#memecoins

Eric Adams NYC Token Crash Fuels Rugging Claims

For a brief window, Eric Adams’ “NYC Token” looked like it might be the next Solana rocket. The price ripped higher almost immediately after launch, pushing the token to a paper valuation north of half a billion dollars.

Then it collapsed. Fast.

Within roughly 30 minutes of peaking, the token had lost more than 80 percent of its value. What looked like a breakout turned into a straight-down chart, and by the time most traders realized what was happening, liquidity was already disappearing.

This was not just volatility. The on-chain data tells a much messier story.

The Numbers Behind the Crash

At its peak, NYC Token briefly reached an estimated market capitalization of around $540 million. That number didn’t last long. As selling pressure hit, the price unraveled almost immediately, wiping out roughly $500 million in value in under an hour.

The speed matters. This was not a slow bleed or a multi-day unwind. It was a vertical move up followed by an even faster move down.

And the data shows why.

The Liquidity Move That Changed Everything

According to on-chain analysis highlighted in the original report, a wallet linked to the token’s deployer pulled roughly $2.5 million worth of USDC liquidity from the main trading pool right around the price peak.

That single action dramatically reduced the pool’s depth.

When liquidity is pulled like that, every sell becomes more painful. Slippage increases, prices gap lower, and panic compounds itself. That’s exactly what happened next.

Later, about $1.5 million in USDC was added back into the pool. But that still leaves roughly $900,000 that was never returned, at least not publicly accounted for.

To traders watching in real time, that sequence looked brutal. Liquidity out near the top, partial liquidity back after the damage was done, and silence on where the rest went.

The Supply Was Never Really Free

Then there’s the ownership data.

This was not a broadly distributed token. The top five wallets controlled roughly 92 percent of the total supply. The top ten held close to 99 percent. One wallet alone reportedly held about 70 percent.

Put simply, almost no one outside a very small group actually controlled meaningful supply.

That means price discovery was never organic. It also means that liquidity removal hit a market that was already artificially thin. Retail traders weren’t trading against thousands of independent holders. They were trading inside a structure dominated by a handful of wallets.

Once those wallets moved, the market had no choice but to follow.

Retail Traders Paid the Price

The data includes some ugly examples.

One wallet tracked on Solana bought the token five separate times, spending a total of about $745,000. Less than 20 minutes later, that same wallet sold everything for roughly $272,000.

That’s a loss of nearly $475,000 in minutes.

That pattern wasn’t unique. Many late buyers entered during the final leg of the pump, assuming liquidity would hold and momentum would continue. Instead, they became exit liquidity as soon as the pool thinned out.

This is how these collapses always look after the fact. Clean on-chain evidence, messy human behavior.

The Narrative Problem

Eric Adams positioned NYC Token as something more than a meme. The messaging leaned heavily on civic themes, education, and fighting antisemitism. It sounded closer to a mission than a gamble.

But the mechanics told a different story.

No clear public breakdown of wallet ownership. No transparent explanation of liquidity controls before launch. No smart-contract enforced locks that traders could independently verify in real time.

When the crash happened, explanations focused on market dynamics and demand rather than addressing the core issue. Liquidity was moved. Concentration was extreme. Retail traders were exposed.

In crypto, narratives don’t survive contact with block explorers.

Was It Rugged?

That depends on definitions, but the structure is hard to defend.

A token that crashes more than 80 percent within 30 minutes, after millions in liquidity are removed by a deployer-linked wallet, while one address holds the majority of supply, is going to be viewed as a rug pool by the market. Fair or not, that perception sticks.

You don’t need a hidden backdoor or malicious code. Control alone is enough.

The Bigger Takeaway

NYC Token will probably be forgotten in a few weeks. The losses won’t be.

This episode is another reminder that in crypto, structure matters more than slogans. Liquidity locks matter. Distribution matters. Transparency matters.

When those things are missing, hype fills the gap. And hype is fragile.

The data here wasn’t subtle. It was loud, fast, and unforgiving. Traders who ignored it paid the price. And the next memecoin with a famous name attached will almost certainly test the same limits again.

Because in this market, the charts always tell the truth eventually.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Unleashing the Power of Memes: A Deep Dive into Cardano’s Hosky Token

In the vast universe of cryptocurrencies, a new star has emerged that doesn’t promise to revolutionize finance or technology.

Instead, it aims to bring some fun and laughter to the crypto world.

Meet Hosky Token ($HOSKY), Cardano’s first-ever meme coin and an exhibitor at Rare Evo, the premier blockchain and cryptocurrency conference bringing Web3 to the Rockies.

What is Hosky Token?

Hosky Token was born out of a perceived lack of “low-quality meme tokens” in the Cardano Ecosystem.

The creators of this token saw a gaping hole in the market and decided to fill it in the most amusing way possible.

Far from being obtuse or secret, Hosky Token is upfront and lighthearted in that it offers no financial value, promises of significant gains, or groundbreaking technology.

Instead, it brings an abundance of dog-themed memes to the table.

This gives the token’s creators a unique marketing strategy that sets Hosky Token apart from other meme coins.

Despite constantly deviating from the norm (even for memecoins), they still attract followers and have a loyal audience. This is a testament to the power of humor and the appeal of not taking oneself too seriously in a field often characterized by complexity and high stakes.

