#Trading

X Plans Smart Cashtags to Show Live Crypto Prices Inside the Timeline

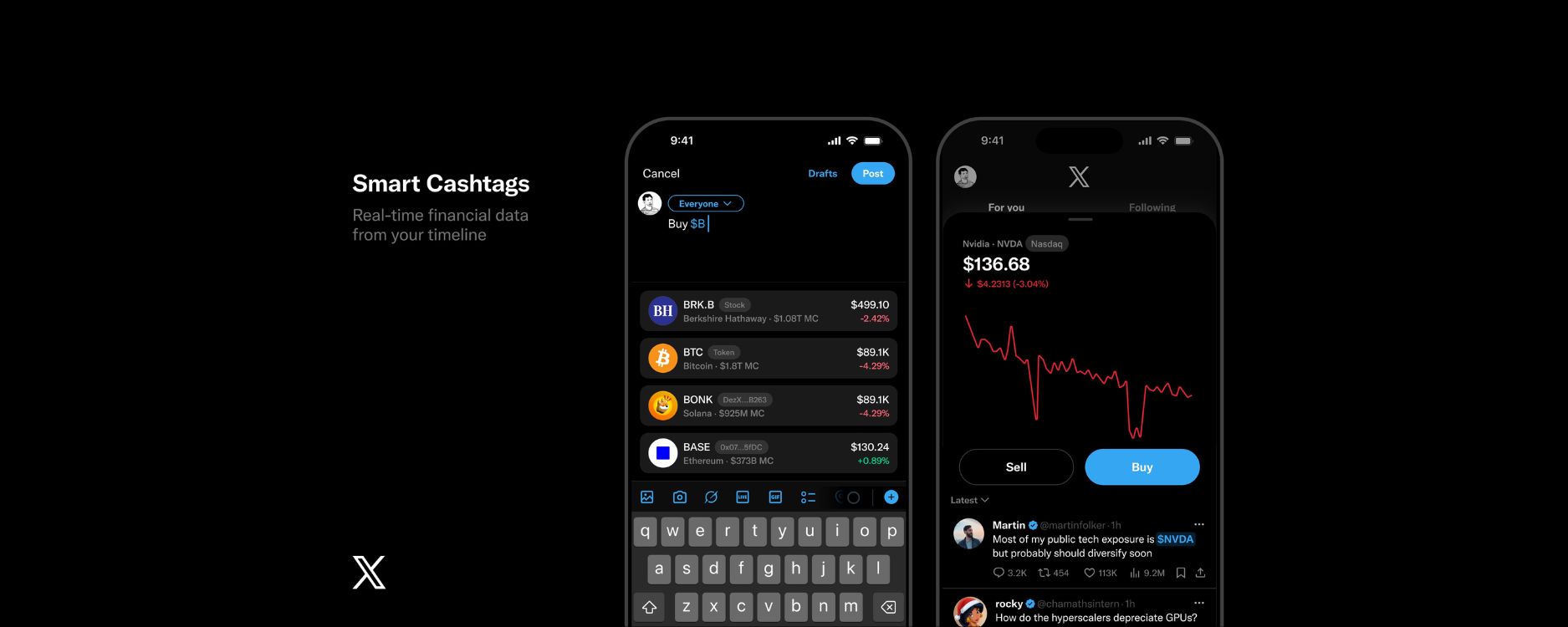

X is getting ready to roll out something called Smart Cashtags, and while the feature sounds minor on the surface, it could change how people follow crypto markets day to day.

Cashtags are already familiar to anyone who spends time on crypto Twitter. Add a dollar sign in front of a ticker like $BTC or $ETH and the platform turns it into a clickable reference tied to ongoing conversations. It has always been useful for tracking sentiment, but not particularly helpful if you actually want to know what the market is doing in that moment.

Smart Cashtags are meant to fix that.

Instead of just linking to a stream of posts, the upgraded version will surface live prices, basic performance data, and charts directly in the feed. The idea is simple: if people are talking about a token, you should be able to see what it is doing without leaving the timeline.

For a platform where crypto narratives often move faster than prices themselves, that shift matters.

Turning the Feed Into a Market Snapshot

Crypto trading already lives on X. News breaks there. Narratives form there. Panic and euphoria show up there first. What has been missing is the data itself.

Smart Cashtags bring that data closer to the conversation.

The feature was announced by Nikita Bier, who is Head of Product at X, saying it will convert posts into live market data entry points.

When someone mentions a token using a cashtag, the platform will recognize the asset and display up to date pricing alongside the post. Tapping the tag is expected to open more context, recent price moves, charts, and related discussion, all in one place.

It reduces the constant app hopping that most traders know too well. Instead of checking a charting app, then jumping back to X to see what people are saying, everything shows up together.

Over time, that could subtly change how people consume market information. The feed becomes less of a rumor mill and more of a lightweight market view.

Why Crypto Traders Will Care

Crypto is unusually sensitive to social momentum. A token can start trending hours before volume shows up. A single viral post can spark a rally or accelerate a selloff.

Putting price data directly next to those conversations tightens that feedback loop.

A trader scrolling their timeline might see a surge in posts about a token at the same moment the price is breaking out. The same dynamic works in reverse during downturns. That kind of visibility favors speed and awareness, especially for retail traders who do not live inside professional trading dashboards.

It also lowers the barrier to entry. You do not need to know where to look or which tools to use. The information comes to you as part of the conversation.

That accessibility cuts both ways. More visibility can mean better context, but it can also amplify emotional reactions during volatile moments.

Not Just a Visual Upgrade

Smart Cashtags are not just about showing a price number.

One of the quieter improvements is accuracy. Crypto tickers can be messy. Different tokens share similar symbols, and some symbols overlap with stocks or other assets. Smart Cashtags are expected to better identify and map posts to the correct asset, reducing confusion and mislabeling.

That matters more as crypto bleeds into traditional finance, with tokenized assets, ETFs, and crossover tickers becoming more common.

This is also not X’s first step into market data. Earlier versions of cashtags already offered limited chart previews through external integrations. Those features felt bolted on. Smart Cashtags move the data front and center, making it part of the native experience instead of a side panel.

Embedding live prices into social feeds is not risk free.

If data is delayed or inaccurate, misinformation spreads faster. When price movements and social reactions are displayed together, markets can become more reflexive. Trends may accelerate, and herd behavior could become more pronounced, especially in smaller or thinner markets.

There is also the question of incentives. Once price data lives inside the feed, it opens the door to monetization, premium analytics, or trading integrations. None of that has been formally announced, but the direction is hard to ignore.

A Bigger Picture Play

Smart Cashtags fit neatly into X’s broader ambitions. The platform has been inching toward financial services, payments, and creator driven monetization for some time. Turning the feed into a place where financial data lives alongside conversation feels like a natural extension, and ultimately leads toward X becoming the everything app.

For crypto specifically, it reinforces X’s position as the main arena where narratives meet price action. It is not a trading terminal, but it does not need to be. Influence often matters more than precision.

The Bottom Line

Smart Cashtags may look like a small product update, but they point to something bigger.

By putting live crypto prices directly into the timeline, X is collapsing the distance between sentiment and market reality. For traders, builders, and casual observers alike, that could change how quickly ideas turn into action.

Whether it leads to better informed decisions or faster hype cycles will depend on how it is used. Either way, crypto conversations on X are about to feel a lot closer to the market itself.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Franklin Templeton Launches XRPZ ETF as Institutional Demand for XRP Accelerates

Franklin Templeton Debuts XRPZ ETF, Signaling a Major Shift for XRP and Institutional Crypto

Franklin Templeton has officially launched its spot XRP exchange-traded fund, the XRPZ, marking a watershed moment for the tokenized asset ecosystem. The debut of this ETF puts XRP in the spotlight as institutional capital flows begin to align with altcoins beyond Bitcoin and Ethereum.

