Crypto Market Surges Ahead of the FOMC Decision and What It Means for the Market

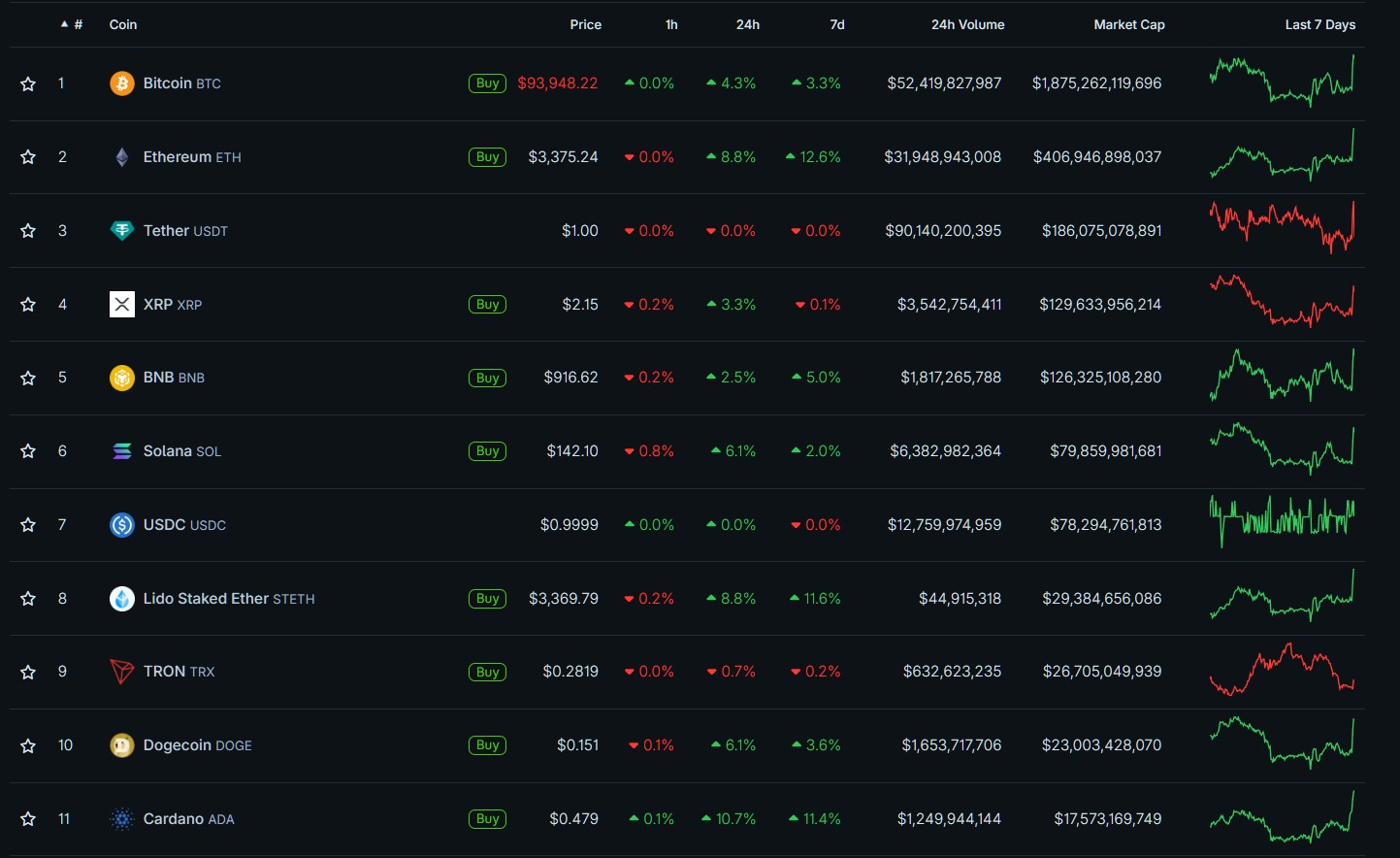

The crypto market has seen a sharp rise in volatility and price movement, with Bitcoin and Ethereum leading the rally. This surge has not come out of nowhere. It is tied closely to speculation surrounding the latest Federal Open Market Committee decision. As traders positioned themselves for potential changes in U.S. monetary policy, the crypto market responded with a wave of buying, short liquidations, and renewed bullish sentiment.

