#Ethereum

Uniswap Wins Final Dismissal in Rug Pull Lawsuit

Uniswap Labs has secured a decisive courtroom victory that could ripple across decentralized finance for years.

On March 2, a federal judge in New York dismissed, with prejudice, a long-running class action lawsuit accusing the company of facilitating crypto rug pulls on its decentralized exchange. The ruling closes the door on a case first filed in 2022 and underscores a principle that courts are becoming increasingly comfortable with: writing open-source software is not the same as committing securities fraud.

The Lawsuit That Would Not Go Away

The case began in April 2022, when a group of investors led by Nessa Risley sued Uniswap Labs, founder Hayden Adams, and several high-profile venture capital backers. The plaintiffs alleged that scam tokens traded on Uniswap had caused substantial losses and argued that the protocol’s creators should bear responsibility.

At its core, the lawsuit tried to stretch traditional securities law into a decentralized environment. The argument was relatively straightforward. If fraudulent tokens were being created and traded on Uniswap, and if Uniswap’s infrastructure made that trading possible, then perhaps the developers and investors behind the protocol were on the hook.

The problem for the plaintiffs was always going to be causation and knowledge.

But Uniswap is a permissionless protocol built on Ethereum. Anyone can deploy a token. Anyone can create a liquidity pool. Smart contracts execute swaps automatically. There is no listing committee. No approval process. No centralized trading desk.

Over the past four years, the case wound through motions to dismiss, amendments to complaints, and an appeal to the Second Circuit. Federal securities claims were largely thrown out earlier in the process. What remained were state law claims, including allegations that Uniswap had aided and abetted fraudulent conduct.

This week, those claims fell too. Manhattan federal judge Katherin Polk Failla dismissed the suit with prejudice on Monday.

Why the Court Said No

Judge Katherine Polk Failla dismissed the second amended complaint with prejudice, meaning the plaintiffs cannot bring the same claims again.

The reasoning was technical but important. To establish aiding and abetting liability, plaintiffs generally must show that a defendant had actual knowledge of wrongdoing and substantially assisted it. The court found that the complaint failed on both fronts.

There were no plausible allegations that Uniswap Labs knew about specific rug pulls before they happened. Nor was there evidence that the company took affirmative steps to advance fraudulent schemes. Providing a neutral, automated protocol that others can use, even if some use it badly, was not enough.

The court drew comparisons to other neutral infrastructure. Payment networks process transactions that later turn out to be illicit. Messaging apps are used for scams. Internet service providers transmit fraudulent communications. Yet courts have historically hesitated to hold those intermediaries liable absent clear knowledge and participation.

The same logic, at least here, applied to DeFi.

The dismissal with prejudice sends a strong signal.

A Win for Protocol Neutrality

Uniswap founder Hayden Adams described the outcome as sensible. Company lawyers called it precedent-setting. That may not be an exaggeration.

The Second Circuit had already affirmed dismissal of the core securities claims last year, reinforcing the notion that decentralized trading protocols are not automatically securities exchanges under existing law. This final ruling on the remaining state claims sharpens the boundary further.

Developers who publish autonomous smart contracts are not, by default, guarantors of every token that trades through them.

If courts had ruled the other way, it would have opened the door to expansive liability for developers across DeFi. Automated market makers, lending protocols, even wallet providers could have found themselves exposed whenever bad actors exploited open systems.

Instead, the judiciary appears to be drawing a line between building infrastructure and orchestrating fraud.

Venture Capital Backers Breathe Easier

The case also named major venture capital firms that invested in Uniswap Labs. While those firms were not accused of directly launching scam tokens, plaintiffs argued that by funding and promoting the protocol, they shared responsibility.

Those claims have now effectively collapsed alongside the broader case.

For crypto VCs, the ruling reduces a specific litigation risk. Investing in a protocol that later hosts fraudulent activity does not automatically translate into liability, at least under the theories tested here.

Still, risk has not disappeared. Regulators continue to scrutinize token listings, governance structures, and revenue models. And courts have not issued a blanket immunity for DeFi projects.

What this case does suggest is that stretching traditional intermediary liability to decentralized software will be an uphill battle.

A Move in the Right Direction

The broader regulatory environment for crypto remains unsettled. Lawmakers are still debating market structure legislation. Agencies continue to spar over jurisdiction. Courts are gradually filling in gaps.

Uniswap’s victory does not settle whether certain tokens are securities. It does not resolve how decentralized autonomous organizations should be treated under U.S. law. And it certainly does not eliminate fraud in DeFi.

But it does clarify one thing.

Writing code that others misuse is not, without more, a securities violation.

For an industry that has spent years arguing that decentralized protocols are more like public infrastructure than traditional financial institutions, this ruling is validation. It also places pressure back where many judges seem to believe it belongs, on the individuals who design and execute scams.

As DeFi matures, that distinction between neutral tools and active misconduct will likely remain central. The Uniswap case may not be the final word, but it is an important chapter in defining how far platform liability extends in crypto’s open markets.

Investors Doubling Down on BitMine, Ethereum

Ethereum has been stuck in a prolonged downtrend. Prices are down more than 60 percent from the August 2025 highs, sentiment is shaky, and some analysts are floating scenarios where ETH could revisit the $1,400 level before finding a durable bottom.

And yet, through all that noise, something else is happening in the background.

Investors are still buying BitMine, as BitMine is buying more Ethereum.

Not trimming. Not waiting. Buying. In some cases, buying aggressively.

Ethereum Weakness Sets the Stage

The broader crypto market has been under pressure for months. Spot Ethereum ETFs have seen notable outflows, a sharp contrast to the steady demand flowing into Bitcoin products. That divergence has reinforced the narrative that institutions are leaning toward relative safety in BTC while treating ETH with more caution.

Ethereum’s price action reflects that hesitation. Lower highs, fading rallies, and persistent risk off positioning have defined the tape. Even bullish long term analysts concede that the near term setup remains fragile.

But the selloff has not scared everyone away.

BitMine Is Doubling Down

BitMine Immersion Technologies, (BMNR), has quietly become one of the largest corporate holders of ETH after pivoting to an Ethereum treasury strategy in 2025 under Chairman Tom Lee.

The company has accumulated millions of tokens, building a balance sheet that is heavily exposed to Ethereum. That exposure has not looked pretty on paper during the drawdown. Reports show billions in unrealized losses as ETH retraced from its highs.

Still, BitMine has continued to add.