With the backing of a $1.5 trillion asset manager, the XRPZ ETF offers regulated exposure to XRP via familiar equity channels, dramatically reducing operational, custody and regulatory friction for large allocators. It is a major validation of XRP’s role in what is evolving from retail crypto trading to long-term institutional infrastructure.

What the XRPZ ETF Involves

The IRA filings, S-1 amendments and DTCC listings confirm that Franklin Templeton is serious about launching the ETF under the ticker XRPZ. Among the structural details:

-

The fund is designed to hold XRP tokens as its primary asset, tracking the spot price of XRP rather than derivatives exposure.

-

Franklin used a shortened “8(a)” clause in its amended S-1 filing, enabling automatic effectiveness after 20 days unless the U.S. Securities and Exchange Commission intervenes, mirroring strategies used for altcoin ETFs earlier in the year.

-

The fund appeared on the Depository Trust & Clearing Corporation (DTCC) database ahead of trading, an early signal that the operational infrastructure (fund registration, clearing, custody) is in place.

-

The ETF carries a low management fee (notably 0.19 %) and in some reports the sponsor fee is waived for the first USD 5 billion in assets under management, enhancing appeal for large institutions.

-

Analysts estimate that XRP spot ETFs, including XRPZ, could attract billions of dollars in inflows over the coming months, materially altering supply-demand dynamics for XRP.

The significance lies in the nature of the issuer. Franklin Templeton is a deeply established financier, trusted by pension funds, retirement plans and advisory networks. Its entry into XRP means the asset is now accessible through mainstream legacy finance rather than purely crypto-native channels.

Institutional Implications: Opening the Floodgates for XRP

1. Institutional On-Ramp

Large financial advisory firms, traditional asset managers and pension portfolios previously avoided exposure to altcoins due to custody, regulatory and operational challenges. With XRPZ, they can gain XRP exposure through a familiar wrapper, potentially unlocking large amounts of capital.

2. Shift in Narrative

XRP has long been viewed as a remittance or settlement token rather than a broad investment asset. The ETF elevates XRP into the asset allocation conversation. The narrative now becomes about yield, infrastructure, tokenized finance and institutional adoption.

3. Supply Pressure Relief

Spot ETFs create demand that pulls tokens off open markets and into long-term holders. As XRP becomes part of ETF-held assets, fewer tokens circulate, tightening supply. At the same time, inflows from new investors broaden the holder base beyond short-term traders.

4. Regulatory Maturation

The fact that prime asset managers are being approved to list spot XRP ETFs signals institutional-grade regulatory comfort with what was once considered controversial. This legitimacy is critical for large scale adoption and asset allocation.

Market & Price Impact: What to Watch

While the broader crypto market remains volatile, the launch of the XRPZ ETF offers several catalysts for XRP’s next phase:

-

Analysts suggest that first-day volumes for XRP ETFs could approach or exceed $200 million, rivaling other major altcoin ETF launches earlier in 2025.

-

XRP price behavior may respond to the ETF wave rather than purely market sentiment. Analysts now forecast higher endpoints for XRP, ranging USD 3.50 to USD 4.50 or more, if institutional flows continue.

-

Supply metrics such as tokens on exchanges, large-wallet accumulation and daily active holders will become increasingly relevant. Any sustained reduction in exchange reserves supports upward pressure.

-

The token unlock schedule for XRP and the ETF’s holdings will influence whether the move becomes a sustained trend or a short-term spike.

-

ETF adoption is likely to materialize gradually, peppered through advisory firm allocations, retirement plan inclusions and wealth-management flows rather than a single instant tsunami.

Key Considerations and Possible Risks

Even with the positive outlook, several factors remain uncertain:

-

Regulatory risk persists. Although the filing uses “automatic-effect” language, the ETF still depends on the SEC not blocking the listing within the timeframe.

-

Market timing. If broader crypto sentiment remains weak, the ETF launch may be delayed, muted or overshadowed by macro factors.

-

Supply-side pressure. If a large number of XRP tokens come off lock-ups or distributions coincide with the launch, price impact may be dampened.

-

Competition. Other digital asset products and ETFs are launching across altcoins. XRP must deliver utility, not just access, to maintain momentum.

-

Implementation risk. Even with an ETF wrapper, custody, audit, tracking and infrastructure must work faultlessly to satisfy institutional standards.

Why XRPZ Could Mark a Turning Point

Franklin Templeton has chosen a moment where regulatory, market and institutional conditions align. The ETF is not merely a product, it is a signal that crypto infrastructure is entering the mainstream. XRP’s upgrade from speculative token to a major asset allocation tool is underway.

For investors evaluating crypto beyond Bitcoin and Ethereum, XRP offers a new frontier. Its lineage in settlement, its emerging ETF access, and the institutional backing now assembling make it uniquely positioned. Provided adoption continues, the tailwinds may significantly favor XRP in 2026.

The debut of the XRPZ ETF by Franklin Templeton represents a milestone in the evolution of digital assets. It paves the way for institutional capital to flow into XRP via conventional investment vehicles and sets a precedent for other altcoins. The long-term outlook for XRP may now shift from speculative volatility toward infrastructure-driven growth.

If institutions commit, supply tightens and adoption accelerates, XRP could quietly become one of the most important digital assets in the next phase of blockchain evolution. Its moment has arrived—and the system is ready to scale.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Polymarket Secures CFTC Approval for Regulated U.S. Relaunch

Polymarket Secures CFTC Approval, Marking a Landmark Return to the U.S. Regulated Market

Polymarket, one of the most well-known crypto prediction platforms, has officially secured approval from the U.S. Commodity Futures Trading Commission to operate as a fully regulated exchange in the United States. This milestone represents the end of a long regulatory saga and marks the beginning of a new era for event-based markets in the American financial system.

Once viewed primarily as an offshore curiosity on the fringes of crypto, Polymarket is now entering the most regulated derivatives market in the world with a structure that resembles a traditional exchange. The approval signals a wider shift in how prediction markets are treated, not as gray-area gambling products but as legitimate financial instruments with real informational and economic value.

A Long Road Back: From Enforcement Actions to Full Approval

Polymarket’s path to reentry took several years and involved significant regulatory challenges.

In 2022 the CFTC fined the company and required it to shut down operations for U.S. customers. At the time the agency viewed Polymarket as an unregistered derivatives venue, and American users were cut off as the platform relocated offshore. For nearly three years Polymarket operated internationally, mostly in regulatory limbo, even as it grew rapidly.

Everything shifted in 2025. Polymarket acquired QCEX, a CFTC-licensed exchange and clearing entity, which gave the company a compliant foundation to reenter the United States. This acquisition changed the regulatory landscape. With QCEX under its umbrella, Polymarket could finally connect to the U.S. derivatives system in a way that aligned with federal rules.

The CFTC then issued a targeted no-action letter providing relief for certain recordkeeping and reporting requirements related specifically to event contracts. This signaled that regulators were open to a structured, compliant form of prediction markets.

The latest approval goes further. It integrates Polymarket’s U.S. entity into the full Designated Contract Market framework, meaning it can now operate in tandem with brokers, clearing firms and professional market infrastructure.

Polymarket has not simply returned. It has transformed.

What the New CFTC Approval Allows

With this newly amended approval, Polymarket’s U.S. exchange gains access to traditional financial infrastructure, including:

Intermediated Access

Brokers, futures commission merchants and financial intermediaries can now connect to the exchange. Retail participants will eventually be able to access markets through their existing brokerage accounts.

Regulated Clearing and Custody

Contracts can settle through a compliant clearinghouse with full risk controls, reporting frameworks and established audit systems. This allows Polymarket to operate with the same safeguards that apply to regulated futures markets.

Clear Legal Status

The exchange now sits inside the CFTC’s regulatory perimeter. Instead of operating in a legal gray zone, Polymarket’s U.S. operations function as a recognized derivatives venue.

This level of integration was once unimaginable for prediction markets. Now it represents the new baseline.

What Polymarket Plans to Bring to U.S. Users

Polymarket’s core innovation is event-based trading. Users buy or sell positions tied to real-world outcomes such as elections, policy decisions, sports results, economic data releases or cultural events.