The move is another clear example of how deeply connected crypto has become to broader macroeconomic conditions.

How FOMC Speculation Became the Spark for the Latest Crypto Rally

In the days leading up to the meeting, expectations grew that the Federal Reserve might soften its stance on interest rates. Even the possibility of a rate cut or a more dovish tone tends to shift investors toward higher risk assets. Crypto is usually among the first to react.

Lower interest rates reduce the appeal of cash and bonds, while making speculative and growth oriented assets more attractive. That dynamic has long played out in equities. Now it is becoming increasingly visible in crypto as well.

Bitcoin and Ethereum both climbed into short term highs before the decision. As prices moved up, heavily leveraged short positions began to unwind. This added fuel to the rally as forced liquidations pushed prices even higher. It was a feedback loop that often appears during major macro events and is especially common in the crypto market due to its high leverage environment.

Market Behavior Shows the Fed Still Drives Risk Appetite

Even though crypto operates independently of government control, the industry still reacts strongly to the tone and trajectory of central bank policy.

A few things are becoming clear:

-

Traders treat FOMC guidance as a direct indicator of risk sentiment.

-

Expectations alone can drive price action before the decision is released.

-

Liquidity conditions continue to shape the strength of crypto market rebounds.

-

Bitcoin and Ethereum are increasingly acting like macro assets rather than purely speculative ones.

As the market leaned toward a more accommodative outlook, traders began rotating capital back into large cap cryptocurrencies. Bitcoin and Ethereum benefited the most, but the effect spilled into altcoins as well.

Short term, this created a volatile environment. Longer term, it signals a deeper connection between crypto and global financial cycles.

Why Some Analysts See This as More Than a Temporary Move

While investors always react to big economic events, this moment feels different. The alignment of easing inflation, slower economic pressure, and the possibility of rate cuts creates a setup where risk assets could see more sustained inflows.

Crypto is no longer operating separately from traditional finance. If liquidity improves across the economy, that liquidity tends to find its way into high growth and high volatility markets. Bitcoin and Ethereum fit that profile perfectly.

This raises a question that many in the industry are now considering. Is this the beginning of a broader shift where crypto consistently responds to macro cycles the same way equities and bonds do?

If so, price behavior may become more predictable around central bank events than it was in the early years of the industry.

What Could Go Right and What Could Still Disrupt the Momentum

What Could Go Right

-

If the Fed follows a path of easing or signals greater flexibility, crypto markets could experience a sustained wave of inflows.

-

Investors may shift back toward risk, viewing Bitcoin and Ethereum as core components of a diversified macro portfolio.

-

Lower interest rates increase liquidity across financial markets, which historically supports larger moves in non traditional assets.

-

A clearer link between crypto and macro conditions could attract more institutional traders who specialize in macro driven strategies.

What Could Go Wrong

-

If the Fed holds rates higher for longer or delivers a hawkish message, the market could see an immediate reversal.

-

Liquidations can cut both ways. The same leverage that amplifies rallies can intensify declines.

-

Uncertainty in global markets, geopolitical pressure, or a sudden risk off event could stall any recovery.

-

Crypto may remain highly sensitive to macro shifts, reducing the independence that once drove speculative surges.

What This Phase Means for Investors and the Broader Market

This moment serves as a reminder that crypto does not move in isolation. Bitcoin and Ethereum now sit within the larger financial ecosystem. When central bank policy shifts, these assets feel the impact quickly. That connection is growing stronger, not weaker.

For traders, FOMC weeks will continue to be periods of heightened volatility. Positioning before and after the decision may offer opportunities, but it also increases risk.

For long term investors, understanding macro cycles is becoming just as important as understanding blockchain fundamentals.

For the market as a whole, this could signal a shift toward a more mature ecosystem. If crypto continues to move with global financial cycles, it may attract more institutional interest, more capital, and more stability over time.

The surge before the FOMC decision is not just another short term rally. It is a signal of where the market is heading and how interconnected crypto has become with traditional finance.

Stay Connected

You can stay up to date on all News, Events, and Marketing of Rare Network, including Rare Evo: America’s Premier Blockchain Conference, happening July 28th-31st, 2026 at The ARIA Resort & Casino, by following our socials on X, LinkedIn, and YouTube.

Leave a Comment