#Avalanche

VanEck Launches First U.S. Spot Avalanche ETF for AVAX Investors

VanEck has officially launched the first spot Avalanche ETF in the United States, giving investors regulated exposure to AVAX AVAX and pushing crypto ETFs further beyond Bitcoin and Ethereum.

The new product, trading under the ticker VAVX, tracks the spot price of Avalanche’s native token while also incorporating staking rewards. It is a notable step for both VanEck and the broader crypto market, where asset managers are increasingly testing how far regulators will allow ETF expansion into large but still volatile altcoins.

For Avalanche, it is easily the most significant institutional milestone the network has seen to date.

What VanEck Is Offering

At its core, the VanEck Avalanche ETF is straightforward. It holds AVAX directly and aims to reflect the token’s real time market price. Where it gets more interesting is staking. Portions of the fund’s AVAX holdings are delegated for staking, with rewards flowing back into the ETF’s net asset value.

That structure gives investors exposure not just to price movements but also to the yield mechanics that are native to proof of stake networks. In traditional markets, that kind of blended price and yield exposure is familiar. In crypto ETFs, it is still relatively new.

VanEck has also leaned on aggressive pricing to attract early interest. The firm waived fees on the first $500 million in assets until late February 2026. After that, the sponsor fee settles at 0.20 percent, putting it on the cheaper end of crypto ETF offerings.

The fund is designed for investors who want exposure to Avalanche without dealing with wallets, private keys, or staking infrastructure. That includes registered investment advisors, family offices, and institutions that operate under strict compliance frameworks.

A Long Road Through Regulation

VanEck’s Avalanche ETF did not appear overnight. The firm first filed for the product in early 2025, at a time when U.S. regulators were still digesting the approval of spot Bitcoin ETFs and cautiously opening the door to Ethereum products.

As with most crypto ETF applications, the process involved multiple amendments, extended review periods, and detailed disclosures around custody, liquidity, and staking mechanics. At several points, regulatory delays weighed on market sentiment around AVAX, highlighting how closely traders now watch ETF headlines.

The final structure reflects compromises shaped by that process. Custody is handled by regulated providers, staking policies are clearly defined, and the fund operates within existing exchange listing standards rather than relying on a bespoke rule change.

In short, this ETF exists because the regulatory climate, while still cautious, is no longer outright hostile to spot crypto products beyond Bitcoin.

Why Avalanche, and Why Now

Avalanche sits in an interesting position in the crypto market. It is large enough to matter, consistently ranking among the top smart contract platforms by market capitalization. At the same time, it has not enjoyed the same institutional mindshare as Ethereum or even Solana.

Launching a spot ETF changes that perception. ETFs tend to function as a kind of legitimacy signal, especially for traditional investors who rely on familiar wrappers to access new asset classes.

The timing also matters. AVAX is well off its previous highs, reflecting both broader crypto market cycles and intense competition among layer one blockchains. For long term allocators, that weakness can look less like a deterrent and more like an entry point.

VanEck’s move suggests it sees Avalanche not as a speculative outlier, but as a network with enough maturity, liquidity, and ecosystem depth to justify a regulated investment product.

How This ETF Stands Apart

Compared with earlier crypto ETFs, VAVX introduces a few meaningful differences.

First, staking is part of the value proposition. Many Bitcoin ETFs are purely directional bets on price. This fund acknowledges that proof of stake assets generate yield and attempts to reflect that reality in a regulated format.

Second, the launch underscores a shift in regulatory tolerance. Bitcoin and Ethereum were once viewed as exceptional cases. The approval of an Avalanche ETF suggests that, under certain conditions, other major networks can now meet regulatory standards as well.

Finally, the ETF expands the menu for investors building diversified crypto exposure through traditional portfolios. Avalanche offers a different risk profile and technological narrative than Bitcoin’s digital gold thesis or Ethereum’s dominant smart contract role.

What It Means for the Market

In the near term, the ETF could improve liquidity and visibility for AVAX, particularly among institutional investors who have been watching crypto ETFs from the sidelines. Even modest allocations from wealth managers can have an outsized impact on altcoin markets.

More broadly, the launch raises the stakes for other issuers. Firms like Grayscale and Bitwise have already signaled interest in Avalanche related products. If VAVX attracts meaningful assets, it strengthens the case for a wider wave of altcoin ETFs.