The company plans a phased rollout for the U.S. market that will begin with a limited number of markets while onboarding infrastructure is tested. Over time the platform intends to expand into broader categories, including political outcomes, macroeconomic indicators and entertainment markets.

The company has raised substantial capital at valuations nearing one billion dollars, and investors expect the regulated U.S. platform to be a major growth driver.

Why This Moment Matters for Prediction Markets

Polymarket’s approval arrives at a time when interest in event contracts is growing across the financial, regulatory and technology sectors. Several major industry trends make this moment especially significant:

A Shift Away From Viewing Markets as Gambling

For decades regulators struggled to categorize prediction markets. The new CFTC framework acknowledges that event-based products can carry informational and hedging value rather than being dismissed as speculative wagers.

Expansion of Prediction Markets Across Industries

Traditional finance platforms, sports betting operators and fintech companies are exploring event-based products. This includes sports markets, political prediction markets and financial data markets.

Integration Into Mainstream Platforms

With intermediated access permitted, it is possible that Polymarket’s markets will eventually appear on traditional brokerage platforms, in the same accounts where users already trade stocks and futures.

Rising Legal Clarity

The regulatory structure around event contracts is still evolving, but Polymarket’s approval provides a template for others to follow. Until recently, no one could point to a clear path. Now there is one.

This is not just a step forward for Polymarket. It is a turning point for the entire prediction market industry.

Remaining Risks and Open Questions

While the approval is a major milestone, several challenges remain:

-

State-level restrictions may still apply. Some states treat event markets as gambling, regardless of federal classification.

-

Political concerns are rising as political event markets attract both attention and controversy.

-

Scope of no-action relief remains limited, meaning regulators could still intervene if markets move outside approved parameters.

-

Global regulatory landscape remains inconsistent, with foreign jurisdictions applying very different gambling and derivatives rules.

Polymarket’s success in the United States does not automatically eliminate international hurdles.

Final Thoughts

Polymarket’s return to the United States in fully regulated form marks one of the most important shifts in the history of prediction markets. A platform once forced offshore has now reentered the U.S. through a regulated, institutional-grade exchange framework. The significance of this moment goes far beyond one company. It signals that prediction markets may finally be entering the financial mainstream.

The next phase will determine how widely these markets spread, how they integrate with traditional finance and how regulators balance innovation with oversight. But for now, a once-fringe industry has gained legitimacy, and Polymarket stands at the center of the transformation.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Cardano Foundation Confirms U.S. ADA ETF Development as Institutional Interest Grows

Cardano Foundation Confirms ADA ETF Effort as Institutional Momentum Builds

Cardano is no longer in the “ETF someday” category. At Cardano Summit 2025 in Berlin, Cardano Foundation CEO Frederik Gregaard publicly stated that the organization is actively working on a United States based ADA exchange traded fund. He described the initiative as a strategic priority aimed at expanding regulated access to Cardano’s multibillion dollar ecosystem and accelerating institutional participation.

This shift marks one of the clearest signals yet that a Cardano ETF is moving from speculation into an organized, deliberate effort.

Cardano Foundation confirms it is developing an ADA ETF

At the summit, Gregaard explained that the Foundation is pursuing a United States listed ETF that would give investors direct regulated exposure to ADA. He emphasized that the initiative aligns with the Foundation’s long term strategy of expanding adoption, strengthening Cardano’s financial infrastructure, and positioning ADA as a legitimate allocation within traditional markets.

Additional background from the Foundation in recent months shows:

-

The Cardano Foundation has scaled substantially, growing from roughly 30 staff to more than 100 in the past few years, and maturing its operational structure and compliance efforts.

-

The organization has been coordinating with exchanges, specialized ETF issuers, and service providers in preparation for eventual product listings.

-

Technical upgrades focused on scalability, security, and interoperability are being prioritized to meet the expectations of regulated financial products.

Gregaard described the ETF as something that supports multiple strategic objectives at once. It expands institutional access, introduces a familiar investment wrapper for traditional market participants, and reinforces Cardano’s positioning as a public blockchain infrastructure network rather than a purely speculative asset.

How this aligns with the current ETF landscape for Cardano

Although the Foundation’s involvement is new, Cardano’s ETF journey has already been building for over a year and the environment around it has shifted dramatically.

1. A spot Cardano ETF filing is already in the system

Earlier this year, a major United States asset manager filed for a spot Cardano ETF. The proposed product would hold ADA directly in cold storage, offering regulated exposure through brokerage accounts without requiring users to interact with exchanges or self custody wallets.

2. The decision window was delayed, not rejected

Regulators extended the review period for the ADA ETF filing and pushed the decision deadline further into 2025. These delays are normal in the ETF approval process. They do not imply rejection, but they confirm that the application remains active.

3. Cardano already has regulated ETPs outside the U.S.

European markets have listed Cardano based exchange traded products for years. Some are pure ADA trackers and others are diversified digital asset baskets that include ADA. These products demonstrate that ADA has already been packaged successfully into regulated investment structures in major jurisdictions.

4. The United States ETF environment is far more open in 2025

Several developments have made altcoin ETFs significantly more achievable:

-

Exchanges now have generic listing standards for commodity style crypto ETFs. This streamlines the process for non Bitcoin products.

-

Multiple spot ETFs for Solana, Litecoin, Hedera, and other altcoins have already launched successfully.

-

A digital large cap ETF that includes Cardano has been approved, confirming that ADA exposure already meets regulatory comfort levels in multi asset funds.

Many market analysts now place the probability of an ADA ETF approval in the high double digits. They cite Cardano’s long lifespan, consistent top ten market cap, and increasing classification as a “mature blockchain ecosystem.”

Why a Cardano ETF would matter

Mainstream portfolio access

A spot Cardano ETF would allow investors to buy ADA exposure from conventional brokerage platforms, retirement accounts, and institutional mandates that require regulated instruments.

This would create several important effects:

-

Lower barriers for financial advisors and institutions that want crypto exposure but cannot interact with direct tokens.

-

Clearer regulatory boundaries, since ETF issuers must comply with formal custody, disclosure, and compliance frameworks.

-

New liquidity sources from large capital pools that are currently sidelined.

For Cardano, this would represent a major reputational milestone. It would place ADA alongside Bitcoin and Ethereum in the category of assets viewed by institutions as suitable for a broad investment audience.

Reinforcing Cardano’s identity as infrastructure

The ETF effort complements the Foundation’s broader goal of defining Cardano as public infrastructure.

The network has emphasized scientific peer review, predictable upgrades, staking sustainability, and structured governance. Cardano also promotes real world adoption through enterprise pilot programs, digital identity initiatives, and global development partnerships. These traits align well with the risk frameworks used by institutional allocators.

An ETF would act as long term validation of Cardano’s technical and governance roadmap.

What an ADA ETF might look like

Based on existing filings and European products, there are several likely structures.

Pure spot ADA ETF

A simple product that holds ADA directly, with pricing tied to spot markets. This is the most likely first approval.

Index based ETF

A multi asset fund where ADA represents a percentage of the portfolio. These are already live in Europe and are gaining traction in the United States.

Staking aware ETF

A future category could attempt to reflect staking yield through derivatives or structural adjustments. This would require more regulatory clarity.

The Cardano Foundation would not issue the ETF itself, but it would provide technical support, network documentation, and ecosystem coordination while a professional asset manager handles regulatory filings.

Remaining uncertainties

Even with strong momentum, several factors can influence the final outcome:

-

Regulators can still deny or indefinitely delay a spot ADA ETF.

-

Political changes or shifts in regulatory priorities may slow down altcoin product approvals.

-

Market reactions are not guaranteed. ETF launches do not always lead to immediate price appreciation, especially during wider market downturns.

Investors must remember that ETF exposure carries ADA’s market volatility and ecosystem risks, even when held through a brokerage account.

