#Hyperliquid

Ripple Integrates Hyperliquid for Institutional DeFi Access

Ripple is pushing further into decentralized markets.

The company said it will support Hyperliquid through Ripple Prime, its institutional brokerage platform, giving professional trading firms access to on-chain derivatives without having to interact directly with DeFi infrastructure.

For Ripple, the move is about meeting institutional demand where it already exists. Many hedge funds and asset managers want exposure to decentralized markets, but they still operate inside traditional risk, margin, and reporting systems. Ripple Prime is designed to sit between those worlds.

With Hyperliquid now supported, Ripple Prime clients can trade decentralized perpetual futures while managing exposure alongside more familiar products like FX and cleared derivatives.

What Changes for Institutions

The biggest shift here is not access, but structure.

Instead of setting up wallets, managing smart contracts, or splitting capital across multiple venues, institutions can route trades through Ripple Prime and maintain a single counterparty relationship. Margin, collateral, and reporting remain centralized, even though execution happens onchain.

That matters for firms that are comfortable trading derivatives but not interested in rebuilding their internal processes for DeFi. It also reduces capital inefficiencies that come from isolating on-chain positions from the rest of a trading book.

This is not retail access. It is aimed squarely at professional desks.

Why Hyperliquid Keeps Showing Up

Hyperliquid has become one of the more active decentralized derivatives platforms in crypto, largely because it does not feel like most DeFi exchanges.

It runs an on-chain order book instead of an automated market maker, which allows for tighter spreads and execution that better suits high-volume traders. Perpetual futures on major assets make up most of the activity, with new markets continuing to roll out.

That combination has drawn liquidity, which is still the hardest thing to build in decentralized markets. For institutions, liquidity tends to matter more than ideology.

Ripple’s support puts Hyperliquid in front of firms that may not have considered trading on a decentralized venue before.

Part of a Bigger Institutional Shift

This announcement fits into a wider trend across crypto infrastructure.

Firms that serve institutions are no longer treating DeFi as a separate category. Instead, they are trying to make it another venue, similar to how traditional desks access exchanges, clearing houses, or OTC markets.

Ripple’s approach reflects that thinking. The company is not asking institutions to learn DeFi. It is packaging DeFi in a way that looks familiar enough to be usable.

That model is starting to show up more often, especially as tokenized assets and on-chain credit products gain traction.

What It Means for XRP Markets

For XRP, deeper on-chain liquidity and derivatives access matter.

Derivatives tend to pull in more sophisticated traders, which can tighten spreads and improve price discovery over time. Connecting XRP-related markets to high-performance decentralized venues adds another layer to its institutional story.

It also shows how fragmented crypto markets are slowly being stitched together, with execution happening in one place and risk managed somewhere else.

Risks Are Still There

Decentralized derivatives come with obvious risks.

Leverage, liquidations, and volatility can move fast, and regulatory attention around perpetual futures is not going away. Even with a prime brokerage layer in front, institutions are still exposed to market dynamics that can get messy.

Ripple’s platform can simplify access and controls, but it does not remove those risks.

The Bottom Line

Ripple’s Hyperliquid support is not a flashy consumer announcement. It is infrastructure work.

It points to a future where on-chain markets are accessed the same way institutions already access everything else, through familiar systems, familiar counterparties, and familiar controls.

Whether that future scales depends on liquidity, regulation, and market demand. But for now, Ripple is clearly positioning itself to be part of that next phase.

Hyperliquid Begins Team Token Unlock With First HYPE Distribution

Hyperliquid has taken its first visible step in releasing tokens to its team, unstaking around 1.2 million HYPE ahead of a planned distribution in early January. While the move was always part of the project’s vesting plan, it is the first time those mechanics have shown up clearly on chain, which is why it caught the market’s attention.

The tokens were unstaked in late December and are expected to land with contributors on January 6. According to the team, this is not a one-off event. Future releases are set to follow a monthly rhythm, with additional tokens unlocking on the sixth day of each month as vesting milestones are reached.

On its own, the amount is relatively small. Still, in crypto, any unexpected token movement tends to raise questions, especially when it involves team allocations.

Why the Unstake Raised Eyebrows

The initial on-chain activity sparked speculation that Hyperliquid was preparing a much larger release. Some traders circulated figures suggesting that close to 10 million tokens could hit the market at once, a scenario that would have meaningfully increased circulating supply.

That interpretation turned out to be off the mark. The team later clarified that the unstake was simply a procedural step tied to an existing vesting schedule, not an acceleration or change in plans. Once that context became clearer, concerns eased, though the episode highlighted how quickly uncertainty can spread when token movements appear without explanation.

For now, the unstaked tokens remain part of the team allocation. They are scheduled to be distributed to individual contributors in early January rather than sold or transferred immediately.

What Hyperliquid Is Building

Hyperliquid is a trading-focused crypto project that has taken a different route than most decentralized platforms. Instead of launching a general-purpose blockchain and layering applications on top, the team built a high-speed perpetual futures exchange first, then designed a custom Layer-1 network around it. Hyperliquid remains the largest decentralized perps DEX by volume.

