#Perpetual Futures

Lighter Launches LIT Token as On-Chain Perpetuals Keep Gaining Ground

Decentralized perpetual futures have gone from niche to normal this year. Volumes keep rising, traders keep rotating on chain, and perps are now one of the few crypto products seeing consistent usage. Lighter’s launch of its native token, LIT, on December 30 fits squarely into that trend.

For Lighter, the token launch was not a sudden pivot. It followed months of points programs, trading incentives, and gradual onboarding of users who were effectively SOL being asked to prove they would stick around. With LIT now live, those points have turned into tokens, and the protocol has taken a step toward formalizing ownership.

How the Launch Was Structured

The LIT token generation event took place on December 30, alongside the initial airdrop. About 25 percent of the total one billion token supply was distributed directly to users who qualified through earlier activity on the platform.

The airdrop was ADA designed to be simple. Tokens were sent automatically to wallets, with no separate claim process and no vesting on that portion. According to the team, the goal was to avoid friction and make sure users actually received what they earned, rather than navigating another multi-step process.

In the days leading up to the launch, large on-chain transfers tied to Lighter hinted that the rollout was imminent. That activity sparked plenty of speculation, but once the token went live, the mechanics turned out to be largely in line with what the team had been signaling.

Token Supply and Incentive Design

LIT has a fixed supply of one billion tokens. Half of that supply is allocated to the community and ecosystem, while the other half is split between the team and early investors.

The team’s allocation accounts for roughly 26 percent of the total supply. Investors hold around 24 percent. Those tokens are locked for the first year and then vest gradually over several years. The structure reflects an effort to balance internal incentives with the expectations of a user base that is increasingly sensitive to future supply.

The community share goes beyond the initial airdrop. It also funds ongoing trading incentives, staking rewards, and future programs aimed at keeping activity on the platform as competition among perps exchanges intensifies.

Early Trading and First Reactions

LIT did not wait until launch day to attract attention. Pre-market trading had already been active, with centralized and decentralized venues offering early exposure through synthetic markets and limited listings.

That early price discovery set expectations, though liquidity was thin and pricing uneven. Since the launch, focus has shifted to how LIT trades with real circulation, as airdropped tokens begin to move and broader markets form. Volatility has been expected, especially in the first few sessions, as supply and demand work themselves out. The LIT token is currently trading at $2.74 with a market cap just shy of $700M.

What Lighter Is Building Under the Hood

At its core, Lighter runs a decentralized perpetuals exchange on Ethereum. The platform uses a Layer-2 design built around zero-knowledge technology to keep trades fast and fees predictable, while still settling activity on chain.

The team has been clear that LIT is not meant to exist in isolation. The token is expected to play a role in staking, incentives, and access to certain platform features over time. Lighter has also pointed to future products, including options and tokenized assets, as part of a broader roadmap that extends beyond perps alone.

Another point emphasized in the launch messaging is alignment. The protocol generates revenue through trading activity, and the intent is for token holders to benefit as the platform grows, whether through reinvestment, incentives, or other value-sharing mechanisms.

Part of a Larger Shift in Perps

Lighter’s token launch comes at a moment when decentralized perpetuals are no longer trying to prove they work. That question has largely been answered. Instead, the focus has moved to scale, retention, and differentiation.

Platforms like Hyperliquid and dYdX have shown that traders will stay on chain if execution is good enough. Tokens, in that context, are becoming tools for locking in users rather than just raising capital.

By distributing a large share of LIT to active participants and keeping insider tokens locked, Lighter is betting that ownership and incentives can help it compete in an increasingly crowded market. Whether that holds up will depend less on launch-day excitement and more on what happens next.

As volumes continue to rise and on-chain perps become a permanent part of crypto trading, Lighter’s challenge will be turning early momentum into something durable. The LIT launch is an important step, but it is only the beginning.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Hyperliquid Begins Team Token Unlock With First HYPE Distribution

Hyperliquid has taken its first visible step in releasing tokens to its team, unstaking around 1.2 million HYPE ahead of a planned distribution in early January. While the move was always part of the project’s vesting plan, it is the first time those mechanics have shown up clearly on chain, which is why it caught the market’s attention.

