Crypto CEOs Join CFTC Innovation Council as Market Shift Begins

Devryn

December 10, 2025

514 views

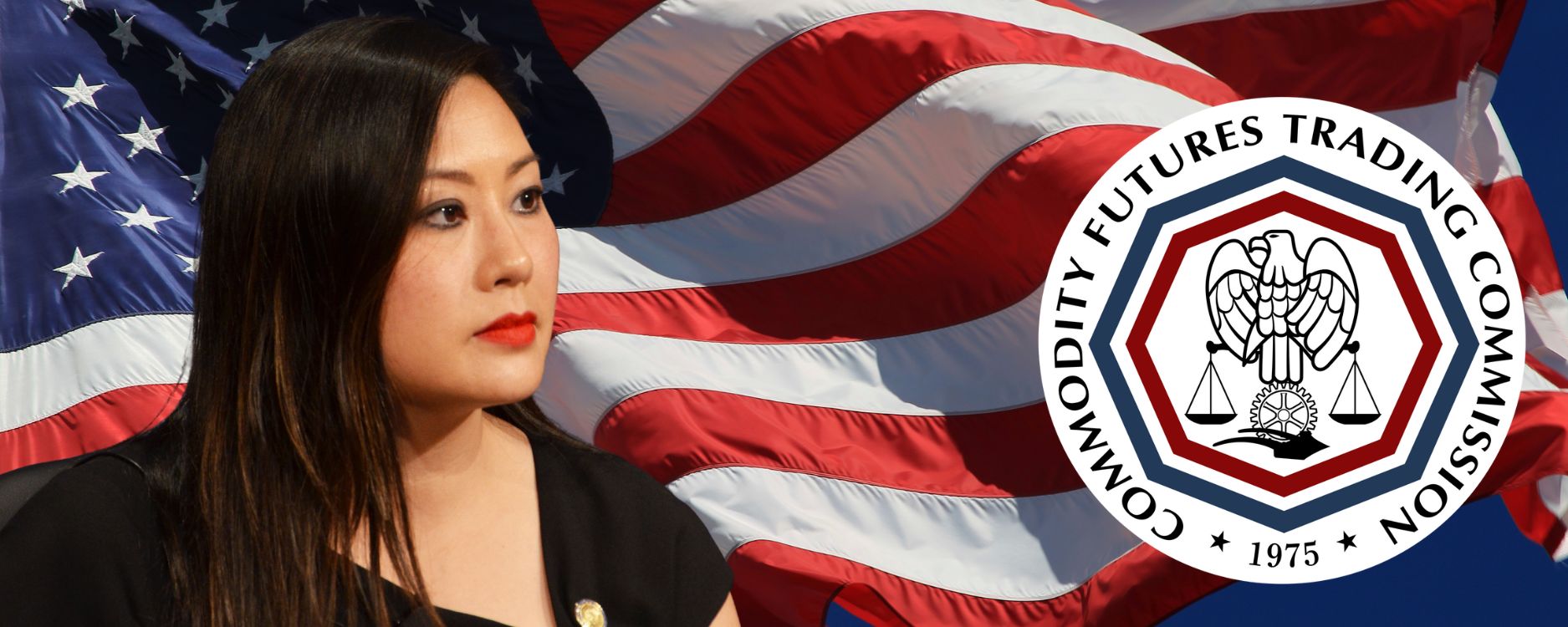

Caroline Pham is heading into her final stretch as acting chair of the CFTC, but she is not easing her way out. Instead, she has pulled together a new CEO Innovation Council, bringing in a mix of crypto founders and leaders from major financial institutions. The timing feels intentional. Markets are shifting fast, the technology is shifting even faster, and she clearly wanted this group in place before she hands off the job.

The council itself is an unusual gathering. On one side are Tyler Winklevoss from Gemini, Arjun Sethi from Kraken and Shayne Coplan from Polymarket. On the other, executives from CME Group, Nasdaq, ICE and Cboe. It is not often you see these people sitting on the same advisory panel, let alone one created this quickly. According to the commission, the entire list came together in about two weeks, which says a lot about how much urgency Pham applied.

She thanked the group for agreeing to join so quickly, noting that the commission needs their experience as it tries to prepare for what comes next. The council will focus on the areas where the rulebook is changing as fast as the products themselves. Tokenization. Prediction markets. Perpetual contracts. Crypto collateral. Around the clock trading. Blockchain market plumbing. Basically all the things that traditional derivatives systems were never built to handle.

Here is the full list of names:

Shayne Coplan, Polymarket

Craig Donohue, Cboe

Terry Duffy, CME Group

Tom Farley, Bullish

Adena Friedman, Nasdaq

Luke Hoersten, Bitnomial

Tarek Mansour, Kalshi

Kris Marszalek, Crypto.com

David Schwimmer, LSEG

Arjun Sethi, Kraken

Jeff Sprecher, Intercontinental Exchange

Tyler Winklevoss, Gemini

All of this is happening as the agency prepares for new leadership. President Trump’s nominee, Mike Selig, is expected to be confirmed soon. When he steps in, he will inherit an agency already deep into crypto policy work that accelerated under Pham. Just this week, the CFTC launched a pilot for using crypto collateral inside derivatives markets. A few days before that, Bitnomial began offering leverage spot crypto trading with her support.

Pham has only been in the acting role for a short time, but she treated crypto as a top priority, pushing several initiatives that line up with the administration’s goal of positioning the United States as a leading hub for digital assets. Over at the SEC, Chairman Paul Atkins has been doing something similar through Project Crypto, which has been absorbing much of the agency’s energy.

What comes next will land in Selig’s lap. But with this council now in place, he will walk into a job where the industry and the regulators are already in the middle of a much bigger conversation about what the future of market structure should look like.