That does not mean the path forward is risk free. AVAX remains volatile, regulatory standards can shift quickly, and investor appetite for crypto exposure is still sensitive to macro conditions. But the direction of travel is clear.

What This Means

VanEck’s Avalanche ETF is not just about one token or one fund. It reflects a crypto market that is slowly, unevenly, but undeniably integrating into traditional financial infrastructure.

For years, the question was whether spot crypto ETFs would ever exist in the U.S. Now the question is how many, and how far down the market cap rankings regulators are willing to go.

With VAVX, Avalanche has an answer. It is officially part of the ETF conversation.

Bitwise Launches BSOL: Solana ETF Ushers in New Era for Altcoin Investments

Bitwise Launches BSOL, Marking a Breakthrough for Solana and a Signal for the Next Era of Altcoin ETFs

Bitwise Asset Management has officially launched BSOL, the first U.S. exchange-traded product offering spot exposure to Solana (SOL). This milestone marks a defining moment for Solana and signals the beginning of a new chapter for altcoins entering the regulated investment landscape.

Solana Takes Center Stage

The BSOL launch cements Solana’s position as a major player in institutional crypto adoption. It is the first product in the U.S. to provide direct, fully backed exposure to Solana’s native token while staking 100 percent of holdings through Bitwise’s in-house infrastructure.

By leveraging Solana’s roughly 7 percent average staking yield, BSOL offers investors not only price exposure but also yield generation — all within a familiar, regulated ETF-style structure. This combination of accessibility, yield, and scalability positions Solana as the most advanced blockchain to reach institutional markets so far.

Solana’s growing ecosystem, low fees, and high-speed performance have made it one of the most active blockchains in the world. With BSOL now available to U.S. investors, Solana is moving from a crypto-native asset to a mainstream investment product — a shift that could have lasting effects on capital inflows and market perception.

The Start of the Altcoin ETF Era

While Solana leads the charge, the BSOL launch is a clear sign that altcoins with strong fundamentals are next in line. The success of Bitcoin and Ethereum ETFs proved investor appetite for digital assets, but Solana’s inclusion marks the next evolution — one defined by innovation, network utility, and yield.

Regulatory momentum and market demand are now aligning in favor of more diversified crypto exposure. As institutional frameworks become more comfortable with blockchain infrastructure, attention is shifting toward other high-performing networks.

Cardano, Avalanche, and Polygon are often mentioned among the top contenders for future ETF approval. Each represents a unique approach to scalability, interoperability, or governance, and together they illustrate the growing depth of the blockchain landscape.

The path forward suggests a broader expansion: Solana today, Cardano and others tomorrow. The foundation is being laid for a new generation of regulated altcoin investment products that reflect the diversity and maturity of modern blockchain ecosystems.

What This Means for Investors

For investors, BSOL offers more than just a new way to hold Solana. It represents a model for how future blockchain ETFs could be built — combining direct asset exposure, staking yield, and institutional security.

As more altcoin ETFs emerge, investors will be able to construct diversified portfolios across multiple ecosystems. This evolution could help reduce volatility, improve liquidity, and create structured opportunities for exposure to Web3 growth.

Institutional adoption is no longer theoretical. With BSOL trading on U.S. markets, it’s becoming a tangible part of investment strategy. If this trend continues, 2026 could be the year that altcoin ETFs become a standard feature of global financial markets.

Conclusion

Bitwise’s launch of BSOL is a turning point for Solana and the broader crypto industry. It validates Solana’s technology, rewards investors through staking yield, and brings blockchain innovation into the regulated financial world.

It also opens the door for what comes next. Altcoins like Cardano, Avalanche, and Polygon are gaining traction and could soon follow in Solana’s footsteps. Together, they represent the next wave of blockchain assets poised for institutional adoption.

Solana has proven that altcoins can succeed on the world’s biggest financial stage. The rest are not far behind.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Stars Arena Hack: Road to Recovery

In a recent turn of events, Stars Arena, the social platform backed by Avalanche's Contract Chain, found itself at the center of a major security breach. Launched last month, this platform had been gaining popularity, following the success of Friend.tech. Stars Arena allowed users to create and monetize online communities, offering influencers, content creators, and public figures a way to profit from their fan base. Users could link their Twitter accounts and trade profile tokens using Avalanche's AVAX, making it an enticing platform for those looking to capitalize on their online presence. However, a late Friday night revelation shook the platform and its users to their core.