Final thoughts

The confirmation from Cardano Foundation CEO Frederik Gregaard that a United States ADA ETF is actively being developed is a major milestone for the ecosystem. Combined with existing ETF filings, the evolving regulatory landscape, and multiple successful altcoin ETF approvals, the pathway to a Cardano ETF is clearer than ever.

For the first time, an ADA ETF is not merely a wish from the community. It is an active strategic initiative with real institutional traction behind it. If approved, it will open the door to a wider class of investors, strengthen Cardano’s position in the regulated financial world, and reinforce its role as a durable blockchain infrastructure platform.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bitcoin Drops Below $95K as Spot ETFs Log Second-Largest Outflows Ever

Bitcoin Drops Below 95,000 Dollars as Spot ETFs Log Second-Largest Outflows Ever

Bitcoin’s slide below 95,000 dollars comes at the same moment U.S. spot Bitcoin ETFs are seeing their second-largest weekly outflows on record, creating a powerful combination of macro pressure, profit-taking, and structural selling.

This is what is actually happening across markets.

Bitcoin breaks below 95,000 dollars as risk appetite evaporates

Bitcoin has been drifting lower for weeks, but the latest leg down reflects broader stress across global risk markets.

-

BTC recently hit a six-month low, trading near 95,800 dollars, down roughly 24 percent from its all-time high above 126,000 dollars earlier in the fall.

-

A sharp selloff in major tech stocks has spilled into crypto. Falling prices in high-beta names like Tesla and Nvidia dragged the Nasdaq lower, and Bitcoin is moving in correlation.

-

On several trading venues, Bitcoin briefly dipped under the 95,000 dollar level, shaken by fading expectations for a near-term Federal Reserve rate cut.

Macro sentiment is driving it. The Fed has signaled caution, and higher yields make cash and bonds more attractive relative to volatile assets like crypto. Risk capital is stepping back accordingly.

Spot Bitcoin ETFs suffer second-largest outflows since launch

At the same time Bitcoin’s price is weakening, spot Bitcoin ETFs are hemorrhaging capital.

Recent ETF flow data shows:

-

About 1.23 billion dollars in net outflows over a single week, marking the second-largest weekly outflow since spot Bitcoin ETFs launched in early 2024.

-

This reversal comes immediately after a massive 2.7 billion dollar inflow the previous week, showing how rapidly sentiment flipped.

Other analytics platforms confirm the scale:

-

More than 2 billion dollars has exited spot Bitcoin ETFs over a similar seven-day stretch.

-

These outflows were led by major products, including the largest U.S. Bitcoin ETFs.

Put simply, the same ETF vehicles that fueled Bitcoin’s run above 120,000 dollars are now feeding selling pressure.

Why ETF investors are selling

1. Profit taking after a euphoric rally

Bitcoin surged to record highs earlier in the fall. Much of that momentum was driven by strong ETF inflows and speculative leverage. When the rally stalled, ETF holders began locking in gains.

In the past month, sustained inflows flipped into a multi-day streak of heavy outflows totaling more than 2 billion dollars.

2. Macro risk-off environment

The ETF redemptions are unfolding during a broader derisking period.

-

Tech stocks are sliding.

-

Investors are reducing exposure to volatility.

-

Falling expectations for Federal Reserve rate cuts are punishing non-yielding assets.

When institutions derisk, ETFs offer an easy way to trim exposure quickly and in size.

3. Long-term holders are selling, too

On-chain estimates show that long-term BTC holders sold roughly 815,000 BTC over the last month. That is the largest 30-day selling wave by long-term holders in close to a year.

When long-term holders sell while ETFs see redemptions, structural and tactical selling pressures align.

Are ETF outflows causing the price drop?

ETF outflows and price declines are interconnected, but not in a simple cause-and-effect way.

-

When ETFs see inflows, issuers buy Bitcoin on the open market.

-

When ETFs see redemptions, they release or sell Bitcoin, which can weigh on price.

But flows also respond to price, rather than only drive it.

During recent drawdowns, Bitcoin began falling before the biggest ETF outflow prints hit. Markets weakened first, flows followed, and the selling then reinforced the downturn.

The bigger picture is not entirely bearish

Despite the heavy redemptions, ETF-held Bitcoin remains historically large.

-

U.S. spot Bitcoin ETFs still hold well over 130 billion dollars in assets even after the latest outflows.

-

These ETFs still control a significant percentage of the circulating BTC supply.

This means institutions have not abandoned Bitcoin. They are rebalancing, not exiting.

What traders and investors should take away

Short-term traders

Expect higher volatility.

Key levels like 95,000, 90,000 and 85,000 dollars will become focal points for liquidations, panic selling, and sharp reversals.

ETF flow data will continue to be a powerful short-term signal. Large outflows can become self-reinforcing sell triggers.

Long-term investors

This environment looks more like a mid-cycle reset than the end of the trend.

-

ETF holdings remain massive.

-

Institutional allocators are still active.

-

Periods of heavy outflow historically set up longer-term opportunities for patient buyers.

What to watch next

-

Daily spot ETF flows

Look for stabilization or the return of small net inflows. Historically, that has coincided with market bottoms. -

Federal Reserve tone

Rate expectations continue to drive risk appetite. -

On-chain behavior

Whether long-term holders continue selling or begin accumulating again will play a crucial role. -

Equity market sentiment

As long as Bitcoin behaves like a high-beta tech asset, weakness in equities will spill into crypto.

Final thoughts

Bitcoin’s break below 95,000 dollars paired with the second-largest weekly outflow ever recorded in spot Bitcoin ETFs shows that the market is finally cooling after an overheated rally. ETF redemptions and long-term holder selling are contributing to the pressure, but they are unfolding within a broader global derisking trend.

The ETF era has not failed. If anything, this volatility highlights how deeply Bitcoin has become integrated into mainstream portfolios, where selling flows can move quickly in response to macro signals.

For traders, this phase demands discipline. For long-term believers, it is a reminder that institutional adoption does not eliminate corrections. It simply changes their shape and scale.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

OKX Launches Built-In DEX Trading Across Base, Solana and X Layer

OKX Launches Unified DEX Trading for Base, Solana and X Layer

The global crypto exchange OKX has introduced a major upgrade to its app that integrates decentralized exchange (DEX) trading across multiple chains: Base, Solana and its own X Layer network. Users can now execute decentralized trades inside the OKX mobile application, enabling both centralized and decentralized trading from a single interface.

This move signals a new phase of centralized exchanges embracing DeFi liquidity rather than competing against it.

Unified interface for CEX and DEX

OKX’s update allows users to shift seamlessly between centralized order-books and on-chain markets. The wallet automatically sets up a self-custody passkey wallet when DEX mode is activated, ensuring users retain control of private keys while trading decentralized liquidity.

Liquidity is aggregated from more than 100 pools across supported chains, enabling the app to route orders toward the best available price.

Multi-chain support: Base, Solana and X Layer

-

On Base the integration taps into the growing ecosystem of Web3 apps building on its Ethereum-compatible roll-up.

-

On Solana the feature connects to high-performance on-chain DEXs that specialize in ultra-low fees and high throughput.

-

On X Layer OKX’s own modular Layer-2 supports EVM equivalence, throughput of several thousand transactions per second and is positioned to be a key part of OKX’s future modular infrastructure.

Self-custody meets exchange convenience

OKX emphasizes that users retain full self-custody of the DEX trades while benefiting from the liquidity and user-experience of a large exchange. For many retail users this removes the friction of switching between wallet apps, bridges and trading venues.

Lowering friction between CEX and DeFi

Historically traders faced two worlds: centralized exchanges (fast, liquid, custodial) and decentralized exchanges (non-custodial, self-sovereign, often clunkier). OKX’s integration helps bridge that divide. By offering both modes in one app it reduces switching cost and increases accessibility to on-chain markets.

Supporting multi-chain adoption

By including Base, Solana and X Layer networks OKX is betting that multi-chain strategies will dominate Web3. Users can access tokens, swaps and liquidity beyond a single network and participate in ecosystems that specialize in performance, low cost and innovation.