Rather than slowing purchases during weakness, the company has leaned into the downturn. The logic appears straightforward. If the long term thesis around Ethereum remains intact, lower prices represent opportunity rather than risk.

It is a classic buy the dip strategy, but on a corporate scale.

Ark Invest Adds More Shares

Cathie Wood’s Ark Invest has reinforced that narrative. The firm has repeatedly increased its exposure to BitMine across multiple ETFs, adding millions of dollars worth of BMNR shares even as Ethereum remained under pressure. The firm bought a total of 212,314 shares across three of its exchange-traded funds, worth $4.2 million based on Thursday's closing price.

Ark has a history of leaning into volatility in high conviction themes. Crypto infrastructure and blockchain exposure remain central to its long horizon strategy. In that context, adding BitMine during a downtrend fits the pattern.

For Ark, the weakness in ETH may be noise relative to the structural growth story around smart contracts, tokenization, and onchain financial rails.

BlackRock Increases Its Stake

It is not just Ark.

BlackRock has also boosted its BMNR position significantly, increasing its holdings by more than 165 percent according to recent disclosures. That scale of increase is difficult to ignore, especially in a market where Ethereum linked products have seen soft flows.

The timing is notable. While some funds reduced direct ETH exposure through ETFs, large asset managers appear comfortable gaining exposure indirectly through equity vehicles like BitMine.

For institutions that prefer regulated equity structures over direct token custody, BMNR offers a levered proxy. It packages Ethereum exposure inside a public company wrapper, complete with traditional reporting and corporate governance.

That structure can matter for mandates that limit direct crypto ownership.

Why Buy BitMine When ETH Is Falling

At first glance, the trade looks counterintuitive. Ethereum is in a downtrend. ETF flows are mixed at best. Volatility remains elevated.

But the bull case rests on a few pillars.

First, long term fundamentals. Ethereum still anchors decentralized finance, stablecoin issuance, and a growing tokenization ecosystem. Institutional advocates argue that the network’s utility has not disappeared simply because price momentum has faded.

Second, balance sheet leverage. BitMine’s growing ETH treasury creates a scenario where equity performance can amplify moves in the underlying asset. For investors who believe ETH eventually reclaims higher levels, BMNR can offer outsized upside.

Third, cycle dynamics. Crypto markets have a history of brutal drawdowns followed by sharp recoveries. Accumulating during periods of pessimism has historically rewarded patient capital, even if timing the bottom is nearly impossible.

Investors are clearly looking past the next few quarters and thinking long term on Ethereum.

The Bottom Line

There is a clear split in the market right now.

Short term traders are reacting to chart levels, macro uncertainty, and ETF flow data. Long term allocators appear to be focusing on strategic positioning.

The continued accumulation of BitMine shares by names like Ark Invest and BlackRock suggests that institutional conviction in Ethereum infrastructure has not broken, even if spot prices have.

That does not guarantee a rebound. Ethereum could test lower levels before sentiment turns. Volatility is part of the asset class.

But the steady bid under BitMine tells its own story.

Even in a downtrend, capital is being deployed...with intent.

For now, Ethereum may be drifting lower. BitMine buyers, however, are still stepping in and definitely betting on Ethereum for the long haul.

Robinhood Chain Launches Ethereum L2 Testnet

Robinhood is going deeper into crypto infrastructure.

The company has launched the public testnet for Robinhood Chain, its own Ethereum layer 2 network built on Arbitrum’s rollup technology. Until now, Robinhood has mostly acted as a gateway, letting users trade crypto and, in some regions, tokenized equities. This move changes that. It is now building the underlying blockchain where those assets could live.

It is a meaningful shift. Running a brokerage app is one thing. Operating blockchain infrastructure is another.

What Robinhood Chain Actually Is

Robinhood Chain is a permissionless Ethereum layer 2. It uses Arbitrum’s technology, which means it inherits Ethereum’s security while offering lower transaction costs and higher throughput through rollups.

“With Arbitrum’s developer-friendly technology, Robinhood Chain is well-positioned to help the industry deliver the next chapter of tokenization and permissionless financial services,” said Steven Goldfeder, Co-Founder and CEO of Offchain Labs. “Working alongside the Robinhood team, we are excited to help build the next stage of finance.”

For developers, it is EVM compatible. Smart contracts built for Ethereum can be deployed here with standard tooling. Wallets, developer libraries, and infrastructure services should feel familiar.

On paper, nothing radical. The differentiation is not in the virtual machine. It is in the intended use case.

The Core Bet: Tokenized Stocks

Robinhood is clearly focused on tokenized real world assets, especially public equities and ETFs.

The company has already offered tokenized stock exposure in Europe. Now it is building infrastructure that could support broader issuance and trading of these assets directly onchain.

A big part of the pitch is continuous trading. Crypto markets operate 24 7. Traditional stock exchanges do not. If equities are represented as tokens on a blockchain, they can, in theory, trade at any time and settle much faster than traditional systems.

That sounds straightforward. In practice, it depends heavily on regulatory clarity. Tokenized securities raise questions around custody, investor protections, and jurisdictional restrictions. Robinhood has acknowledged this and appears to be designing the chain with compliance in mind.

Compliance Is Not an Afterthought

Unlike many general purpose layer 2 networks, Robinhood Chain is being built with regulated financial products as the primary target.

That means infrastructure that can handle minting and burning of tokenized securities in a controlled way. It likely also means features that support jurisdiction based restrictions and other compliance requirements at the protocol or system level.

Robinhood has not framed this as a purely decentralized experiment. It is positioning the network as financial infrastructure, with guardrails.

That will appeal to some institutions. It may frustrate parts of the crypto community. Both reactions are predictable.

Infrastructure Partners in Place

Robinhood is not building this alone.

Chainlink is involved to provide oracle services, which are essential if you are dealing with tokenized stocks that need accurate real world price feeds. Alchemy is supporting developer infrastructure. Other analytics and compliance firms are integrated from the outset.

This is not a bare bones testnet thrown into the wild. It is being launched with a fairly complete infrastructure stack.

The company is also rolling out developer documentation and encouraging builders to start experimenting immediately.

The Exchange Layer 2 Trend

Robinhood joins a growing list of exchanges and fintech firms launching their own Ethereum layer 2 networks.

Coinbase operates Base. Kraken is developing its own network. Other trading platforms are exploring similar strategies.

The rationale is not complicated. If tokenized assets and onchain trading grow, exchanges would prefer that activity to happen on networks they influence, rather than on third party chains. Controlling infrastructure can mean more flexibility in product design, fee structures, and integration with existing platforms.