The exchange has been the main draw so far. It offers deep liquidity, advanced order types, and execution speeds that feel closer to centralized trading venues than what most on-chain platforms can deliver. That performance focus has helped Hyperliquid attract active traders, including professional market makers who typically avoid decentralized exchanges due to latency and reliability issues.

To make that possible, Hyperliquid runs its own blockchain rather than relying on shared infrastructure. The network is optimized specifically for financial activity, prioritizing throughput and consistency over broad flexibility. It is not trying to support every type of application, but it does aim to do trading extremely well. The model has worked. Hyperliquid has generated almost $1B in fees, with another $843B in total revenue in 2025.

How the Token Supply Is Structured

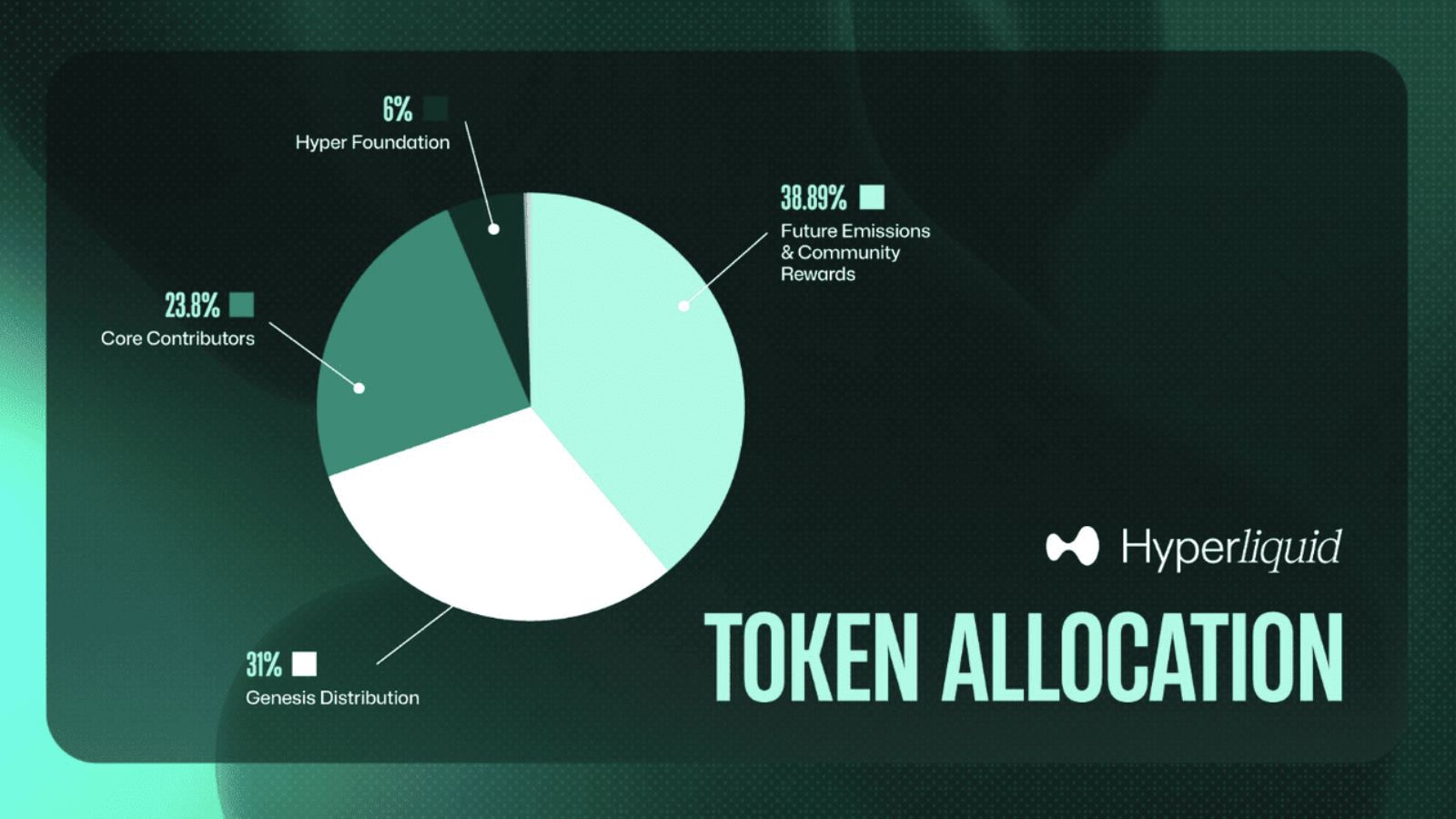

HYPE has a fixed supply of one billion tokens. The protocol did not raise money from traditional venture capital firms and instead distributed a large share of its token supply directly to users through a genesis airdrop. That decision helped build early loyalty, while leaving the team with a significant role in guiding the protocol as it grows

About 24 percent is allocated to core contributors, with the rest split between community rewards, the initial user airdrop, and funds set aside for ecosystem development and operations.

