and 2025.

Together, the two platforms now represent the core of the prediction market ecosystem. One operates with traditional oversight, and the other leverages blockchain transparency. Both models have succeeded by meeting rising demand for trading around news, sports, politics and global uncertainty.

Surge in Demand From Sports, Politics and Macroeconomics

The November boom appears to have been driven by significant events across sports and entertainment, along with heightened activity in political and macroeconomic markets. Major sporting events, international political developments and volatility in global markets created a perfect environment for event driven speculation.

Polymarket in particular saw sharp month over month growth, with more than 3 billion dollars traded in October followed by an even stronger November contribution. Kalshi also reported record numbers across political, sports and economic categories.

What This Means for the Future of Prediction Markets

Prediction Markets Are Becoming a Serious Asset Class

A combined 10 billion dollars in monthly trading volume places prediction markets in the realm of legitimate financial instruments. This surge demonstrates that traders are increasingly comfortable speculating on real world outcomes using structured markets rather than informal sentiment or traditional betting platforms.

Liquidity and Market Depth Are Strengthening

As more capital enters the ecosystem, liquidity improves and spreads tighten. Higher liquidity reduces volatility and improves price accuracy, allowing events to reflect true market expectations. This makes prediction markets more reliable indicators of sentiment around elections, economic reports, policy shifts and high profile entertainment events.

Traditional Finance Meets Crypto Native Innovation

Kalshi and Polymarket represent two very different models. Kalshi is regulated, compliant and geared toward traditional market participants. Polymarket is decentralized, global and capable of listing a wide variety of markets. The success of both platforms shows that prediction markets can appeal to different audiences and regulatory frameworks while still growing in parallel.

New Hedging and Speculation Tools

Prediction markets enable traders to hedge against real world uncertainty. Instead of relying solely on equities, commodities or forex markets, users can now hedge or speculate directly on election outcomes, interest rate decisions, policy changes or cultural events. This is a fundamental expansion of what financial markets can price.

Challenges That Still Remain

Prediction markets face headwinds even as they achieve record volume.

-

Regulatory uncertainty. Some jurisdictions classify certain event markets as gambling, while others treat them as derivatives.

-

Concentration of liquidity. Large events dominate attention, leaving smaller markets with limited participation.

-

Volatility around major events. Binary markets can swing sharply as news breaks, creating risk for traders and market makers.

-

Infrastructure demands. Platforms must scale securely to handle institutional interest and larger volumes.

How Kalshi, Polymarket and future competitors handle these challenges will help determine whether prediction markets can sustain long term growth.

Final Thoughts

The combined 10 billion dollar surge in November volume from Kalshi and Polymarket signals a major shift in the financial landscape. Prediction markets are becoming mainstream. They are attracting serious capital, gaining institutional legitimacy and proving that people want tools that let them trade on real world information.

Whether it is politics, macroeconomics, sports or cultural events, prediction markets offer a new expression of financial participation. If growth continues, they may soon become a standard part of global finance, sitting alongside equities, futures, options and digital assets.

This moment marks the transition from niche concept to powerful market infrastructure. The prediction market revolution is now fully underway.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Tom Lee Makes Major Ethereum Bet as BitMine Buys 97,000 ETH

Why Tom Lee Is Betting Big on Ethereum, and Why He Thinks the Best Is Still Ahead

When Tom Lee makes a bold call, people pay attention. He has built a reputation for spotting major market trends early, and now he is putting that conviction behind Ethereum in a very real way. His firm, BitMine Immersion Technologies, just picked up another 97,000 ETH, increasing its total holdings to 3.73 million tokens, worth about $10.5 Billion at latest prices. That is not a casual trade. It is a signal that Lee believes Ethereum is on the edge of something much bigger.

Instead of waiting for a hype cycle or chasing a rally, Lee is buying during a quieter period in the market. And based on his recent comments, there is a clear reason why. He sees a combination of catalysts lined up at the same time, and he believes they give Ethereum one of the strongest setups of any major asset heading into 2026.

BitMine’s ETH Strategy Is Not a Short Term Play

Lee has been gradually stacking ETH throughout the year, and the latest acquisition is simply the biggest chapter in that story. Multiple large purchases over several months paint a clear picture. This is not a speculative gamble or a quick swing trade. BitMine is positioning Ethereum as a long term strategic asset on its balance sheet.