Strategic advantage for OKX

For OKX this feature furthers differentiation. Many exchanges now support wallet-apps, but fewer integrate full DEX trading across major chains inside their main app. OKX’s move could drive retention, user growth and stronger positioning in both CEX and DeFi sectors.

The broader context in DeFi evolution

Decentralized exchange volumes recently reached record highs with monthly totals exceeding $600 billion. The early DeFi wave emphasized pure open protocols while the current phase is more about unified UX, interoperability and ease of on-chain access from mass-market portals. OKX’s upgrade is consistent with this maturation trend.

At the same time, other major platforms are pursuing similar strategies. For example Coinbase recently added DEX access for Base network tokens and Binance has integrated wallet-native DEX routing on its app. OKX’s multi-chain DEX rollout therefore represents an escalation.

Potential risks and challenges

-

Liquidity fragmentation: Even though OKX aggregates over 100 pools, liquidity on some chains and tokens may still be shallow, increasing slippage for large trades.

-

Smart-contract and chain risk: Trading on-chain introduces protocol risks like bridge failures, network downtime or contract exploits which are less common on centralized markets.

-

Centralization criticism: While the feature offers non-custodial trading, critics may argue that routing via a centralized app reintroduces centralization trade-offs under the guise of decentralization.

-

User education: Retail users may assume the same protections apply across CEX and DEX modes; mismatches in custody, recovery or regulation awareness could lead to errors.

What to watch next

-

Adoption metrics: How many users enable the DEX mode and how much trading volume flows through the integrated system on each of the three chains.

-

Token listings: Will OKX prioritize new token launches or cross-chain assets via DEX mode, and how quickly will additional chains be added?

-

Development of X Layer: As OKX’s proprietary roll-up matures, liquidity and user activity on that network will be a key strategic indicator.

-

User experience and security feedback: Reports of slippage, wallet setup issues or custody concerns could influence how successful the rollout is.

-

Competitive responses: How other major exchanges respond with similar features, and whether this becomes standard across the industry.

Final thoughts

OKX’s rollout of built-in DEX trading across Base, Solana and X Layer marks a meaningful evolution in the convergence of centralized exchanges and decentralized finance. By enabling users to access on-chain liquidity from within a trusted exchange app, OKX is making DeFi more accessible, multi-chain, and user-friendly.

For traders and DeFi enthusiasts this is a powerful tool: multi-chain access, self-custody trading and deep-liquidity routing in a single environment. For OKX it is a strategic differentiation as the industry moves into its next phase of scale and adoption.

That said, execution will matter: how smoothly the feature works, how security is upheld and how users adopt it will determine whether this raises the bar for exchange-DeFi integration or remains a headline feature.

If OKX nails it, the result could be a clearer path for the average user to interact with DeFi fully, from wallet to swap to multi-chain strategy...all inside one seamless interface.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Canary Capital XRP Spot ETF Set to Begin Trading November 13

Canary Capital XRP Spot ETF Set for Trading on November 13th

Canary Capital is poised to launch what could become the first major U.S. spot ETF tied to XRP on November 13, 2025. The firm updated its S-1 registration to remove a delaying amendment that previously gave the U.S. Securities and Exchange Commission (SEC) indefinite discretion over timing. With that procedural hurdle cleared, the launch date now stands as scheduled, assuming final exchange filings are completed without new regulatory objections.

What changed in the filing

-

The updated S-1 submission eliminates the “delaying amendment” that prevented automatic effectiveness under Section 8(a) of the Securities Act of 1933.

-

Without that clause, the filing can become auto-effective after a 20-day waiting period unless the SEC raises substantial comments.

-

With this obstacle removed, the fund is tracking toward a November 13 launch, contingent on approval of its Form 8-A listing with the Nasdaq Stock Market and final clearance from the exchange.

-

The timing follows the same process used by other altcoin spot ETFs launched by Canary Capital, including products for Solana, Litecoin and Hedera. These also relied on the auto-effective mechanism.

Why it matters for XRP and the crypto market

-

A spot ETF for XRP dramatically expands investor access by enabling exposure through standard brokerage accounts. Investors will not need self-custody or direct interaction with crypto exchanges.

-

Institutional demand is expected to be significant. XRP has one of the largest global user bases in the digital asset sector. Many analysts believe the ETF could attract substantial inflows during its first months of trading.

-

The launch arrives during a broader shift in U.S. regulatory policy. Regulators have recently approved generic listing standards for spot crypto ETFs, creating a path for assets other than Bitcoin and Ethereum.

-

If the listing proceeds as planned, November 13 could become a landmark moment for altcoin investment products and a sign that regulated crypto ETFs are entering mainstream financial markets.

Launch mechanics and product details

-

The ETF will trade on Nasdaq or another major U.S. exchange under a ticker that Canary Capital has not yet confirmed. Several filings suggest the ticker may be “XRPC.”

-

The fund is structured as a Delaware statutory trust and will hold direct spot XRP. No futures or synthetic exposure will be used.

-

Custodial providers and market makers are reportedly in place to support liquidity and orderly trading on the first day.

-

The removal of the delaying amendment gives the fund a direct legal path to launch. Unless the SEC issues new comments, the product will go live automatically on the expected date.

Risks and remaining conditions

-

Although the date is targeted and procedurally aligned, the launch still depends on final exchange filings such as Form 8-A and the absence of additional SEC review. Any new staff comments could delay effectiveness.

-

The auto-effective pathway speeds up the process, but it does not guarantee that the SEC will not exercise its authority to halt or modify the filing.

-

As with all crypto-related ETFs, the product carries risks such as volatility, liquidity fluctuations, custody risk and potential tracking differences between the ETF and spot XRP.

-

High expectations may pose additional pressure. If initial trading performance does not meet market enthusiasm, sentiment could shift quickly.

What to watch next

-

Official confirmation of the ETF ticker and the listing exchange.

-

Announcements from authorized participants and liquidity providers, which will shape the ETF’s trading quality.

-

Secondary market trading volume and creation-unit activity once the fund opens.

-

XRP price action as markets react to the upcoming launch and investors position ahead of the date.

-

Additional regulatory updates that may impact this ETF or future altcoin ETFs.

Final thoughts

Canary Capital’s spot XRP ETF represents one of the most significant steps yet toward expanding regulated crypto products beyond Bitcoin and Ethereum. If the ETF goes live on November 13, 2025, it will open the door for broader institutional involvement in XRP and potentially set the stage for additional altcoin ETFs.

For XRP holders, the launch could bring new sources of liquidity, price discovery and market legitimacy. For the industry at large, it signals a shift toward regulated access points for digital assets. Success, however, will depend on smooth execution, clear communication from regulators and strong market participation once trading begins.

All indicators suggest that the launch is on track. Unless regulators introduce unexpected changes, November 13 could become a historic date for crypto investment products.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

CFTC Prepares to Approve Leveraged Spot Crypto Trading in the U.S.

CFTC Eyes First Leveraged Spot Crypto Products by Next Month

The Commodity Futures Trading Commission (CFTC) is reportedly preparing to allow leveraged spot crypto asset products to launch as early as next month. These products would enable retail and institutional traders to buy and sell cryptocurrencies like Bitcoin and Ether on a spot basis with margin or leverage, similar to traditional commodity trading instruments.

This initiative marks a major shift in U.S. crypto regulation. For years, regulators treated spot crypto as largely unregulated or under-enforced. Now, the CFTC is using its existing authority under the Commodity Exchange Act to extend oversight to spot crypto trading, especially trades involving leverage, margin, or financing.

What the Proposal Means

Leveraged spot crypto products would work like this: A designated contract market (DCM) or registered futures exchange would list spot crypto contracts that are backed by actual delivery of crypto or tracked via underlying assets. Traders could engage in margin trades on the spot market rather than relying solely on futures or derivatives.