Team tokens were locked at launch and are subject to a multi-year vesting schedule. Earlier unlocks affecting developers and contributors began in late 2025, but the bulk of the allocation remains locked and will continue to enter circulation gradually over time.

The January distribution represents a small slice of the total team allocation. Even so, these releases are closely watched because they incrementally increase circulating supply, which can influence liquidity and price dynamics.

How the Market Has Responded

So far, the reaction has been relatively calm. HYPE has continued trading within a fairly tight range, suggesting that traders are treating the unlock as expected rather than disruptive.

Market observers often point out that predictable vesting schedules tend to be easier for investors to digest than irregular or poorly communicated releases. By committing to a consistent monthly timeline, Hyperliquid appears to be trying to set clearer expectations around future supply changes.

That does not mean future unlocks will be ignored. Larger tranches and shifts in broader market conditions could still shape sentiment as time goes on.

What to Watch Going Forward

As more team tokens vest in the months and years ahead, attention will likely shift toward how those tokens are handled. Whether contributors hold, stake, or sell their allocations will matter, particularly as Hyperliquid continues to expand its trading and blockchain infrastructure.

For now, the first team distribution serves as a reference point. It gives the market a clearer sense of how Hyperliquid plans to manage token releases while continuing to scale its platform. The longer-term test will be whether that transparency holds as the numbers grow and expectations rise.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Solana Co-Founder Anatoly Yakovenko Reveals Percolator, a New Perp DEX Design

Anatoly Yakovenko, co-founder of Solana, has introduced a blueprint for a decentralized perpetual futures exchange called Percolator. The design was released publicly and is positioned as a potential Solana-native alternative to established platforms such as Hyperliquid and Aster.

A Solana-Native Exchange Concept

Percolator is described as an “implementation-ready” framework for a perpetual futures DEX that runs directly on Solana. Unlike centralized exchanges, it would rely on a sharded architecture to distribute trading activity across multiple “slabs.” Each slab acts as an independent engine, handling its own set of markets in parallel.

A router layer would manage collateral, portfolio margining, and the routing of trades between slabs. The goal is to achieve low-latency execution at scale, reduce congestion during high demand, and allow users to retain custody of their assets while trading.

Yakovenko has suggested that this design could enable centralized-exchange-level speeds within a fully decentralized structure. If implemented, it would represent a step forward in marrying the performance advantages of Solana with the growing demand for decentralized derivatives.

Addressing a Market Gap

Perpetual futures have become one of the most active areas of crypto trading, often accounting for a large share of overall derivatives volume. Platforms such as Hyperliquid and Aster have attracted significant activity, but Solana has not yet established a dominant native alternative in this space.

Percolator is seen as a way to change that. By offering a blueprint for a scalable and efficient perp DEX, the design could strengthen Solana’s DeFi ecosystem and attract more sophisticated traders. It would also broaden the network’s use cases beyond its reputation for high-speed transactions and meme coin speculation.

Open Development Approach

One notable feature of Yakovenko’s announcement was the decision to publish the design openly on GitHub. Rather than launching Percolator as a closed project, he invited developers to experiment, adapt, and build upon the code.

This open-source approach aligns with Solana’s broader strategy of encouraging community-driven innovation. It positions Percolator not just as a single potential product, but as a framework that could inspire multiple teams and projects across the ecosystem.

Challenges and Risks

Despite the enthusiasm, there are several challenges. Yakovenko himself has downplayed expectations, noting that the release was experimental and not necessarily a commitment to launching a production-ready DEX.

Regulatory pressure is another factor. Perpetual futures are leveraged products that have drawn scrutiny from regulators worldwide. Operating such markets in a decentralized structure could bring legal uncertainty, especially if they attract high volumes.

Technical risks also remain. Building and maintaining a sharded DEX with multiple trading engines introduces complexity, and it is unclear how the design would perform under sustained high-volume trading. Competition is also fierce, with other perp DEXs already establishing liquidity and user bases.

The Outlook for Solana

Even with these risks, Percolator underscores Solana’s ambition to expand into more advanced financial infrastructure. The release highlights the network’s strengths in throughput and efficiency, while showing a willingness to experiment in areas that are becoming increasingly important to crypto markets.

If the concept develops into a working platform, it could elevate Solana’s role in decentralized finance and attract a new wave of derivatives traders. Even if it does not, the blueprint has already sparked discussion about what is possible when high-performance blockchains are combined with open-source collaboration.

Conclusion

Percolator is not yet a product, but it is a statement of intent. It reflects Yakovenko’s ongoing focus on technical experimentation and Solana’s drive to compete at the highest levels of decentralized finance. Whether it emerges as a functioning exchange or remains a reference design, it signals a move toward more complex, scalable infrastructure that could shape the future of on-chain derivatives.