For Robinhood, which already serves millions of retail users, owning a layer 2 could tighten the loop between its app, its wallet, and onchain markets.

Testnet Today, Mainnet Later

Right now, Robinhood Chain is in public testnet. Developers can deploy contracts, test integrations, and experiment with wallet flows, including direct testing with Robinhood Wallet. No production assets are live yet.

To drive activity, Robinhood is backing developer engagement with hackathons and incentives, including a seven figure prize pool aimed at financial applications built on the network.

A mainnet launch is expected later this year, though exact timing has not been pinned down publicly. Technical stability and regulatory comfort will likely dictate the pace.

The Bottom Line

Robinhood Chain is a signal that tokenized finance is not just a side project for major platforms anymore.

If tokenized equities become widely accepted, infrastructure will matter as much as distribution. Robinhood already has distribution through its app. Now it is trying to build the rails underneath.

There are open questions. Will regulators in the US allow meaningful onchain trading of tokenized securities? Will liquidity concentrate on exchange backed layer 2s or on more neutral networks? Will users care which chain their tokenized stock sits on?

For now, Robinhood has made its position clear. It wants to be more than a broker. It wants to operate the blockchain layer where digital versions of traditional assets trade and settle.

The testnet is the first real step in that direction.

A Ghost From Ethereum’s Past Is Becoming a $220 Million Security Fund

Nearly a decade after one of crypto’s most painful episodes, a large pool of forgotten Ether tied to TheDAO is being put back to work. This time, not as a risky experiment, but as a long-term security fund for Ethereum.

Roughly $220 million worth of ETH that has sat unclaimed since the infamous 2016 DAO hack is being transformed into a new, ecosystem-wide security endowment. The goal is simple on paper: fund audits, tools, research, and emergency response efforts that help keep Ethereum and its users safe.

From Crisis to Capital

To understand why this matters, you have to go back to TheDAO itself.

In early 2016, TheDAO was pitched as a radical idea. A decentralized venture fund governed entirely by code and token holders. It quickly became the biggest crowdfunding event crypto had ever seen, pulling in millions of Ether from participants around the world.

Then it broke.

A flaw in the smart contract allowed an attacker to drain a massive portion of the funds. Panic followed. Debates erupted. And eventually, Ethereum hard-forked to reverse the damage, a decision that permanently split the network and created Ethereum Classic.

What was left behind were fragments of that original system. Contracts that never got emptied. ETH that was never claimed. Funds that, for years, were largely ignored.

Now they are coming back into focus.

Where the Money Comes From

The new security fund is built from two main pools of ETH left over from TheDAO era.

The largest portion comes from what is known as the ExtraBalance contract. This Ether was left behind during the original refund process, largely due to overpayments and technical quirks. Today, that balance adds up to more than 70,000 ETH, worth over $200 million at current prices.

Most of that ETH will not be spent outright. Instead, the majority is expected to be staked, generating yield that can fund security work year after year. That turns a one-time windfall into something closer to an endowment.

The second pool is smaller but more immediately usable. Around 4,600 ETH sits in old curator-related wallets connected to TheDAO. Those funds are expected to be deployed more directly toward grants and security initiatives.

Together, they form one of the largest dedicated security funds the Ethereum ecosystem has ever seen.

What the Fund Will Actually Do

Ethereum has no shortage of capital, but security spending has often been fragmented. This fund is meant to change that.

The focus is broad by design. Audits for major protocols. Funding for security tooling and infrastructure. Support for incident response teams when exploits happen. Research into emerging risks across layer 2 networks, wallets, and user-facing applications.

There is also an emphasis on user protection, things like phishing detection, transaction safety tools, and services that help everyday users avoid costly mistakes.

Some of the money will likely go to well-known security firms. Some will go to smaller, community-driven projects that quietly do important work but struggle to secure consistent funding.

Governance, DAO-Style

In a nod to TheDAO’s original vision, the fund will not operate like a traditional foundation grant program.

Instead, distribution is expected to lean heavily on decentralized governance mechanisms. Quadratic funding, retroactive grants, and community voting will all play a role. The idea is to reward impact, not just proposals, and to let a broad set of stakeholders help decide where the money goes.

The Ethereum Foundation will still be involved, particularly in setting guardrails and defining what qualifies as security work. But the ambition is to keep decision-making as open and participatory as possible.

Why This Matters Now

Ethereum is no longer an experimental network. It secures hundreds of billions of dollars in value across DeFi, NFTs, stablecoins, and layer 2 systems. With that scale comes constant pressure from attackers.

Exploits today are faster, more complex, and often more damaging. At the same time, public funding for security work tends to lag behind growth. This fund helps close that gap.

It also reflects a broader shift in how the Ethereum community thinks about risk. Security is no longer something you bolt on at the end. It is infrastructure.

The Bottom Line

There is something poetic about this moment. I love how they are taking one of Ethereum's darkest moments and turning it in to a security fund to try to ensure that something like this would never happen again.

TheDAO hack forced Ethereum to confront its own limits

It exposed the dangers of unaudited code and untested governance. It shaped how the ecosystem thinks about security to this day.

Turning the remnants of that failure into a permanent security fund feels like closing a loop. A way of acknowledging the past without being defined by it.

If the fund works as intended, one of crypto’s earliest disasters may end up funding its future resilience.

Schwab Jumps into the Crypto Ring: A New Era for TradFi?

The walls between Wall Street and the "Wild West" of digital assets just got a little thinner.

Charles Schwab, the stalwart of retail investing, has officially signaled its intent to join the spot crypto trading fray.

CEO Rick Wurster confirmed on Yahoo Finance’s Opening Bid podcast that Schwab plans to roll out spot Bitcoin and Ethereum trading within the next 12 months. The rollout will debut on their high-octane Thinkorswim platform before migrating to the standard Schwab.com and mobile interfaces.

The Strategy: Blue Chips Only

While platforms like Robinhood or Coinbase often lean into the viral chaos of "meme coins," Schwab is taking a predictably measured approach. Wurster made it clear that the firm isn't interested in the speculative frenzy of the latest Shiba Inu derivative.

"Those are areas we will leave to the side," Wurster stated, emphasizing that Schwab’s focus remains on "everyday investors" looking to integrate crypto into a diversified, long-term portfolio.

A Shifting Regulatory Tide

Schwab isn't acting in a vacuum. The move comes as the regulatory environment in Washington undergoes a massive vibe shift. Since the Trump administration took office, the SEC has pivoted from its previously aggressive "regulation by enforcement" stance.