This means platforms regulated under the CFTC could list inventory of crypto assets, allow participants to borrow or finance positions, and require clearing, custody, and risk-management frameworks similar to those in commodities markets.

The CFTC recently launched a “listed spot crypto trading initiative,” inviting comment on how to list these products, including how to handle clearinghouses, custodian arrangements, and whether crypto assets are commodities or securities. That initiative referenced Section 2(c)(2)(D) of the Commodity Exchange Act, which specifically governs retail commodity transactions offered on a leveraged, margined, or financed basis.

The CFTC and the Securities and Exchange Commission (SEC) have also issued a joint staff statement affirming that current law does not prohibit regulated exchanges from listing certain spot crypto asset products, including those with leverage. Together, these regulatory moves signal a clear shift toward opening margin and leverage trading of spot crypto in the U.S.

Why It’s Significant for Crypto Markets

-

Regulatory clarity and scale

For years, one of the key obstacles in the U.S. crypto market was uncertainty over how spot trading with leverage could function under existing law. By establishing a path for leveraged spot crypto trading under CFTC authority, the industry gains a bridge to larger-scale, regulated activity. -

Margin and leverage could bring more liquidity

Allowing spot crypto trading with margin may attract more participants, both retail and institutional, because they can use less capital to gain exposure. That could increase market depth and volatility. -

Domestic competition with offshore exchanges

Many existing leveraged crypto products are offered by overseas exchanges that lack full U.S. oversight. A regulated domestic pathway could shift volume from offshore platforms to U.S. venues, improving transparency and investor protection. -

Integration with futures and derivatives markets

Because these spot leveraged products could be listed on futures exchanges, the ecosystem of trading, hedging, and settlement may become more integrated. This could bring spot, futures, and options markets into closer alignment for crypto assets.

The Regulatory Mechanics and Timeline

The key regulatory anchor is Section 2(c)(2)(D) of the Commodity Exchange Act (CEA), which states that retail commodity transactions offered on a leveraged, margined, or financed basis must be conducted on a DCM or foreign board of trade (FBOT). Historically, this applied to futures and certain commodities. The CFTC is now interpreting this to apply to spot crypto if leverage or financing is involved.

On August 4, 2025, the CFTC launched its listed spot crypto trading initiative. Regulators invited public comments on how to implement listing spot crypto asset contracts on designated contract markets. Meanwhile, the CFTC’s acting chair has engaged with regulated exchanges and clearing organizations to prepare the framework.

Separately, the SEC-CFTC joint staff statement issued in early September affirmed that regulated U.S. exchanges may list spot crypto asset products and that margin and leverage are within scope, provided proper registration and oversight exist.

According to multiple reports, the CFTC is in active discussions with major exchanges, including futures venues such as CME, Cboe, and ICE, as well as crypto-native platforms, to list these leveraged spot products possibly by next month. That timeline positions the rollout sooner than many expected, though final approvals and exchange rule submissions remain necessary.

Potential Risks and Industry Implications

While this development could scale regulated crypto markets, several risks remain:

-

Clearing and custody risk: Spot leveraged contracts require robust clearinghouses and custodians. Any weakness in settlement or collateral arrangements could create systemic stress.

-

Market risk: Leverage amplifies both gains and losses. If leveraged retail positions grow without sufficient risk controls, it could increase volatility or trigger sharp liquidations.

-

Regulatory arbitrage: As U.S. venues expand these offerings, overseas platforms may still offer different terms. Fragmentation could persist unless the domestic offering is competitive on cost and efficiency.

-

Securities law overlap: The CFTC’s effort applies to “commodity” crypto assets. If tokens are deemed securities, the SEC retains oversight. Platforms must ensure proper asset classification and compliance.

What to Watch Next

-

Exchange rule filings: Watch for futures exchanges or DCMs submitting rule changes or product proposals for leveraged spot crypto contracts.

-

Clearinghouse partnerships: Expect new collaborations between clearing organizations and crypto custodians, which are essential for safe margin and settlement operations.

-

Public feedback: The CFTC’s open comment process will reveal where industry stakeholders align or disagree on the proposal’s structure.

-

Asset inclusion: Bitcoin and Ether are expected to be first, but whether other tokens join early will indicate how broad the regulatory green light truly is.

-

Margin parameters: The permitted leverage levels, such as 2x, 5x, or 10x, will determine the potential scale of new trading activity.

Final Thoughts

The CFTC’s push to approve leveraged spot crypto products marks a pivotal moment in U.S. digital asset regulation. It moves the market closer to a structure where spot trading of crypto under margin and leverage is not only possible but also regulated in line with traditional commodities.

For the crypto industry, this means deeper liquidity, greater institutional involvement, and a more secure trading environment. Yet it also raises the stakes. Leverage and margin create opportunity but also amplify risk. The success of this initiative will depend on how carefully exchanges, clearinghouses, and regulators manage execution and oversight.

If the launch proceeds as early as next month, it could accelerate crypto’s integration into mainstream financial markets and bring a new era of regulated spot trading to the U.S. The next few weeks may determine whether leveraged spot crypto becomes a lasting cornerstone of the industry or remains a tightly controlled experiment.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Crypto Prices Surge After Trump Announces Tariff Dividend Plan

Crypto Prices Surge After Trump Announces Tariff Dividend Plan

Crypto markets moved sharply higher after President Trump announced his intent to send “at least” a $2,000 tariff dividend to every American, funded by tariff revenues. Bitcoin climbed roughly 1.7% to trade above $103,000, while Ethereum rose more than 3% to around $3,480. Solana also gained nearly 2%, helping the broader crypto market recover from a difficult week.

The announcement, which Trump described as a “dividend for the American people,” immediately set off speculation about a new wave of consumer stimulus. Market watchers compared the idea to the 2020–2021 stimulus checks that fueled both retail investing and crypto adoption during the pandemic.

What a “Tariff Dividend” Means

The proposal is straightforward: redistribute federal tariff revenue to households in the form of direct payments. The administration framed it as “returning America’s money to Americans,” though the plan would likely require congressional authorization and a detailed funding framework.

In practical terms, this would act much like a stimulus payment, except funded through tariffs rather than new government borrowing. Whether or not it comes to fruition, the market’s reaction suggests traders are already pricing in the possibility of renewed liquidity entering the system.

Why Crypto Reacted: The 2020 Playbook

When the United States issued direct stimulus checks in 2020 and 2021, data showed a measurable uptick in crypto activity. Exchanges recorded surges in $1,200 deposits — the same amount as the first stimulus payment — and analysts noted a wave of new retail wallets buying Bitcoin and Ethereum.

In other words, stimulus checks created a wealth shock that found its way into digital assets. The pattern was clear: free cash plus frictionless access to trading apps equaled inflows into crypto.

If a 2025 “tariff dividend” reaches consumer bank accounts, it could produce a similar reaction:

-

Immediate liquidity shock: Households receive cash, and some percentage of it flows into high-risk, high-reward assets.

-

Ease of access: It is easier than ever to buy crypto directly through apps that support bank transfers and debit cards.

-

Narrative power: Headlines about free money drive social media buzz, which has historically amplified market moves.

-

Altcoin momentum: In 2020 and 2021, retail inflows often rotated into smaller tokens, fueling broader speculative rallies.

How 2025 Differs From 2020

There are important differences between the two environments.

-

Economic backdrop: Interest rates are higher, inflation is more persistent, and households are facing tighter budgets. Liquidity injections might not carry the same purchasing power they did during lockdowns.

-

Policy complexity: A tariff dividend is not an emergency measure. It would require legislation, debate, and administrative systems to distribute funds.

-

Market maturity: Crypto ownership is broader and more institutionalized now. Retail checks could still drive excitement, but large funds and ETFs dominate trading volume.

-

Tariff revenue limits: Total tariff collections may not fully cover such large payments, which could influence how much money actually reaches citizens.

Even with these caveats, the narrative alone can move markets. Traders have a short memory for policy hurdles but a long memory for liquidity events.