It is the kind of move you normally see from companies preparing for a shift in market conditions, or from firms that believe a key technology is about to break out. In this case, Lee seems to believe both are true.

What Is Driving Tom Lee’s Confidence

Ethereum Looks More Like Financial Infrastructure Than a Crypto Coin

One point Lee keeps returning to is the idea that Ethereum is becoming the backbone of digital finance. Between stablecoins, DeFi platforms, real world asset tokenization and on chain identity systems, Ethereum has become much more than a place to speculate.

Lee’s view is simple. If financial markets continue moving toward tokenization, Ethereum stands to benefit more than almost any other chain. It has the developers, the users and the network effects that make growth not just possible, but likely.

The Macro Environment Could Create Fuel

Another major part of his thesis is tied to the Federal Reserve. Lee thinks the Fed may start cutting interest rates in the coming year. If that happens, liquidity usually returns to risk assets, and crypto tends to be one of the biggest beneficiaries.

In past easing cycles, assets with high growth potential often outperformed. Lee sees ETH in that category today, especially with everything happening on chain.

The Fusaka Upgrade Could Kick Off a New Phase

Ethereum’s next upgrade, called Fusaka, is coming soon. Lee views it as a serious quality of life improvement for the entire network. Cheaper data availability, more efficient rollups and improved scalability have the potential to bring even more activity into the ecosystem.

If applications become cheaper and faster to run, it opens the door for new waves of DeFi tools, enterprise systems and consumer apps. That kind of expansion is exactly the type of catalyst Lee likes to position around before the crowd catches on.

Why This Institutional Move Matters

Institutional buying during sideways markets has a different energy than buying during bull runs. It comes from research, planning and long horizon thinking, not excitement or fear of missing out.

Lee is not buying ETH on a whim. He is building what looks like a strategic treasury position, much like companies that accumulate energy reserves, metals or other foundational commodities. When firms treat ETH as infrastructure instead of speculation, it sends a message. It suggests they believe Ethereum is becoming a permanent part of the financial landscape.

And when a well known market voice makes a move like this, it often encourages others to re-evaluate their assumptions.

Of Course, There Are Still Risks

Lee is bullish, but he is not blind. He has acknowledged several things that could slow Ethereum down.

-

The economy could stay tight if inflation refuses to cool

-

Technical delays could undermine upgrades

-

Regulation could shift unexpectedly

-

Competing blockchains are not standing still

None of these risks are trivial. But Lee’s argument is that Ethereum has enough traction, developers and real world use cases to keep moving forward regardless.

Final Thoughts

Tom Lee’s purchase of 97,000 ETH is more than a headline. It is a statement. He believes Ethereum is undervalued, underappreciated and on the verge of a major turning point. Between the Fusaka upgrade, the potential for a friendlier macro environment and Ethereum’s expanding role in tokenized finance, his case is not hard to understand.

You do not accumulate this much ETH unless you think the future is brighter than the present. And Lee clearly does.

If he is right, Ethereum could be gearing up for one of its strongest chapters ever.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

yETH Exploit of Yearn Finance, Attacker Sends Millions to Tornado Cash

yETH Exploit Drains Millions, Attacker Launders Funds Through Tornado Cash

A recent exploit targeting Yearn Finance’s yETH product resulted in the theft of millions of dollars in assets, followed by a series of transfers into Tornado Cash. Blockchain analytics show that roughly 3 million dollars worth of Ethereum was funneled into the mixer shortly after the attack. The incident highlights ongoing vulnerabilities in DeFi protocols and the persistent challenge of laundering stolen funds through privacy mixing services.

What Happened, The yETH Exploit and Stolen ETH Flows

The attack began when a malicious actor exploited an infinite mint vulnerability in yETH, which is a liquid staking token product operated by Yearn Finance. The flaw allowed the attacker to mint an effectively unlimited supply of yETH in a single transaction. With this artificially inflated supply, the attacker was able to drain liquidity pools that held real assets, including ETH and major liquid staking tokens.