The tokens were unstaked in late December and are expected to land with contributors on January 6. According to the team, this is not a one-off event. Future releases are set to follow a monthly rhythm, with additional tokens unlocking on the sixth day of each month as vesting milestones are reached.

On its own, the amount is relatively small. Still, in crypto, any unexpected token movement tends to raise questions, especially when it involves team allocations.

Why the Unstake Raised Eyebrows

The initial on-chain activity sparked speculation that Hyperliquid was preparing a much larger release. Some traders circulated figures suggesting that close to 10 million tokens could hit the market at once, a scenario that would have meaningfully increased circulating supply.

That interpretation turned out to be off the mark. The team later clarified that the unstake was simply a procedural step tied to an existing vesting schedule, not an acceleration or change in plans. Once that context became clearer, concerns eased, though the episode highlighted how quickly uncertainty can spread when token movements appear without explanation.

For now, the unstaked tokens remain part of the team allocation. They are scheduled to be distributed to individual contributors in early January rather than sold or transferred immediately.

What Hyperliquid Is Building

Hyperliquid is a trading-focused crypto project that has taken a different route than most decentralized platforms. Instead of launching a general-purpose blockchain and layering applications on top, the team built a high-speed perpetual futures exchange first, then designed a custom Layer-1 network around it. Hyperliquid remains the largest decentralized perps DEX by volume.

The exchange has been the main draw so far. It offers deep liquidity, advanced order types, and execution speeds that feel closer to centralized trading venues than what most on-chain platforms can deliver. That performance focus has helped Hyperliquid attract active traders, including professional market makers who typically avoid decentralized exchanges due to latency and reliability issues.

To make that possible, Hyperliquid runs its own blockchain rather than relying on shared infrastructure. The network is optimized specifically for financial activity, prioritizing throughput and consistency over broad flexibility. It is not trying to support every type of application, but it does aim to do trading extremely well. The model has worked. Hyperliquid has generated almost $1B in fees, with another $843B in total revenue in 2025.