With the swearing-in of the pro-crypto Paul Atkins as SEC Chair—replacing the crypto-skeptic Gary Gensler—lawsuits against major exchanges have been dropped, and restrictive accounting rules for banks holding crypto have been scrapped. Morgan Stanley is reportedly following a similar blueprint, with eyes on adding spot trading to E*Trade by 2026.

Ty’s Take: The View from the New Guy

As someone who is relatively new to the financial industry, watching this unfold feels like seeing a massive cruise ship finally decide to change course. For years, the "old guard" of finance treated crypto like a radioactive hobby. Now, they're laying out the red carpet.

My honest opinion? This is the "Adults in the Room" moment for crypto.

I think Schwab’s decision to avoid meme coins is a brilliant move for their brand. It tells their clients: "We aren't here to help you gamble; we're here to help you invest." For a guy like me, seeing these legacy institutions provide a regulated, familiar bridge to Bitcoin makes the space feel less like a casino and more like a legitimate asset class.

However, there’s a catch. Part of me wonders if Schwab is a little late to the party. By the time they launch, many retail investors may have already set up shop elsewhere. But if there’s one thing I’ve learned in my short time here, it’s that you never bet against the convenience of having all your money—stocks, bonds, and now crypto—under one roof.

The "crypto winter" is officially over, and the thaw is being led by the very people who once told us to stay away. It’s an exciting time to be entering the industry, even if it means I have a lot more homework to do on blockchain tech.

Vitalik Buterin Says 2026 Is Ethereum’s Reset for Self Sovereignty

Vitalik Buterin is not really talking about price right now. That alone makes his latest message stand out.

While much of the crypto market remains fixated on ETFs, flows, and whether this cycle has one more leg left, Ethereum’s co-founder is pointing somewhere else entirely. In his view, 2026 should be the year Ethereum starts actively reversing what he sees as a slow drift away from self-sovereignty and trustlessness.

It is not framed as a dramatic pivot or some shiny new roadmap. It is more like a reminder. Ethereum, according to Buterin, has spent years getting bigger, faster, and easier to use, and in the process it has quietly accepted compromises that would have felt uncomfortable in its earlier days.

Now he wants to unwind some of that.

Ethereum Got Easier, and That Was Not Free

There is no denying Ethereum’s growth. Rollups work. DeFi runs real money. Institutions are here. The network feels permanent in a way it did not a few years ago.

But ease comes with dependencies. Many users do not run nodes. Many apps rely on the same handful of infrastructure providers. Wallets often default to custodial or semi-custodial setups because it is simpler and users are afraid of losing seed phrases.

None of this is accidental. It happened because it worked. It brought users in. It made Ethereum usable.

But Buterin’s argument is that convenience has slowly started to crowd out something more important. If Ethereum depends too much on trusted intermediaries, even friendly ones, then it starts to look less like a trustless system and more like a decentralized brand layered on top of familiar structures.

That, in his view, is a problem worth addressing head-on.

Self-Sovereignty Is Not Just a Slogan

When Buterin talks about self-sovereignty, he is not being abstract. He is talking about very practical things, like how people actually control their assets.

Seed phrases remain one of crypto’s most unforgiving design choices. Lose it and your funds are gone. For many users, that risk pushes them straight into custodial solutions, which defeats the point.

Ethereum’s push around account abstraction and social recovery wallets is meant to change that dynamic. The idea is not to make users memorize better passwords. It is to give them safer ways to stay in control without handing the keys to someone else.

This is where Buterin tends to sound almost stubborn. He does not accept that usability and self-custody have to be opposites. He sees bad wallet UX as a solvable design problem, not a reason to abandon the principle.

Running a Node Should Not Feel Like a Hobby Project

Another issue that keeps coming up is verification. Ethereum is designed so anyone can independently verify the network’s state. In practice, most people do not.

Instead, users and apps lean on centralized RPC providers, cloud services, and hosted endpoints. It works. Until it does not.

Buterin has been blunt about this. If Ethereum becomes a network where only a small group of actors can realistically verify what is happening, then decentralization starts to thin out where it matters most.

This is why there is so much emphasis on lighter nodes, better data availability, and zero-knowledge tech. The goal is not academic elegance. It is making verification cheap and accessible enough that it becomes normal again.

In other words, Ethereum should be something you can check for yourself, not something you take on faith.

Privacy Is Still Missing From the Default Experience

Despite years of progress, privacy on Ethereum remains optional and often awkward. Many transactions leak more information than users realize, simply because they rely on centralized relayers or analytics-heavy infrastructure.

Buterin has been pushing the idea that privacy should feel boring. Not exotic. Not advanced. Just there.

If private transactions require special effort or deep technical knowledge, most users will skip them. That creates a network where surveillance becomes the default state, which cuts directly against the idea of permissionless participation.

The renewed focus here is about making privacy part of the base layer experience, not something bolted on later for power users.

Thinking Past the Current Cycle

One of the more interesting parts of Buterin’s recent comments is how long-term they are. He talks openly about quantum resistance and cryptographic upgrades that may not matter for years.

That is not the kind of thing that drives usage next quarter. It is the kind of thing you worry about if you think Ethereum should still be around in 20 or 30 years.

The same mindset shows up in his thoughts on stablecoins and financial infrastructure. Relying entirely on centralized issuers and traditional banking rails might be convenient now, but it introduces fragility over time.

The message is subtle but consistent. Ethereum should not optimize only for what works today. It should optimize for what survives stress.

Less Hype, More Backbone

There is also something missing from this conversation, and it feels intentional. Buterin is not talking about memecoins, viral apps, or chasing narratives to pump activity.

Instead, he keeps circling back to resilience. Can Ethereum keep working if major providers go offline. Can users still transact if key companies disappear. Can the system hold up under pressure.

That focus might feel boring to parts of the market. It is also probably why it matters.

Why This Year Matters

Ethereum is no longer trying to prove that it works. It already does. The question now is what kind of system it wants to be as it becomes harder to change.

By framing 2026 as a year of recommitment, Buterin is effectively asking the ecosystem to slow down just enough to check its foundations. Not to undo progress, but to make sure that progress did not quietly hollow out the original mission.

Whether developers and users fully follow that lead is an open question. Ethereum is too big to move in one direction all at once.

Still, when its most influential voice says the next phase is about trustlessness, self-sovereignty, and resilience, it is worth paying attention. Not because it promises a price move, but because it says something about where Ethereum thinks its long-term value really comes from.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Alchemix v3 Upgrade Signals the Next Phase of Self-Repaying DeFi

Alchemix has always been built around a simple but powerful idea. Use yield to repay debt over time and let users borrow without the pressure of liquidations. That foundation remains fully intact in Alchemix v3.