Immediately after draining the pools, the attacker began moving stolen assets through multiple wallets. On chain activity shows that large transactions flowed directly into Tornado Cash. In total, about 1,000 ETH, roughly 2.8 million dollars in value, was pushed into the mixer as part of the laundering process.

The exploit appears to be isolated to the older yETH implementation, which relied on outdated token mechanics. Yearn Finance acknowledged the situation, stating on their official X account that "We are investigating an incident involving the yETH LST stableswap pool," and that users can feel secure that "Yearn Vaults (both V2 and V3) are not affected.".

Why This Attack Is Significant

Infinite Mint Vulnerabilities Remain a Critical Threat

This type of exploit is one of the most catastrophic forms of smart contract failure. When a token’s supply can be arbitrarily increased, attackers can manipulate liquidity pools, redeem inflated assets and drain valuable tokens held by real users. Even established protocols with long track records can be exposed if older code is not continuously audited and updated.

Liquidity Pools Become Fragile Under Supply Manipulation

The integrity of liquidity pools depends entirely on predictable token behavior. When a token’s supply is altered outside expected rules, the pool’s balance collapses instantly. This creates massive losses for users who provided liquidity and may trigger wider liquidity crises across DeFi platforms that rely on interconnected pools.

Mixers Are Still the Tool of Choice for Laundering

The attacker quickly sent stolen ETH to Tornado Cash, which remains a primary method for obscuring stolen funds. Despite regulatory scrutiny and sanctions, mixers continue to attract hackers because they allow for rapid, high volume anonymization. This pattern is consistent with previous DeFi exploits and exchange hacks, where mixers are used almost immediately after funds are stolen.

A Pattern That Repeats Across DeFi

The combination of an exploit followed by a mixer transfer has become predictable. Major hacks from past years have shown the same behavior. An attacker identifies a flaw, drains assets, splits them among multiple wallets and launders them through a mixing protocol. This cycle reinforces two critical realities, DeFi is still highly vulnerable, and laundering infrastructure remains robust enough for attackers to operate with confidence.

Until more advanced detection systems, stronger audits and better economic modeling become the standard, similar vulnerabilities will continue to be exploited.

Implications for DeFi Security and Governance

Even reputable projects with long track records must prioritize frequent, thorough audits, especially for older token contracts. Legacy code is often the weakest link.

Mechanisms that detect abnormal supply changes, enforce withdrawal limits or restrict redemptions during anomalies should be incorporated into liquidity pool architecture. Economic safety modeling must complement smart contract audits.

DeFi users often underestimate the risk of providing liquidity or staking in complex protocols. No audit or reputation fully eliminates risk. Users must diversify exposure and treat yield opportunities with caution.

With Tornado Cash and similar services repeatedly used for laundering, regulators may push for more enforcement actions. This increases pressure on privacy tools, but it also highlights the need for decentralized privacy solutions that cannot be misused as easily.

Final Thoughts

The Yearn yETH exploit and subsequent laundering through Tornado Cash are the latest reminders that DeFi, while innovative, remains structurally fragile. As ecosystems grow more interconnected and protocol complexity increases, so does the risk of catastrophic failures.

For DeFi to become a trusted global financial system, it must adopt stronger audits, safer economic design and better user protections. Until then, the space will continue to experience painful setbacks where millions are lost and trust is shaken.

This incident reinforces a simple truth, decentralization does not remove the need for rigorous security. It amplifies it.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Ethereum Fusaka Upgrade Set for December 3, Bringing Major Scalability Improvements

Ethereum’s Fusaka Upgrade: A Critical Step Toward True Scalability

Ethereum is preparing for one of its most important upgrades in years. The Fusaka hard fork, officially scheduled for December 3, 2025, is designed to improve scalability, lower transaction costs, and strengthen support for layer 2 rollups. In a year defined by record network usage, rising global adoption, and increasing competition among blockchains, Fusaka represents a meaningful step toward Ethereum’s long-term vision as a scalable, decentralized world computer.

This upgrade is not a small patch. It integrates improvements across data availability, block capacity, gas economics, and validator efficiency. With Fusaka coming only months after a significant earlier update, Ethereum developers are clearly pushing hard to meet growing demand and prepare the network for its next phase of growth.