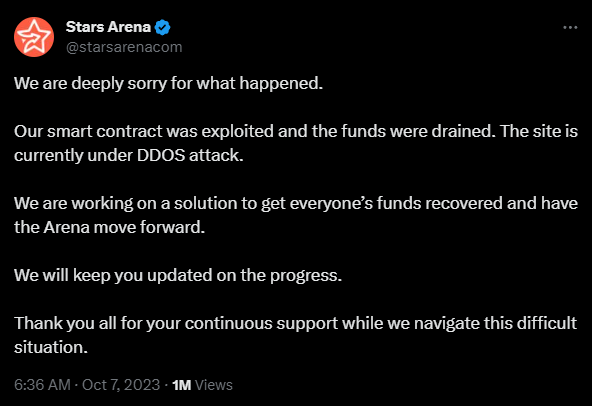

The official Stars Arena Twitter account posted a dire warning, confirming that the platform's smart contract had fallen victim to a cyberattack. The message explicitly stated: "We're actively checking the issue. DO NOT deposit any funds."

The breach was first noticed by Redline, a self-proclaimed crypto expert. Hackers had exploited the platform, siphoning off 266,103 AVAX, equivalent to roughly $2.85 million, via the FixedFloat exchange service. The repercussions of the attack rippled through the AVAX ecosystem, causing a drop in the token's price from $11.56 to $10.78. Users, in a bid to protect their assets, urged each other to remove Stars Arena from their Twitter accounts.

Hours later, Stars Arena issued an apology for the smart contract exploit. They also confirmed that they were facing a Distributed Denial of Service (DDOS) attack. The team assured users that they were actively working on a solution to recover the lost funds and allow the platform to move forward.

To address the situation, Stars Arena hosted a live Twitter Spaces session on Saturday, during which they announced, "A special white hat development team is coming in to rapidly review the security of the platform. We will re-open the contract with all the funds in full after a full security audit. This will happen very soon."

The breach occurred on the heels of a surge in transactions on Stars Arena, with the platform's volume spiking by 248% in the 24-hour period leading up to the attack. Earlier that week, the platform had also suffered an exploit that allowed hackers to make off with $2,000. Although the exploit was promptly rectified, Stars Arena made it clear they were in a battle against "malicious actors in the space who want to steal your money."

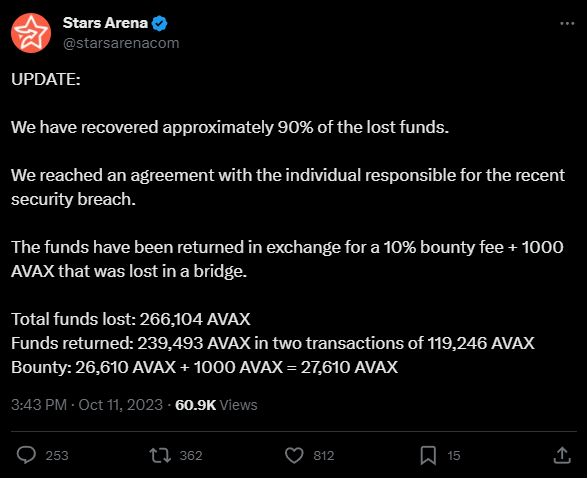

However, there is a glimmer of hope amid the turmoil. In a recent update, Stars Arena announced that they had successfully recovered approximately 90% of the lost funds. An agreement was reached with the individual responsible for the security breach. In exchange for the return of the funds, the responsible party received a 10% bounty fee plus 1,000 AVAX, which had been lost in a bridge.

Here are the key figures: Total funds lost: 266,104 AVAX Funds returned: 239,493 AVAX in two transactions of 119,246 AVAX https://twitter.com/starsarenacomBounty: 26,610 AVAX + 1,000 AVAX = 27,610 AVAX

This turn of events marks a significant step towards recovery and redemption for Stars Arena. The platform is determined to learn from its experiences and continue its mission to provide a safe and innovative space for online communities and content creators.

Grab your early bird tickets to Rare Evo 2024!

General Admission - $100

VIP - $400

These early bird prices will go up October 24th.

VIP tickets will be airdropped our Rare Perks NFT!

Purchase Tickets Here