What v3 introduces is scale, structure, and confidence.

With the full protocol migration set for February 6th, 2026, Alchemix is rolling out its most advanced architecture to date, expanding what self-repaying loans can support while keeping the experience familiar to long-time users.

v3 Is Built to Do More, Cleanly and Intentionally

Alchemix v3 represents a step forward in how the protocol organizes yield, debt, and user positions.

The new system introduces standardized vaults, clearer internal accounting, and a modular design that allows the protocol to support higher capital efficiency and more predictable outcomes. These upgrades do not change how Alchemix works at a conceptual level. They allow it to work at a larger scale, with more flexibility.

It is the difference between a system that functions well and one that is designed to support growth.

Fixed Redemption Windows Add Structure to the System

A standout feature of v3 is the upgraded Transmuter and the introduction of fixed redemption windows.

Synthetic assets like alUSD and alETH can now be redeemed for underlying collateral after defined timeframes. This gives the system a clearer rhythm and strengthens peg behavior, while still relying on yield as the core engine behind redemptions.

For users, this means clearer expectations. For the protocol, it means more predictable flows and easier long-term planning.

This added structure is a major step forward in making self-repaying loans easier to understand and trust at scale.

Mix-Yield Expands Yield’s Role in the Protocol

Yield has always been central to Alchemix, and v3 expands what yield can do through the introduction of the Mix-Yield Token, or MYT.

MYT represents aggregated yield exposure managed at the protocol level. Instead of interacting with individual strategies, users gain access to diversified yield through a single mechanism governed by the DAO.

This design allows Alchemix to adapt as yield opportunities evolve, without changing the user experience. It also strengthens the protocol’s ability to manage risk and allocate capital efficiently across strategies and environments.

It is yield abstraction done with intention.

Higher Capital Efficiency, Same Calm Experience

One of the most visible improvements in v3 is the increase in borrowing capacity to up to 90 percent loan-to-value.

This unlocks significantly more flexibility for users, allowing capital to work harder while maintaining the defining characteristics of Alchemix. Loans still repay themselves over time. There are still no liquidations. Users are still free from constant position management.

The improvement comes from a stronger internal structure and more efficient system design, not from added complexity.

Position NFTs Open the Door to Composability

In v3, user positions are represented as NFTs that fully encode collateral, debt, and yield exposure.

This approach makes positions easier to track, transfer, and integrate with other DeFi protocols in the future. It also simplifies the protocol’s internal architecture, making it more modular and easier to extend.

Position NFTs serve as a building block, enabling Alchemix to plug into a wider ecosystem without altering its core mechanics.

A Migration Designed for Continuity and Confidence

The move to v3 is being executed through a protocol-level migration that prioritizes continuity.

On February 6th, 2026, v2 contracts will be frozen, positions will be snapshotted, and equivalent positions will be recreated in v3. Economic value is preserved, and users are not required to take action unless they choose to.

To reinforce alignment, Alchemix is also introducing a Migration Mana Program that rewards users who remain deposited through the transition.

The process reflects a careful, deliberate approach to upgrading critical infrastructure.

v3 Clarifies Where Alchemix Is Headed

As details around v3 have emerged, the direction of the protocol has become clearer.

Alchemix is focusing on predictability, capital efficiency, and long-term composability. The goal is not to chase trends, but to strengthen the foundations of self-repaying finance so it can support broader use cases over time.

Alchemix, Expanded

Alchemix v3 does not replace what came before. It expands on it.

Self-repaying loans remain the core. Yield remains the engine. Time remains a feature, not a risk.

With the v3 migration scheduled for February 6th, 2026, Alchemix is demonstrating how a proven DeFi model can evolve thoughtfully, gaining structure and scale without losing its identity.

Sometimes the most powerful upgrades are the ones that simply let a great idea grow into its full potential.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

MrBeast, DeFi, and a $200M Investment by BitMine

A public company best known for holding large amounts of Ethereum is now placing a very different kind of bet, one that sits at the intersection of crypto, finance, and the creator economy.

BitMine Immersion Technologies, a crypto treasury firm chaired by Fundstrat’s Tom Lee, says it plans to invest $200 million into Beast Industries, the company behind YouTube creator MrBeast. The goal, according to executives, is to explore how decentralized finance could play a role in a future financial services platform tied to one of the internet’s largest audiences.

This is not a meme coin launch or a celebrity endorsement deal. It looks more like a strategic attempt to combine capital markets, Ethereum infrastructure, and massive consumer distribution.

Why a crypto treasury firm is backing a creator company

BitMine has been repositioning itself as an Ethereum-focused treasury company, following a playbook that investors have seen before in Bitcoin-heavy balance sheet strategies. The difference is scale and ambition.

The firm holds a substantial amount of ETH and has spoken publicly about building staking infrastructure and validator operations. But simply holding crypto is no longer enough to sustain investor interest, especially as enthusiasm around treasury-style trades has cooled.

The next step is finding ways to turn those holdings into something operational. That is where Beast Industries comes in.

MrBeast is not just a YouTuber. His business spans media, merchandise, and consumer brands, and it reaches hundreds of millions of people, many of them young and digitally native. For a company looking to build or support crypto-based financial products, that kind of distribution is hard to ignore.

What Beast Industries appears to be exploring

Executives at Beast Industries have been clear that the company is looking at financial services. Trademark filings and past reporting suggest a wide scope, including payments, lending, insurance, and potentially crypto-related offerings.

The key word is explore. There is no product launch yet, and there is no guarantee that every idea becomes reality. Still, the language around incorporating DeFi suggests interest in crypto-native rails rather than simply slapping a brand on traditional products.

In practice, that could mean crypto-powered payments, wallet functionality, token-based rewards, or lending products that lean on blockchain infrastructure behind the scenes. It could also mean partnerships with existing fintech or crypto firms to avoid the heavy regulatory lift of building financial institutions from scratch.

DeFi as a distribution play, not a technical flex

In this context, DeFi should probably be read less as a commitment to complex on-chain protocols and more as a distribution strategy.

For years, crypto has struggled to reach mainstream users without relying on exchanges or speculative narratives. A creator-led platform flips that equation. The audience already exists. The challenge becomes offering products that are simple, compliant, and trustworthy enough to meet that audience where it is.