Possible Scenarios

Scenario 1: Full $2,000 payments in early 2025.

Expect an immediate increase in retail deposits and small-ticket crypto buys. Bitcoin would likely lead the rally, followed by Ethereum and major Layer 1 tokens. Within days, altcoins could outperform as speculative capital spreads through the market.

Scenario 2: Reduced or delayed payments.

A scaled-down version would still spark optimism, but the impact would be smaller. Prices could rise on anticipation and then fade if payments are limited or phased in over time.

Scenario 3: No payments, only rhetoric.

If Congress rejects or delays the plan, the initial market rally could unwind quickly. Traders would shift focus back to macro factors such as interest rates and ETF inflows.

What to Watch Next

-

Policy developments: Official statements from the White House and Treasury will clarify how serious the proposal is.

-

Legislative signals: Watch for draft bills or congressional discussions that determine timing and funding.

-

Exchange activity: Look for clustering of retail-sized purchases near the proposed check amount, as seen in 2020.

-

Altcoin breadth: If retail flows return, altcoins typically benefit first due to their lower market caps and higher volatility.

-

Tariff policy shifts: Increased tariffs could pressure supply chains and offset some of the stimulus effect, adding complexity to market sentiment.

Final Thoughts

Today’s market reaction shows how sensitive crypto remains to liquidity narratives. History suggests that direct payments to households act as fuel for risk assets, particularly digital currencies.

In 2020, stimulus checks helped ignite one of the strongest bull runs in crypto history. Bitcoin’s price more than tripled in less than a year as new retail investors piled in. If a 2025 “tariff dividend” delivers similar injections of cash, it could trigger another wave of retail-driven buying — especially in the smaller, more speculative corners of the market.

Still, the outcome depends on whether policy turns into action. Until checks start landing, investors should treat this as a potential catalyst rather than a certainty. Yet if history is any guide, the prospect of free money flowing into crypto is enough to remind markets just how powerful liquidity can be.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Bybit Expands Into Real-World Assets with Backed Finance Partnership for Tokenized Stocks

Bybit Expands Into Real-World Assets with Backed Finance Partnership for Tokenized

A new wave of tokenized equity products is reshaping how investors access global markets, and xStocks is leading the charge. Created by Backed Finance in partnership with Bybit and Mantle, xStocks allows tokenized versions of major U.S. company shares such as Nvidia (NVDA), Apple (AAPL), and MicroStrategy (MSTR) to be traded on-chain in a regulated, transparent, and globally accessible format.

Each xStock token is backed one-to-one by the underlying equity, which is held in custody by regulated third-party custodians. This approach ensures full backing while enabling the shares to move seamlessly within decentralized finance (DeFi) ecosystems.

How xStocks Works

For every xStock minted, a real-world share of the corresponding company is held by the issuer in custody. These tokens can then be traded 24/7 on platforms such as Bybit and used within DeFi protocols for lending, borrowing, or liquidity provision.

Bybit supports deposits and withdrawals of xStocks through the Mantle Network, which acts as the blockchain infrastructure layer connecting centralized and decentralized platforms. Mantle’s low fees and high performance make it an ideal environment for on-chain trading of real-world assets.

This structure allows investors to gain global exposure to leading U.S. equities without the limitations of traditional brokerage systems or market hours. Tokenized stocks can also be composed into smart contracts, collateral systems, and decentralized trading strategies, creating new opportunities for both traders and developers.

Why Tokenized Stocks Matter

The launch of xStocks marks a major step toward convergence between traditional finance (TradFi) and decentralized finance. By tokenizing shares of publicly traded companies and making them available on-chain, the project introduces a host of benefits:

-

Global access: Investors from almost any region can gain exposure to U.S. stocks without relying on traditional brokerages.

-

Composability: Tokenized stocks can integrate with DeFi platforms, enabling creative use cases such as yield farming or collateralized lending.

-

Continuous trading: Unlike traditional markets, xStocks can trade around the clock, while still tracking underlying asset prices through custodial backing and oracle feeds.

-

Fractional ownership: Smaller investors can gain access to high-value stocks through fractionalized token units.

This level of accessibility and flexibility represents a meaningful expansion of the global financial system into blockchain-based environments.

Key Partnerships Driving xStocks

-

Backed Finance serves as the issuer and compliance manager for xStocks, ensuring that each token is fully backed by a corresponding equity share and held under regulated custody.

-

Bybit, one of the world’s top crypto exchanges, provides the liquidity, infrastructure, and user base to make tokenized stock trading seamless.

-

Mantle Network delivers the blockchain infrastructure that underpins the system, offering a modular Layer 2 framework with high throughput and low transaction costs.

Together, these partners form a complete pipeline for bringing traditional assets onto the blockchain. Shares are securely held, tokenized, and then made accessible through regulated on-chain channels.

Use Cases and Early Listings

The initial lineup for xStocks includes a mix of technology and finance leaders such as Nvidia, Apple, Tesla, Coinbase, and MicroStrategy. Each stock is represented by a corresponding xStock token (for example, NV DAX for Nvidia and MSTRX for MicroStrategy).

Holders can store these tokens in self-custody wallets, trade them directly on Bybit, or integrate them into DeFi applications across the Mantle ecosystem. Over time, more equities and potentially ETFs may be added to expand the offering.

Regulatory and Market Considerations

While the concept is groundbreaking, tokenized securities carry some caveats:

-

No voting or dividend rights: Token holders typically gain economic exposure but not shareholder privileges like voting or direct dividend collection.

-

Jurisdictional restrictions: Residents of certain countries, including the United States, may be restricted from purchasing or holding xStocks until further licensing is obtained.

-

Price variance risk: During off-market hours, token prices can deviate from the underlying asset price, creating both arbitrage opportunities and liquidity risks.

-

Regulatory evolution: The treatment of tokenized stocks varies across jurisdictions, and projects like xStocks will likely face ongoing regulatory review as adoption grows.

Even with these considerations, the model represents a significant advancement toward a future where on-chain representations of real-world assets can coexist with traditional financial infrastructure.

A New Era for Real-World Assets

Tokenization of assets like equities, bonds, and commodities has long been viewed as the next frontier for blockchain adoption. Projects such as xStocks demonstrate that this vision is now moving from concept to implementation.

By combining regulatory compliance, on-chain transparency, and cross-border accessibility, xStocks delivers a clear example of how tokenized finance could evolve. The initiative also highlights the growing appetite for real-world assets (RWAs) among DeFi participants, who are increasingly seeking stable, yield-bearing alternatives to purely speculative tokens.

Final Thoughts

The xStocks launch represents more than a new trading product. It is part of a broader transformation of financial infrastructure — one that connects traditional equity markets to the programmable, borderless nature of blockchain.

Bybit, Mantle, and Backed Finance are positioning themselves at the intersection of these two worlds. If xStocks succeeds, it could pave the way for widespread tokenization of major assets, potentially redefining how investors trade, store, and leverage real-world value in the digital age.

As more institutions explore on-chain settlement, custodial bridges, and tokenized asset offerings, xStocks may be remembered as one of the early milestones that made Wall Street truly interoperable with Web3.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Robinhood Crypto Revenue Soars 339% as Bitstamp Acquisition Expands Global Reach

Robinhood’s Crypto Revenue Soars, Signaling Surge in Retail Crypto Engagement

Robinhood Markets reported that its cryptocurrency-trading revenue surged by 339% in Q3 2025 to $268 million. This performance underscores the increasing role of crypto in Robinhood’s business model and reflects broader retail investor enthusiasm for digital assets. The rise comes against a backdrop of product innovation, global expansion and favorable sector sentiment.

Strong Performance Across the Platform

While crypto trading was a standout, Robinhood’s overall performance paints a positive picture of a company gaining traction. Earlier in the year the company reported Q2 revenue of $989 million, up 45% year-on-year and with crypto revenue alone up 98% to $160 million. The momentum built into stronger Q3 performance where crypto contributed a larger share of transaction-based revenues. The company’s expanded crypto product offerings, including new tokens, staking and acquisition of Bitstamp, helped fuel activity.