How the Token Supply Is Structured

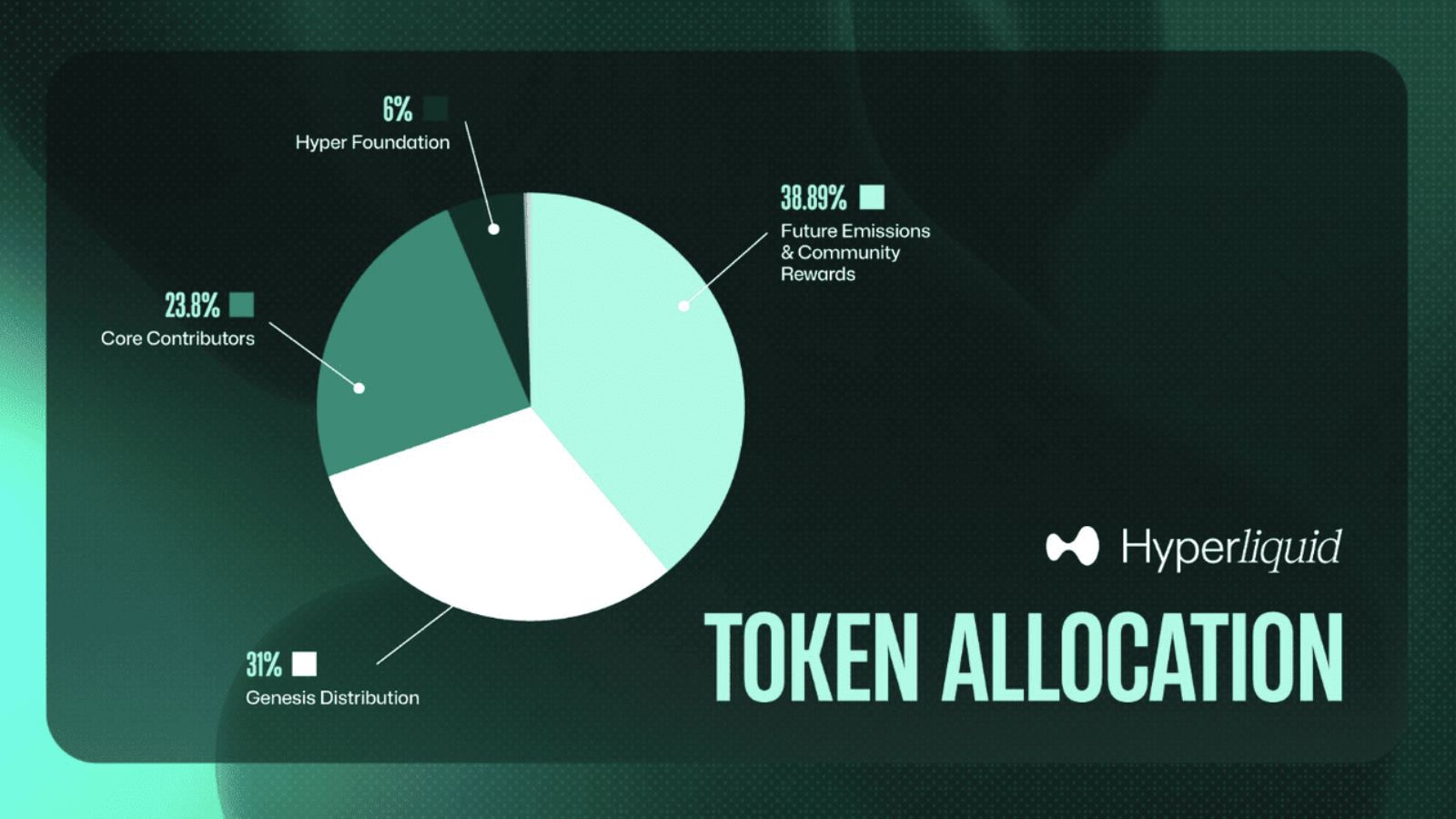

HYPE has a fixed supply of one billion tokens. The protocol did not raise money from traditional venture capital firms and instead distributed a large share of its token supply directly to users through a genesis airdrop. That decision helped build early loyalty, while leaving the team with a significant role in guiding the protocol as it grows

About 24 percent is allocated to core contributors, with the rest split between community rewards, the initial user airdrop, and funds set aside for ecosystem development and operations.

Team tokens were locked at launch and are subject to a multi-year vesting schedule. Earlier unlocks affecting developers and contributors began in late 2025, but the bulk of the allocation remains locked and will continue to enter circulation gradually over time.

The January distribution represents a small slice of the total team allocation. Even so, these releases are closely watched because they incrementally increase circulating supply, which can influence liquidity and price dynamics.

How the Market Has Responded

So far, the reaction has been relatively calm. HYPE has continued trading within a fairly tight range, suggesting that traders are treating the unlock as expected rather than disruptive.

Market observers often point out that predictable vesting schedules tend to be easier for investors to digest than irregular or poorly communicated releases. By committing to a consistent monthly timeline, Hyperliquid appears to be trying to set clearer expectations around future supply changes.

That does not mean future unlocks will be ignored. Larger tranches and shifts in broader market conditions could still shape sentiment as time goes on.

What to Watch Going Forward

As more team tokens vest in the months and years ahead, attention will likely shift toward how those tokens are handled. Whether contributors hold, stake, or sell their allocations will matter, particularly as Hyperliquid continues to expand its trading and blockchain infrastructure.

For now, the first team distribution serves as a reference point. It gives the market a clearer sense of how Hyperliquid plans to manage token releases while continuing to scale its platform. The longer-term test will be whether that transparency holds as the numbers grow and expectations rise.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

DeFi Surges Ahead as Decentralized Exchanges Top $1 Trillion in Monthly Volume

DeFi Surges Ahead as Decentralized Exchanges Top $1 Trillion in Monthly Volume

A turning point for decentralized finance and the next wave of blockchain innovation

Decentralized finance just hit another major milestone. For the first time ever, decentralized exchanges (DEXs) recorded more than $1 trillion in monthly trading volume. This achievement highlights how DeFi has evolved from a niche experiment into a core pillar of the global crypto economy.