That trust component matters. MrBeast’s brand is built on transparency and goodwill. Any financial product under that banner would be judged harshly if it felt confusing, risky, or exploitative. Crypto’s history with celebrity-adjacent scams only raises the stakes.

The risks on both sides of the deal

For Beast Industries, entering finance is not trivial. Even lightweight financial products come with regulatory scrutiny, reputational risk, and long-term obligations to users. A misstep could damage a brand that has taken years to build.

For BitMine, the risk is different. Crypto treasury strategies have gone in and out of favor, often tracking the price of the underlying asset more than business fundamentals. Investors have shown signs of fatigue toward companies whose primary strategy is buying and holding crypto.

Backing a creator-led financial push is an attempt to move beyond that narrative. Whether markets reward that shift remains an open question.

Why this matters beyond one deal

This investment fits into a broader trend where crypto companies are looking for real-world distribution and cash-flow-adjacent businesses, while creators are looking for ways to turn attention into durable platforms.

Ethereum sits in the middle of that equation. It provides the infrastructure for staking, tokenization, and programmable finance, all of which appeal to firms trying to rethink how financial products are built and delivered.

The unusual part is seeing a public crypto treasury company and a creator empire meet at that intersection.

What to watch next

Several things will determine whether this becomes a defining moment or a footnote.

First is structure. How the investment is deployed, and what BitMine actually receives in return, will shape how investors interpret the move.

Second is execution. A vague commitment to DeFi means little without a clear product vision and compliance strategy.

Third is messaging. Any hint of speculative tokens or unclear financial incentives could quickly undermine trust.

The bigger picture

BitMine’s $200 million bet is a sign that crypto treasury firms are searching for their next evolution. Holding Ethereum is one thing. Building products, platforms, and distribution around it is another.

MrBeast brings something crypto rarely has in abundance: mainstream attention paired with trust at scale. Whether that combination can be turned into sustainable financial services without repeating the industry’s past mistakes is the real test.

For now, the deal signals that crypto’s next phase may be less about balance sheets and more about who controls distribution.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

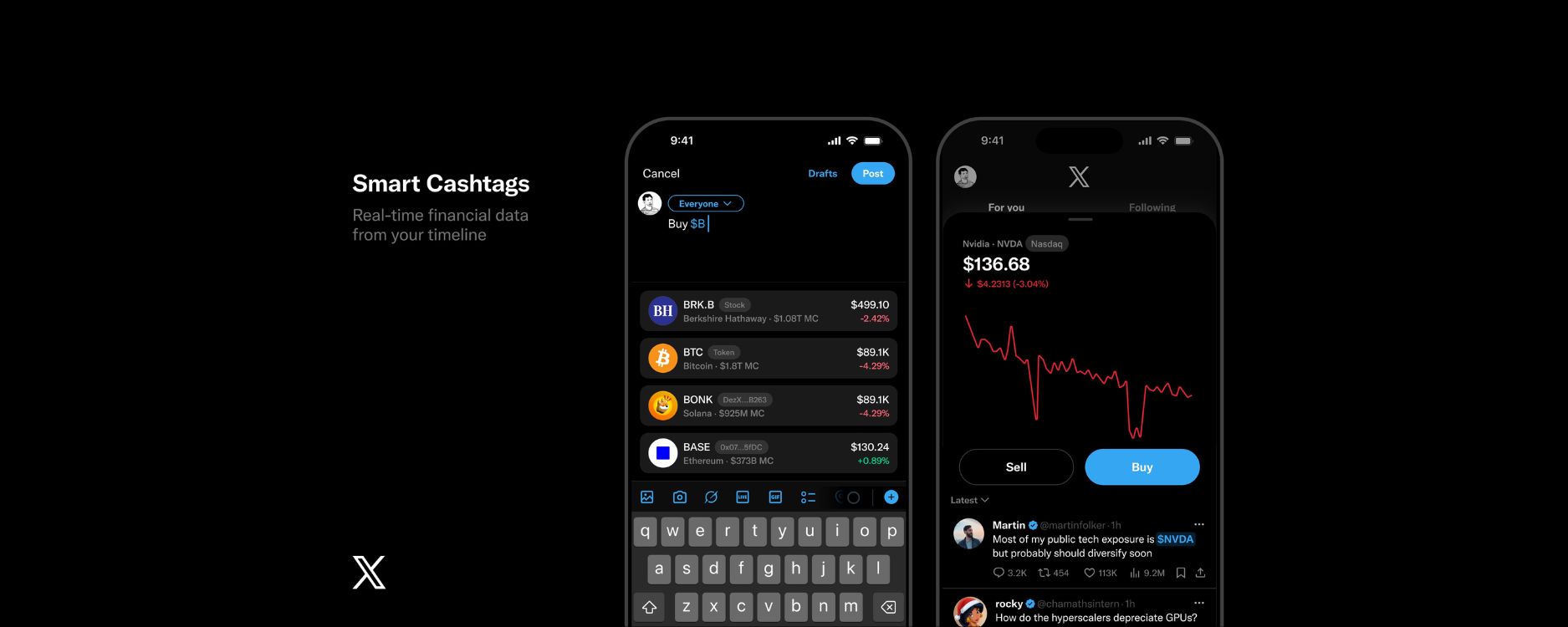

X Plans Smart Cashtags to Show Live Crypto Prices Inside the Timeline

X is getting ready to roll out something called Smart Cashtags, and while the feature sounds minor on the surface, it could change how people follow crypto markets day to day.

Cashtags are already familiar to anyone who spends time on crypto Twitter. Add a dollar sign in front of a ticker like $BTC or $ETH and the platform turns it into a clickable reference tied to ongoing conversations. It has always been useful for tracking sentiment, but not particularly helpful if you actually want to know what the market is doing in that moment.

Smart Cashtags are meant to fix that.

Instead of just linking to a stream of posts, the upgraded version will surface live prices, basic performance data, and charts directly in the feed. The idea is simple: if people are talking about a token, you should be able to see what it is doing without leaving the timeline.

For a platform where crypto narratives often move faster than prices themselves, that shift matters.

Turning the Feed Into a Market Snapshot

Crypto trading already lives on X. News breaks there. Narratives form there. Panic and euphoria show up there first. What has been missing is the data itself.

Smart Cashtags bring that data closer to the conversation.

The feature was announced by Nikita Bier, who is Head of Product at X, saying it will convert posts into live market data entry points.

When someone mentions a token using a cashtag, the platform will recognize the asset and display up to date pricing alongside the post. Tapping the tag is expected to open more context, recent price moves, charts, and related discussion, all in one place.