What Fusaka Introduces

Fusaka delivers a bundle of Ethereum Improvement Proposals focused on two primary goals: lowering the cost of data availability for layer 2 rollups and improving network throughput. At the center of the upgrade is a major new feature called PeerDAS, or Peer Data Availability Sampling.

PeerDAS: Foundational to Ethereum’s Scaling Vision

PeerDAS allows validators to verify data blobs by sampling only parts of the data instead of downloading the entire blob. This dramatically reduces bandwidth requirements and storage costs for validators. As a result, layer 2 networks can publish more data to Ethereum at a lower cost, which ultimately means cheaper and faster transactions for users.

PeerDAS is a core component of Ethereum’s long-term scaling strategy. Instead of increasing block size in ways that may centralize the network, Ethereum is increasing throughput through smarter and more efficient data verification.

Higher Block Gas Limit

Ahead of Fusaka, the block gas limit has been increased to 60 million. This allows more computational work per block, which helps handle higher transaction volumes. It also prepares the network for the increased activity expected from growing layer 2 ecosystems.

Blob Parameter Only Forks

Fusaka introduces a new mechanism that allows Ethereum to gradually increase blob capacity without requiring massive, coordinated hard forks. This flexibility gives developers the ability to scale blob data availability as demand from rollups increases. It is a more responsive and modern approach to protocol upgrades.

Gas Cost and Opcode Optimization

The upgrade also includes refinements to gas costs and opcode behavior. These changes improve smart contract efficiency, reduce unnecessary overhead, and create a more predictable environment for developers building large-scale applications.

Why Fusaka Matters

More Sustainable Layer 2 Growth

Layer 2 networks are already driving the majority of Ethereum’s user activity. However, their economics depend heavily on blob costs and data publishing efficiency. Fusaka directly supports this growth by lowering data availability costs and improving the performance of rollups.

For users, this could translate to lower fees and smoother experiences across DeFi, gaming, on-chain social networks, and other decentralized applications.

Reduced Congestion and Lower Fees

Ethereum has sometimes struggled with network congestion during peak periods, resulting in high gas fees. The combination of higher block gas limits, improved data handling, and optimized computation can help reduce these spikes. Fusaka does not eliminate gas fees entirely, but it makes the network more efficient and resilient under stress.

Future-Proofing Ethereum

Fusaka is designed as part of Ethereum’s larger “Surge” roadmap, which aims to scale the network to thousands of transactions per second without sacrificing decentralization. By improving both layer 1 and layer 2 performance, Fusaka builds the foundation for the next decade of Ethereum growth.

Improved Developer and Validator Experience

Optimizations in Fusaka reduce the burden on validators, make node operations more efficient, and help smart contract developers build more scalable applications. By lowering technical barriers and improving performance, the upgrade strengthens Ethereum’s long-term decentralization.

Community and Developer Readiness

Ethereum developers have tested Fusaka across multiple testnets, and client teams have signaled readiness for activation. The increase in block gas limits and smooth rollout of test configurations suggest strong coordination between developers, infrastructure teams, and validators.

Early analytics show rising activity on layer 2 networks, growing demand for blob space, and expanding multi-chain connectivity. These trends indicate that Fusaka is arriving at a crucial moment.

Risks and Considerations

Fusaka brings meaningful benefits, but there are challenges to consider.

-

Large upgrades carry technical and synchronization risks for nodes and validators.

-

Adoption by layer 2 networks may require additional time after Fusaka activates.

-

High demand may still outpace capacity upgrades until additional improvements go live.

-

Competing chains with aggressive scaling strategies may continue to pressure Ethereum.

Careful coordination among the ecosystem’s stakeholders will be essential to ensure a smooth transition.

What Fusaka Means for Ethereum’s Future

For users, Fusaka promises lower costs, improved performance, and a better on-chain experience. For developers, it offers stronger infrastructure and greater room to innovate without hitting scalability bottlenecks. For investors, it represents a tangible step toward long-term network maturity.

Ethereum’s evolution has always focused on gradual, sustainable progress rather than risky shortcuts. Fusaka embodies that philosophy. It improves the network in practical, meaningful ways, without compromising decentralization or security.

If successful, Fusaka may be remembered as the upgrade that unlocked Ethereum’s next growth cycle and cemented its position as the dominant platform for decentralized applications.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.