The surge reflects a growing appetite for permissionless trading, better infrastructure, and a new level of confidence in decentralized platforms.

A Record Month for DeFi

Throughout September 2025, decentralized exchanges saw explosive growth in both spot and derivatives trading. Platforms specializing in perpetual futures, often called “perp DEXs,” led the way by crossing the $1 trillion mark in total monthly activity.

Trading volume soared as market volatility increased, drawing in traders looking for liquidity and flexibility. What makes this especially significant is that decentralized exchanges achieved volumes once thought possible only on centralized platforms.

This moment signals that DeFi is no longer a secondary market. It is becoming the main arena for digital asset trading.

What’s Behind the Surge

Several key factors are driving this wave of adoption:

1. Mature Infrastructure and Seamless User Experience

DEX platforms have come a long way. Today’s decentralized exchanges offer the speed, stability, and intuitive interfaces that rival traditional trading venues. Many now feature lightning-fast transaction times, deep liquidity pools, and cross-chain functionality that lets users trade assets from multiple blockchains.

2. Empowered Traders and True Ownership

At the heart of DeFi is freedom. By using non-custodial wallets, traders maintain full control of their funds. This removes the risks associated with centralized intermediaries and custodians, putting ownership directly in the hands of users.

3. Rising Popularity of Perpetual Futures

Perpetual futures contracts have become one of the most traded instruments in the DeFi space. They allow traders to hold leveraged positions indefinitely, without expiration dates. This flexibility, combined with on-chain transparency, is attracting both retail users and professional traders who value autonomy and liquidity.

4. Global Accessibility and Open Participation

Unlike centralized exchanges that may impose restrictions based on geography or account type, decentralized platforms are open to anyone with a crypto wallet. This global accessibility is driving adoption in regions where traditional finance and centralized platforms have limited reach.

A New Era of Market Confidence

The $1 trillion milestone represents more than just trading volume. It is a reflection of trust.

As users increasingly seek transparency, fairness, and control, decentralized systems are proving their value. The fact that billions of dollars move daily through smart contracts shows how far blockchain infrastructure has advanced.

Institutional interest in DeFi is also growing. Hedge funds, liquidity providers, and professional traders are now entering decentralized markets for their efficiency and risk diversification potential.

For many, this shift marks a fundamental change in how digital markets operate — from opaque and centralized to open and community-driven.

Challenges and Opportunities

While the DeFi ecosystem is thriving, its next phase of growth will depend on how it handles several key challenges:

-

Sustainability: Can DEXs maintain these record volumes once volatility stabilizes? Continued innovation in liquidity management will be key.

-

Security: Smart contract audits, insurance solutions, and responsible code development will strengthen user confidence.

-

Education: As new users enter DeFi, accessible resources and clear guidance will ensure safer participation.

-

Regulatory Clarity: Engagement with policymakers will help shape frameworks that allow innovation to flourish while protecting users.

Each of these challenges is also an opportunity for DeFi to evolve further and prove that decentralized systems can be both powerful and responsible.

The Future of Decentralized Trading

Crossing the $1 trillion threshold is more than a headline moment. It is a signal that DeFi has arrived.

The ecosystem now supports traders of all sizes, powers new financial models, and fosters innovation across chains. Projects are integrating real-world assets, DeFi-native derivatives, and decentralized governance — creating a truly borderless financial system.

As developers and users continue to refine these platforms, the next frontier of DeFi will likely combine performance, interoperability, and strong community-driven ecosystems.

Final Thoughts

The rise of decentralized exchanges marks one of the most inspiring success stories in crypto. It proves that transparent, trustless, and user-controlled finance can scale globally without sacrificing efficiency.

With over $1 trillion traded in a single month, DeFi has firmly established itself as a cornerstone of the modern digital economy. The path forward is clear: innovation will continue, user empowerment will expand, and decentralized systems will keep reshaping the way the world interacts with finance.

DeFi’s momentum is unstoppable, and this milestone is just the beginning.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.