Why Crypto Revenue Grew So Fast

Several factors helped drive Robinhood’s crypto-business acceleration:

- Retail engagement in crypto trading is high. With more tokens listed, easier access and zero-commission trading, Robinhood has captured more users’ attention.

- Global expansion. The acquisition of Bitstamp gave Robinhood more licensing in Europe and access to more markets, increasing liquidity and cross-border trading.

- New product launches. Added services such as crypto staking in the U.S. and EU, tokenized stocks, and enhanced platform features boosted user activity.

- Macro environment. Periods of heightened crypto volatility and interest often correspond with higher trading volumes and revenue for platforms like Robinhood.

Implications for Robinhood and Crypto Platforms

For Robinhood, the spike in crypto revenue suggests the firm is successfully evolving beyond a retail stock-trading app into a broader digital-asset-centric platform. Crypto trading is no longer a niche segment, it is now a meaningful driver of revenue and growth.

For the broader crypto industry, Robinhood’s results highlight several important trends:

- Retail platforms with strong user bases and simple onboarding for crypto are gaining a larger share of trading volume and attention.

- Crypto is becoming more integrated into mainstream fintech business models, not just peripheral to them.

- Expanding regulatory clarity and global licensing (as seen via Bitstamp acquisition) are helping platforms scale crypto services globally.

- The overlap between equities, options and crypto trading is becoming more pronounced, as platforms leverage overlapping customer bases.

What to Watch Moving Forward

- Sustainability of the growth. Strong quarter-to-quarter gains are impressive but maintaining this requires continuous product innovation, user acquisition and regulatory compliance.

- Crypto revenue mix and token exposure. As crypto revenue grows, the breakdown by asset class, trading type and geography will matter for understanding risk and opportunity.

- Platform expansion and licensing. Global regulatory regimes continue to evolve, so Robinhood’s ability to scale globally while maintaining compliance will be key.

- Competitive landscape. Other platforms are competing aggressively in crypto trading, tokenization and wallet services. Robinhood’s product velocity and customer experience will determine how it holds competitive edge.

Robinhood’s Market Strength and Expanding Footprint

Robinhood’s impressive crypto performance came alongside strong overall financial results. Although shares dipped about 2% in after-hours trading, the stock remains up roughly 260% year-to-date, reflecting the market’s confidence in the company’s long-term trajectory.

Chief Financial Officer Jason Warnick said the quarter highlighted “another period of profitable growth” and emphasized the company’s diversification. He noted that Robinhood added two new business lines, Prediction Markets and Bitstamp, each already generating around $100 million in annualized revenue.

“Q4 is off to a strong start,” Warnick added, pointing to record trading volumes across equities, options, prediction markets, and futures, along with new highs for margin balances.

The company’s market capitalization has now reached $126 billion, placing it ahead of major competitors like Coinbase, which also reported strong earnings recently.

These results follow a string of moves aimed at deepening Robinhood’s role in the global crypto ecosystem. The acquisition of Bitstamp, one of the world’s oldest crypto exchanges, gave Robinhood an established regulatory presence and a user base spanning more than 50 countries. This acquisition not only expanded access to international markets but also strengthened its compliance infrastructure — a crucial advantage as global regulators define the next phase of crypto policy.

Final Thoughts

Robinhood’s record-setting quarter represents more than just strong numbers, it highlights a pivotal transformation in how traditional fintech and digital assets are converging.

The company’s 339% surge in crypto trading revenue reflects growing confidence among retail investors, while its acquisitions and new business lines show a clear pivot toward becoming a comprehensive global trading platform. With Bitstamp under its umbrella and new markets like prediction trading contributing nine-figure revenues, Robinhood is building an ecosystem that spans equities, options, futures, and crypto — all within a single, regulated framework.

Despite the minor dip in after-hours trading, investor sentiment remains overwhelmingly positive. Robinhood’s valuation of $126 billion underscores that the market views the company not as a speculative fintech, but as a major financial institution reshaping digital trading.

As the boundaries between finance and crypto continue to blur, Robinhood’s expansion signals a broader truth: the next generation of global markets will not separate traditional and digital assets. Instead, they will coexist on platforms that offer both speed and security — and Robinhood appears determined to lead that charge.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Crypto Markets Under Pressure as Bitcoin Falls Below $104,000

Crypto Markets Under Pressure as Bitcoin Falls Below $104,000

The crypto world is showing clear signs of stress. Bitcoin slipped below roughly $104,000, triggering a wave of liquidations and renewed concern over how fragile this market remains.

The Scale of the Liquidations

On-chain analytics and exchange data indicate that over $1.3 billion in positions were liquidated in just a 24-hour window when Bitcoin slipped under $104,000. The bulk of those losses came from long (bullish) bets.

One analysis found that around $600 million of liquidations were directly linked to Bitcoin’s fall under $104,000.

In earlier drops, like when Bitcoin fell under $108,000, at least $320 million in positions were liquidated.

ETF flows also reflected the sentiment, with large outflows of around $186.5 million hitting Bitcoin ETFs as the price dropped.

What’s Driving the Sell-Off

Several factors combined to produce this sharp correction:

-

Excess leverage: Many traders held large leveraged positions expecting the uptrend to continue. When the price broke key support, automatic liquidations accelerated the drop.

-

Technical triggers: The break below $104,000 appears to have been a psychological and technical threshold. Once it was breached, stop-losses and algorithmic selling kicked in.

-

Macroeconomic headwinds: Concerns around global growth, trade tensions, and regulatory uncertainty are making crypto a less comfortable risk asset right now.

-

Liquidity strain: When prices drop rapidly, thin liquidity in some crypto markets magnifies the effect of trades. Large orders or liquidations can push the price further than expected.

Why This Is More Than Just a Price Drop

This is not simply a normal pullback. It points to deeper vulnerabilities within the market.

It shines a spotlight on how exposed leveraged traders are in crypto markets.

It shows that major protocols or large holders are still vulnerable to rapid swings caused by price and sentiment.

It signals that the risk profile of crypto is evolving. Institutional participants and retail investors both face threats from sharp corrections and ecosystem instability, not just price volatility.

What to Watch Moving Forward

-

Support levels: Bitcoin near $100,000 to $104,000 is under the microscope. A sustained bounce could ease pressure, while a break below could trigger the next wave of liquidations.

-

Leverage risk: If more long positions unwind, additional forced selling could occur.

-

Sentiment and volume: Watch indicators like funding rates, open interest in futures, and spreads. When these show stress, the environment becomes more fragile.

-

Macro factors: Crypto is not isolated. Changes in interest rates, global trade shocks, or new regulations can quickly trigger risk-off sentiment.

-

Recovery potential: Some analysts believe this type of leveraged wipeout can be healthy in the long term. It clears excess risk and resets the market for future growth. The key is whether prices stabilize soon.

Final Thoughts

The current correction may not mark the end of the cycle, but it underscores how volatile and interconnected the crypto markets have become.

For anyone trading or investing in this space, success is not only about picking the right asset. It also depends on understanding how the broader system reacts when momentum reverses.

History has already shown how over-leverage can turn optimism into collapse. During the 2021–2022 downturn, major players like Three Arrows Capital (3AC) and Celsius Network imploded after taking on excessive risk through leveraged positions and unsustainable yield strategies. Their collapses erased billions in value, triggered contagion across lenders and exchanges, and shook investor confidence for years.

These events serve as reminders that leverage amplifies both gains and losses. In bull markets, it fuels parabolic rallies and rapid expansion. In downturns, it becomes a chain reaction that accelerates the fall.

The lesson is simple but critical: leverage without risk management always ends badly. The healthiest market growth comes from measured exposure, transparent liquidity, and long-term discipline...not from borrowing against optimism.

In crypto, big moves are not exceptions. They are the rule. The priority now is managing risk carefully, staying alert to signals, and avoiding the assumption that prices will always move higher.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.