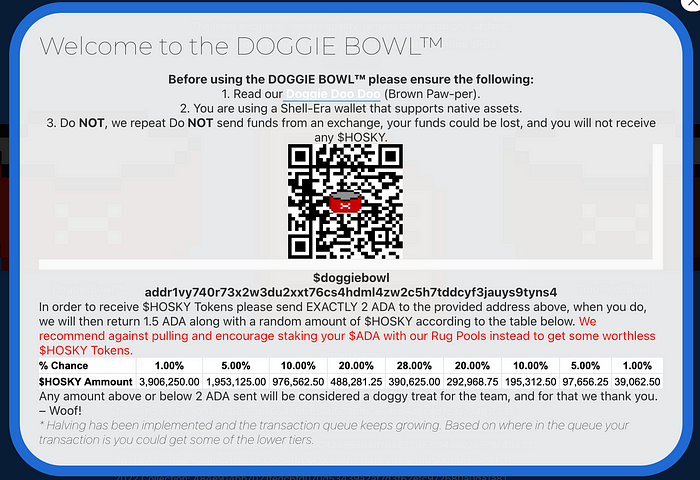

The Unpredictable Doggie Bowl™ Pull Rates

One of the unique features of the Hosky Token is its unpredictable Doggie Bowl™ Pull Rates.

Unlike other crypto projects where users know the exact amount of tokens they’re getting for their money, Hosky Token keeps you in suspense and wonder.

This element of surprise adds a layer of excitement to the process of acquiring tokens and further enhances the playful nature of the project.

Tokenomics of the Hosky Token

The initial token mint put exactly 1,000,000,000,000,000 Hosky Tokens into circulation.

Half of these tokens were “Gifted to the Master” (presumably the founder of Cardano, Charles Hoskinson), while the other half was allocated in the following manner:

- To-Be-Determined

̶6̶0̶̶ 40% of the supply has no designation at this moment; howl-ever, Hosky Token plans to use all of their dexterous doggo brains to get this token into as many paws as paws-ible. - Meme Acquisition

10% of the circulating supply will be used to grow the meme pool further and to increase Hosky’s meme howl-dings. - Stake Pool Operators

̶1̶0̶ 20% of the circulating supply will be allocated to SPOs for distribution. This does not mean you should expect a $HOSKY Pool, but it also does not mean it is entirely out of the question; this is for the community to decide. - Doggie Bowl™

̶1̶0̶ 20% of the circulating supply will be available through the Doggie Bowl™, Hosky’s token faucet available on hosky.io. - Founders

10% of the circulating supply has been sent as a treat to the wallets of the token founders, and Hosky has no intention of selling and plans to increase our howl-dings.

Hosky Token’s Philanthropic Endeavors

In a surprising and heartwarming twist, the Hosky Token has partnered with the United Nations Refugee Agency (UNHCR) to raise funds for refugees worldwide.

This partnership is facilitated through the WRFGS Stake Pool, which supports the UNHCR. Those staking to the 100% margin Pool WRFGS can claim HOSKY tokens from hosky.io.

HOSKY and the Cardano Foundation are proud to support the community members who are sacrificing their $ADA rewards to help refugees and providing them with the “nothing” that is $HOSKY Token for their contribution to the cause.

The Historical Performance of the Hosky Token

Hosky Token, being a meme coin, has a unique performance metric not tied to traditional financial indicators.

Instead, its success is measured by the spread and popularity of its memes within the Cardano ecosystem and community.

The unpredictable Doggie Bowl Pull Rates and the unique marketing strategy have contributed to the token’s distinct performance in the meme coin market, which fluctuates daily.

Throwing a Bone to Cardano

Hosky Token is a refreshing addition to the crypto world. It reminds us that while cryptocurrencies can be a serious business, they can also be a source of fun and entertainment.

Whether you’re a seasoned crypto investor or a newbie, the Hosky Token offers a unique opportunity to participate in the crypto space in a lighthearted way.

So, why not take a break from the seriousness of traditional cryptocurrencies and dive into the world of meme coins?

Who knows, you may become the next #memellionaire!

Connect With Hosky Token

Hosky Token is the premiere low-quality meme coin exclusively on the Cardano Ecosystem. It brings absolutely nothing other than low-quality memes, no financial value, no promises of mastiff gains, no mind-beagle-ing technology, just doggo memes.

Hosky Token is also an exhibitor at Rare Evo, the premier blockchain and cryptocurrency conference bring Web3 to the Rockies. Promising to merge business and pleasure in a luxurious environment, Hosky’s participation in Rare Evo underscores the token’s commitment to being an active player in the Cardano ecosystem and beyond.

To stay updated with the latest news and developments, follow Hosky Token: Twitter | Telegram | Discord

About The Rare Network

The Rare Network is a dynamic and growing organization that bridges the gap between traditional industry and emerging blockchain technology.

Our flagship event, Rare Evo, is the premier blockchain conference that brings together multi-chain projects, industry leaders, investors, and enthusiasts.

Rare Evo isn’t just a convention. It’s an immersive experience set in Denver, Colorado. We’ve got everything from educational sessions and networking opportunities to interactive experiences and live entertainment.

Hosted at the stunning Gaylord Rockies Resort, our luxurious and family-friendly venue ensures there’s something for everyone.

Don’t miss out on this game-changing event!

Buy your tickets, book your hotel room, and join the Web3 revolution.

Remember to stay connected with us on Twitter, YouTube, and Discord for the latest updates.