It reduces the constant app hopping that most traders know too well. Instead of checking a charting app, then jumping back to X to see what people are saying, everything shows up together.

Over time, that could subtly change how people consume market information. The feed becomes less of a rumor mill and more of a lightweight market view.

Why Crypto Traders Will Care

Crypto is unusually sensitive to social momentum. A token can start trending hours before volume shows up. A single viral post can spark a rally or accelerate a selloff.

Putting price data directly next to those conversations tightens that feedback loop.

A trader scrolling their timeline might see a surge in posts about a token at the same moment the price is breaking out. The same dynamic works in reverse during downturns. That kind of visibility favors speed and awareness, especially for retail traders who do not live inside professional trading dashboards.

It also lowers the barrier to entry. You do not need to know where to look or which tools to use. The information comes to you as part of the conversation.

That accessibility cuts both ways. More visibility can mean better context, but it can also amplify emotional reactions during volatile moments.

Not Just a Visual Upgrade

Smart Cashtags are not just about showing a price number.

One of the quieter improvements is accuracy. Crypto tickers can be messy. Different tokens share similar symbols, and some symbols overlap with stocks or other assets. Smart Cashtags are expected to better identify and map posts to the correct asset, reducing confusion and mislabeling.

That matters more as crypto bleeds into traditional finance, with tokenized assets, ETFs, and crossover tickers becoming more common.

This is also not X’s first step into market data. Earlier versions of cashtags already offered limited chart previews through external integrations. Those features felt bolted on. Smart Cashtags move the data front and center, making it part of the native experience instead of a side panel.

Embedding live prices into social feeds is not risk free.

If data is delayed or inaccurate, misinformation spreads faster. When price movements and social reactions are displayed together, markets can become more reflexive. Trends may accelerate, and herd behavior could become more pronounced, especially in smaller or thinner markets.

There is also the question of incentives. Once price data lives inside the feed, it opens the door to monetization, premium analytics, or trading integrations. None of that has been formally announced, but the direction is hard to ignore.

A Bigger Picture Play

Smart Cashtags fit neatly into X’s broader ambitions. The platform has been inching toward financial services, payments, and creator driven monetization for some time. Turning the feed into a place where financial data lives alongside conversation feels like a natural extension, and ultimately leads toward X becoming the everything app.

For crypto specifically, it reinforces X’s position as the main arena where narratives meet price action. It is not a trading terminal, but it does not need to be. Influence often matters more than precision.

The Bottom Line

Smart Cashtags may look like a small product update, but they point to something bigger.

By putting live crypto prices directly into the timeline, X is collapsing the distance between sentiment and market reality. For traders, builders, and casual observers alike, that could change how quickly ideas turn into action.

Whether it leads to better informed decisions or faster hype cycles will depend on how it is used. Either way, crypto conversations on X are about to feel a lot closer to the market itself.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Optimism Proposes OP Buybacks Using Superchain Revenue

Optimism Weighs OP Token Buybacks Using Half of Superchain Revenue

Optimism is considering a significant shift in how value flows back to its native token holders.

A new governance proposal would allocate 50 percent of all Superchain revenue toward regular buybacks of the OP token, marking one of the clearest attempts yet by a major Layer 2 ecosystem to directly link token economics with real network revenue.

If approved, the buybacks would begin as early as February and would be funded through sequencer fees generated across the Superchain, Optimism’s growing network of OP Stack based chains. The remaining revenue would continue to support protocol development, public goods funding, and ecosystem operations.

The proposal reflects a broader debate playing out across crypto: how networks should balance reinvestment with returning value to token holders.

Tying OP Closer to Network Activity

Optimism’s Superchain model pools revenue from multiple Layer 2 networks that use the OP Stack. These chains contribute a portion of their sequencer fees into a shared system, creating a steady revenue stream tied directly to transaction activity.

Under the new plan, half of that revenue would be used to purchase OP tokens on the open market. Those tokens would then be held by the Optimism treasury, where governance could later decide whether to burn them, redistribute them, or use them for future incentives.

Supporters of the proposal argue that buybacks would strengthen the relationship between Superchain usage and demand for OP. As more chains join the ecosystem and activity grows, buyback volumes could rise alongside revenue.

It is a notable shift for a project that has historically emphasized governance participation and public goods funding over direct token value capture.

A Strategic Pivot for the Superchain

Optimism has spent the past year expanding the Superchain, with more networks adopting the OP Stack and contributing fees back to the collective. That growth has made revenue allocation a more pressing question. Optimism shared that it has collected 5,868 ETH in revenue from the Superchain, all of which has flowed into a token-governed treasury.

Rather than committing all proceeds to grants or long term development, the Foundation appears to be signaling that token holders should benefit more directly from the ecosystem’s success.

At the same time, the proposal stops short of mandating token burns or fixed distributions. By returning bought tokens to the treasury, Optimism preserves flexibility while still introducing a market facing mechanism tied to revenue.

Governance Decision Ahead

Under the proposal, which is expected to go to a governance vote on January 22, Optimism would begin monthly OP token buybacks as early as February. The purchases would be funded by sequencer fee revenue generated across OP Stack based networks, including Coinbase’s Base, Uniswap’s Unichain, World’s World Chain, Sony’s Soneium, and other Superchain members.

Approval would make Optimism one of the more prominent Ethereum scaling projects to formalize buybacks as part of its economic model.

Whether the plan passes or not, the discussion highlights a shift in tone across crypto infrastructure projects. As networks mature and generate meaningful revenue, questions around sustainability, incentives, and value capture are becoming harder to avoid.

For Optimism, the vote could shape how the Superchain evolves from a technical scaling solution into a fully self sustaining economic system.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Aave Moves to Ease DAO Tensions Over Revenue Sharing and Control

Aave is once again at the center of a familiar DeFi question. Who really controls the protocol, the DAO or the company that builds and maintains it?

This week, Aave Labs moved to ease growing tensions with the Aave DAO after backlash over how non-protocol revenue is handled. The dispute has exposed deeper cracks in the relationship between token holders and the development team, and raised uncomfortable questions about decentralization, ownership, and incentives in one of crypto’s largest lending platforms. In a governance post on Friday, Aave founder Stani Kulechov wrote that,

"Given the recent conversations in the community, at Aave Labs we are committed to sharing revenue generated outside the protocol with token holders, alignment is important for us and for AAVE holders, and we’ll follow up soon with a formal proposal that will include specific structures for how this works.”

At issue is revenue generated outside Aave’s core smart contracts. Specifically, fees tied to the protocol’s frontend and swap integrations. While these fees are not produced directly by the lending protocol itself, many DAO members argue they should still benefit token holders, especially when the interface is tightly associated with the Aave brand.

The disagreement came into focus after Aave Labs switched its frontend swap provider, a move that redirected fees away from the DAO treasury. Some delegates estimate the change could divert millions of dollars annually that previously flowed to token holders. That sparked immediate criticism, with governance participants accusing Aave Labs of unilaterally monetizing the ecosystem without sufficient community approval.

Aave Labs has pushed back on that framing. The team says the frontend is a separate product that requires ongoing development, maintenance, and legal responsibility. From its perspective, monetizing the interface is a reasonable way to fund operations, and not a violation of DAO governance. The protocol itself, they argue, remains fully controlled by token holders.

Still, the explanation did little to calm concerns. For many in the DAO, the issue is less about the money and more about precedent. If revenue connected to the Aave user experience can be captured outside governance, it raises questions about how much power token holders actually have.

The situation escalated when a proposal surfaced that would move control of Aave’s brand assets into a DAO-controlled legal structure. The vote was rushed to Snapshot, drawing criticism over process and transparency. Some contributors said the proposal appeared without proper consultation, further eroding trust at an already sensitive moment.

Market reaction was swift. AAVE’s price slid as traders weighed the uncertainty, adding financial pressure to an already tense governance environment. Longtime delegates warned that unresolved conflicts between Labs and the DAO could weaken Aave’s standing as a leading DeFi protocol.

In response, Aave Labs has now signaled a willingness to compromise. The team proposed sharing portions of non-protocol revenue with the DAO, framing it as a goodwill gesture rather than an obligation. The move is intended to reset the conversation and bring governance discussions back to alignment rather than escalation.

Whether that will be enough remains unclear. Some DAO members see the offer as a step in the right direction. Others worry it avoids the core issue, which is defining where the DAO’s authority begins and ends.

The broader implications stretch well beyond Aave. As DeFi matures, protocols are increasingly forced to reconcile decentralization ideals with the realities of product development, regulation, and sustainable funding. Aave’s governance clash is becoming a case study in what happens when those lines are left blurry.

For now, both sides appear to be stepping back from the brink. But the debate has made one thing clear. In crypto, decentralization is not a destination, it’s an ongoing negotiation.

Crypto in 2026: Less Hype, More Infrastructure, and a Market Growing Up

Crypto enters 2026 without the drama that once defined the start of a new year. Prices are steady but not euphoric. The timelines are calmer. The noise has faded. And yet, beneath that surface calm, the industry feels more focused and more self-assured than it has in a long time.

This does not feel like a market losing relevance. It feels like one that has stopped trying to prove itself every day.

After a tough reset in 2025, crypto is no longer driven by momentum alone. It is being shaped by infrastructure, regulation, and a growing sense that digital assets are slowly becoming part of the financial background rather than a constant headline.

The Reset Did What Cycles Are Supposed to Do

The pullback that closed out 2025 forced a hard reset across the industry. Excess leverage was flushed out. Projects built purely on narrative struggled to survive. Capital became more cautious, and in many cases, more serious.

Entering 2026, the market feels leaner and more selective. Bitcoin and Ethereum remain central, not because they promise overnight gains, but because they sit at the core of a system that is gradually being integrated into global finance.

Volatility has not disappeared, but it feels more tied to real catalysts. Flows, macro conditions, regulatory developments. This is no longer a market reacting to every rumor or viral post.

For investors who think in cycles rather than weeks, this is often the phase where foundations quietly form.

Institutions Are Acting Like They Are Here to Stay

Institutional involvement is no longer a future narrative. It is an active force shaping how crypto evolves.

ETFs, custody platforms, tokenized funds, and on chain settlement tools are becoming familiar concepts inside traditional finance. What stands out is how little of this activity is happening in public. Much of it is operational, slow, and deliberate.

That shift is noticeable at industry conferences and in private meetings. The energy is different. Fewer grand predictions. More conversations about compliance, liquidity, risk frameworks, and long term deployment. More handshakes, fewer hype decks.

Institutions do not move quickly, but when they start building infrastructure, they tend to stay.

Regulation Brings Structure, Not an End

Regulation is still controversial, but the tone has softened. Clearer rules are beginning to replace uncertainty, especially around stablecoins, custody, and reporting.

For many market participants, this clarity is not restrictive. It is enabling. It allows companies to plan, investors to allocate, and builders to focus on execution instead of interpretation.

Crypto does not need to be unregulated to grow. It needs to be understood. 2026 feels like a step in that direction.

Stablecoins and Tokenization Quietly Gain Momentum

One of the strongest signals for crypto’s future is how little attention some of its most important developments receive.

Stablecoins are increasingly used for payments and settlement, especially in cross border contexts where traditional systems are slow and expensive. This is not a speculative use case. It is a practical one.

Tokenization is following a similar path. Real world assets like funds, bonds, and private credit are being tested on chain. The goal is efficiency, transparency, and liquidity, not buzz.

These are the kinds of changes that rarely reverse once they gain traction.

DeFi and AI Settle Into Useful Roles

DeFi is no longer trying to reinvent finance overnight. It is focusing on doing specific things better. Automation, interoperability, and capital efficiency are the priorities now.

AI, meanwhile, is becoming part of the background. It shows up in analytics, trading strategies, monitoring tools, and security systems. Less hype, more utility.

This maturation may feel less exciting, but it is exactly what long term systems tend to look like before they scale.

A Market That Feels Like It Is Setting Up

Crypto in 2026 does not feel like a peak. It feels like a setup.

Builders are still building, even without constant attention. Institutions are committing resources, not just headlines. Regulators are engaging instead of reacting. Investors are meeting in person again, comparing notes, and thinking beyond the next quarter.

The industry feels more grounded, but also more aligned.

A Sharper Outlook Beyond 2026

What makes 2026 particularly interesting is not what happens this year, but what it enables next.

If infrastructure continues to solidify, regulation continues to clarify, and real usage keeps expanding, crypto may enter its next growth phase from a position of strength rather than speculation. The next cycle, whenever it arrives, is likely to be driven less by hype and more by inevitability.

Markets tend to move fastest when most people are no longer watching closely. Crypto may be entering that phase now.

It does not need to shout. It just needs to keep working.

And if it does, the years beyond 2026 may end up being the ones that finally justify everything that came before.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.